|

市場調查報告書

商品編碼

1683455

日本電池市場:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Japan Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

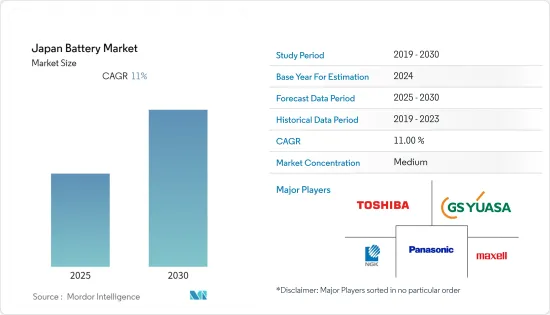

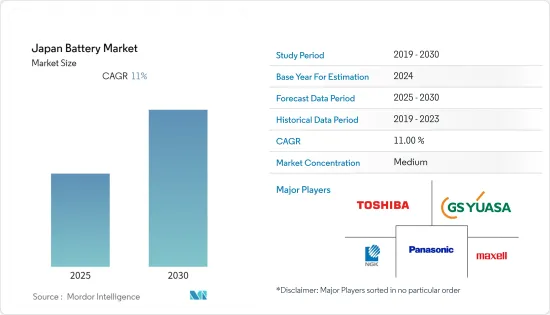

預計預測期內日本電池市場的複合年成長率將達到 11%。

新冠肺炎疫情為市場帶來了負面影響。目前市場已恢復至疫情前的水準。

關鍵亮點

- 預計電動車的普及率不斷提高、家用電子電器的需求不斷增加以及可再生能源設施數量的不斷增加等因素將推動市場的發展。

- 然而,由於對鋰離子電池的需求增加,尤其是電動車的需求,礦物價格大幅上漲。在某些情況下,礦產供應短缺,這可能會在預測期內抑制市場成長。

- 新興市場在電池化學研發方面的發展預計將為未來日本電池市場提供重大成長機會。

日本電池市場趨勢

二次電池領域預計將佔據市場主導地位

- 在二次電池中,電極反應是可逆的,因此當施加外部電壓時電極會恢復到其原始狀態。因此,二次電池既可用作能源來源,也能源儲存系統。二次電池通常具有容量和初始電壓較低、自放電率高以及充電壽命不穩定等特點。此外,儘管每個電池都相對昂貴,但從長遠來看這些電池是具有成本效益的。

- 日本廣泛使用的二次電池包括鉛酸電池、鹼性電池、鋰離子電池。

- 鉛酸電池是各種終端應用中最常用且最常見的二次電池,包括運輸、工業、商業、住宅和電網儲存。但由於嚴格的鉛排放法規和優勢(成本優勢、重量輕、持續改進等),鋰離子電池擴大部署在大電流應用中,例如家用電子電器產品、電池能源儲存系統、電動車和無線電動工具。

- 然而,由於鉛酸電池的比能量低、循環壽命有限、重量能量比較差,預計在二次電池領域成長緩慢。日本可充電鉛酸電池出口額大幅下降,從2018年的1.28億美元下降到2021年的8,300萬美元,下降超過30%。

- 日本最受歡迎的二次電池是鋰離子電池。鋰離子電池可以快速充電,並且比同類電池的使用壽命更長。據日本電池工業稱,近年來汽車使用的鋰離子電池數量大幅增加。

- 日本各地電動車(EV)的日益普及,以及人們對氣候變遷的日益關注,可能為二次電池製造商創造積極的商業前景。

- 日本的目標是到2050年實現「從油井到車輪零排放」措施,重點關注能源供應和汽車創新,與全球零排放努力保持一致。透過將所有汽車替換為電動車,每輛車可減少約 80% 的溫室氣體排放量,其中每輛乘用車可減少約 90% 的溫室氣體排放量。

- 因此,鑑於上述情況,預計預測期內二次電池領域將佔據日本市場的主導地位。

可再生能源的普及預計將推動市場

- 日本是亞太地區最大的可再生能源市場之一。 2021年,全國可再生能源裝置容量達111.86吉瓦,與前一年同期比較去年同期成長4.67%以上。

- 太陽能、水力、風能和生質能源是該國主要的再生能源來源。根據英國石油公司的《世界能源統計評論》,到2021年,可再生能源發電將佔總發電量的12%左右,佔初級能源結構的6.6%左右。

- 過去十年,日本太陽能發電裝置容量從2011年的489萬千瓦成長至2021年的約7,400萬千瓦。不過,太陽能在日本能源結構中的比例仍然較低。根據BP《2022年世界能源統計報告》,2021年太陽能發電量為86.3TWh,僅佔總發電量的8.5%左右。

- 為了正確利用屋頂光伏 (PV) 和大型太陽能發電工程的太陽能,需要一個強大的電池儲存系統,因為太陽能是間歇性的且夜間不可用。電池儲存系統在陽光不足或沒有陽光時提供電力,透過防止電壓突然突波和下降來幫助穩定電網。

- 日本有望成為全球併網電池計劃的領導者之一,目前已有多個大型電池計劃正在規劃和建設中。例如,2022年7月,Orix與關西電力的合資公司宣布將在日本西部建造和營運大型電池儲能系統。該計劃的容量為 48MW/113MWh,預計將於 2024 年投入營運。

- 2022年2月,經濟產業省公佈了適用於10至250千瓦太陽能發電設施的上網電價計畫(FIT)和適用於2022年透過競標系統選出的250千瓦或以上太陽能發電工程計畫(FIP)。該部已將10千瓦至50千瓦太陽能發電系統的上網電價(FIT)設定為0.096美元/千瓦時,50千瓦至250千瓦太陽能發電系統的上網電價(FIT)設定為0.087美元/千瓦時。因此,預計可再生能源在日本能源結構中的佔有率不斷增加將在預測期內推動日本儲能電池市場的發展。

- 因此,可再生能源的不斷增加的應用將推動對電池儲能系統的需求,這反過來將在預測期內推動日本的電池市場的發展。

日本電池產業概況

日本的電池市場是分散的。該市場的主要企業(不分先後順序)包括松下電器產業株式會社、麥克賽爾株式會社、GS Yuasa International Ltd、NGK Insulators Ltd. 和東芝株式會社。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第 2 章執行摘要

第3章調查方法

第4章 市場概況

- 介紹

- 2028 年市場規模與需求預測(十億美元)

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 限制因素

- 供應鏈分析

- PESTLE分析

第5章 市場區隔

- 電池類型

- 一次電池

- 二次電池

- 科技

- 鋰離子電池

- 鉛酸電池

- 其他

- 應用

- 汽車電池(HEV、PHEV、EV)

- 工業電池(動力、固定(電信、UPS、能源儲存系統(ESS) 等))

- 攜帶式電池(例如家用電子電器產品)

- SLI 電池

- 其他

第6章 競爭格局

- 併購、合資、合作、協議

- 主要企業策略

- 公司簡介

- Panasonic Corporation

- Maxell, Ltd.

- GS Yuasa International Ltd

- NGK Insulators Ltd

- Toshiba Corporation

- Contemporary Amperex Technology Co Ltd

- LG Energy Solution

- EEMB Battery

- B & B Battery Co. Ltd

- Furukawa Battery Co. Ltd

第7章 市場機會與未來趨勢

簡介目錄

Product Code: 71543

The Japan Battery Market is expected to register a CAGR of 11% during the forecast period.

The outbreak of COVID-19 negatively impacted the market. Currently, the market has reached pre-pandemic levels.

Key Highlights

- Factors such as the increasing adoption of electric vehicles, along with the increasing demand for consumer electronics and increasing renewable energy installations, are expected to drive the market.

- However, with the increasing demand for lithium-ion batteries, especially in electric cars, there is a substantial growth in mineral prices. In some cases, there is a shortage of mineral supply, which is likely to act as a restraint for the market growth during the forecast period.

- Advancements in the research and development of battery chemistries are expected to be a significant growth opportunity for the Japan Battery market in the future.

Japan Battery Market Trends

Secondary Battery Segment Expected to Dominate the Market

- In secondary batteries, electrode reactions are reversible, implying that applying an external voltage reconstructs the electrodes to their original state. Accordingly, secondary batteries act as both energy sources and energy storage systems. In general, secondary batteries have a low capacity and initial voltage, high self-discharge rates, and varying recharge life ratings. Moreover, these batteries are cost-efficient over the long term, even though individual batteries can be comparatively more expensive.

- Secondary batteries that are widely used in Japan include lead-acid batteries, alkaline storage batteries, and lithium-ion batteries.

- Lead-acid batteries are the most frequently used and available rechargeable batteries for various end-use applications, such as transportation, industrial, commercial, residential, and grid storage. However, due to stringent lead emission standards and benefits (such as cost advantages, lightweight, and ongoing improvements), lithium-ion batteries are increasingly deployed in high-drain applications, such as consumer electronics, battery energy storage systems, electric vehicles, and cordless electric power tools.

- However, lead-acid batteries are set to witness moderate growth in the secondary battery segment owing to their low specific energy, limited cycle life, and poor weight-to-energy ratio. The export value of rechargeable lead-acid batteries in Japan registered a considerable decline of more than 30%, from USD 128 million in 2018 to USD 83 million in 2021.

- The most popular secondary battery in Japan is the lithium-ion battery. It has a fast charging ability and offers longer life when compared to its counterparts. According to the Battery Association of Japan, sales of lithium-ion batteries for vehicles in terms of volume witnessed significant growth in recent years.

- The rising adoption of electric vehicles (EVs) across the country, coupled with a growing focus on climate change, is likely to create a positive business scenario for secondary battery manufacturers.

- By 2050, Japan aims to realize a 'Well-to-Wheel Zero Emission' policy, in line with the global efforts to eliminate emissions, with a focus on energy supply and vehicle innovation. Replacing all vehicles with EVs can reduce greenhouse gas emissions by around 80% per vehicle, including an approximate 90% reduction per passenger vehicle.

- Therefore, owing to the above points, the secondary battery segment is expected to dominate the Japanese market during the forecast period.

Increasing Renewable Energy Installations Expected to Drive the Market

- Japan is one of the largest renewable energy markets in the Asia-Pacific region. The country's renewable energy installed capacity reached 111.86 GW in 2021, representing an increase of over 4.67% compared to the previous year's value.

- Solar, hydro, wind, and bioenergy are the major renewable energy sources in the country. According to the BP statistical review of World Energy, in 2021, renewable energy sources accounted for approximately 12% of the total electricity generation mix and 6.6% of the primary energy mix in the country.

- Over the last decade, Japan's installed solar energy capacity has grown from 4.89 GW in 2011 to approximately 74 GW in 2021. However, the share of solar energy in the country's energy mix is still low. According to the BP Statistical Review of World Energy 2022, solar generation was 86.3 TWh in 2021, accounting for only about 8.5% of its total electricity generation.

- As solar energy is intermittent and unavailable at night, competent battery storage systems are necessary to properly utilize solar energy from rooftop photovoltaic (PV) and large-scale utility solar projects. Battery storage systems provide power during low and no sunlight hours and provide grid stability, preventing sudden voltage surges and sags.

- Japan is expected to become one of the global leaders in grid-connected battery storage projects, with several large-scale battery storage projects in the pipeline and under construction. For instance, in July 2022, a joint venture of Orix and Kansai Electric (KEPCO) announced that it would build and operate a large-scale battery storage system in western Japan. The project will have a capacity of 48MW/113MWh and will begin operation by 2024.

- In February 2022, the Ministry of Economy, Trade and Industry (METI) published the feed-in tariffs (FITs) that it proposes to apply to solar installations with a capacity of 10 to 250 kW, as well as the feed-in premiums (FIPs) to solar projects over 250 kW selected through the auction scheme in 2022. The ministry set a fixed FIT of USD 0.096/kWh for PV systems with capacities between 10 kW and 50 kW and a FIT of USD 0.087/kWh for installations between 50 kW and 250 kW. Thus, increasing renewable energy share in the country's energy mix is likely to drive the battery market in Japan for energy storage applications during the forecast period.

- Therefore, owing to the above points, increasing renewable energy installations fuelling the demand for battery energy storage systems, thus, in turn, driving the Japan battery market during the forecast period.

Japan Battery Industry Overview

The Japan battery market is fragmented. Some of the major players in the market (in no particular order) include Panasonic Corporation, Maxell, Ltd., GS Yuasa International Ltd, NGK Insulators Ltd., and Toshiba Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Primary Battery

- 5.1.2 Secondary Battery

- 5.2 Technology

- 5.2.1 Lithium-ion Battery

- 5.2.2 Lead-Acid Battery

- 5.2.3 Others

- 5.3 Application

- 5.3.1 Automotive Batteries (HEV, PHEV, EV)

- 5.3.2 Industrial Batteries (Motive, Stationary (Telecom, UPS, Energy Storage Systems (ESS), etc.)

- 5.3.3 Portable Batteries (Consumer Electronics, etc.)

- 5.3.4 SLI Batteries

- 5.3.5 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Panasonic Corporation

- 6.3.2 Maxell, Ltd.

- 6.3.3 GS Yuasa International Ltd

- 6.3.4 NGK Insulators Ltd

- 6.3.5 Toshiba Corporation

- 6.3.6 Contemporary Amperex Technology Co Ltd

- 6.3.7 LG Energy Solution

- 6.3.8 EEMB Battery

- 6.3.9 B & B Battery Co. Ltd,

- 6.3.10 Furukawa Battery Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219