|

市場調查報告書

商品編碼

1690771

美國維護、維修和營運 (MRO):市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)United States Maintenance, Repair, And Operations (MRO) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

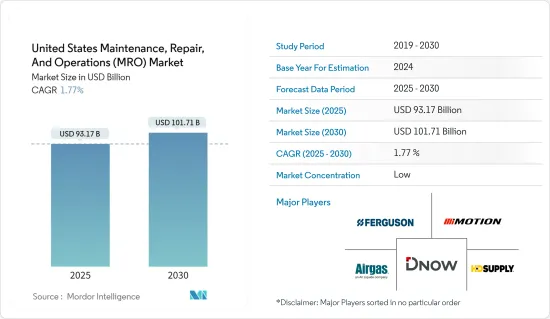

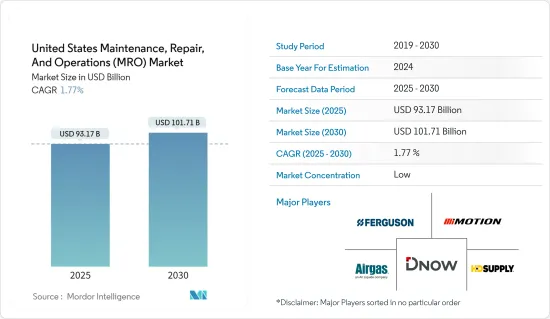

美國維護維修和營運 (MRO) 市場規模預計在 2025 年為 931.7 億美元,預計到 2030 年將達到 1017.1 億美元,預測期內(2025-2030 年)的複合年成長率為 1.77%。

MRO 代表維護、修理和營運,涵蓋所有不直接參與生產但對於維護設施和確保生產過程順利進行至關重要的活動。這個總稱涵蓋了從 MRO 庫存管理到實施預測性、預防性和糾正性維護策略的所有內容。由於其重要性,MRO 流程在維持工廠運作方面發揮著至關重要的作用。

主要亮點

- 由於人們對內部效率的興趣日益濃厚、數位化的進步以及對維護業務的投資不斷擴大,美國MRO 市場正在迅速受到關注。隨著越來越多的公司認知到 MRO 的成本節約潛力,尤其是透過流程簡化和供應鏈效率的提高,對該市場的投資正在增加。

- 此外,美國經濟和製造業正在成長,進一步增加了對維護和維修服務的需求,特別是在政府重新集中精力恢復關鍵產業的情況下。工業4.0的出現也刺激了MRO產業的發展。

- 製造業、公共產業和其他工業設施中的設備老化會導致生產力下降、效率降低以及停機而導致的成本增加。雖然所有資產都會面臨非計劃性停機,但舊資產更容易出現計劃內和計劃外停機,而且風險會隨著資產老化而增加。

- 作為正在進行的工業革命的產物,工業 4.0 與傳統的線性供應鏈模式有著很大的不同。工業 4.0 與傳統的線性供應鏈模式有著顯著的不同,預示著製造業將迎來互聯互通、敏捷供應營運的新時代。從一級產業革命到現在的工業4.0,製造業的演變正在重塑這個產業。工業 4.0 不僅僅是將舊有系統升級為智慧機器;它是關於建立數位化工廠和促進互聯互通的企業網路。

- 儘管美國工業 MRO 市場繼續提供有利可圖的機會,但經銷商卻面臨持續的價格壓力。許多供應商強調規模和SKU多樣性,但這並不是保護他們免受商品化威脅的策略。此外,MRO 市場的供應商通常專注於擴大其 SKU 產品以吸引更廣泛的客戶群。然而,單純增加SKU數量並不會帶來利潤的增加。需要與多個供應商夥伴關係,供應商通常必須與供應商和客戶共用利潤率和成本效益。

美國維護、維修和營運 (MRO) 市場的趨勢

製造業(工業MRO)佔最大佔有率

- 該國製造業對工業MRO設備的採用受到各種促進因素的影響,例如降低成本的需求突然增加,市場成熟度,新設備銷售的週期性變化以及對改進產品品質的需求不斷增加。製造企業不斷尋求實現高利潤率,並努力提高淨資產資產回報率(RONA)。

- 除安全和環境事故外,計劃外或意外停機已成為製造工廠中最昂貴的事件之一。根據《富比士》雜誌報道,平均製造商每年面臨 800 小時的設備停機時間,相當於每週超過 15 小時。這次停機成本很高。例如,汽車製造商的生產線停工時平均每分鐘損失 22,000 美元。總計非計畫停機每年對工業製造商造成的損失高達 500 億美元。

- 此外,國內製造商正在尋求最佳化流程以降低整體能源消費量,以遵守政府法規。作為拜登總統「投資美國」議程的一部分,美國能源局(DOE)宣布向20多個州的33個計劃投入高達60億美元的資金,以實現能源密集型產業脫碳、減少工業溫室氣體排放、支持高薪工會工作、振興工業社區並增強國家製造業的競爭力。

- 根據 EIA 的數據,工業部門是該國第二大能源消耗部門,因此對工業 MRO 服務和解決方案的需求不斷增加。在此過程中,製造商正在進行產品生命週期評估,並納入實施精實製造實務所需的 MRO 設施。

食品飲料和造紙加工(電氣 MRO)產業實現顯著成長

- 電氣系統(包括控制面板、配電板、電源、電路斷流器和緊急停止系統)的正常和持續運作對食品和飲料產業至關重要,並可能導致大量的產品浪費和生產停工。

- 美國食品加工產業是全球巨頭。根據美國人口普查局的數據,2023年,美國食品和飲料零售商的年銷售額為9.853億美元。幾十年來,這一數字一直在穩步成長。該行業是美國經濟的基石,為數百萬人提供了就業機會並產生了可觀的收益。

- 在電氣系統中,維持嚴格的衛生標準對於避免污染風險至關重要。零件需要經常清洗,精確的溫度控制對於食品安全至關重要。隨著工業機械變得越來越大、越來越複雜,電氣系統必須跟上發展步伐,需要堅固可靠的零件。紙張加工過程中容易產生對電氣設備有害的灰塵,因此定期清潔和維護對於防止因灰塵堆積而造成故障至關重要。

- 2024年3月,美國政府向卡夫亨氏撥款1.7億美元,用於維修10家工廠。利用這筆資金,卡夫亨氏計畫採用多種技術,包括熱泵、電暖器、電鍋爐、厭氧消化器、沼氣燃氣鍋爐、太陽能熱能、光伏發電和熱能能源儲存。同樣,2024 年 6 月,SunOpta 透露將投資 2,600 萬美元擴建其位於加州的植物飲料加工廠。這些發展,加上該領域的許多其他擴張和升級,有望提振需求並為美國電氣服務 MRO 市場創造機會。

美國維護、維修和營運 (MRO) 行業概況

美國維修營運(MRO)市場分散且競爭激烈,國內和國際市場上都有多家供應商營運。市場似乎相當集中。主要企業正在採取合併、收購和擴張等策略來擴大其地理範圍並保持競爭力。市場的主要企業包括 DNOW Inc.(DistributionNOW)、Airgas Inc.(Air Liquide SA)、Ferguson PLC、Motion Industries Inc.(原廠零件公司)和 HD Supply Holdings Inc.

- 2024 年 5 月 - Ferguson PLC 收購 AVCO Supply, Inc.,增強其產品組合。此次收購凸顯了弗格森為機械承包商提供的客製化解決方案。此外,該公司還將鞏固弗格森在商務用管道、閥門和配件產品以及水暖類別方面的現有優勢,尤其是在費城市場。

- 2024 年 3 月 - MSC Industrial Direct Co. Inc. 成功從 Schmitz Manufacturing Research & Technology LLC (SMRT) 收購智慧財產權 (IP) 資產。這些資產是專門為增強 MSC 向美國製造業提供的技術而量身定做的。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 產業價值鏈分析

- PESTLE分析

- 關鍵技術進步—物聯網、3D 列印和機器視覺系統的融合

- 評估宏觀經濟因素對 MRO 產業的影響

第5章 市場動態

- 市場促進因素

- 國內製造設施老化,更重視營運效率

- 技術進步,例如自動化解決方案的出現(工業自動販賣機)

- 市場挑戰

- MRO的商品化導致競爭加劇,影響了工業設備等關鍵領域的產業利潤率。

第6章 市場細分

- 工業MRO

- 當前市場狀況

- 按最終用戶產業

- 製造業

- 建設業

- 化工和石化

- 食品飲料/造紙加工

- 其他

- 市場展望

- 電氣 MRO

- 當前市場狀況

- 按最終用戶產業

- 製造業(製程製造業及非製程製造業)

- 建設業

- 化工和石化

- 食品飲料及造紙工業

- 其他最終用戶產業

- 市場展望

- 設施維護、維修和大修

- 當前市場狀況

- 按最終用戶產業

- 醫療保健和社會援助

- 製造業

- 建設業

- 其他最終用戶產業

- 市場展望

第7章 競爭格局

- 公司簡介

- DNOW Inc.(DistributionNOW)

- Airgas Inc.(Air Liquide SA)

- Ferguson PLC

- Motion Industries Inc.(Genuine Parts Company)

- HD Supply Holdings Inc.

- MRC Global Inc.

- Fastenal Company

- MSC Industrial Direct Co. Inc.

- Applied Industrial Technologies

- WESCO International Inc.

- Sonepar SA

- Rexel Holdings USA(Rexel)

- Eastern Power Technologies Inc.

- Consolidated Electrical Distributors Inc.

- Elliot Electric Supply

- Border States Industrial Inc.

- Ferguson PLC

- WW Grainger Inc.

- Fastenal Company

- MSC Industrial Direct Co. Inc.

- Distribution Solutions Group Inc.

- The Home Depot Inc.(Interline Brands Inc.)

- Builders Firstsource

- Bluelinx Holdings

第8章投資分析

The United States Maintenance, Repair, And Operations Market size is estimated at USD 93.17 billion in 2025, and is expected to reach USD 101.71 billion by 2030, at a CAGR of 1.77% during the forecast period (2025-2030).

MRO, short for maintenance, repair, and operations, encompasses all the activities essential for maintaining a facility and ensuring the smooth operation of the production process without directly engaging in production. This umbrella term covers everything from managing MRO inventory to implementing predictive, preventive, and corrective maintenance strategies. Given their significance, MRO processes play a pivotal role in sustaining factory operations.

Key Highlights

- The US MRO market is witnessing a surge in interest due to a heightened focus on internal efficiency, the rise of digitization, and amplified investments in maintenance operations. As companies increasingly recognize the cost-saving potential of MRO, particularly in streamlining processes and enhancing supply chain efficiency, their investments in this market have been on the rise.

- Moreover, the United States is experiencing economic and manufacturing growth, especially owing to the renewed focus of the government on restoring some of the critical industries, thereby further fueling the demand for maintenance and repair services. The advent of Industry 4.0 is also catalyzing advancements in the MRO sector.

- Aging equipment in manufacturing, utility, and other industrial facilities leads to reduced productivity, efficiency, and heightened costs due to increased downtime. While all equipment faces unplanned downtime, older equipment is prone to more frequent planned and unplanned downtimes, with risks escalating as they age.

- Industry 4.0, a product of the ongoing industrial revolution, marks a significant departure from the traditional linear supply chain model. It ushers in an era of interconnected, agile supply operations within manufacturing. This evolution in manufacturing, from the First Industrial Revolution to the current Industry 4.0, is reshaping the sector. Industry 4.0 is not just about upgrading from legacy systems to smart machines; it's about creating digital factories and fostering a network of interconnected enterprises.

- While the industrial MRO market in the United States continues to present lucrative opportunities, distributors grapple with persistent pricing pressures. Many vendors lean heavily on scale and SKU variety, a strategy that doesn't shield them from the threat of commoditization. Vendors in the MRO market also usually focus on ramping up their SKU offerings to attract a broader customer base. However, merely expanding SKU numbers doesn't equate to higher profits. It necessitates forging partnerships with multiple suppliers, often requiring vendors to share profit margins and cost benefits with both suppliers and customers.

USA Maintenance Repair & Operations (MRO) Market Trends

Manufacturing (Industrial MRO) Accounts for the Largest Share

- The adoption of industrial MRO equipment in the manufacturing industry in the country has been impacted by various driving factors, which include the surging demand to reduce cost, ramping market maturity, cyclical fluctuations in new equipment sales, as well as the growing need to enhance product quality. With enterprises in the manufacturing sector continuously looking forward to achieving large profit margins, they have been looking to increase return on net assets (RONA).

- Next to a safety or environmental mishap, unscheduled or unplanned downtime has emerged as one of the costliest events at any manufacturing plant. According to Forbes, an average manufacturer confronts 800 hours of equipment downtime per year, which turns out to be more than 15 hours per week. That downtime arrives at a cost, and it's quite hefty. For instance, the average automotive manufacturer loses USD 22,000 per minute when the manufacturing line stops, and that swiftly adds up. Collectively, unplanned downtime costs industrial manufacturers as much as USD 50 billion a year.

- Furthermore, manufacturers in the country have been looking towards optimizing their processes to reduce their overall energy consumption in adherence to government regulations. As part of President Biden's Investing in America agenda, the US Department of Energy (DOE) announced up to USD 6 billion for 33 projects across more than 20 states to decarbonize energy-intensive industries, reduce industrial greenhouse gas emissions, support good-paying union jobs, revitalize industrial communities, and strengthen the nation's manufacturing competitiveness.

- The rising demand for industrial MRO services and solutions as the industrial segment has been the second largest energy consumer in the country, as per EIA. In the process, manufacturers have been conducting lifecycle assessments of their products and incorporating the required MRO equipment to practice lean manufacturing.

Food, Beverage and Paper Processing (Electrical MRO) Segment to Witness Major Growth

- Proper and continuous functioning of the electrical systems, including control panels, distribution boards, power supplies, circuit breakers, and emergency stop systems, is of utmost importance in the food & beverage industry, which may result in significant product wastage and production downtime.

- The US food processing industry is a global giant. In 2023, retail food and beverage stores in the United States reported annual sales of USD 985.3 million, as per the US Census Bureau. This figure has been on a consistent upward trajectory for decades. Beyond its financial might, the industry is a cornerstone of the US economy, offering employment to millions and driving substantial revenue.

- Maintaining stringent hygiene standards is paramount in electrical systems to avert contamination risks. Components require frequent cleaning, and precise temperature regulation is crucial for food safety. As the industry's machinery grows in size and complexity, electrical systems must adapt, demanding robust and dependable components. Given the propensity of paper processing to generate dust, which can harm electrical equipment, regular cleaning, and maintenance are imperative to prevent failures due to buildup.

- In March 2024, the US government awarded USD 170 million to Kraft Heinz to upgrade ten facilities. Kraft Heinz plans to use the funds to install a range of technologies, including heat pumps, electric heaters, electric boilers, anaerobic digestors, biogas boilers, solar thermal, solar photovoltaic, and thermal energy storage. Similarly, in June 2024, SunOpta disclosed a USD 26 million investment to expand its California plant-based beverage processing facility. These developments, alongside numerous other expansions and upgrades in the sector, are poised to bolster demand and create opportunities in the US electrical service MRO market.

USA Maintenance Repair & Operations (MRO) Industry Overview

The United States Maintenance, Repair, and Operations (MRO) Market is fragmented and highly competitive due to multiple vendors operating in the domestic and international markets. The market appears to be moderately concentrated. The significant players adopt strategies such as mergers, acquisitions, and expansions to expand their geographic reach and stay competitive. Some of the major players in the market are DNOW Inc. (DistributionNOW), Airgas Inc. (Air Liquide SA), Ferguson PLC, Motion Industries Inc. (Genuine Parts Company), and HD Supply Holdings Inc., among others.

- May 2024 - Ferguson PLC bolstered its offerings by acquiring AVCO Supply Inc. This move underscores Ferguson's dedication to offering tailored solutions to mechanical contractors. Moreover, it enhances Ferguson's existing prowess in commercial pipe, valve, and fitting products, as well as in the hydronic categories, particularly in the Philadelphia market.

- March 2024 - The MSC Industrial Direct Co. Inc. successfully finalized the acquisition of intellectual property (IP) assets from Schmitz Manufacturing Research & Technology LLC (SMRT). These assets are specifically tailored to enhance MSC's technology offerings for the US manufacturing sector.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Pestle Analysis

- 4.5 Major Technological Advancements - Convergence of IoT, 3D Printing, and Machine Vision Systems

- 4.6 Assessment of the Impact of Macroeconomic Factors on the MRO Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Emphasis on Operational Efficiency and Aging of Manufacturing Equipment in the Country

- 5.1.2 Technological Advancements, such as the Emergence of Automated Solutions (Industrial Vending Machines)

- 5.2 Market Challenges

- 5.2.1 Commodification of MRO has led to Higher Competition, thereby, Affecting Industry Margins in Key Segments, such as Industrial

6 MARKET SEGMENTATION

- 6.1 Industrial MRO

- 6.1.1 Current Market Scenario

- 6.1.2 By End-user Industry

- 6.1.2.1 Manufacturing

- 6.1.2.2 Construction

- 6.1.2.3 Chemicals and Petrochemicals

- 6.1.2.4 Food, Beverage and Paper Processing

- 6.1.2.5 Others

- 6.1.3 Market Outlook

- 6.2 Electrical MRO

- 6.2.1 Current Market Scenario

- 6.2.2 By End-user Industry

- 6.2.2.1 Manufacturing (Process and Non-Process)

- 6.2.2.2 Construction

- 6.2.2.3 Chemicals and Petrochemicals

- 6.2.2.4 Food, Beverage and Paper Processing

- 6.2.2.5 Other End-user Industries

- 6.2.3 Market Outlook

- 6.3 Facility MRO

- 6.3.1 Current Market Scenario

- 6.3.2 By End-user Industry

- 6.3.2.1 Healthcare and Social Assistance

- 6.3.2.2 Manufacturing

- 6.3.2.3 Construction

- 6.3.2.4 Other End-user Industries

- 6.3.3 Market Outlook

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 DNOW Inc. (DistributionNOW)

- 7.1.2 Airgas Inc. (Air Liquide SA)

- 7.1.3 Ferguson PLC

- 7.1.4 Motion Industries Inc. (Genuine Parts Company)

- 7.1.5 HD Supply Holdings Inc.

- 7.1.6 MRC Global Inc.

- 7.1.7 Fastenal Company

- 7.1.8 MSC Industrial Direct Co. Inc.

- 7.1.9 Applied Industrial Technologies

- 7.1.10 WESCO International Inc.

- 7.1.11 Sonepar SA

- 7.1.12 Rexel Holdings USA (Rexel)

- 7.1.13 Eastern Power Technologies Inc.

- 7.1.14 Consolidated Electrical Distributors Inc.

- 7.1.15 Elliot Electric Supply

- 7.1.16 Border States Industrial Inc.

- 7.1.17 Ferguson PLC

- 7.1.18 W.W. Grainger Inc.

- 7.1.19 Fastenal Company

- 7.1.20 MSC Industrial Direct Co. Inc.

- 7.1.21 Distribution Solutions Group Inc.

- 7.1.22 The Home Depot Inc. (Interline Brands Inc.)

- 7.1.23 Builders Firstsource

- 7.1.24 Bluelinx Holdings