|

市場調查報告書

商品編碼

1683827

非洲塑膠包裝:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Africa Plastic Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

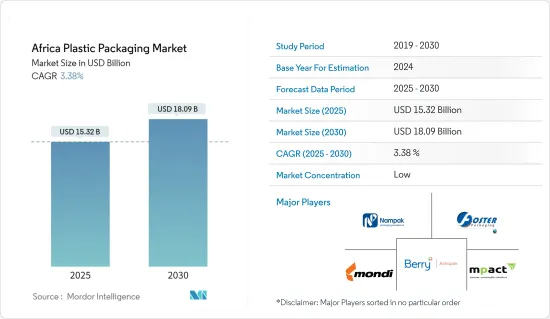

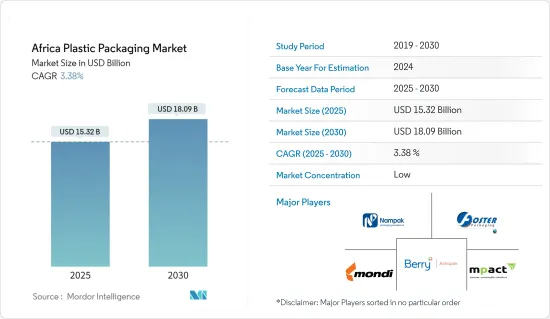

預計 2025 年非洲塑膠包裝市場規模為 153.2 億美元,到 2030 年將達到 180.9 億美元,預測期內(2025-2030 年)的複合年成長率為 3.38%。

近年來,非洲人口成長和都市化進程快速推進。隨著人口的成長和越來越多的人遷入城市,對包裝商品的需求也隨之增加,從而產生了對塑膠包裝產品的需求。此外,經濟成長擴大了該地區各國的中產階級,增加了各國的可支配收入。隨著人們購買力的增強,對包裝商品的需求也隨之增加,推動了塑膠包裝產業的成長。

主要亮點

- 該地區的許多國家都注重工業化和製造業來發展經濟,其中包括為食品、食品和飲料、製藥和個人保健產品等各個行業設立工廠。塑膠包裝是這些行業的多功能且便捷的解決方案,從而導致該地區其需求持續成長。

- 隨著人口的成長,非洲國家對食品和飲料的需求不斷增加。根據世界銀行估計,到 2030 年,非洲食品產業總價值可能成長到 1 兆美元(約 8,415 億歐元)。

- 由於監管標準的動態變化,市場預計將面臨嚴峻挑戰,這主要是由於人們對環境問題的日益關注。該地區各國政府正在回應公眾對塑膠包裝廢棄物的擔憂,並實施法規以減少環境廢棄物並改善廢棄物管理流程。

- 由於產品需求不斷成長,國際食品製造公司正在非洲擴大業務。 2022 年 10 月,餅乾製造商 Britannia Industries Ltd 簽署了在肯亞營運的協議,作為其非洲擴張計畫的一部分。

- 預計市場將面臨挑戰,主要原因是由於環境問題日益嚴重導致監管標準動態變化。該地區各國政府正在回應公眾對塑膠包裝廢棄物的擔憂,並實施法規以減少環境廢棄物並改善廢棄物管理流程。

非洲塑膠包裝市場的趨勢

食品業佔據硬質和軟質塑膠包裝市場的大部分佔有率

- 塑膠食品儲存容器透過提供有效的密封,有助於在儲存期間保存和保持食物新鮮。這些容器適合在咖啡館、雜貨店或任何食品企業使用。包裝是西非的一個重要市場。此次區域工業的發展主要是為了回應農業和食品工業的成長。奈及利亞、南非和肯亞佔據該地區塑膠包裝市場的很大佔有率。

- 預計到 2050 年,東部和南部非洲的食品產業將成長 800%,加工食品貿易將成長高達 90%。預計到 2030 年,整個非洲的食品產業規模將達到 1 兆美元,都市區消費將推動更多產品的需求。食品包裝是非洲最重要的終端用戶塑膠產業之一。硬質塑膠包裝在食品業中正日益普及。工業界因為它重量輕、節省成本而被廣泛使用。

- 硬質塑膠和一次性容器對於外帶、食品連鎖店和餐廳來說是必不可少的。但全部區域都存在著環境問題。由於全部區域開設了多家食品連鎖店,非洲對塑膠包裝的需求激增。 2022 年 5 月,總部位於杜拜的清真速食連鎖店 ChicKing 宣布計劃未來五年在肯亞開設 30 家門市。

- 典型的軟性食品包裝應用包括用於包裝起司、肉類、麵包和蔬菜等食品的薄膜和袋子。大多數情況下,軟包裝被用作初級包裝,但在某些情況下也可能被用作二次包裝。

- 這些薄膜有貼合加工和無層壓型兩種,可以耐受冷凍庫等惡劣環境。它的抗衝擊強度、抗撕裂強度、抗屈撓開裂性能和優異的密封性能使其廣泛應用於食品應用。這些因素正在推動非洲軟包裝市場的發展。

- 隨著非洲都市化不斷加快,越來越多的人居住在城市,獲得新鮮農產品的機會也越來越少。此外,消費者越來越關注永續性,導致包裝採用更易於回收的再生材料製成,從而支持了對軟包裝的需求。

南非佔據主要市場佔有率

- 盒裝午餐的日益普及、餐廳和超級市場數量的不斷增加以及瓶裝水和飲料的消費量的不斷成長都是推動該國市場擴張的主要因素。

- 近年來,隨著人們越來越追求更健康的生活方式,南非家庭護理產品市場經歷了長足的成長。這增加了對飲料瓶、洗漱用品瓶和塑膠袋等產品的需求,從而促進了該地區塑膠包裝市場的成長。

- 由於該國的塑膠垃圾數量龐大,政府措施和強大的消費者意識正在幫助推動回收趨勢以健康的速度向前發展。此外,南非可口可樂等公司收集和回收的 PET 比當地生產的還要多。

- 在需求方面,隨著行動連線的改善,南非消費者正在轉向電子商務。由於新冠疫情以及該國對非接觸式交易的興趣日益濃厚,這一趨勢進一步加速。這使得一些市場收購得以實現。例如,2021年7月,奧地利塑膠包裝公司ALPLA集團收購了南非包裝製造商Verigreen Packaging,以擴大在南部非洲的業務。

- 總體來看,儘管受到外部經濟變數的影響,但該國飲料消費量仍在快速成長。由於氣候條件的影響,該國的軟性飲料消費量正在增加,人們飲用碳酸飲料的次數也越來越多。過去兩年的嚴重缺水也導致瓶裝水使用量急劇增加。 寶特瓶已成為市場主流, 寶特瓶的需求量也不斷增加。因此,這些因素正在推動該國塑膠包裝市場的成長。

非洲塑膠包裝產業概況

非洲的塑膠包裝市場高度分散,由 Mondi、Nampak 和 Very Astrapak 等市場現有企業以及幾家區域包裝公司組成。隨著全球對環境問題的關注度日益提高,各大公司都在加大研發投入,以解決環境問題,讓塑膠瓶更加安全。

- 2023 年 1 月,Phatisa 宣布收購 MHL International Holdings 的大量少數股權,該公司透過位於肯亞和奈及利亞的子公司在撒哈拉以南非洲地區開展印刷和包裝業務,並且在食品和飲料領域擁有強大的影響力。

- 2022年8月,Alpura擴大了其OTC包裝製造技術。 ALPLA 集團旗下的醫藥包裝業務 Alplapharma 已擴展其 OTC 瓶製造能力,包括靈活的擠出吹塑成型(EBM),從而為該領域提供永續的、針對客戶的包裝解決方案。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 生態系分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場動態

- 市場促進因素

- 預計寶特瓶需求的增加將推動該地區對硬質包裝的需求

- 未來幾年飲料包裝可望受到青睞

- 市場挑戰

- 原物料價格波動

- 新冠疫情與近期地緣政治變化對非洲包裝產業成長的影響

- 非洲主要新興市場分析

- 根據相關 HS 編碼分析非洲主要原料進口

- 塑膠包裝市場的技術創新

- 包裝產業廣泛的投資報酬率指標分析

第6章 市場細分

- 硬包裝

- 材料

- 聚乙烯 (PE)

- 聚對苯二甲酸乙二醇酯(PET)

- 聚丙烯(PP)

- 聚苯乙烯 (PS) 和發泡聚苯乙烯 (EPS)

- 聚氯乙烯(PVC)

- 其他材料

- 最終用戶

- 食物

- 飲料

- 醫療保健和醫藥

- 個人護理和化妝品

- 其他最終用戶

- 材料

- 軟包裝

- 材料

- 聚乙烯 (PE)

- 雙軸延伸聚丙烯(BOPP)

- 流延聚丙烯(CPP)

- 聚氯乙烯(PVC)

- 乙烯 - 乙烯醇(EVOH)

- 其他材料

- 最終用戶

- 食物

- 飲料

- 個人護理和化妝品

- 其他最終用戶

- 材料

- 國家

- 南非

- 奈及利亞

- 埃及

- 肯亞

- 摩洛哥

- 迦納

- 衣索比亞

- 坦尚尼亞

- 尚比亞

第7章 競爭格局

- 公司簡介

- Berry Astrapak(Berry Global Group Inc.)

- Nampak Ltd

- Mondi PLC

- Mpact Pty Ltd

- Foster International Packaging

- Constantia Flexibles

- Tetra Pak SA

- Amcor PLC

- LIQUIBOX(Sealed Air Corporation)

- Sonoco Products Company

- Toppan Inc.

- Huhtamaki Oyj

- ALPLA Group

- Plastipak Holdings Inc.

- Polyoak Packaging

第 8 章:非洲主要供應商(按國家/地區)列表

- 南非

- 奈及利亞

- 埃及

- 肯亞

- 摩洛哥

- 迦納

- 衣索比亞

- 坦尚尼亞

- 尚比亞

第9章:未來市場展望

第10章 投資分析

The Africa Plastic Packaging Market size is estimated at USD 15.32 billion in 2025, and is expected to reach USD 18.09 billion by 2030, at a CAGR of 3.38% during the forecast period (2025-2030).

Africa has experienced rapid population growth and urbanization in recent years. As the population increases and more people move to cities, there is a rising demand for packaged goods, creating the need for plastic packaging products. Furthermore, economic growth resulted in an expansion of the middle class and increased disposable income in various countries of the region. As purchasing power of people increases, the demand for packaged goods also rises, driving the growth of the plastic packaging industry.

Key Highlights

- Many countries in the region are focusing on industrialization and manufacturing for their economic development, which includes the establishment of factories for various industries, such as food, beverage, pharmaceuticals, personal care products, and more. As plastic packaging is a convenient solution for these industries in multiple applications, its demand is growing continuously in the region.

- With a growing population, demand for food and beverages is continuously increasing in the countries of Africa. According to World Bank, the total value of the African food industry could rise to USD one trillion (approx. EUR 841.5 billion) by 2030.

- The market is expected to be challenged owing to dynamic changes in regulatory standards, primarily due to increasing environmental concerns. Governments across the region have been responding to public concerns regarding plastic packaging waste and implementing regulations to minimize environmental waste and improve waste management processes.

- International food manufacturing companies are expanding their operations in Africa due to rising product demand. In October 2022, cookie manufacturer Britannia Industries Ltd finalized a deal for operations in Kenya as part of its plan to expand in Africa.

- The market is expected to be challenged owing to dynamic changes in regulatory standards, primarily due to increasing environmental concerns. Governments across the region have been responding to public concerns regarding plastic packaging waste and implementing regulations to minimize environmental waste and improve waste management processes.

Africa Plastic Packaging Market Trends

Food Industry to Hold Major Share in Both Rigid and Flexible Plastic Packaging Markets

- Plastic food storage containers help preserve food during storage or keep them fresh by effective sealing. These containers are suitable for use in cafes, grocery shops, or any food business. Packaging is an important market in West Africa. This industry has developed in the sub-region largely in response to farming and the growth of the food industry. Nigeria, South Africa, and Kenya have a substantial share of the plastic packaging market in the region.

- The food sector in Eastern and Southern Africa is expected to grow by 800% by 2050, with trade in processed foods increasing by up to 90%. Africa as a whole is anticipated to be a USD 1 trillion food industry by 2030, with urban consumption driving demand for more products. Food packaging is one of Africa's most significant end-user plastic industries. Rigid plastic packaging is increasing in the food industry. The industry uses it for its properties, such as lightweight and reduced cost.

- Rigid plastic and disposable containers are integral to takeouts, food chains, and restaurants. However, there are environmental concerns across the region. The opening of several food chains across the region has spiked the demand for plastic packaging in Africa. In May 2022, the Dubai-based halal fast-food chain ChicKing announced its intentions to open 30 outlets in Kenya over the next five years.

- Typical flexible food packaging applications include films and pouches to package food products like cheeses, meats, bread, and vegetables, among others. In most cases, flexible packaging is used as the primary packaging, but it can also be used as the secondary packaging in some cases.

- These films can be laminated or nonlaminated and withstand harsh environments like freezers. Their impact strength, tear strength, flex-crack resistance, and excellent sealing properties are extensively used in food applications. Such factors are driving the flexible packaging market in the country.

- Due to increasing urbanization in Africa, more people are living in cities and having less access to fresh produce, which is driving the demand for flexible packaging. Additionally, the growing focus of consumers toward sustainability is leading to packaging made from recycled materials that can be easily recycled, hence supporting the demand for flexible packaging.

South Africa to Hold Significant Market Share

- The rising popularity of packed meals, the expanding number of restaurants and supermarkets, and rising bottled water and beverage consumption are all key drivers of the country's market expansion.

- The South African home care products market has seen considerable growth in recent years owing to a growing trend among individuals to maintain a healthier lifestyle. This has driven demand for products like beverage bottles, toiletry bottles, plastic bags, and others, thereby increasing the growth of the region's plastic packaging market.

- With the country's enormous volume of plastic garbage, the recycling trend is expanding at a healthy rate, owing to government restrictions and strong consumer awareness. Moreover, companies like Coca-Cola in South Africa collected and recycled more PET than was produced within the country.

- On the demand side, customers in South Africa are migrating to e-commerce as mobile connectivity develops. This tendency has accelerated as a result of the COVID-19 pandemic as well as a spike in interest in contactless transactions inside the country. This has permitted several market acquisitions. For instance, in July 2021, Austrian plastic packaging firm ALPLA Group purchased South African packaging producer Verigreen Packaging to extend its footprint in southern Africa.

- Overall, beverage consumption in the country is increasing rapidly, despite the impact of external economic variables. Soft drink consumption is increasing in the country as a result of climatic conditions, with people drinking more carbonated beverages. Due to severe water scarcity in the country over the previous two years, the usage of bottled water has also increased dramatically. With PET bottles becoming the market norm, the demand for plastic bottles has also increased. Therefore, these factors are driving the growth of the plastic packaging market in the country.

Africa Plastic Packaging Industry Overview

The African plastic packaging market is highly fragmented, comprising market incumbents such as Mondi, Nampak, and Berry Astrapak and several regional packaging firms. With environmental concerns rising across countries, major players have boosted their investments in research and development to tackle environmental concerns and make plastic bottles safer.

- In January 2023, Phatisa announced the acquisition of a significant minority stake in MHL International Holdings, a printing and packaging provider operating in Sub-Saharan Africa through subsidiaries in Kenya and Nigeria with strong exposure to the food and beverage sector.

- In August 2022, ALPLA expanded its OTC packaging manufacturing technology. Alplapharma, the pharma packaging business of the ALPLA group, accomplished this by expanding its manufacturing technology for OTC bottles with the inclusion of flexible extrusion blow molding (EBM), which allows for sustainable and customer-specific packaging solutions in this field.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Ecosystem Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Demand for Pet Bottles is Expected to Drive the Need for Rigid Packaging in the Region

- 5.1.2 Beverage Packaging is Expected to Gain Traction over the Coming Years

- 5.2 Market Challenges

- 5.2.1 Fluctuating Raw Material Prices

- 5.3 Impact of COVID -19 and the Recent Geopolitical Changes on the Growth of the African Packaging Industry

- 5.4 Analysis of the Key Emerging Markets in Africa

- 5.5 Analysis of the Key Raw Material Imports into Africa Based on Relevant HS Codes

- 5.6 Technological Innovations in the Plastic Packaging Market

- 5.7 Analysis of the Broader ROI Measures within the Packaging Industry

6 MARKET SEGMENTATION

- 6.1 Rigid Packaging

- 6.1.1 Material

- 6.1.1.1 Polyethylene (PE)

- 6.1.1.2 Polyethylene Terephthalate (PET)

- 6.1.1.3 Polypropylene (PP)

- 6.1.1.4 Polystyrene (PS) and Expanded Polystyrene (EPS)

- 6.1.1.5 Polyvinyl Chloride (PVC)

- 6.1.1.6 Other Materials

- 6.1.2 End User

- 6.1.2.1 Food

- 6.1.2.2 Beverage

- 6.1.2.3 Healthcare and Pharmaceutical

- 6.1.2.4 Personal Care and Cosmetics

- 6.1.2.5 Other End Users

- 6.1.1 Material

- 6.2 Flexible Packaging

- 6.2.1 Material

- 6.2.1.1 Polyethylene (PE)

- 6.2.1.2 Bi-orientated Polypropylene (BOPP)

- 6.2.1.3 Cast Polypropylene (CPP)

- 6.2.1.4 Polyvinyl Chloride (PVC)

- 6.2.1.5 Ethylene Vinyl Alcohol (EVOH)

- 6.2.1.6 Other Materials

- 6.2.2 End User

- 6.2.2.1 Food

- 6.2.2.2 Beverage

- 6.2.2.3 Personal Care and Cosmetics

- 6.2.2.4 Other End Users

- 6.2.1 Material

- 6.3 Country

- 6.3.1 South Africa

- 6.3.2 Nigeria

- 6.3.3 Egypt

- 6.3.4 Kenya

- 6.3.5 Morocco

- 6.3.6 Ghana

- 6.3.7 Ethiopia

- 6.3.8 Tanzania

- 6.3.9 Zambia

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Berry Astrapak (Berry Global Group Inc.)

- 7.1.2 Nampak Ltd

- 7.1.3 Mondi PLC

- 7.1.4 Mpact Pty Ltd

- 7.1.5 Foster International Packaging

- 7.1.6 Constantia Flexibles

- 7.1.7 Tetra Pak SA

- 7.1.8 Amcor PLC

- 7.1.9 LIQUIBOX (Sealed Air Corporation)

- 7.1.10 Sonoco Products Company

- 7.1.11 Toppan Inc.

- 7.1.12 Huhtamaki Oyj

- 7.1.13 ALPLA Group

- 7.1.14 Plastipak Holdings Inc.

- 7.1.15 Polyoak Packaging

8 LIST OF KEY VENDORS IN AFRICA BY COUNTRY

- 8.1 South Africa

- 8.2 Nigeria

- 8.3 Egypt

- 8.4 Kenya

- 8.5 Morocco

- 8.6 Ghana

- 8.7 Ethiopia

- 8.8 Tanzania

- 8.9 Zambia