|

市場調查報告書

商品編碼

1683456

東南亞水電市場 -市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Southeast Asia Hydropower - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

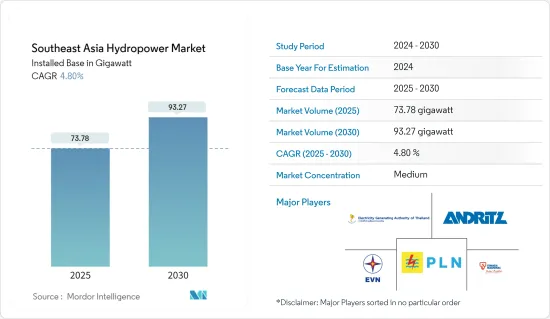

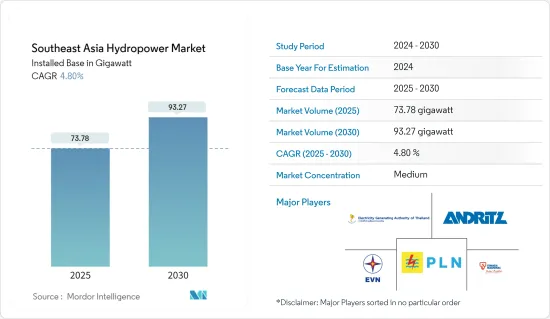

東南亞水力發電市場規模預計將從 2025 年的 73.78 吉瓦擴大到 2030 年的 93.27 吉瓦,預測期內(2025-2030 年)的複合年成長率為 4.8%。

關鍵亮點

- 從長遠來看,水力發電廠投資增加和可再生能源需求成長等因素預計將推動市場成長。

- 然而,與太陽能和風力發電等其他可再生能源相比,水力發電的初始成本較高,預計會抑制市場成長。

- 預計發電工程效率的提高和生產成本的下降將為東南亞市場參與企業創造充足的機會。

- 由於水力發電領域投資不斷增加且越南擁有該地區最大的水力發電裝置容量,預計越南將成為該地區最大的水力發電市場。

東南亞水力發電市場趨勢

大型水力發電領域可望主導市場

- 大型水力發電廠利用流動的水推動巨大的水輪機來產生可再生能源。為了產生大量的水力發電,必須將水儲存在湖泊、水庫和水壩中,並進行調節,以便用於發電、灌溉、生活用水和工業用途。

- 大型水力發電廠分為四種:傳統型水力發電廠、抽水蓄能電站、徑流電站和潮汐電站。大型水力發電廠的安裝成本很高,但發電成本較低,尤其是在大城市。根據國際可再生能源機構的數據,2022年運作的新水力發電發電工程的全球加權平均平準化能源成本(LCOE)為0.048美元/千瓦時。

- 根據寮國《2020-2030年電力發展規劃》,到2025年,寮國的水力發電裝置容量預計將超過14吉瓦。到2025年,可再生能源將佔總能源結構的30%,而水力發電預計將成為這一成長的主要組成部分。

- 作為東南亞國家聯盟 (ASEAN) 能源合作行動計畫 (APAEC) 2021-2025 的一部分,該國計劃在 2025 年實現 35% 的裝置容量來自可再生能源發電,這可能需要安裝 35-40GW。 2023年3月,印尼政府開工興建Mentarang Induk水力發電廠,計劃需投資26億美元。該發電廠容量超過 1.3 吉瓦,由 PT Kayan Hydropower Nusantara 開發,該公司是 PT Adaro Energy Indonesia、PT Kayan Patria Pratama Group 和 Sarawak Energy 的合資企業。

- 此外,越南、柬埔寨、緬甸、菲律賓等東南亞國家2023年水力發電裝置容量分別為2,263.9萬千瓦、179.1萬千瓦、326.9萬千瓦、382.6千萬瓦。 2023 年 11 月,菲律賓可再生 Energy Holdings Corporation 的水電子公司)運作一座 1.4 兆瓦的現代化徑流式水力發電廠,這是 REDC 投資組合中的第八座水力發電廠。下拉巴亞特發電廠位於奎松省雷亞爾,位於上拉巴亞特水力發電廠之間,利用下拉巴亞特河的水力,預計每年每小時發電 8 千兆瓦。

- 由於這些原因,大型水力發電廠預計將佔據市場主導地位。

越南可望主導市場

- 越南是東南亞最大的水力發電市場之一。根據越南電力局(EVN)預測,截至2023年,越南水力發電量將達到2,263.9萬千瓦,佔全國總設備容量的近30%。

- 水力發電佔全國總發電量的很大一部分,將近30.77%。越南經濟嚴重依賴水力發電來滿足國內需求。然而,隨著國內需求激增,燃煤電廠發電量的比重不斷增加,而其他再生能源雖然穩定成長,但在總發電量中所佔比例仍然較小。

- 越南傳統上依賴水力發電,是一個成熟的水力發電市場,已開發了近60%的總水力發電潛力。根據《越南能源展望》,越南大中型水力發電潛力(定義為30MW以上,通常與水庫相連)已接近充分挖掘。然而,該河流域的小型水力發電潛力仍未開發,約11吉瓦。

- 儘管如此,越南政府仍在投資開發該國剩餘的大型水力發電潛力,以實現排放目標,同時努力滿足不斷成長的電力需求,預計2021年至2030年間電力需求將成長近6-7%。

- 2024 年 1 月,越南電力公司 (EVN) 在河內舉行的第 46 屆越南-寮國雙邊合作政府間委員會上簽署了 19 份購電協議,從寮國 26 座水力發電廠購買 2,689 兆瓦電力。該協議的簽署標誌著越南與寮國電力合作的不斷深化。

- 由於上述因素,預計越南將在 2024-2029 年期間佔據研究市場的主導地位。

東南亞水電產業概況

東南亞水電市場中等細分化。該市場的主要企業包括越南電力建設股份公司、泰國電力局、PT Perusahaan Listrik Negara、Tenaga Nasional Berhad 和 Andrtiz AG。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第2章調查方法

第3章執行摘要

第4章 市場概況

- 介紹

- 2029年水力發電容量及預測(單位:GW)

- 可再生能源結構(2023 年)

- 未來規劃主要水力發電發電工程一覽(東南亞主要國家)

- 目前和即將進行的東南亞水電競標清單

- 東南亞主要水力發電顧問公司及財團名單

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 增加水力發電投資

- 政府優惠政策

- 限制因素

- 採用其他替代清潔能源來源

- 驅動程式

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場區隔

- 按類型

- 大型水力發電

- 小型水力

- 抽水蓄能發電

- 按地區

- 越南

- 印尼

- 馬來西亞

- 寮國

- 菲律賓

- 泰國

- 其他東南亞國家

第6章 競爭格局

- 併購、合資、合作、協議

- 主要企業策略

- 公司簡介

- Vietnam Electricity Construction JSC

- Andritz AG

- Electricity Generating Authority of Thailand

- PT Perusahaan Listrik Negara

- Tenaga Nasional Berhad

- Toshiba Corporation

- General Electric Company

- Aboitiz Power Corporation

- Power Construction Corporation of China Ltd

- 市場排名分析

第7章 市場機會與未來趨勢

- 高效能水力渦輪機的創新

簡介目錄

Product Code: 71551

The Southeast Asia Hydropower Market size in terms of installed base is expected to grow from 73.78 gigawatt in 2025 to 93.27 gigawatt by 2030, at a CAGR of 4.8% during the forecast period (2025-2030).

Key Highlights

- In the long term, factors such as increasing investments in hydropower plants and increasing demand for renewable energy are expected to drive the market's growth.

- However, the high initial cost of hydropower compared to other forms of renewable energies like solar and wind energy is expected to restrain the growth of the market.

- Nevertheless, technological advancements in efficiency and a decrease in the production cost of hydropower projects are expected to create ample opportunities for market players in Southeast Asia.

- Vietnam is expected to be the region's largest hydropower market due to increasing investment in the sector and the highest installed capacity of hydropower energy in the region.

Southeast Asia Hydropower Market Trends

The Large Hydropower Segment is Expected to Dominate the Market

- Large-scale hydropower plants use flowing water to drive huge water turbines and generate renewable energy. To generate significant amounts of hydroelectricity, lakes, reservoirs, and dams must store and regulate water for later release for power generation, irrigation, domestic use, and industrial use.

- Large-scale hydropower plants can be classified into four types: conventional hydroelectric dams, pumped storage, run-of-the-river, and tidal. Although large hydropower plants are expensive to install, they produce electricity at a low cost, especially in large cities. According to the International Renewable Energy Agency, the global weighted average levelized cost of energy (LCOE) of newly commissioned hydropower projects in 2022 was USD 0.048/kWh.

- According to the Laos Power Development Plan 2020 -2030, the hydropower capacity of Laos is expected to exceed 14 gigawatts by 2025. By 2025, renewable energy may represent 30% of the total energy mix, and hydropower is anticipated to be a major component of this growth.

- As part of the Association of Southeast Asian Nations (ASEAN) Plan of Action for Energy Cooperation (APAEC) 2021-2025, the aim is to reach 35% renewable generation in installed power capacity by 2025, which may require the deployment of 35-40 GW. In March 2023, the Indonesian government began construction works for the Mentarang Induk hydropower plant, and the project requires a USD 2.6 billion investment. With more than 1.3 GW of capacity, the power plant will be developed by PT Kayan Hydropower Nusantara, a joint venture of PT Adaro Energy Indonesia, PT Kayan Patria Pratama Group, and Sarawak Energy.

- Moreover, in 2023, hydropower installed capacity in Southeast Asian Countries such as Vietnam, Cambodia, Myanmar, and the Philippines stood at 22.639 GW, 1.791 GW, 3.269 GW, and 3.826 GW. In November 2023, Philippine-based renewable energy producer Repower Energy Development Corporation, the hydropower subsidiary of Pure Energy Holdings Corporation, launched its newest 1.4 MW run-of-river hydropower plant, the eighth of its kind in REDC's portfolio. Located in Real, Quezon, between the Upper Labayat and Tibag hydropower plants, the Lower Labayat plant is estimated to generate 8 gigawatts per hour annually, utilizing the downstream current of the Labayat River.

- Owing to the above points, large hydropower plants are expected to dominate the market.

Vietnam is Expected to Dominate the Market

- Vietnam is one of the largest hydropower markets in Southeast Asia. According to the Electricity Authority of Vietnam (EVN), as of 2023, Vietnam had 22.639 GW of hydropower, accounting for nearly 30% of the country's total installed capacity.

- Hydropower has accounted for a significant share of the country's gross electricity generation mix, accounting for nearly 30.77% of the country's total electricity generation. The Vietnamese economy relied heavily on hydroelectricity to satiate domestic demand. However, as domestic demand increased rapidly, the share of coal-fired generation in electricity rose, along with other renewables, which have grown steadily but occupy a relatively smaller share of the total electricity generation mix.

- Due to its traditional dependence on hydroelectricity, Vietnam has already developed nearly 60% of its total hydropower potential, making it a mature hydropower market. According to the Vietnam Energy Outlook, the country is close to fully utilizing its potential for large-scale and medium-scale hydropower (defined as greater than 30 MW and typically with a connected reservoir). However, there is still untapped potential for run-of-river small-scale hydro of around 11 GW.

- Despite this, as the government tries to deal with the growing power demand, which is projected to grow by nearly 6-7% during 2021-2030 while realizing its emission reduction targets, the Vietnamese government is investing in the development of the remaining large-scale hydro potential in the country.

- In January 2024, State utility Vietnam Electricity (EVN) entered into 19 power purchase agreements for the acquisition of 2,689 MW of electricity from 26 hydropower plants in Laos during the 46th meeting of the Vietnam-Laos Intergovernmental Committee for Bilateral Cooperation in Hanoi. The signing of the agreements demonstrated deeper cooperation in electricity between Vietnam and Laos.

- Due to the above-mentioned factors, Vietnam is expected to dominate the market studied between 2024 and 2029.

Southeast Asia Hydropower Industry Overview

The Southeast Asian hydropower market is moderately fragmented. Some of the key players in this market are Vietnam Electricity Construction JSC, Electricity Generating Authority of Thailand, PT Perusahaan Listrik Negara, Tenaga Nasional Berhad, and Andrtiz AG.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Hydropower Installed Capacity and Forecast in GW, till 2029

- 4.3 Renewable Energy Mix, 2023

- 4.4 List of Major Upcoming Hydropower Projects, By Major Countries, Southeast Asia

- 4.5 List of On-going and Upcoming Hydropower Tenders, Southeast Asia

- 4.6 List of Major Hydropower Consulting Companies and Consortiums, Southeast Asia

- 4.7 Recent Trends and Developments

- 4.8 Government Policies and Regulations

- 4.9 Market Dynamics

- 4.9.1 Drivers

- 4.9.1.1 Increasing Investments in Hydropower Generation

- 4.9.1.2 Favorable Government Policies

- 4.9.2 Restraints

- 4.9.2.1 Adoption of Other Alternative Clean Energy Sources

- 4.9.1 Drivers

- 4.10 Supply Chain Analysis

- 4.11 Porter's Five Forces Analysis

- 4.11.1 Bargaining Power of Suppliers

- 4.11.2 Bargaining Power of Consumers

- 4.11.3 Threat of New Entrants

- 4.11.4 Threat of Substitutes Products and Services

- 4.11.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Large Hydropower

- 5.1.2 Small Hydropower

- 5.1.3 Pumped Storage

- 5.2 By Geography

- 5.2.1 Vietnam

- 5.2.2 Indonesia

- 5.2.3 Malaysia

- 5.2.4 Laos

- 5.2.5 Philippines

- 5.2.6 Thailand

- 5.2.7 Rest of Southeast Asia

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Vietnam Electricity Construction JSC

- 6.3.2 Andritz AG

- 6.3.3 Electricity Generating Authority of Thailand

- 6.3.4 PT Perusahaan Listrik Negara

- 6.3.5 Tenaga Nasional Berhad

- 6.3.6 Toshiba Corporation

- 6.3.7 General Electric Company

- 6.3.8 Aboitiz Power Corporation

- 6.3.9 Power Construction Corporation of China Ltd

- 6.4 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Innovations in Efficient Hydropower Turbines

02-2729-4219

+886-2-2729-4219