|

市場調查報告書

商品編碼

1651031

北美塑膠包裝:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)NA Plastic Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

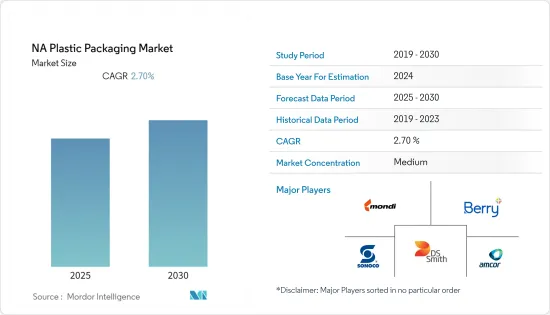

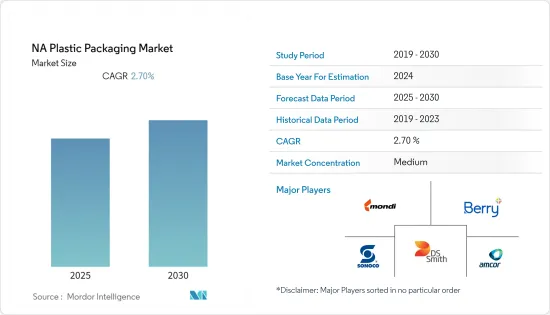

預計預測期內北美塑膠包裝市場的複合年成長率為 2.7%。

主要亮點

- 近年來,北美包裝產業發生了巨大變化,電子商務的成長、數位印刷的創新和永續性推動了市場的發展。這推動了對永續包裝的需求。例如,根據軟包裝協會的調查,超過 60% 的北美消費者願意為有形的功能性包裝優勢(如產品保護、運輸便利性和供應鏈效率)支付更多費用。

- 軟包裝主要用於食品,佔整個市場的60%以上。美國軟包裝產業正在經歷健康成長,這得益於該行業面臨的許多包裝挑戰的創新解決方案的實施。據軟包裝協會稱,品牌所有者正在採用薄膜、小袋和袋子作為包裝解決方案,部分原因是它們在美國消費者中被廣泛接受。

- 國內鋁需求的增加,導致從中國進口的鋁箔數量激增。過去10年,中國對美國的鋁箔出貨量增加了近10倍,達到約2.65億磅。目前,軟包裝主要用於食品,其中成長最快的領域是咖啡、零嘴零食、生鮮食品、已調理食品和寵物食品。

- 由於許多行業擴大採用創新包裝技術,預計加拿大將經歷更高的成長。此外,該地區零售業蓬勃發展,並且在零售領域處於全球領先地位,因此嚴重依賴靈活的包裝方法。

- 在加拿大,能夠延長成品食品保存期限的包裝介質越來越受歡迎,這推動了加拿大食品和飲料行業的硬質包裝發展。此外,對簡便食品的需求不斷成長以及核心家庭的數量不斷增加預計將進一步推動食品和飲料硬包裝市場的採用。

北美塑膠包裝市場趨勢

來自終端用戶的食品——預計在預測期內,軟質塑膠包裝將佔據落後佔有率

- 由於外出用餐的需求不斷增加以及食品零售業務的成長,食品業在市場研究中佔據著突出的佔有率。該地區的消費者越來越注重維持健康的飲食習慣,新鮮、健康食品送到他們手中所需的時間也正在改變。

- FDA 對國家的食品業進行嚴格監管。 FDA 負責監管該國銷售的大多數包裝食品,並對包裝必須包含的物質、身份、淨含量、營養成分、成分等有具體要求。該政府機構根據有關食品接觸物質、食品和包裝輻照以及環境的決客製化定具體的包裝法規。

- FDA 正在開發用於食品接觸通知 (FCN) 的包裝因素 (PF) 的更新資料庫,其中可能包括 550 種食品的 PF。這項發展與該國各非政府組織的遊說一致,要求 FDA 撤銷食品包裝中使用 PFAS 的核准。

- 包裝食品出口的增加推動了對軟包裝的需求。加拿大加工食品出口到190個國家。我們的產品大部分出口到美國、中國、日本、墨西哥、俄羅斯和韓國。據加拿大統計局稱,加拿大加工食品出口額達 280 億加元。

- 加拿大的零售和食品服務業的銷售額也在成長。對即食消費、速食等的需求推動了加工食品的成長,從而促進了軟包裝市場的發展。根據美國農業部外國農業服務局 2019 年的研究,2017 年至 2022 年期間加拿大包裝食品銷售額預計成長的可能是甜餅乾、點心棒和水果零食,成長 19.8%,其次是塗抹醬、食用油和乳製品,分別成長 15.8%、13.8% 和 12.3%。研究進一步發現,2018 年包裝食品進口總額達 248 億加幣。

- 近日,美國食品藥物管理局(FDA)與加拿大食品檢驗局(CFIA)和加拿大衛生署達成協議。該協議旨在核准食品安全系統和檢查。因此,遵守 FDA 包裝產品品質標準的需求促使加拿大製造商為其產品採用增強的包裝材料和系統。

- 此外,美國和加拿大的主要鋁箔容器製造商已經成立了一個協會,即鋁箔容器製造商協會(AFCMA),其使命是生產最高品質的產品並向公眾宣傳鋁箔容器的好處。

加拿大可望成為最大市場

- 許多加拿大消費者越來越傾向使用更環保的包裝。由於塑膠和塑膠製品的使用會對環境產生有害影響,這些國家的政府對該行業實施了非常嚴格的規章制度,與其他材料相比,該行業成長相對緩慢。

- 同時,安大略省管理部門在各個市政當局開展的「塑膠在行」宣傳活動正在刺激路邊藍色垃圾箱的硬質塑膠容器的供應。安大略省瓶裝水製造商 Ice River Springs 的回收部門正在將寶特瓶與超級市場瓶殼混合,以製造 100% 再生瓶。該工作小組匯集了包裝和廢棄物管理產業、政府、大學、產業協會和沃爾瑪供應商合作夥伴的代表,是首批專注於減少包裝和廢棄物轉移的工作小組之一。

- 沃爾瑪加拿大包裝 SVN推出了永續包裝記分卡,根據材料類型和重量、產品與包裝的永續性以及立方體利用率等多項標準來評估產品包裝的永續性。 SVN 也與其他幾個組織的代表合作成立了一個材料最佳化委員會,其目標是探索提高掩埋回收率和增加從垃圾掩埋場轉移的廢棄物量的方法。

- 隨著對永續性的關注度日益提高,公司正致力於採用環保和可回收的產品。每年,加拿大塑膠產業積極參與並支持加拿大各地市政當局的項目,以增加收集的塑膠數量和種類。 Recycle BC 是一家非營利組織,負責整個不列顛哥倫比亞省的住宅包裝和紙製品回收。

- 小森株式會社和 Komcan Inc. 正在透過向軟包裝公司提供機械和設備來擴大其在加拿大包裝市場的佔有率。例如,Produlith Packaging 公司用一台配備塗佈機(GLX640C)和 H-UV 油墨固化系統的六色小森 Lithrone GX40 印刷機取代了兩台競爭對手的印刷機,同時還採用了小森的 KP-Connect 技術,這雲端基礎的資料驅動操作技術,可以即時控制所有印刷過程。

- 據安大略省回收委員會稱,加拿大約有 9% 的塑膠被回收利用,其餘的則被送入垃圾掩埋場或被當作垃圾丟棄。加拿大消費者越來越傾向於使用可回收的食品包裝,並且更傾向於對包裝負責的品牌。

- 2020年2月,加拿大領先的食品和飲料包裝公司聯手在該國發展塑膠循環經濟。該地區的公司也在創新和開發靈活的食品包裝產品。例如,2019 年 7 月,ProAmpac 憑藉其新的兒童零食包裝設計獲得了 PAC 加拿大領導力銀獎,並憑藉頂級護髮產品軟質包裝圖形創新獲得了第二名。

北美塑膠包裝產業概況

北美塑膠包裝市場競爭激烈,有幾個主要參與者。少數參與者享有更好的市場信譽,並擴大了地理知名度和影響力。擁有較大市場佔有率的大型企業正致力於擴大其在終端用戶行業的基本客群。

- 2020 年 6 月 - Amcor 與 Espoma Organic 合作創新更具永續的包裝並推出新型生物基聚合物包裝。聚乙烯(PE)薄膜含有25%源自甘蔗的生物基材料。

- 2020 年 9 月 – 安姆科 (Amcor) 將與雀巢合作,推出用於濕貓糧的可回收軟性殺菌袋,可將消費包裝的環境足跡改善多達 60%。新款包裝袋符合 CEFLEX 聯盟最近發布的《循環經濟包裝指南》。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭對手之間的競爭

- 替代品的威脅

- 產業價值鏈分析

第5章 市場動態

- 市場促進因素

- 便捷包裝需求不斷成長

- 人口和生活方式的變化

- 市場限制

- 對製造商在環境惡化方面的嚴格規定

- 評估新冠肺炎對市場的影響

第6章 按類型細分市場

- 硬質塑膠包裝

- 按材質

- PE

- PP

- PET

- PS 和 EPS

- 其他材料

- 按產品

- 瓶子和罐子

- 托盤和容器

- 蓋子與封口裝置

- 其他產品

- 按最終用戶

- 食物

- 飲料

- 個人護理

- 藥品

- 其他最終用戶

- 按材質

- 軟質塑膠包裝

- 按材質

- PE

- BOPP

- CPP

- 其他材料

- 按產品

- 袋子和包包

- 薄膜包裝

- 更多產品

- 按最終用戶

- 食物

- 飲料

- 個人護理

- 其他最終用戶

- 按材質

- 按國家

- 美國

- 加拿大

第7章 競爭格局

- 公司簡介

- Berry Global Inc.

- Anchor Packaging

- Amcor PLC

- Mondi PLC

- American Packaging Corporation

- Tetra Pak International SA

- US Packaging & Prapping LLC

- Crown Holdings Inc.

- Packaging Corporation of America

- Owens Illinois Inc.

- Transcontinental Inc.

- Emmerson Packaging

- DS Smith PLC

- Winpak Ltd

- ES Plastic

- Guycan Plastics Limited

- Sonoco Products Company

- St. Johns Packaging

- Flair Flexible Packaging Corporation

第8章投資分析

第9章:市場的未來

簡介目錄

Product Code: 55176

The NA Plastic Packaging Market is expected to register a CAGR of 2.7% during the forecast period.

Key Highlights

- The packaging industry in the North American region has undergone a drastic change in recent years, and the growth of e-commerce, along with innovations in digital printing, and sustainability are driving the market. Due to this, there has been an increased demand for sustainable, flexible packaging. For instance, according to the Flexible Packaging Association, more than 60% of consumers in North America are keen to pay more for tangible and functional packaging benefits, such as product protection, shipping friendly, and supply chain efficacy, among others.

- Flexible packaging is mainly used for food, which contributes to more than 60% of the total market. The US flexible packaging industry is witnessing healthy growth, as the industry was able to implement innovative solutions for the many packaging challenges it faced. According to the Flexible Packaging Association, brand owners are taking on films, pouches, and bags as a go-to packaging solution, acknowledgments in part to extensive acceptance by American consumers.

- The increased domestic demand for aluminum has led to an upsurge in aluminum foil imports from China, whose foil shipments to the United States increased almost 10-fold, valued at around 265 million pounds, in the last decade. Today, flexible packaging is mostly used for food, with the fastest areas of expansion being coffee, snack foods, fresh produce, ready-to-eat meals, and pet food.

- Canada is anticipated to witness a higher growth rate due to the growing adoption of innovative packaging techniques across numerous industries. Furthermore, the region has a flourishing retail industry that banks heavily on flexible packaging methods, being a global leader in the retail industry.

- The increasing popularity of packaging media in Canada, which provides long shelf life to finished food products, is driving the rigid packaging in the food and beverage industry in Canada. Moreover, the rising demand for convenience food and an increasing number of nuclear families is expected to further enhance the adoption of the rigid packaging market for food and beverages.

North America Plastic Packaging Market Trends

Food from end-user - flexible plastic packaging is expected to hold lagest share during the forecast period

- The food segment holds a prominent share of the market studied due to the rising demand for food services and the growing retail food business. The consumers in the region are increasingly becoming cautious about maintaining a healthy diet, which is transforming the time of fresh, healthy food being delivered to them, which, in turn, is expected to augment the demand for flexible food packaging.

- The FDA highly regulates the food industry in the country. The FDA regulates most packaged foods sold in the country and has specific requirements, such as what elements a package must contain, identity statement, net quantity, nutrition facts, and ingredients. The government body has a particular set of packaging rules based on food contact substances, irradiation of food and packaging, and environmental decisions.

- The FDA is developing an updated database of packaging factors (PFs) for food contact substance notifications (FCNs) that may include PFs for 550 food items. The development is in line with the push from various NGOs in the country to pull the FDA's approval of PFASs in food packaging.

- The demand for flexible packaging is rising due to the increase in exports of packaged foods. Processed food products from Canada are exported to 190 countries. A significant share of the products is exported to the United States, China, Japan, Mexico, Russia, and South Korea. According to StatCan, the export value of processed food products from Canada was CAD 28 billion.

- The country is also witnessing an increasing growth in its retail and food services sales. The demand for on-the-go consumption, and fast food, among others, is driving the growth of processed food, which, in turn, is boosting the flexible packaging market. According to the USDA Foreign, Agricultural Service studies 2019, the expected sales growth of packaged food in Canada between 2017 and 2022 may be driven by sweet biscuits, snack bars, and fruit snacks with 19.8% growth followed by spreads, edible oil, dairy with 15.8%, 13.8%, and 12.3% respectively. Additionally, according to the same study, the import of packaged food in 2018 was CAD 24.8 billion.

- In the recent past, US Food and Drug Administration (FDA) signed an arrangement with the Canadian Food Inspection Agency (CFIA) and the Department of Health Canada (Health Canada). The agreement is aimed at recognizing food safety systems and inspections. Thus, with the need to comply with packaging product quality standards of the FDA, Canadian manufacturers have sought to adopt enhanced packaging materials and systems for their products.

- Moreover, leading manufacturers of aluminium foil containers in the United States and Canada have formed an association, the Aluminium Foil Container Manufacturers Association (AFCMA), dedicated to producing top quality products and educating the public of the advantages of aluminium foil containers.

Canada is expected to hold the largest market

- Many consumers in Canada are increasingly moving toward eco-friendly packaging materials. As the usage of plastic and plastic products has potentially hazardous implications on the environment, governments in these countries have imposed very stringent rules and regulations in the industry, making it a relatively slower-growing industry compared to other materials.

- At the same time, Stewardship Ontario's "Plastic Is In" campaigns in municipalities are stimulating the supply of rigid plastic containers in curbside Blue Boxes. Ontario bottled water manufacturer Ice River Springs' Recycling Division uses a mix of PET bottles and supermarket shells to create 100% recycled bottles. It is one of the first working groups focused on packaging reduction and waste diversion, bringing together representatives from the packaging and waste management industries, government, universities, industry associations, and Walmart vendor partners.

- The Walmart Canada Packaging SVN launched the Sustainable Packaging Scorecard, which evaluates the sustainability of product packaging based on several criteria, such as material type and weight, product-to-package ratio, and cube utilization. They also collaborated with representatives of several other organizations to form the Material Optimization Committee, aimed at exploring how to improve recycling rates for packaging and increase the volume of waste diverted from landfills.

- With the increased focus on sustainability, companies are focusing on adopting eco-friendly and recyclable products. Each year, the Canadian plastics industry undertakes proactive outreach and program support to municipalities across Canada in order to increase the amount and types of plastics collected for recycling. Recycle BC is a not-for-profit organization responsible for residential packaging and paper product recycling throughout British Columbia.

- Komori and Komcan Inc. extended their presence in the Canadian packaging market by providing flexible packaging companies with machinery and equipment. For instance, Produlith Packaging replaced two competitive presses with the purchase of a six-color Komori Lithrone GX40 with coater (GLX640C) and H-UV ink curing system along with Komori's KP-Connect, a cloud-based technology for data-driven operations that offers real-time control of all printing processes.

- According to the recycling council of Ontario, Canada recycles about 9% of its plastics, with the rest dumped in landfills or tossed away as litter. Consumers in the country are increasingly moving toward recyclable food packaging materials and prefer brands that are responsible for their packaging that pushes the market for flexible packaging.

- In February 2020, major Canadian food and beverage packaging companies collaborated to develop a circular economy for plastic in the country. The companies are also innovating and developing flexible food packaging products in the region. For instance, in July 2019, ProAmpac achieved silver PAC Canadian leadership awards for designing the packaging for new children's snacks and the second for graphics innovation in flexible packaging for premier hair care products.

North America Plastic Packaging Industry Overview

The North America Plastic Packaging Market is highly competitive and has several major players. A few of the players enjoy better market goodwill and extended geographical recognition and presence. The major players, who have a relatively prominent share in the market, are focusing on expanding their customer base across the end-user industries.

- JUN 2020- Amcor partnered with Espoma Organic to innovate more sustainable packaging and launch a new bio-based polymer package. The polyethylene (PE) film contains 25% bio-based material derived, in this case, from sugarcane.

- SEP 2020- Amcor collaborated with Nestle to launch recyclable flexible retort pouches that will improve the environmental footprint of consumer packaging by up to 60%, starting with wet cat food. The new pouch meets the packaging guidelines for a circular economy recently published by the CEFLEX Consortium.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 The Increased Demand for Convenient Packaging

- 5.1.2 Changing Demographic and Lifestyle Factors

- 5.2 Market Restraints

- 5.2.1 Stringent Regulation on Manufacturers Pertaining to Environmental Degradation

- 5.3 Assessment of the Impact of COVID 19 on the market

6 MARKET SEGMENTATION - BY TYPE

- 6.1 Rigid Plastic Packaging

- 6.1.1 By Material

- 6.1.1.1 PE

- 6.1.1.2 PP

- 6.1.1.3 PET

- 6.1.1.4 PS and EPS

- 6.1.1.5 Other Materials

- 6.1.2 By Product

- 6.1.2.1 Bottles and Jars

- 6.1.2.2 Trays and Containers

- 6.1.2.3 Caps and Closures

- 6.1.2.4 Other Products

- 6.1.3 By End User

- 6.1.3.1 Food

- 6.1.3.2 Beverage

- 6.1.3.3 Personal Care

- 6.1.3.4 Pharmaceuticals

- 6.1.3.5 Other End Users

- 6.1.1 By Material

- 6.2 Flexible Plastic Packaging

- 6.2.1 By Material

- 6.2.1.1 PE

- 6.2.1.2 BOPP

- 6.2.1.3 CPP

- 6.2.1.4 Other Materials

- 6.2.2 By Product

- 6.2.2.1 Pouches and Bags

- 6.2.2.2 Films and Wraps

- 6.2.2.3 Other Products

- 6.2.3 By End User

- 6.2.3.1 Food

- 6.2.3.2 Beverage

- 6.2.3.3 Personal Care

- 6.2.3.4 Other End Users

- 6.2.1 By Material

- 6.3 By Country

- 6.3.1 US

- 6.3.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Berry Global Inc.

- 7.1.2 Anchor Packaging

- 7.1.3 Amcor PLC

- 7.1.4 Mondi PLC

- 7.1.5 American Packaging Corporation

- 7.1.6 Tetra Pak International SA

- 7.1.7 U.S. Packaging & Prapping LLC

- 7.1.8 Crown Holdings Inc.

- 7.1.9 Packaging Corporation of America

- 7.1.10 Owens Illinois Inc.

- 7.1.11 Transcontinental Inc.

- 7.1.12 Emmerson Packaging

- 7.1.13 DS Smith PLC

- 7.1.14 Winpak Ltd

- 7.1.15 ES Plastic

- 7.1.16 Guycan Plastics Limited

- 7.1.17 Sonoco Products Company

- 7.1.18 St. Johns Packaging

- 7.1.19 Flair Flexible Packaging Corporation

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219