|

市場調查報告書

商品編碼

1683412

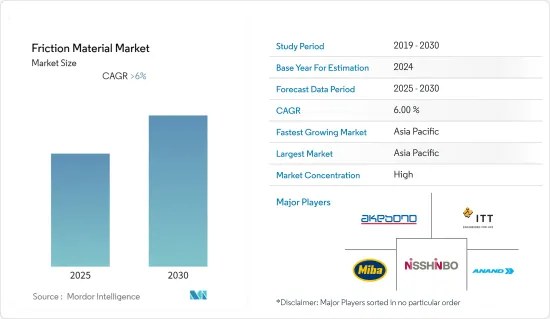

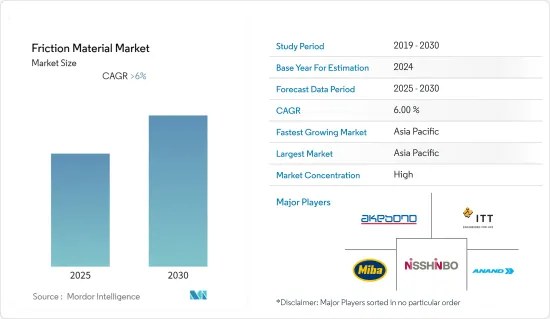

摩擦材料市場:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Friction Material - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

預計預測期內摩擦材料市場複合年成長率將超過 6%。

2020 年,市場受到了 COVID-19 的負面影響。在疫情期間,由於封鎖期間汽車製造活動暫時停止,汽車離合器、齒輪、煞車系統等中使用的摩擦材料的消耗量下降。此外,疫情期間,客運列車和航空運輸設施長期關閉,減少了列車煞車系統以及飛機離合器、煞車和齒輪中使用的摩擦材料的消費量。然而,貨運列車仍滿載運作。例如,截至2020年8月19日,印度鐵路的負載容量總量達到約5,747萬噸,較2019年同期成長6.6%,從而增加了對貨運列車煞車系統中使用的摩擦材料的需求。

短期內,各種工業機械對摩擦材料產品的需求不斷成長預計將推動市場成長。

另一方面,摩擦材料和維護的高成本預計會阻礙市場的成長。

由於中國、印度和日本等國家消費量龐大,預計亞太地區將在預測期內佔據市場主導地位。

摩擦材料市場趨勢

汽車產業佔市場主導地位

摩擦材料在小型和大型車輛的應用越來越多。在汽車中,摩擦材料用於離合器、煞車、齒輪等。

摩擦煞車透過摩擦將車輛的動能轉化為熱能,然後將熱量散發到周圍環境中,從而降低車輛速度。

在所使用的材料中,燒結金屬材料非常適合採礦車輛運輸車等重型應用。

陶瓷離合器可以承受相當大的熱量,並且可以在高達 550°C 的溫度下運行,而不會因離合器反覆接合和分離而褪色。這些耐熱特性使其成為賽車應用和各種最終用途的汽車煞車技術的理想選擇。

過去三年來,汽車產業發展放緩。根據國際汽車工業組織(OICA)的數據,汽車產量從2019年的92,175,805輛下降到2020年的77,621,582輛,下降了15.8%。此外,汽車銷量也從2019年的9,042萬輛下降到2020年的7,797萬輛。

造成這一下降的主要原因是美國、中國、日本和德國等主要汽車中心的產量下降。 2020年,這些國家的降幅與2019年相比分別達到19%、2%、17%和24%。

因此,預計上述因素將在未來幾年對市場產生重大影響。

亞太地區可望主導市場

由於中國和印度擁有龐大的工業和汽車行業,並且該地區正在持續投資發展建築業,因此亞太地區預計將主導全球市場。

在中國和印度,對卡車、巴士、火車、工業機械和機器人的需求不斷成長,推動了各種應用對摩擦材料的需求。

中國是世界上最大的汽車製造業國家。 2018年,產業成長放緩,產銷量均出現下滑。類似的趨勢持續,2019年產量下降了7.5%。此外,2020年的產量達到2,523萬輛,比2019年下降了約2%。

隨著疫情蔓延,許多汽車公司因全國的停工而停產。除了湖北汽車公司外,特斯拉還關閉了位於上海的新工廠,並推遲了其 Model 3 的生產。此外,大眾也推遲了與上汽有合作的所有中國工廠的生產。

此外,印度2019年產量約452萬台,而2020年產量約339萬台,下降了約25%。

摩擦材料也用於鐵路。根據IBEF統計,印度鐵路營運著世界上最大的鐵路網路之一,軌道長度為123,236公里,擁有13,523列客運列車和9,146列貨運列車,載客量達2,300萬人次。

此外,印度和中國的航太製造業正在快速成長,預計將刺激市場需求。根據波音公司《2020-2039年民用飛機市場展望》,2020年至2039年期間,亞太地區將交付約17,485架新飛機。因此,預計到2039年該地區的飛機持有量將達到約18,770架,這將增加對摩擦材料的需求。

因此,預計上述因素將在未來幾年對市場產生重大影響。

摩擦材料產業概況

摩擦材料市場在本質上是部分整合的,少數主要企業控制很大一部分市場。主要參與企業包括日清紡控股公司、曙光煞車工業公司、ITT公司、米巴股份公司和ANAND集團。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 工業機械需求不斷成長

- 其他促進因素

- 限制因素

- 摩擦材料的維護成本高

- 新冠肺炎疫情的影響

- 其他限制因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場區隔

- 類型

- 磁碟

- 墊片

- 堵塞

- 襯墊

- 其他

- 材料

- 陶瓷製品

- 石棉

- 半金屬

- 燒結金屬

- 醯胺纖維

- 其他

- 應用

- 離合器和煞車系統

- 輪齒系統

- 其他

- 最終用戶產業

- 車

- 鐵路

- 航太

- 礦業

- 其他

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作、協議

- 市場佔有率分析**/排名分析

- 主要企業策略

- 公司簡介

- ABS Friction

- ANAND Group

- Akebono Brake Industry Co. Ltd

- Brembo SpA

- ITT Inc.

- Japan Brake Industrial Co. Ltd

- Miba AG

- Nisshinbo Holdings Inc.

- Tenneco Inc.

- Yantai Haina Brake Technology Co. Ltd

第7章 市場機會與未來趨勢

- 耐熱摩擦材料需求不斷增加

- 其他機會

The Friction Material Market is expected to register a CAGR of greater than 6% during the forecast period.

The market was negatively impacted by COVID-19 in 2020. During the pandemic scenario, automotive manufacturing activities were stopped temporarily during the lockdown, thereby decreasing the consumption of friction materials used in vehicles' clutches, gears, braking systems, and others. Furthermore, the passenger train and air transport facilities were halted during the pandemic for a long duration of time, which decreased the consumption of friction materials used in the braking systems of trains and clutches, brakes, and gears of aircraft. However, freight trains were running at full pace. For instance, the total freight loading through Indian railways amounted to about 57.47 million ton till August 19, 2020, with a growth rate of 6.6% compared to the same period of 2019, which has enhanced the demand for friction materials used in the braking systems of freight trains.

Over the short term, the growing need for friction material products for various industrial machinery is expected to drive the market's growth.

On the flip side, the high cost and maintenance of friction materials are expected to hinder the market growth.

The Asia-Pacific region is expected to dominate the market during the forecast period due to the huge consumption from countries such as China, India, and Japan.

Friction Materials Market Trends

The Automotive Industry Dominates the Market

Friction materials have been increasingly used in both light- and heavy-duty vehicles. In vehicles, friction materials find their applications in clutches, brakes, and gears, among others.

Friction brakes are used to decelerate a vehicle by transforming the kinetic energy of the vehicle to heat via friction and dissipating that heat to the surroundings.

Among all the materials used, sintered metal materials are well-suited for heavy-duty applications, such as mining vehicle transporters.

Ceramic material clutches can withstand considerable heat, and they can operate without fading at temperatures up to 550°C due to repeated engagement and disengagement of the clutch. This heat resistance property makes them ideal for racing applications and for use in brake technology in various high-end automobiles.

The automotive industry has seen a slowdown in the past three years. According to the International Organization of Motor Vehicle Manufacturers (OICA), automotive production witnessed a 15.8% decline from 92,175,805 units in 2019 to 77,621,582 units in 2020. Also, the sales of automobiles declined from 90.42 million units in 2019 to 77.97 million units in 2020.

The decline is majorly attributed to the reduced production in the major automotive hubs such as the United States, China, Japan, and Germany. In 2020, these countries witnessed a decline of 19%, 2%, 17%, and 24%, respectively, compared to 2019.

Therefore, the aforementioned factors are expected to significantly impact the market in the coming years.

The Asia-Pacific Region is Expected to Dominate the Market

Asia-Pacific is expected to dominate the global market due to the vast industrial and automotive sectors in China and India, coupled with the continuous investments done in the region to advance the construction sector.

The growing demand for trucks, buses, trains, industrial machines, and robots in China and India drives the demand for friction materials in various applications.

The Chinese automotive manufacturing industry is the largest in the world. The industry witnessed a slowdown in 2018, wherein production and sales declined. A similar trend continued, with production witnessing a 7.5% decline in 2019. Additionally, the production volume reached 25.23 million vehicles in 2020, registering a decline rate of about 2% compared to 2019.

As the pandemic spread, many auto companies across the country shut down their manufacturing activities due to the nationwide shutdown. In addition to the auto companies based in Hubei, Tesla's new factory in Shanghai was shut down and postponed the production date of its Model 3. Moreover, Volkswagen postponed production at all of its Chinese plants that run in partnership with SAIC.

Additionally, around 3.39 million vehicles were produced in India during 2020 compared to 4.52 million vehicles produced in 2019, witnessing a decline rate of about 25%.

Friction materials also find applications in the railways. According to IBEF, the Indian Railways operates one of the world's largest rail networks, with a route length of 1,23,236 kilometers, 13,523 passenger trains and 9,146 freight trains, and transporting 23 million passengers.

The aerospace manufacturing sector is also growing rapidly in India and China, which is expected to increase the demand in the market. According to Boeing Commercial Market Outlook 2020-2039, around 17,485 new airplane deliveries will be made in the Asia-Pacific region during the period of 2020-2039. With this addition, the total airplane fleet volume in the region will reach about 18,770 units by 2039, which is expected to enhance the demand for friction materials.

Therefore, the aforementioned factors are expected to have a significant impact on the market in the coming years.

Friction Materials Industry Overview

The friction material market is partially consolidated in nature, with a few major players dominating a significant portion of the market. Some of the key players include Nisshinbo Holdings Inc., Akebono Brake Industry Co. Ltd, ITT Inc., Miba AG, and ANAND Group, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Need for Industrial Machinery

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 High Maintenance and Cost of Friction Materials

- 4.2.2 Impact of COVID-19 Outbreak

- 4.2.3 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Discs

- 5.1.2 Pads

- 5.1.3 Blocks

- 5.1.4 Linings

- 5.1.5 Other Types

- 5.2 Material

- 5.2.1 Ceramic

- 5.2.2 Asbestos

- 5.2.3 Semi-metallic

- 5.2.4 Sintered Metals

- 5.2.5 Aramid Fibers

- 5.2.6 Other Materials

- 5.3 Application

- 5.3.1 Clutch and Brake Systems

- 5.3.2 Gear Tooth Systems

- 5.3.3 Other Applications

- 5.4 End-user Industry

- 5.4.1 Automotive

- 5.4.2 Railway

- 5.4.3 Aerospace

- 5.4.4 Mining

- 5.4.5 Other End-user Industries

- 5.5 Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle-East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle-East and Africa

- 5.5.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ABS Friction

- 6.4.2 ANAND Group

- 6.4.3 Akebono Brake Industry Co. Ltd

- 6.4.4 Brembo SpA

- 6.4.5 ITT Inc.

- 6.4.6 Japan Brake Industrial Co. Ltd

- 6.4.7 Miba AG

- 6.4.8 Nisshinbo Holdings Inc.

- 6.4.9 Tenneco Inc.

- 6.4.10 Yantai Haina Brake Technology Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Demand for High Thermal-resistant Friction Materials

- 7.2 Other Opportunities