|

市場調查報告書

商品編碼

1651029

零售雲端安全-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Retail Cloud Security - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

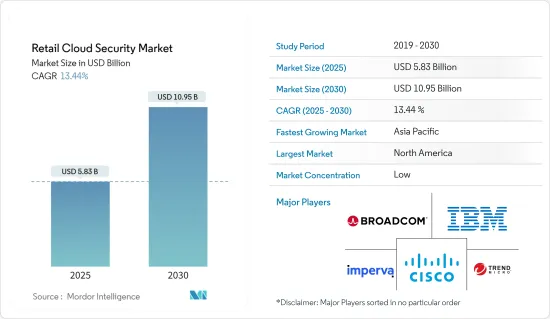

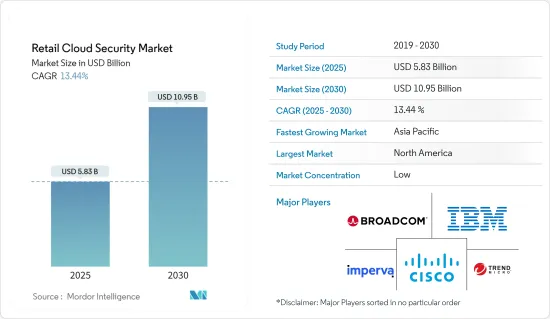

零售雲端安全市場規模在 2025 年估計為 58.3 億美元,預計到 2030 年將達到 109.5 億美元,預測期內(2025-2030 年)的複合年成長率為 13.44%。

由於技術的發展和大量以數位格式提供的資訊,資料外洩變得越來越普遍。根據 IBM 的《2022 年資料外洩成本研究》,2022 年的平均資料外洩成本為 435 萬美元。企業正在採取全面的預防措施來消除從最終用戶到 IT 系統的潛在系統漏洞,從而推動雲端安全市場的採用和成長。

關鍵亮點

- 隨著消費者購買行為的不斷變化,很難預測未來幾年零售業務的表現如何。為了在競爭中保持領先,零售商必須不斷創新、確保準確性並保持同步。許多零售企業已經採用雲端解決方案,在雲端安全地在線上儲存敏感資訊和庫存。這種技術轉變需要安全的網路解決方案,而雲端安全供應商則為其提供保障。

- 新冠疫情促使更多消費者上網。零售商採用分析技術來更了解消費者的需求,並採用人工智慧流程來滿足消費者的需求。零售業的數位轉型產生了對雲端儲存的需求,這又導致對雲端保全服務的需求增加。

- 據趨勢科技稱,91% 的網路攻擊都是從針對組織內特定員工的「魚叉式網路釣魚」電子郵件開始的。由於零售業中有許多非技術員工,人為因素可能是許多資料安全問題的根源。需要向員工普及各種資料安全風險及其應對方法。否則,雲端安全產業將很難保護資料免受機會性攻擊。

零售雲端安全市場趨勢

入侵偵測與預防取得顯著成長

- 入侵偵測系統 (IDS) 監控網路流量,如果偵測到惡意活動則立即發出警報。入侵偵測系統的學習任務是建立一個預測模型,能夠區分惡意連線(例如入侵或攻擊)和良好連線。系統管理員可以調查警報並採取措施防止損害。

- 根據軟體要求,入侵偵測系統 (IDS) 有許多不同類型。例如,思科開發了入侵防禦系統 (IPS),提供網路入侵偵測和防禦模式功能。使用者可以根據需要在IPS或IDS模式下啟用Snort。

- 根據 Verizon 的 2023 年資料外洩調查報告,83% 的資料外洩是由於外部經濟動機因素造成的,零售、金融和醫療保健行業預計將成為這些攻擊的先鋒。

- 許多零售商正在投資使用物聯網進行付款處理的非接觸式交易技術。這些技術創新有助於保護人們的健康並增加網路威脅。攻擊者使用複雜的機器人網路來獲取信用卡號和登入憑證等資料。為了應對日益增多的網路攻擊,政府機構已開始要求處理敏感資料的系統採用多因素身份驗證 (MFA)。

亞太地區將經歷最高成長

- 零售業每年平均遭遇 4,000 次資料安全威脅。 2022 年,亞太地區連續第二年成為遭受網路攻擊最多的地區,佔全球所有攻擊事件的 31%。

- 根據X-Force威脅情報指數,魚叉式網路釣魚是主要的感染媒介,佔40%。 13% 的事件使用了勒索軟體,而部署後門使攻擊者可以遠端存取系統,佔攻擊總數的 31%。

- 2023 年 3 月,Keeper Security 將與 Daiwabo Information Systems (DIS) 合作,向 19,000 個銷售合作夥伴和 90 個地點分發安全解決方案,協助保護日本企業和客戶免受網路攻擊和資料外洩。 Keeper 平台可擴展以適應任何規模的組織,可在幾分鐘內完成部署,幾乎不需要持續的管理。此外,該解決方案可與任何安全堆疊和資料環境無縫協作—單雲、多重雲端或混合雲。

零售雲端安全產業概覽

雲端安全供應商多家,競爭激烈,市場集中度低。幾乎每個產業都在從本地部署轉型為數位平台。快速數位化導致網路攻擊和資料外洩的增加。這迫使企業選擇雲端安全解決方案。該領域領先的雲端安全供應商包括 IBM Corporation、Trend Micro Inc.、McAfee、Broadcom Inc. 和 Cisco Systems Inc.這些雲端安全供應商正在透過新的產品解決方案和服務、併購和策略聯盟跨產業和跨地區擴張。

2023 年 2 月,思科收購了 Valtix,以增強其安全雲端產品組合。 Valtix 設計的雲端解決方案可提供 100% 的安全覆蓋,具有持續發現功能,可在 30 秒內動態適應新應用程式或現有應用程式的變更。透過這種整合,思科能夠提供一個易於使用的環境來保護多重雲端環境中的工作負載。

2022年10月,Beyond Cyber與趨勢科技建立合作關係,加強巴林的網路安全架構。根據協議,兩家公司將即時檢測並預先遏止網路威脅,降低風險和損失。

2022 年 5 月,泰國零售公司 TD Tawandang 與 Google Cloud 合作,為其客戶提供零售即服務 (RaaS) 平台。透過採用 Google Cloud 的安全、可擴展的基礎架構、進階分析、人工智慧 (AI) 和機器學習 (ML) 技術,我們將為便利商店連鎖店提供更精簡的後端服務。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 產業價值鏈分析

- COVID-19 工業影響評估

第5章 市場動態

- 市場促進因素

- 網路攻擊威脅加劇將推動市場成長

- 市場限制

- 將零售流程從本地遷移到雲端是一個巨大的挑戰

第6章 市場細分

- 按解決方案

- 身份驗證和存取管理

- 預防資料外泄

- 入侵偵測與預防

- 安全資訊和事件管理

- 加密

- 安全功能

- 應用程式安全

- 資料庫安全

- 端點安全

- 網路安全

- Web 和電子郵件安全

- 依部署方式

- 私人的

- 混合

- 民眾

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 歐洲其他地區

- 亞太地區

- 印度

- 中國

- 日本

- 其他亞太地區

- 拉丁美洲

- 中東和非洲

- 北美洲

第7章 競爭格局

- 公司簡介

- Trend Micro Inc.

- Imperva Inc.

- Broadcom Inc.

- IBM Corporation

- Cisco Systems Inc.

- Fortinet Inc.

- Sophos PLC

- Mcafee LLC

- Qualys Inc.

- Check Point Software Technologies Ltd

- Computer Science Corporation(CSC)

第8章投資分析

第9章 市場機會與未來趨勢

The Retail Cloud Security Market size is estimated at USD 5.83 billion in 2025, and is expected to reach USD 10.95 billion by 2030, at a CAGR of 13.44% during the forecast period (2025-2030).

Due to technological development and the vast amount of information available in digital form, data breaches are frequent. According to IBM's Cost of a Data Breach Study 2022, the average data breach cost was 4.35 million USD in 2022. Businesses implement all-encompassing preventative actions to close any potential system vulnerabilities, from end users to IT systems, leading to the adoption and growth of the cloud security market.

Key Highlights

- Forecasting how the retail business will perform over the next few years is challenging due to the ongoing change in consumer purchasing behavior. To withstand competition, retailers must consistently innovate, guarantee precision, and maintain synchronization. Many retailers adopted cloud solutions to store confidential information securely and inventory online within the cloud. This technological shift demanded a secure network solution, which Cloud Security providers are guarding.

- The COVID-19 pandemic pushed more consumers online. Retailers employed analytics to understand better consumer demands and AI-powered processes to give what they want. With the digital transformation in the retail industry, cloud storage has become a need, increasing the demand for cloud security services.

- According to Trend Micro, 91 percent of all cyberattacks start with an email "spear-phishing" attempt directed at a particular employee within an organization. The retail sector employs many unskilled employees so human factors may contribute to many data security issues. Employees must be educated about the various data security dangers and how to handle them; otherwise, it will be difficult for the cloud security industry to protect the data from untimely attacks.

Retail Cloud Security Market Trends

Intrusion Detection and Prevention to Register a Significant Growth

- When malicious activity is detected, an intrusion detection system (IDS) monitors network traffic and immediately provides alarms. The intrusion detector learning task is to build on a predictive model that can differentiate between bad connections, such as intrusions and attacks, and good connections. The system administrator can then investigate the alert and act to prevent damage.

- Different types of Intrusion Detection Systems (IDS) exist, depending on the software requirement. For instance, Cisco developed an Intrusion Prevention System (IPS), which provides network intrusion detection and prevention mode functionalities. Users can enable Snort in IPS or IDS mode based on their needs.

- According to Verizon's 2023 Data Breach Investigations Report,83% of breaches involved external factors with finanfial motives, retail, financial and healthcare sector has been seen at forefront of such attacked.These attacks were primarily made to steal customer data for profit.

- Many retailers invest in contactless transaction technologies that use IoT to process payments. These innovations contribute to human health protection and increase cyber threats. Attackers use sophisticated bot networks to collect data like credit card numbers or login credentials. Government agencies have started demanding MFA (multi-factor authentication) for systems that handle sensitive data in response to the rising tide of cyberattacks.

Asia-Pacific to Witness the Highest Growth

- The retail sector suffers an average of 4,000 data security threats every year. In 2022, the Asia-Pacific area experienced the most cyberattacks for the second consecutive year, with 31% of all incidents remedied globally.

- According to the X-Force Threat Intelligence Index, spear phishing via attachment was discovered to be the leading infection vector at 40%. Ransomware was used in 13% of incidents, while backdoor deployment, which grants attackers remote access to systems, accounted for 31% of attacks.

- In March 2023, Keeper Security collaborated with Daiwabo Information System Co., Ltd. (DIS) to distribute security solutions across 19,000 sales partners and 90 bases to help protect Japanese businesses and customers from cyberattacks and data breaches. The Keeper platform is scalable to meet the demands of any size organization, deploys within minutes, and requires very little ongoing management. Furthermore, the solution can seamlessly interact with any security stack and data environment, including single-cloud, multi-cloud, and hybrid.

Retail Cloud Security Industry Overview

There is intense competition with several providers of Cloud Security, because of which market concentration will be low. Almost every industry is transitioning from on-premises to digital platforms for corporate activity. With rapid digitalization, cyber-attacks and data breaches have increased. Thus, businesses are compelled to opt for cloud security solutions. Some significant cloud security providers in this sector include IBM Corporation, Trend Micro Inc., McAfee, Broadcom Inc., and Cisco Systems Inc. With new product solutions and services, mergers and acquisitions, and strategic collaborations, these Cloud security player are expanding their reach in different industries and geographies.

In February 2023, Cisco acquired Valtix to enhance its security cloud portfolio. The cloud solution designed by Valtix can achieve 100% security coverage through continuous discovery and takes 30 seconds to adapt to new apps and modifications to existing apps dynamically. The integration will fasten Cisco's progress towards providing an easy-to-use environment for safeguarding workloads across multi-cloud settings.

In October 2022, Beyon Cyber and Trend Micro partnered to boost Bahrain's cybersecurity framework. According to the agreement, the companies will detect cyber threats in real time, take preemptive measures to contain them and reduce risk and harm, giving the nation's organizations complete insight to safeguard all digital environments with full visibility and control.

In May 2022, Thailand-based retail company TD Tawandang collaborated with Google Cloud to provide a retail-as-a-service platform to its customers. Adopting Google Cloud's secure and scalable infrastructure, advanced analytics, artificial intelligence (AI), and machine learning (ML) technologies will help convenience store chains with more streamlined backend services.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of COVID-19 impact on the industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Threats of Cyber Attacks are Augmenting Market Growth

- 5.2 Market Restraints

- 5.2.1 Migration of Retail Processes from On-Premise to Cloud is a Major Challenge

6 MARKET SEGMENTATION

- 6.1 By Solution

- 6.1.1 Identity and Access Management

- 6.1.2 Data Loss Prevention

- 6.1.3 Intrusion Detection and Prevention

- 6.1.4 Security Information and Event Management

- 6.1.5 Encryption

- 6.2 By Security

- 6.2.1 Application Security

- 6.2.2 Database Security

- 6.2.3 Endpoint Security

- 6.2.4 Network Security

- 6.2.5 Web and Email Security

- 6.3 By Deployment Mode

- 6.3.1 Private

- 6.3.2 Hybrid

- 6.3.3 Public

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 US

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 Germany

- 6.4.2.2 UK

- 6.4.2.3 France

- 6.4.2.4 Rest of Europe

- 6.4.3 Asia-Pacific

- 6.4.3.1 India

- 6.4.3.2 China

- 6.4.3.3 Japan

- 6.4.3.4 Rest of Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Trend Micro Inc.

- 7.1.2 Imperva Inc.

- 7.1.3 Broadcom Inc.

- 7.1.4 IBM Corporation

- 7.1.5 Cisco Systems Inc.

- 7.1.6 Fortinet Inc.

- 7.1.7 Sophos PLC

- 7.1.8 Mcafee LLC

- 7.1.9 Qualys Inc.

- 7.1.10 Check Point Software Technologies Ltd

- 7.1.11 Computer Science Corporation (CSC)