|

市場調查報告書

商品編碼

1683407

智慧清管市場:市場佔有率分析、產業趨勢與成長預測(2025-2030 年)Intelligent Pigging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

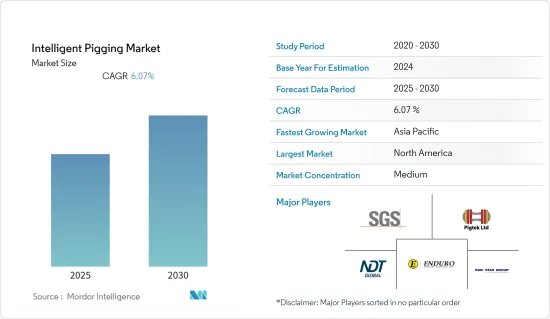

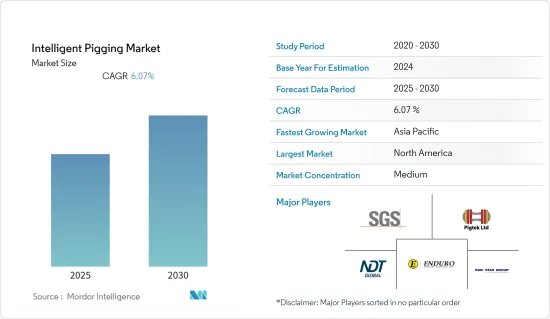

預測期內,智慧清管市場預計將實現 6.07% 的複合年成長率

關鍵亮點

- 從中期來看,預計即將實施的管道計劃和日益增強的管道安全意識將在預測期內推動市場發展。

- 然而,預計高昂的前期成本將阻礙預測期內的市場成長。

- 氣體水合物和頁岩等傳統型能源來源的探勘和生產活動的增加預計將為智慧清管市場創造巨大的機會。

- 由於北美擁有龐大的管道基礎設施,預計該地區將成為智慧清管市場的主導地區。

智慧清管市場趨勢

卡尺清管領域實現顯著成長

- 卡尺清管器用於精確測量管道內徑。卡尺清管器用於精確測量管道內徑,並提供有關管道形態的詳細資訊,包括直徑變化、橢圓度、凹痕和變形。這種全面的檢查能力對於評估管道完整性和流動能力至關重要。

- 卡鉗清管在管道完整性管理中扮演關鍵角色。透過檢測腐蝕、水垢堆積或物理損壞等異常,操作員可以識別可能需要進一步檢查或維護的關注區域。卡尺清管器準確測量壁厚的能力對於評估管道的腐蝕和侵蝕程度特別有價值。

- 清管器可用於多種類型的管道,包括石油、天然氣、水和產品平臺。它的多功能性和適應各種管道尺寸和配置的能力使其成為各行各業管道檢測的首選。

- 隨著全球管道長度的增加,預計管徑清管的需求將大幅增加。例如,截至2023年5月,約有21,900公里的管道處於提案階段,超過9,000公里的管道處於建設階段。

- 例如,2022年9月,德國EUROPIPE公司訂單北美TC Energy(TCE)公司墨西哥灣東南酵母管線計畫的管線供應合約。 TCE 正在與墨西哥國有電力公司 Comisión Federal de Electricidad (CFE) 合作建造價值 45 億美元的海上天然氣管道。

- 因此,鑑於上述情況,預計卡尺清管將在預測期內發揮重要作用。

北美佔據市場主導地位

- 近年來,北美的石油和天然氣產量大幅成長,導致用於運輸所生產的石化燃料的管道基礎設施投資增加。

- 此外,北美有嚴格的法規來確保其管道基礎設施的完整性和安全性。美國管道和危險物質安全管理局 (PHMSA) 和加拿大國家能源委員會 (NEB) 等監管機構要求定期對管道進行檢查和維護。遵守這些法規正在推動智慧清管技術的採用。

- 北美的許多管道已經運行了幾十年,由於年久失修,需要定期檢查和維護。智慧清管描述了一種評估這些管道狀況、識別潛在問題並確定維護活動優先順序的有效方法。

- 例如,2023年2月,金德摩根宣布幾天前發現洩漏的管線修復工作已經完成,並已恢復營運。這條管道是加州的一條汽油管道,向內華達州南部的倉儲設施供應無鉛汽油和柴油。

- 此外,北美在智慧清管技術進步方面處於領先地位。該地區是創新中心,各公司都在投資研發以提高智慧清管技術的能力。這些進步吸引了來自世界各地的客戶,並有助於鞏固北美市場的主導地位。

- 因此,鑑於上述情況,預計北美地區將在預測期內主導智慧清管市場。

智慧清管產業概況

智慧清管市場適度細分。市場的主要企業(不分先後順序)包括 Enduro Pipeline Services Inc.、NDT Global Services Ltd.、Pigtek Ltd.、Romstar Group、SGS SA 和 A.Hak Industrial Services BV。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第 2 章執行摘要

第3章調查方法

第4章 市場概況

- 介紹

- 至2028年市場規模及需求預測(單位:美元)

- 現有石油管線長度(公里)及至2023年的預測

- 現有天然氣管道長度(公里)及至2023年預測長度(公里)

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 即將進行的管道計劃

- 對管道安全的日益關注

- 限制因素

- 初期投資高

- 驅動程式

- 供應鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 科技

- 漏磁清管器

- 卡尺清管器

- 超音波清管機

- 市場分析:依地區分類,市場規模及需求預測至 2028 年(按地區分類)

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 俄羅斯

- 英國

- 挪威

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 澳洲

- 馬來西亞

- 印尼

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 委內瑞拉

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 奈及利亞

- 埃及

- 伊朗

- 其他中東和非洲地區

- 北美洲

第6章 競爭格局

- 併購、合資、合作、協議

- 主要企業策略

- 公司簡介

- Enduro Pipeline Services Inc.

- NDT Global Services Ltd.

- Pigtek Ltd

- Romstar Group

- SGS SA

- A.Hak Industrial Services BV

- PipeSurvey International

- Decon International Technologies

- Rosen Australia Pty. Ltd.

- Penspen Limited

第7章 市場機會與未來趨勢

- 開發非傳統型能源來源

簡介目錄

Product Code: 68203

The Intelligent Pigging Market is expected to register a CAGR of 6.07% during the forecast period.

Key Highlights

- Over the medium term, the upcoming pipeline projects and increasing awareness of pipeline safety are expected to drive the market during the forecasted period.

- On the other hand, the high upfront cost is expected to hinder the market's growth during the forecasted period.

- Nevertheless, the increasing exploration and production activities for unconventional energy sources such as gas hydrates and shale are expected to create huge opportunities for the intelligent pigging market.

- North America is expected to be a dominant region for the intelligent pigging market due to the large pipeline infrastructure in the region.

Intelligent Pigging Market Trends

Caliper Pigging Segment to Witness Significant Growth

- Caliper pigs are designed to measure the internal diameter of pipelines accurately. They provide detailed information about the pipeline's geometry, including variations in diameter, ovality, and dents or deformations. This comprehensive inspection capability is essential for assessing pipelines' integrity and flow capacity.

- Caliper pigging plays a crucial role in pipeline integrity management. Detecting anomalies such as corrosion, scale buildup, or physical damage helps operators identify areas of concern that require further inspection or maintenance. The ability of caliper pigs to accurately measure wall thickness is particularly valuable for assessing the level of corrosion or erosion in pipelines.

- Caliper pigs can be used in various types of pipelines, including oil, gas, water, and refined product pipelines. Their versatility and ability to adapt to different pipeline sizes and configurations make them a preferred choice for pipeline inspection across different industries.

- With the increasing pipeline length globally, the requirement for Caliper Pigging is expected to increase significantly. For instance, as of May 2023, around 21,900 Km of pipelines are under the proposed stage, while more than 9000 KM are under the construction stage.

- For instance, in September 2022, EUROPIPE, located in Germany, was awarded North American TC Energy (TCE) a contract to supply pipe for the Southeast Gateway Pipeline project in the Gulf of Mexico. TCE is constructing the USD 4.5 billion offshore gas pipeline with the Mexican state-owned power utility Comision Federal de Electricidad (CFE).

- Therefore, as per the above points, Caliper Pigging is expected to play a significant role during the forecasted period.

North America to Dominate the Market

- The North American region has witnessed significant growth in oil and gas production in recent years, which, in turn, has led to increasing investments in pipeline infrastructure to transfer the produced fossil fuels.

- Moreover, North America has stringent regulations to ensure the integrity and safety of pipeline infrastructure. Regulatory bodies, such as the Pipeline and Hazardous Materials Safety Administration (PHMSA) in the United States and the National Energy Board (NEB) in Canada, mandate regular inspections and maintenance of pipelines. Compliance with these regulations drives the adoption of intelligent pigging technologies.

- Many pipelines in North America have been in operation for several decades and require regular inspection and maintenance due to aging. Intelligent pigging provides an effective method to assess the condition of these pipelines, identify potential issues, and prioritize maintenance activities.

- For instance, in February 2023, Kinder Morgan announced that repair work had been completed on a pipeline, and it resumed operations after a leak was detected a few days prior. The pipeline in question is a California gasoline pipeline that supplies unleaded and diesel fuel to storage facilities in southern Nevada.

- Additionally, North America is at the forefront of technological advancements in intelligent pigging. The region has been a hub for innovation, with companies investing in research and development to enhance the capabilities of intelligent pigging technologies. These advancements attract customers globally and contribute to North America's dominance in the market.

- Therefore, per the above points, the North American region is expected to dominate the Intelligent Pigging Market during the forecasted period.

Intelligent Pigging Industry Overview

The intelligent pigging market is moderately fragmented. Some of the key players in the market (in no particular order) include Enduro Pipeline Services Inc., NDT Global Services Ltd., Pigtek Ltd, Romstar Group, SGS SA, and A.Hak Industrial Services B.V among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, until 2028

- 4.3 Existing Oil Pipeline Length and Forecast in kilometers, till 2023

- 4.4 Existing Gas Pipeline Length and Forecast in kilometers, till 2023

- 4.5 Recent Trends and Developments

- 4.6 Government Policies and Regulations

- 4.7 Market Dynamics

- 4.7.1 Drivers

- 4.7.1.1 Upcoming Pipeline Projects

- 4.7.1.2 Increasing Focus on Pipeline Safety

- 4.7.2 Restraints

- 4.7.2.1 High Initial Investment

- 4.7.1 Drivers

- 4.8 Supply Chain Analysis

- 4.9 Industry Attractiveness - Porter's Five Forces Analysis

- 4.9.1 Bargaining Power of Suppliers

- 4.9.2 Bargaining Power of Consumers

- 4.9.3 Threat of New Entrants

- 4.9.4 Threat of Substitute Products and Services

- 4.9.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Technology

- 5.1.1 Magnetic Flux Leakage Pigs

- 5.1.2 Caliper Pigs

- 5.1.3 Ultrasonic Pigs

- 5.2 Geography Regional Market Analysis {Market Size and Demand Forecast till 2028 (for regions only)}

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 Russia

- 5.2.2.2 United Kingdom

- 5.2.2.3 Norway

- 5.2.2.4 Italy

- 5.2.2.5 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 India

- 5.2.3.3 Australia

- 5.2.3.4 Malaysia

- 5.2.3.5 Indonesia

- 5.2.3.6 Rest of Asia-Pacific

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Venezuela

- 5.2.4.4 Rest of South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 United Arab Emirates

- 5.2.5.3 Nigeria

- 5.2.5.4 Egypt

- 5.2.5.5 Iran

- 5.2.5.6 Rest of Middle-East and Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Enduro Pipeline Services Inc.,

- 6.3.2 NDT Global Services Ltd.

- 6.3.3 Pigtek Ltd

- 6.3.4 Romstar Group

- 6.3.5 SGS SA

- 6.3.6 A.Hak Industrial Services B.V

- 6.3.7 PipeSurvey International

- 6.3.8 Decon International Technologies

- 6.3.9 Rosen Australia Pty. Ltd.

- 6.3.10 Penspen Limited

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Development of Unconventional Energy Sources

02-2729-4219

+886-2-2729-4219