|

市場調查報告書

商品編碼

1645153

歐洲維護、維修和營運 (MRO) -市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Europe Maintenance, Repair, And Operations (MRO) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

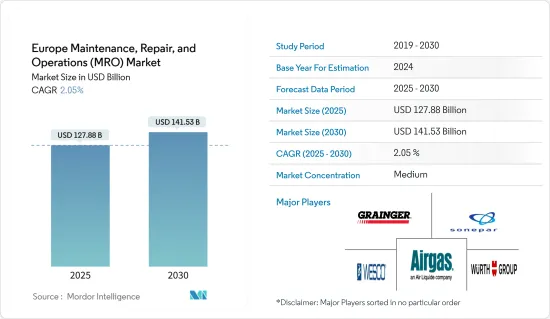

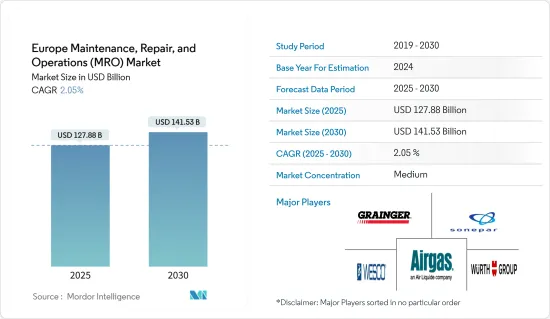

歐洲維護、維修和營運市場規模預計在 2025 年為 1,278.8 億美元,預計到 2030 年將達到 1,415.3 億美元,預測期內(2025-2030 年)的複合年成長率為 2.05%。

由於製造業和工業活動中對維修和維護服務業務的需求不斷增加,維護、修理和營運(MRO)市場預計將成長,尤其是在挪威、瑞典、德國和芬蘭。由於該地區擁有商業性的MRO 商品和服務熟練勞動力,因此為發展工業和製造業活動提供了廣泛的機會。此外,這也促進了歐洲經濟主要企業的銷售。此外,由於工業產量不斷上升,預計德國、義大利、法國和英國的MRO 活動活性化。

關鍵亮點

- 機械設備製造業是歐洲最具競爭力和最重要的工業領域之一。大型機械製造業對維護和修理工具以及定期維修的需求龐大。歐洲也是世界主要的機械製造地之一。內需本身在外商眼中就蘊藏著巨大的發展潛力。國際產業參與企業憑藉其在各個細分行業的能力,能夠參與該細分市場並為其價值鏈做出重大貢獻。

- 歐盟的研究與創新(R&I)計畫大力支持工業技術和解決方案的開發,使歐洲製造業能夠充分利用最尖端科技。這將促進 MRO 解決方案中的智慧技術並在英國鄉村市場創造更多機會。

- 英國政府已委託「智慧製造」產業目標審查,並提出建議,確保英國在 2030 年成為第四次工業革命的主要參與企業。各國政府機構支持智慧產業的案例也進一步推動了MRO市場的成長。

- 此外,Groupe Roux-Jourfier 等公司正在幫助企業將「協作機器人」納入工廠,這些機器人可以運行完全自動化的流程,並與人類操作員並肩工作,執行更複雜的任務。這對於航太業來說尤其重要,因為該行業OEM始終面臨著按時交付產品的壓力,並將這種壓力轉嫁給供應商。

- 新冠疫情導致一些潛在領域的工業生產下降,在一定程度上阻礙了MRO市場的成長。由於全球需求減少,新冠疫情導致德國等國家面臨貿易前景疲軟。中國是德國最大的貿易夥伴,製造商嚴重依賴中國的供應鏈和中國對「德國製造」產品的需求。由於經濟放緩,市場面臨多重挑戰。此外,Insee的數據顯示,製造業產出成長從5月的22.2%放緩至14.4%。汽車和運輸設備產量增加39.5%,其次是石油產品和焦炭製造業,成長18.9%。疫情期間,法國政府宣布了一項 80 億歐元(約 88 億美元)的支持計劃,以幫助汽車製造業從新冠危機中復甦。

歐洲維護、維修和營運 (MRO) 市場的趨勢

工業 MRO 可望大幅成長

- 隨著該地區物料輸送產業的發展,參與企業正專注於採用無機策略以維持市場競爭力。例如,最近的一個例子是,AMH 物料輸送宣布與 Geek+ 建立新的策略夥伴關係關係,Geek+ 成為其英國官方經銷商。作為自動化、物料輸送和維護領域的專家,AMH 為英國大多數客戶提供服務和維護支援。我們也提供 Geek+ 產品作為我們倉庫設備解決方案的一部分。

- 在歐洲,電氣和電子製造業正在經歷重大變革,工廠正在採用新技術。住宅和業務用途對高科技設備的需求不斷成長,迫使製造商對其生產流程做出必要的調整。這也對我們的 MRO 業務產生了正面影響。預計政府針對循環系統、腫瘤和呼吸系統疾病的新治療設施的舉措將在整個預測期內推動歐洲製藥業的擴張。由於製藥公司優先考慮有效的設施和機器維護,預計未來幾年對相關 MRO 服務的需求將會成長。

- 在該地區營運的技術推動公司正在採用創新解決方案,利用庫存管理和設施 MRO 領域的多種解決方案的順利整合。

- 2022 年 10 月,公司宣布對位於愛爾蘭魯汶郡鄧多克的歐洲 MRO(維護、維修和營運)設施進行大規模擴建。該公司宣布將大幅擴大位於勞斯郡的歐洲 MRO(維護、修理和營運)設施。 PTS 預計其鄧多克工廠每月將安裝 1,500 至 2,000 台設備。除了作為歐洲的銷售基地外,我們還維修波音 CSS 設備、X 系列和 Next IFE 系統。

- 法國的工業和相關服務業佔GVA的不到20%。法國央行公佈的資料顯示,法國工業部門除了規模相對於其他歐洲國家較小之外,過去兩年運轉率也持續下滑。這凸顯了該市場採用自動化解決方案的理想條件。

德國:預計將大幅成長

- 德國不斷發展的工業部門是歐洲和全球 MRO 市場的重要組成部分。該國各個潛在產業採用最尖端科技為 MRO 市場創造了機會。德國的工業基礎由被稱為「Mittelstand」的中型製造商支撐,其中 90% 在 B2B 市場運作。為促進這一目標,德國政府制定了“中小企業數位化計劃”,創建了一個相關人員網路,讓中小企業和企業家可以相互學習。這有助於中小企業建立信任、接受和支持,以採用工業 4.0。

- 人工智慧是德國製造業趕上美國和亞洲等其他地區所需的唯一技術。德國政府最近承諾到 2025 年將投資 30 億歐元用於人工智慧研發。預計這將進一步加速德國製造業正在進行的數位化進程。

- 在該國營運的公司正專注於有機和無機成長策略,以保持市場競爭力。例如,普惠公司旗下的營運子公司普惠公司(P&WC)去年 10 月宣布,將與長期合作夥伴 MTU 航空引擎公司合作,於 2024 年在德國開設第二家 PW800 引擎維護、維修和營運 (MRO) 設施。

- 此外,德國聯邦統計局表示,該國製造業僱用了800多萬人。然而,根據Bitkom和TUV-Verband的調查,不到三分之二的公司提供員工數位化培訓課程。

- 這一狀況即將改變,因為博世與斯圖加特地區商會 (IHK) 以及其他科學和工業合作夥伴共同開發了一門名為 Fachkraft fur Industrie 4.0 (IHK)(工業 4.0 專家)的數位化認證課程。

- 在該國營運的公司正專注於開發高效的建築圍護結構,進一步為市場成長創造機會。例如,去年7月波音公司、ESG Elektroniksystem-und Logistik-GmbH和漢莎技術公司簽署了三方協議,為德國新型P-8A海神飛機提供服務。根據這份新契約,德國的 P-8A 維持計畫將由波音公司、ESG 和漢莎技術公司組成的三家公司團隊負責執行。此次合作體現了我們致力於為本地客戶提供優質德國工業產品的決心。

歐洲維護、維修和營運 (MRO) 產業概況

歐洲 MRO 市場由多個全球和地區參與企業組成,他們在相當激烈的市場空間中競爭。收購、與產業參與企業的合作以及推出新產品和服務是該市場供應商的主要競爭策略。在分散的行業中,供應商夥伴關係和聯盟是競爭策略的一部分,在這個行業中,即使是知名的供應商的市場佔有率也很低,但利潤卻很高。由於知名產業參與企業預計將擴大其市場佔有率,預計這項發展將在各個終端用戶垂直領域增加。預計市場供應商將專注於與技術提供者合作,以進一步增強其整合服務產品。

2022 年 10 月,TUI 和 Joramco 將擴大維修合作關係,Joramco 將對 TUI 的波音 787 飛機進行全面檢查。在此之前,Joramco 已完成 TUI窄體737 和 Embraer 飛機的維護檢查。 Joramco執行長在評論此次活動時表示:「Joramco 很自豪能夠繼續與 TUI 集團保持牢固的合作關係,TUI 集團是我們的長期重要客戶,信任我們能夠維持從美國和瑞典飛往我們約旦工廠的飛機。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 市場定義和範圍

- 調查前提

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業相關人員分析

- 產業吸引力-波特五力模型

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場動態

- 市場促進因素

- 更加重視業務效率,對設施和工業 MRO 的需求不斷成長

- 技術進步

- 市場問題

- 原料和人事費用上漲導致收益下降

- 市場機會

- 歐洲MRO產業分銷通路分析

- 關鍵技術創新—物聯網、3D列印和機器視覺系統的融合

- COVID-19 對 MRO 產業供需動態的影響

第6章 市場細分

- 按 MRO 類型

- 工業MRO

- 工業 MRO 市場範圍

- 工業 MRO 最終用戶產業

- 主要經銷商供應商簡介

- 工業 MRO經銷商列表

- 電氣 MRO

- 電氣 MRO 市場範圍

- 電氣 MRO(按最終用戶行業分類)

- 主要經銷商供應商簡介

- 電氣 MRO經銷商清單

- 設施維護、維修和大修

- 設施 MRO 市場範圍

- 最終用戶行業設備 MRO

- 主要經銷商供應商簡介

- 設施 MRO經銷商清單

- 工業MRO

- 按國家

- 英國

- 德國

- 法國

- 西班牙

- 歐洲其他地區(義大利、波蘭等)

第7章 競爭格局

- 公司簡介

- Wurth Group GmbH

- Airgas Inc.(Air Liquide SA)

- Eriks NV

- WESCO International Inc.

- Sonepar SA

- Rexel Holdings USA(Rexel SA)

- Wolseley Limited(Ferguson PLC)

- WW Grainger Inc.

- Electrocomponent PLC

第8章投資分析

第9章 市場機會與未來趨勢

The Europe Maintenance, Repair, And Operations Market size is estimated at USD 127.88 billion in 2025, and is expected to reach USD 141.53 billion by 2030, at a CAGR of 2.05% during the forecast period (2025-2030).

The maintenance, repair, and overhaul (MRO) market is anticipated to see growth prospects due to the rising demand for repair, maintenance, and service operations in manufacturing and industrial activities, particularly in Norway, Sweden, Germany, and Finland. A wide range of opportunities for developing industrial and manufacturing activities in the area have been established by the commercial availability of MRO goods and skilled labor for services. Additionally, this has increased sales for the major players in the European economies. Further, rising industrial output is anticipated to increase MRO activities in Germany, Italy, France, and the United Kingdom.

Key Highlights

- One of Europe's most competitive and significant industrial sectors is manufacturing machinery and equipment. A sizable machinery manufacturing sector creates a great demand for maintenance and repair tools and routine services. Also, Europe is one of the world's top manufacturing hubs for machinery. The domestic demand itself presents tremendous development potential from the perspective of foreign investors. The international industry players can participate in this sector and contribute significantly to its value chain thanks to their competencies in various industrial verticals.

- The European Union's research & innovation (R&I) programs have firmly supported the development of industrial technologies and solutions that enable the European manufacturing industry to take full advantage of cutting-edge technologies. This promotes smart technologies in MRO solutions, further creating opportunities for the United Kingdom country market.

- The UK Government commissioned the 'Made Smarter' review with the aim of the industry, providing recommendations to ensure that the UK will be a significant player in the 4th industrial revolution by 2030. These instances of supporting smart industry from government bodies in the country further boost the MRO market growth.

- Further, firms like Groupe Roux-Jourfier enable companies to incorporate "collaborative robotics" into their plants, perform entirely automatic processes, and work collaboratively alongside human operators to perform more complex tasks. This is particularly essential for the Aerospace industry, where OEMs are always under pressure to deliver products on time and transfer this pressure to suppliers.

- The decreasing industrial production in some potential sectors due to the COVID-19 pandemic impedes the MRO market growth to a certain extent. Due to the outbreak of COVID-19, countries such as Germany's trade outlook became weak due to a decrease in global demand. China is Germany's biggest trading partner, with manufacturers highly dependent on Chinese supply chains and the Chinese demand for "Made in Germany" goods. Due to the slowdown, the market is facing several challenges. Further, as per Insee's statistics, manufacturing output growth slackened to 14.4% from 22.2% in May. Automotive and transport equipment production increased by 39.5%, followed by an 18.9% rise in refined petroleum products and coke manufacture. During the pandemic, the French government announced a EUR 8 billion or USD 8.8 billion aid package to help the automotive manufacturing industry recover from the COVID-19 crisis, which will help create ample opportunities for the MRO players centered on the automotive manufacturing sector.

Europe Maintenance, Repair, & Operations (MRO) Market Trends

Industrial MRO is Expected to Witness Significant Growth

- With the advancement in the region's material handling sector, the players focus on the adoption of inorganic strategies to stay competitive in the market. For instance, in the recent past, AMH Material Handling announced its new strategic partnership with Geek+ as an official United Kingdom distributor. As automation, material handling, and maintenance specialists, AMH will offer service and maintenance support to most UK customers. Still, it will also supply Geek+ products as part of its warehouse facility solutions.

- Manufacturing of electrical and electronic products is changing significantly in Europe, and factories are using new technology. Manufacturers have been forced to make the necessary adjustments to the production processes due to the growing demand for high-tech equipment in residential and commercial applications. This has had a favorable impact on the MRO operations business. Government initiatives for new treatment facilities for circulatory system disorders, neoplasms, and respiratory diseases are expected to cause the pharmaceutical industry in Europe to expand throughout the projected period. The need for relevant MRO services is expected to rise in the upcoming years as pharmaceutical companies prioritize effective facility equipment and machinery maintenance.

- Technology enabler companies operating in the region are adopting innovative solutions to leverage the smooth integration of several solutions with inventory management for the facility MRO segment.

- In October 2022, The considerable expansion of its European MRO (maintenance, repair, and overhaul) facility in Dundalk, Co. Louth, Ireland, was announced by Panasonic Avionics Corporation (Panasonic Avionics). PTS anticipates introducing 1,500-2,000 units each month at its Dundalk site. In addition to serving as its European distribution hub, it will perform repairs on Boeing CSS equipment, X series, and Next IFE systems.

- France's industry and related services are worth less than 20% of GVA. In addition to being a relatively smaller player in its economy compared to other European counterparts, the French industrial sector has been experiencing a continuous decline in capacity utilization for the past two years, according to data released by the Bank of France. This highlights the ideal situation that exists in this market for the introduction of automation solutions.

Germany is Expected to Witness Significant Growth

- With the rising industrial sector in the country, it has become a significant segment of the MRO market across Europe and the globe. The adoption of cutting-edge technologies across the country's potential sectors has created opportunities for the MRO market. The backbone of Germany's industrial base is the Mittelstand, mid-size manufacturers, where 90% operate in business-to-business markets. To encourage this, the government of Germany has created the Mittelstand-Digital Initiative, in part in recognition, which creates networks between stakeholders through which SMEs and entrepreneurs can learn from each other. This has helped develop trust, acceptance, and buy-ins among SMEs for Industry 4.0 adoption.

- AI is the only technology where German manufacturing needs to catch up compared to other regions like the United States and Asia. In the recent past, the German government pledged to spend Euro 3 billion on research and development in artificial intelligence by 2025. This is expected to add to the already advanced digitization process in German Manufacturing.

- Players operating in the country focus on various organic and inorganic growth strategies to stay competitive in the market. For instance, in October last year, In partnership with longtime partner MTU Aero Engines, Pratt & Whitney (P&WC), a business subsidiary of Pratt & Whitney, announced a second maintenance, repair, and overhaul (MRO) facility for the PW800 engine will open in Germany in 2024.

- Further, the German federal statistics bureau stated that the domestic manufacturing industry employs more than 8 million people. However, Bitkom and TUV-Verband found that less than two-thirds of these companies are offering workforce training courses on digitalization.

- This is about to change as Bosch, in collaboration with the Stuttgart Region Chamber of Industry and Commerce (IHK), and other sciences and industry partners have developed a certification course on digitization called Fachkraft fur Industrie 4.0 (IHK), or Industry 4.0 specialist.

- Players operating in the country are focusing on developing efficient building envelopes, further creating market growth opportunities. For instance, in July last year, To service the new German P-8A Poseidon fleet, Boeing, ESG Elektroniksystem- und Logistik-GmbH, and Lufthansa Technik inked a tripartite agreement. With the new deal, the P-8A sustainment program in Germany will be carried out by a team made up of Boeing, ESG, and Lufthansa Technik. This collaboration reflects a dedication to providing local customers with German industry primes.

Europe Maintenance, Repair, & Operations (MRO) Industry Overview

The MRO market in Europe comprises several global and regional players vying for attention in a somewhat contested market space. Acquisitions, partnerships with industry participants, and new product/service rollouts have been key competitive strategies exhibited by vendors in the market. Partnerships and alliances with suppliers are part of a competitive strategy in the industry, which is fragmented, and even prominent vendors command lower market share and gain from higher margins. Such developments are expected to increase in respective end-user verticals as prominent industry players are expected to expand their market presence. Vendors in the market are expected to focus on forming alliances with technology providers to enhance their integrated service offerings further.

In October 2022, TUI and Joramco expanded their maintenance collaboration, under which Joramco will thoroughly inspect TUI's Boeing 787 aircraft. Before this, Joramco had completed maintenance inspections on TUI's narrowbody 737s and Embraers. The CEO of Joramco, Fraser Currie, made the following statement about the event: "We at Joramco are proud to continue building on our strong relationship with TUI Group, who has been a valued customer for many years and has put their trust in us to perform maintenance on aircraft flown into our facilities in Jordan from both the UK and Sweden.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Market Definition and Scope

- 1.2 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Stakeholder Analysis

- 4.3 Industry Attractiveness - Porter Five Forces

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing emphasis on operational efficiency, Growing demand for Facility and Industrial MRO

- 5.1.2 Technological advancements

- 5.2 Market Challenges

- 5.2.1 Raw material and labor cost increase to further contribute to declining profits

- 5.3 Market Opportunities

- 5.4 Distribution Channel Analysis - Europe MRO Industry

- 5.5 Major technological innovations - Convergence of IoT, 3D Printing and Machine Vision Systems

- 5.6 Impact of COVID-19 on the Supply & Demand-side dynamics of the MRO industry

6 MARKET SEGMENTATION

- 6.1 By MRO Type

- 6.1.1 Industrial MRO

- 6.1.1.1 Market Scope of Industrial MRO

- 6.1.1.2 Industrial MRO by End-user Industry

- 6.1.1.3 Vendor Profiles of Key Distributors

- 6.1.1.4 List of Distributors in Industrial MRO

- 6.1.2 Electrical MRO

- 6.1.2.1 Market Scope of Electrical MRO

- 6.1.2.2 Electrical MRO by End-user Industry

- 6.1.2.3 Vendor Profiles of Key Distributors

- 6.1.2.4 List of Distributors in Electrical MRO

- 6.1.3 Facility MRO

- 6.1.3.1 Market Scope of Facility MRO

- 6.1.3.2 Facility MRO by End-user Industry

- 6.1.3.3 Vendor Profiles of Key Distributors

- 6.1.3.4 List of Distributors in Facility MRO

- 6.1.1 Industrial MRO

- 6.2 By Country

- 6.2.1 United Kingdom

- 6.2.2 Germany

- 6.2.3 France

- 6.2.4 Spain

- 6.2.5 Rest of Europe (Italy, Poland and others)

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Wurth Group GmbH

- 7.1.2 Airgas Inc. (Air Liquide SA)

- 7.1.3 Eriks NV

- 7.1.4 WESCO International Inc.

- 7.1.5 Sonepar SA

- 7.1.6 Rexel Holdings USA (Rexel SA)

- 7.1.7 Wolseley Limited (Ferguson PLC)

- 7.1.8 W.W. Grainger Inc.

- 7.1.9 Electrocomponent PLC