|

市場調查報告書

商品編碼

1683200

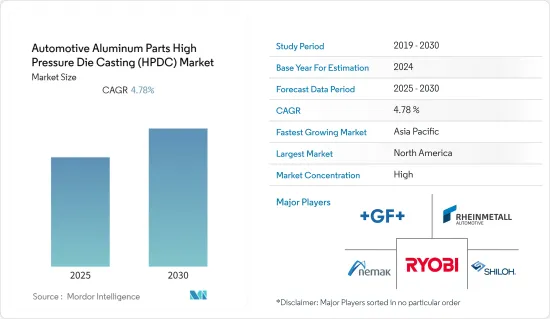

汽車鋁高壓鑄 (HPDC) 市場 -市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Automotive Aluminum Parts High Pressure Die Casting (HPDC) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

預計預測期內汽車鋁高壓壓鑄市場複合年成長率為 4.78%。

2020 年上半年,COVID-19 疫情對市場產生了負面影響,製造工廠的關閉和封鎖導致全球汽車產量下降。不過,2021年法規的逐步開放導致汽車產量回升、電動車銷售更加穩定,有助於市場成長恢復。

由於透過高壓鋁壓鑄開發的汽車零件的優勢,預計乘用車和商用車產量的增加將推動市場發展。推動市場成長的關鍵因素包括嚴格的排放法規和企業平均燃油經濟性(CAFE)標準、歐洲對商用車及其銷售的需求不斷成長以及汽車行業的成長。大約75.0%的消耗鋁可以重新利用,而且再生鋁可以無限循環利用,使其成為汽車零件高壓壓鑄最受歡迎的材料。

美國、德國、英國、印度和中國等主要國家的政府都透過提供補貼來支持汽車製造商並鼓勵消費者採用電動車。電動車的發展趨勢正在鼓勵市場參與企業生產各種電動車零件,如電池外殼、傳動零件等。

此外,汽車和汽車行業中鋁替代鋼的成長以及這些行業的資金籌措可能會為預測期內高壓鋁壓鑄市場的成長創造有利機會。

鋁汽車零件高壓鑄市場趨勢

鋁價漲阻礙市場

2021 年全球汽車銷量約 6,670 萬輛,而 2020 年約為 6,380 萬輛。全球疫情影響了世界各地的經濟活動,包括汽車銷售,多個國家實施了嚴格的封鎖措施,以遏制病毒傳播。因此,2020年的汽車銷量與2019年相比下降了14.8%。然而,隨著生活恢復正常,預計全球汽車銷售將增加,有助於汽車鋁高壓壓鑄市場在預測期內實現成長。

隨著對乘用車的需求不斷增加以及對電動車的認知不斷提高,主要企業在尋求使其現有持有實現電氣化。例如:

- 2022年8月,日本汽車製造商鈴木汽車宣布一項價值730億印度盧比的戰略投資,在古吉拉突邦爾普爾建立一家電動汽車電池工廠。該工廠將為印度即將推出的電動車技術生產先進的化學電池。這將是鈴木繼與東芝公司和電裝公司合作在古吉拉突邦設立的TDS鋰離子電池古吉拉突邦(TDSG)之後,在印度開展的第二項電動車電池業務。

- 2022年3月,福特汽車宣布將在2024年終在歐洲推出三款電動車,並設定了2026年在歐洲每年銷售超過60萬輛電動車的目標。

- 2022年1月,通用汽車宣布正考慮在密西根州的兩家工廠投資超過40億美元,以增加電動車產能。通用汽車和 LG 能源解決方案公司提案在蘭辛建立一個價值 25 億美元的電池工廠。

隨著乘用車銷售量的不斷成長,HPDC的需求呈現出良好的成長動能。目前,乘用車需要質量輕、抗張強度高的HPDC用於製造各種汽車零件。鋁擠型企業正大力投資,以顯示銷售量的上升。例如,2022年8月,拉丁美洲最大的鋁擠型製造商Cuprum宣布將投資1億美元在新萊昂州建造一座新的鋁擠型工廠,為汽車領域提供高壓壓鑄技術。

考慮到這些因素和上述發展,預計乘用車領域將為汽車鋁 HPDC 的需求提供同等的推動力。

北美成長速度更快

世界各地的許多壓鑄零件製造商都在大力投資擴大其用於汽車行業的鋁高壓壓鑄生產流程。 2020年至2021年,北美被公認為領先地區之一,Nemak、Bocar、George Fischer等主要製造商將大量投資並擴大新生產工廠,主要集中在美國和墨西哥。

該地區二氧化碳排放的增加以及相關嚴格的 CAFE 和 EPA 法規迫使汽車製造商在其製造過程中更廣泛地採用鋁高壓壓鑄 (HPDC) 零件,從而推動了該國市場的成長。

墨西哥的汽車壓鑄市場正在崛起,該國是世界第七大汽車製造國,也是繼德國、日本和韓國之後的第四大汽車出口國。

豐田、梅賽德斯-奔馳(與日產合資)、奧迪和寶馬等主要汽車製造商均在墨西哥建立了新工廠。通用汽車、飛雅特克萊斯勒、現代和本田等其他汽車製造商正專注於擴大現有工廠。此外,美國近期宣布提高從中國進口的汽車零件的關稅,也促使中國汽車製造商計劃擴大在墨西哥的生產基地。

墨西哥汽車工業的成長帶動了層級、層級和層級供應商數量的大幅增加。隨著汽車零件輕量化和堅固化趨勢的日益成長,上述供應商很可能在預測期內採用透過 HPDC 生產的鋁零件。

鋁製汽車零件高壓壓鑄產業概況

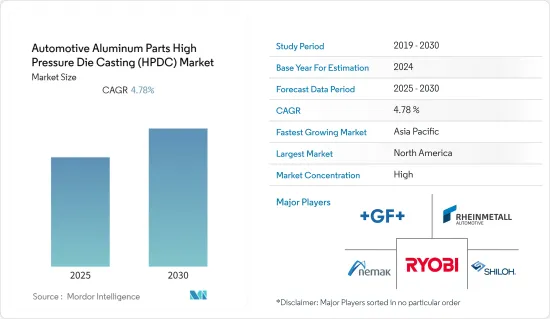

汽車鋁零件高壓壓鑄市場主要由萊茵金屬車、Endurance Group、Shiloh Industries、GF Casting Solutions、Ryobi Die Casting Inc. 和 Nemak 等主要企業細分。

擴大業務部門和製造工廠、在重點區域與當地製造商建立合資企業以及併購是參與企業保持和提高其市場競爭地位的主要策略。例如

- 2022 年 8 月,Minda Corporation Limited 宣布已開始收購美國、非洲和歐洲內燃機和電動車領域的多家一級供應商和OEM,以發展其高壓壓鑄件業務,包括鋁製 HPDC 零件。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場促進因素

- 市場限制

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 應用程式類型

- 白車身

- 門框

- 電池外殼

- 支柱

- 屋頂

- 其他(前端支架、加強件、橫樑、儀表板支架)

- 底盤

- 傳播

- 其他(懸吊、轉向)

- 白車身

- 汽車模型

- 搭乘用車

- 商用車

- 地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 歐洲其他地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 其他亞太地區

- 其他

- 巴西

- 南非

- 其他國家

- 北美洲

第6章 競爭格局

- 供應商市場佔有率

- 公司簡介

- Georg Fischer AG

- Rheinmetall Automotive AG(KSPG AG(KS Kolbenschmidt GmbH))

- Ryobi Die Casting Inc.

- Nemak

- Endurance Technologies

- Shiloh Industries Inc.

- Pace Industries

- Brabant Alucast*

第7章 市場機會與未來趨勢

The Automotive Aluminum Parts High Pressure Die Casting Market is expected to register a CAGR of 4.78% during the forecast period.

The COVID-19 pandemic had a negative impact on the market as the shutdown of manufacturing facilities and lockdowns in the first half of 2020 resulted in a decline in vehicle production across the world. However, with the gradual opening of restrictions in 2021 vehicle production picked up and further stable EV sales help the market regain its growth.

An increase in the production of passenger cars and commercial vehicles is expected to drive the market for the automotive parts developed through high-pressure aluminum die casting owing to their advantages. Some of the major factors driving the growth of the market are the enactment of stringent emission regulations and Corporate Average Fuel Economy (CAFE) standards, an increase in the demand for commercial vehicles and sales in the European region, and the growth of the automotive industry. Approximately 75.0% of the aluminum consumed can be reused, and reclaimed aluminum can be recycled indefinitely, making it the most popular material for automotive parts high pressure die casting.

Government pushing automobile manufacturers and encouraging customers to adopt electric vehicles by providing subsidies across key major countries like the United States, Germany, United Kingdom, India, China, etc. This trend of growing electric mobility encourages players operating in the market to produce various electric vehicle components like battery housings, transmission parts, etc.

Furthermore, growth in the substitution of aluminum for iron and steel in the automotive and automobile sectors, as well as increased funding in these sectors, would create lucrative opportunities for the growth of the high-pressure aluminum die casting market during the forecast period.

Automotive Aluminum Parts High Pressure Die Casting Market Trends

Rising Aluminum Prices Hindering the Market

In 2021, the global car sales were around 66.7 Million, which in 2020 were 63.8 Million. The global pandemic impacted economic activities all around the world including car sales the globe, and strict lockdowns were enforced in several countries to contain the spread of the virus. Owing to this the number of cars sold in 2020 was 14.8% lower than compared in 2019. But with life returning to normalcy, the number of cars sold globally has increased which will aid the automotive aluminium parts high-pressure die casting market to grow in the forecast period.

Owing to the increase in the demand for passenger cars and the growing awareness of electric mobility, major players are looking forward to electrifying their present fleet. For instance:

- In August 2022, Japanese carmaker Suzuki Motor announced its strategic investment worth INR 7,300 crore to set up the electric vehicle battery plant at Hansalpurin Gujarat. The plant will look forward for manufacturing advanced-chemistry cell batteries for upcoming electric vehicle technology in India. This will be Suzuki's second EV battery initiative in India after TDS Lithium-Ion Battery Gujarat (TDSG), which it set up in Gujarat in collaboration with Toshiba and Denso.

- In March 2022, Ford Motors announced to include three all-electric passenger vehicles in Europe by the end of 2024 and set a target to sell more than 600,000 electric vehicles annually by 2026 in the Europe region.

- In January 2022, General Motors announced considering investing more than USD 4 billion in two Michigan factories to increase its electric car manufacturing capacity. GM and LG Energy Solution have proposed constructing a USD 2.5 billion battery facility in Lansing.

With rising sales of the passenger car segment, demand for HPDC is witnessing promising growth. Nowadays, passenger car demanding HPDC in their different car components owing to their lightweight features and higher tensile strength. Aluminium extrusion companies are investing heavily to witness elevate sales bars. For instance, in August 2022, Cuprum who is the Latin America's largest aluminium extruder announced the investment of USD 100 million to build a new plant in Nuevo Leon for extrusion of aluminium to offer high pressure die casting technology in the automotive sector.

Considering these factors and aforementioned developments, passenger car segmented is expected to provide equivalent momentum to the demand for automotive aluminium HPDC.

North America Growing at a Faster Pace

Many die casting parts manufacturers across the world have significantly invested in the expansion of the aluminum high-pressure die-casting production process for the automotive industry. During 202-2021, North America has been recognized as one of the major regions with a larger number of investments and expansions of new production plants by major manufacturers like Nemak, Bocar, and George Fischer, mainly in the United States and Mexico.

Increased CO2 emissions and subsequent stringent CAFE and EPA regulations in the region are forcing automakers to employ high-pressure die casting (HPDC) parts of aluminum more extensively in their manufacturing processes, acting as a propellant for the market's growth in the country.

The Mexican automotive die casting market is emerging, as the country is one of the largest vehicle manufacturers and seventh-largest car manufacturers in the world, as well as is the fourth-largest car exporter, behind Germany, Japan, and South Korea.

Key automakers, like Toyota, Mercedes-Benz (with Nissan), Audi, and BMW established new factories in Mexico. Other automakers, like General Motors, Fiat-Chrysler, Hyundai, and Honda are focusing on expanding their existing factories. Additionally, Chinese automobile manufacturers are planning to expand their production bases in Mexico, owing to the recent announcement of an increase in import tariff on auto parts from China to the United States.

Owing to the growing Mexican automotive industry, the presence of tier 1, tier 2, and tier 3 suppliers have been significantly increasing. With the rising trend of lightweight and robust automotive parts, the above suppliers are likely to adopt aluminum parts manufactured through HPDC, during the forecast period.

Automotive Aluminum Parts High Pressure Die Casting Industry Overview

The automotive aluminum parts high pressure die casting market is fragmented, as major players, like Rheinmetall Automotive, Endurance Group, Shiloh Industries, GF Casting Solutions, Ryobi Die Casting Inc., and Nemak.

Expansion of business segments and manufacturing plants, joint ventures with local manufacturers in key geographies, and mergers and acquisitions are the key strategies adopted by the players to maintain and improve their competitive position in the market. For instance,

- In August 2022, Minda Corporation Limited has announced that it has initiated acquisition of several Tier1 and OEMs in the internal combustion engine and electric vehicles space in United States, Africa, and Europe for developing business for high pressure die cast parts which includes aluminium HPDC parts as well.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Application Type

- 5.1.1 Body-in-white

- 5.1.1.1 Door Frames

- 5.1.1.2 Battery Housing

- 5.1.1.3 Pillar

- 5.1.1.4 Roof Components

- 5.1.1.5 Others (Front-end Carriers, Reinforcement, Cross Beams, and Instrument Panel Support)

- 5.1.2 Chassis

- 5.1.3 Transmission

- 5.1.4 Other Components (Suspension and Steering)

- 5.1.1 Body-in-white

- 5.2 Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Commercial Vehicles

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 Brazil

- 5.3.4.2 South Africa

- 5.3.4.3 Other Countries

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Georg Fischer AG

- 6.2.2 Rheinmetall Automotive AG (KSPG AG (KS Kolbenschmidt GmbH))

- 6.2.3 Ryobi Die Casting Inc.

- 6.2.4 Nemak

- 6.2.5 Endurance Technologies

- 6.2.6 Shiloh Industries Inc.

- 6.2.7 Pace Industries

- 6.2.8 Brabant Alucast*