|

市場調查報告書

商品編碼

1687183

汽車壓鑄:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Automotive Parts Die Casting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

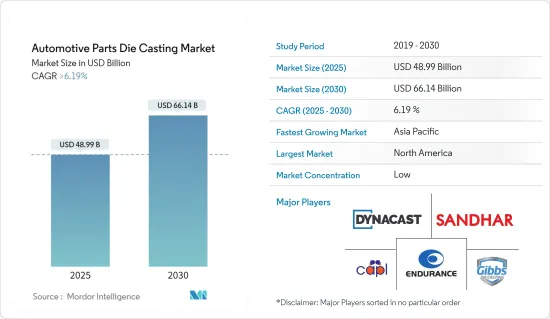

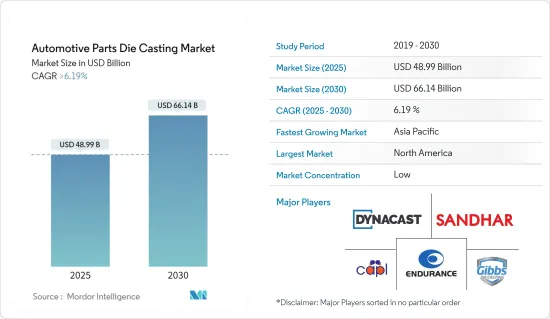

預計 2025 年汽車壓鑄市場規模為 489.9 億美元,到 2030 年將達到 661.4 億美元,預測期內(2025-2030 年)的複合年成長率將超過 6.19%。

汽車零件壓鑄市場正在經歷顯著的成長,這主要受到全球向輕型汽車的轉變和電動車日益普及的推動。汽車輕量化的趨勢是為了滿足全球環境法規和永續性目標而提高燃油經濟性和減少二氧化碳排放的需求。電動車尤其需要複雜、高精度、重量輕且堅固的零件,而壓鑄是滿足這些要求的理想製程。

例如,CAFE標準和EPA減少汽車排放氣體、提高燃油經濟性的政策正在推動汽車製造商透過使用輕質非鐵金屬來減輕汽車重量。美國環保署計劃在 2025 年將每加侖英里數 (mpg) 標準提高到 54.5 mpg,此舉將為壓鑄業帶來幫助。因此,使用壓鑄件作為輕量化策略是市場的主要驅動力。

此外,壓鑄技術的進步也大大促進了市場的擴張。機器設計、製程控制和模具技術的創新提高了壓鑄操作的效率和品質。這些技術改進提高了鑄件的精度和強度,減少了廢棄物和能源消耗,使製程更加環保且具成本效益。電腦輔助工程 (CAE) 和物聯網 (IoT) 等自動化和數位技術的整合最佳化了壓鑄工藝,從而縮短了前置作業時間並提高了生產力。

此外,壓鑄的多功能性使其能夠生產各種汽車零件,包括複雜的引擎部件、傳動系統和結構件。高壓壓鑄 (HPDC) 已成為一項突出的技術,具有高速生產能力和製造高尺寸精度的複雜形狀的能力。此外,真空壓鑄越來越受歡迎,因為它能夠生產具有優異機械性能和最小孔隙率的零件,從而進一步提高汽車零件的品質和耐用性。

隨著汽車製造商越來越注重減輕車輛重量以滿足嚴格的排放法規並提高電動車電池續航里程,對創新壓鑄解決方案的需求預計將激增。預計這將推動材料和工藝的進一步進步,包括新合金的開發和鑄造技術的改進,以滿足汽車行業不斷變化的需求。

汽車壓鑄市場趨勢

雖然壓力壓鑄佔據了最大的市場佔有率,但真空壓鑄預計將出現強勁成長

按生產類型分類,壓力壓鑄是最大的類別。壓力壓鑄因其效率、大規模生產能力以及生產複雜耐用零件的能力而佔據汽車壓鑄市場的主導地位。

壓力壓鑄在汽車壓鑄市場中佔有重要地位,這主要歸功於其在生產具有完美表面光潔度的大批量複雜零件方面的優勢。此外,高壓鑄(HPDC)擴大被用於生產大型汽車零件。

特斯拉等大型汽車公司使用 HPDC 來製造單件汽車前端和後端等關鍵零件。 HPDC 的應用代表著汽車製造流程效率和永續性的重大進步。例如,HPDC可以用一個零件取代70到100個零件,大幅降低生產複雜性並提高整體效率。

雖然壓力壓鑄佔據最大的佔有率,但由於真空壓鑄能夠提高生產零件的品質和強度,預計它將成為汽車零件壓鑄市場中成長最快的領域。這一成長軌跡是由該技術在減輕鑄造過程中的空氣滯留方面的固有優勢所驅動,從而確保生產出結構完整性更高的零件。

此外,真空壓鑄顯著降低了孔隙率,從而製造出更緻密、更堅固的汽車零件。在製造至關重要的汽車關鍵零件時,對此特性的要求越來越高,因為卓越的品質和強度是至關重要的。此外,該方法在生產高品質、耐用零件方面的熟練程度使其成為不斷發展的汽車製造業必不可少的技術,特別是在生產需要高可靠性和性能標準的零件方面。

亞太地區預計將在市場中發揮關鍵作用

由於印度、中國和日本等主要國家的存在,亞太地區預計將在市場中發揮主導作用。中國是壓鑄件主要生產國之一,佔亞太地區壓鑄件市場佔有率的60%以上。

由於中國和印度的重大貢獻,亞太地區引領汽車零件壓鑄市場。這是由於該地區汽車行業不斷發展、汽車產量高且主要汽車製造商都位於該地區。

2022年,亞太地區汽車產量超過3,500萬輛,光是中國就生產了2,700萬輛汽車。繼中國之後,日本汽車產量超過780萬輛,印度汽車產量超過540萬輛。此外,2022 年該地區商用車整體銷量將超過 660 萬輛,僅在中國就將售出超過 330 萬輛。

此外,亞太地區擁有完善的製造業基礎設施,並得到政府有利於汽車產業發展的政策支持,從而鞏固了其在全球範圍內的主導地位。新製造技術和對省油車的關注等因素正在塑造市場。

此外,中階的日益富裕也對市場成長產生了正面影響。在該地區,受政府清潔能源汽車和環境問題政策的推動,電動和混合動力汽車等先進汽車技術正在推動市場發展。亞太地區不斷發展的市場環境具有快速成長和技術進步的特點,預計將進一步推動全球汽車零件壓鑄產業的發展。

汽車壓鑄產業概況

全球壓鑄市場較為分散,許多區域性中小型企業也來自新興市場。 Nemak、Georg Fischer Automotive、Ryobi Die casting、Rheinmetall AG、Form Technologies Inc. (Dynacast)和Shiloh Industries等知名主要企業佔據了全球市場佔有率。這些主要參與者將收益集中在研發上,以開發更好的汽車零件生產流程和合金。例如

- 2023 年 10 月,該公司收購了位於肯塔基州拉塞爾維爾的 Rane Precision Die Casting 工廠。該工廠專門生產用於汽車和其他行業的鋁鑄件。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場促進因素

- 對高性能汽車的需求不斷成長推動了市場

- 市場限制

- 原料供應鏈中斷是一個問題

- 購買原料的初始成本高是一個問題

- 波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 產品類型

- 壓力鑄造

- 真空壓鑄

- 擠壓壓鑄

- 半固態壓鑄

- 原料

- 鋁

- 鋅

- 鎂

- 其他原料類型

- 應用

- 車身組裝

- 引擎零件

- 傳動部件

- 其他用途

- 地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 其他歐洲國家

- 亞太地區

- 印度

- 中國

- 日本

- 韓國

- 其他亞太地區

- 拉丁美洲

- 墨西哥

- 巴西

- 阿根廷

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 其他中東和非洲地區

- 北美洲

第6章 競爭格局

- 供應商市場佔有率

- 公司簡介

- Castwel Auto Parts Pvt Ltd

- Die-casting Solutions GmbH

- Dynacast International Inc.

- Endurance Group

- Gibbs Die-casting Group

- Kinetic Die-casting Company

- Mino Industry USA Inc.

- Ningbo Parison Die-casting Co. Ltd

- Raltor Metal Technik India Pvt. Ltd

- Rockman Industries Ltd

- Ryobi Die-casting Inc.

- Sandhar Technologies Limited

- Sipra Engineers Pvt. Ltd

- Spark Minda, Ashok Minda Group

- Sunbeam Auto Pvt Ltd

- Texas Die-casting

- Tyche Diecast Private Limited

第7章 市場機會與未來趨勢

- 對輕質和永續材料的日益偏好將成為一個主要趨勢。

The Automotive Parts Die Casting Market size is estimated at USD 48.99 billion in 2025, and is expected to reach USD 66.14 billion by 2030, at a CAGR of greater than 6.19% during the forecast period (2025-2030).

The automotive parts die casting market is experiencing significant growth, primarily driven by the global shift toward lightweight vehicles and the increasing popularity of electric vehicles. This trend toward lighter vehicles arises from the need to improve fuel efficiency and reduce carbon emissions, aligning with global environmental regulations and sustainability goals. Electric vehicles, in particular, require complex, high-precision components that are both lightweight and sturdy, and die casting is an ideal process to meet these demands.

For instance, CAFE standards and EPA policies to reduce automobile emissions and increase fuel efficiency are driving automobile manufacturers to reduce the weight of the automobile by using lightweight, non-ferrous metals. The move by the EPA to raise the miles per gallon (mpg) standards to 54.5 mpg by 2025 has helped the die casting industry, as the only way to get to those mileage standards is by manufacturing lightweight vehicles. Subsequently, using die cast parts as a weight-reduction strategy is a major driver for the market.

Further, advancements in die casting technology are significantly contributing to the expansion of the market. Innovations in machine design, process control, and mold technologies improve the efficiency and quality of die casting operations. These technological improvements increase the precision and strength of the cast parts and reduce waste and energy consumption, making the process more environmentally friendly and cost-effective. Integrating automation and digital technologies, such as computer-aided engineering (CAE) and the Internet of Things (IoT), optimizes the die casting process, leading to reduced lead times and increased productivity.

Moreover, the versatility of die casting allows for the production of a wide range of automotive parts, including intricate engine components, transmission systems, and structural elements. High-pressure die casting (HPDC) has emerged as a prominent technology, offering high-speed production capabilities and the ability to produce complex shapes with high dimensional accuracy. Moreover, vacuum die casting is gaining traction due to its ability to produce parts with superior mechanical properties and minimal porosity, further enhancing the quality and durability of automotive components.

As vehicle manufacturers increasingly focus on reducing vehicle weight to meet stringent emission standards and improve battery range in EVs, the demand for innovative die casting solutions is expected to surge. This is likely to lead to further advancements in materials and processes, such as the development of new alloys and enhanced casting techniques, to meet the evolving requirements of the automotive industry.

Automotive Parts Die Casting Market Trends

Pressure Die Casting Holds the Largest Market Share While Vacuum Die Casting is Expected to Witness a High Growth Rate

Pressure die casting is the largest category based on production type. Pressure die casting dominates the automotive parts die casting market with its efficient, high-volume, intricate, and durable components production.

Pressure die casting has been pivotal in the automotive parts die casting market, primarily due to its proficiency in fabricating high-volume, complex parts with perfect surface finish. Additionally, high-pressure die casting (HPDC) is increasingly used to produce large auto parts.

Major automotive companies like Tesla are utilizing HPDC to manufacture significant components, such as the front and rear ends of vehicles, as single parts. This application of HPDC has led to significant advancements in the efficiency and sustainability of automotive manufacturing processes. For instance, HPDC allows for replacing 70 to 100 parts with a single part, drastically reducing production complexity and improving overall efficiency.

While pressure die casting has the largest share, vacuum die casting is expected to emerge as the fastest-growing segment in the automotive parts die casting market, driven by its ability to enhance the quality and strength of manufactured components. This growth trajectory is underpinned by the technology's intrinsic advantage in mitigating air entrapment during the casting process, thereby ensuring the production of components with enhanced structural integrity.

Further, vacuum die-casting significantly reduces porosity, creating denser and more robust automotive parts. This attribute is increasingly sought in producing critical automotive components, where superior quality and strength are non-negotiable. Moreover, the method's proficiency in manufacturing high-quality, durable parts positions it as an indispensable technology in the evolving automotive manufacturing sector, particularly for components that require higher reliability and performance standards.

The Asia-Pacific Region is Expected to Play Key Role in the Market

The Asia-Pacific region is expected to play a dominant role in the market owing to the presence of key countries like India, China, and Japan. China is one of the major producers of die casting parts, accounting for more than 60% of the regional (Asia-Pacific) die casting market share.

The Asia-Pacific region leads in the automotive parts die casting market because of significant contributions from China and India. This is due to their growing car industry, high vehicle production, and major car manufacturers based there.

In 2022, over 35 million vehicles were produced in Asia-Pacific, with China accounting for 27 million motor vehicles alone. China was followed by Japan and India, which produced over 7.8 million and 5.4 million motor vehicles, respectively. Additionally, the overall commercial vehicle sales in the region in 2022 were registered at over 6.6 million units; over 3.3 million units were sold in China alone.

Moreover, the Asia-Pacific region derives strength from a well-entrenched manufacturing infrastructure, augmented by government policies favorably inclined toward the automotive industry's growth, thereby cementing its leadership position in the global context. Factors such as new manufacturing technologies and a focus on fuel-efficient cars shape the market.

The increasing wealth of the middle class also positively impacts the market growth. The region's push for advanced car technologies like electric and hybrid vehicles, backed by government policies for clean energy vehicles and environmental concerns, drives the market. This evolving market environment in Asia-Pacific, marked by rapid growth and technological advancements, is expected to drive the global automotive parts further die casting industry.

Automotive Parts Die Casting Industry Overview

The global market for die casting is fragmented, with many regional small-medium scale players from developing countries entering the market. Major recognized players, such as Nemak, Georg Fischer Automotive, Ryobi Die casting, Rheinmetall AG, Form Technologies Inc. (Dynacast), and Shiloh Industries, accounted for over 16% of the global market share. These key players have focused their revenues on R&D to develop better production processes and alloys for automotive parts. For instance,

- In October 2023, Kentucky Industrial Holdings Inc. purchased the Rane Precision Die Casting facility in Russellville, Kentucky. The plant specializes in aluminum castings for the automotive and other industries.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increasing Demand for High-Performance Vehicles Will Drive the Market

- 4.2 Market Restraints

- 4.2.1 Supply Chain Disruption of Raw Materials Could be a Challenge

- 4.2.2 High Initial Cost Related to the Purchase of Raw Materials is a Challenge

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value - USD Billion)

- 5.1 Production Process Type

- 5.1.1 Pressure Die Casting

- 5.1.2 Vacuum Die Casting

- 5.1.3 Squeeze Die Casting

- 5.1.4 Semi-solid Die Casting

- 5.2 Raw Material

- 5.2.1 Aluminum

- 5.2.2 Zinc

- 5.2.3 Magnesium

- 5.2.4 Other Raw Material Types

- 5.3 Application Type

- 5.3.1 Body Assemblies

- 5.3.2 Engine Parts

- 5.3.3 Transmission Parts

- 5.3.4 Other Application Types

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Spain

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Latin America

- 5.4.4.1 Mexico

- 5.4.4.2 Brazil

- 5.4.4.3 Argentina

- 5.4.5 Middle East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Castwel Auto Parts Pvt Ltd

- 6.2.2 Die-casting Solutions GmbH

- 6.2.3 Dynacast International Inc.

- 6.2.4 Endurance Group

- 6.2.5 Gibbs Die-casting Group

- 6.2.6 Kinetic Die-casting Company

- 6.2.7 Mino Industry USA Inc.

- 6.2.8 Ningbo Parison Die-casting Co. Ltd

- 6.2.9 Raltor Metal Technik India Pvt. Ltd

- 6.2.10 Rockman Industries Ltd

- 6.2.11 Ryobi Die-casting Inc.

- 6.2.12 Sandhar Technologies Limited

- 6.2.13 Sipra Engineers Pvt. Ltd

- 6.2.14 Spark Minda, Ashok Minda Group

- 6.2.15 Sunbeam Auto Pvt Ltd

- 6.2.16 Texas Die-casting

- 6.2.17 Tyche Diecast Private Limited

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Inclination Towards the Use of Lightweight and Sustainable Materials Will be Key Trend