|

市場調查報告書

商品編碼

1683749

美國汽車經銷商:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)United States Automotive Dealership - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

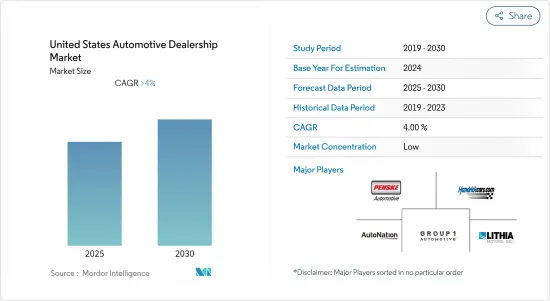

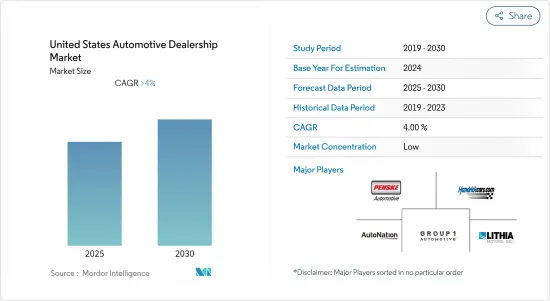

預計預測期內美國汽車經銷市場複合年成長率將超過 4%。

由於主要OEM和經銷商的生產活動停工和關閉,2020 年上半年需求陷入停滯,新冠疫情對美國汽車經銷市場的成長產生了負面影響。然而,隨著年終限制措施的放鬆,全國各大專利權和非專利權經銷商紛紛復甦,新車和二手車銷量增加,市場重新獲得動力。

隨著汽車產業的擴張,主要製造商對聯網汽車、電動車和自動駕駛汽車等新技術的大量投資預計將在中期支持市場成長。此外,汽車經銷商的不斷成長,加上消費者對無憂購買體驗的偏好,預計將在未來幾年進一步推動市場成長。

例如,根據NADA的2022年中期報告,該國16,752家專利權輕型車經銷商銷售了680萬輛小型車,輕型車經銷商總銷售額達6,180億美元。此外,2021年汽車零件商店和汽車經銷店的收入與前一年同期比較成長了約23%。美國汽車和零件經銷商的零售收益接近1.53兆美元。

然而,庫存短缺等因素正受到一系列供應鏈中斷的影響。此外,越來越多的消費者更喜歡在網路上購買而不是去展示室體驗,這也對市場成長構成了挑戰。儘管存在這些挑戰,但經銷商管理系統的技術進步(例如人工智慧(AI)、雲端運算和資料分析)預計將進一步推動市場需求。

例如,2022 年 6 月,Advanced Business Computers of America Inc. (ABCoA),一家紮根於二手車行業的 SaaS 公司,以 Deal Pack® 和 cyclCRM 而聞名,宣布推出一款名為 DST Dealership Sales Tools 的全新突破性經銷商管理軟體 (DMS)。

此外,獨立商店的推出、全通路零售策略的採用、消費者對認證二手車的興趣日益成長以及主要原始OEM製造商積極擴張國內經銷網路等因素預計將推動未來市場的成長。

美國汽車經銷商市場趨勢

汽車經銷商不斷改善的消費者體驗和對經銷商網路的日益關注將推動需求

毫無疑問,汽車和旅遊產業是新冠肺炎疫情期間受打擊最嚴重的產業之一。但隨著全國各地限制措施的放鬆,汽車經銷商變得越來越忙,許多經銷商爭相搶購庫存。受疫情影響,許多消費者開始選擇個人交通而不是公共交通,這為經銷商帶來了機會,而經銷商最有可能為新車和二手車提供融資服務。因此,隨著該國提供各種融資選擇,經銷商網路預計將在未來幾年蓬勃發展。

對於目標商標產品製造商(OEM)而言,汽車經銷商仍然是本地、有意義的客戶互動的關鍵參與者,並在售後市場和持續的消費者互動中發揮至關重要的作用。在過去十年中,大型經銷商網路能夠維持淨利率並建立投資和適應所需的規模。

例如,2022年11月,起亞汽車宣布推出2023款Telluride SUV的改良版本,並將逐步引入美國各地的經銷店。 2023 年 Telluride 在第一代 Telluride 的成功基礎上增加了兩個新的堅固裝飾等級(X-Line 和 X-Pro),使 Telluride 能夠更好地追蹤城市、郊區、越野和牧場風格的景觀。

在這種樂觀的環境下,公司專注於滿足授權和非授權經銷商的期望並提供客自訂解決方案。例如,2021年3月,北美發展最快的汽車集團之一HGreg.com收購了大洛杉磯地區兩家歷史悠久的汽車零售商Buena Park Nissan和Puente Hills Nissan。此次收購使HGreg.com能夠繼續在西海岸的成長計劃,擴大其優質二手車庫存,並最終提供簡化的全通路購車流程。

此外,電動車的擴張和搭載新技術的新車的快速普及預計將為市場創造樂觀的環境。這些市場趨勢預示著未來幾年的需求將良好。

二手車銷售增加預計將推動未來五年市場成長

由於全球半導體短缺以及俄羅斯-烏克蘭戰爭導致的供應鏈中斷等前所未有的事件,二手車在美國越來越受歡迎。這影響了新車銷售,並降低了該國二手車的積極前景。此外,客戶無力購買新車也是二手車銷售成長的因素之一,再加上市場參與企業在建立經銷商網路方面的投資。這個經銷商網路幫助市場參與企業建立自己的品牌,並使二手車選擇成為現實。

例如,2021 年二手車佔專利權汽車經銷商銷售額的約 36.7%,高於前一年的約 33%。新車的貢獻率從 2020 年的 55% 下降到 2021 年的 52.2%。這種向二手車的轉變與美國新車價格上漲有關。

此外,預計未來幾年汽車價格、二手車供應以及個人交通需求等因素將推動美國經銷商數量的成長。例如,2021 年 10 月,二手車經銷商 CarLotz 宣布將在北德克薩斯擴張,並在普萊諾開設新店。作為其擴張計劃的一部分,這將是該公司在首都地區的首家門市,也是該州的第二個門市。 Carlotz 在加州、科羅拉多、喬治亞州、伊利諾伊喬治亞、密蘇裡州、北卡羅來納州、田納西州、德克薩斯、維吉尼亞和華盛頓州擁有 20 家門市。該公司計劃在 2022年終在阿拉巴馬州和內華達州開設零售店。

為了提供無縫的二手車購買體驗,各主要企業都建立了線上和實體門市。例如,2020年9月,AutoNation Inc.擴大了其二手車店,在美國丹佛市場開設了兩家新店。該組織還宣布了到 2026 年開設 130 家 AutoNation Inc. 商店的目標。此類發展和趨勢預計將在未來幾年推動整體市場成長。

美國汽車經銷商產業概況

美國汽車經銷市場由於競爭性質和遍布全國的眾多參與者而被視為分散的。預計這些參與者將專注於開發新產品和創新,以擴大產品系列併吸引不僅在國內而且在該地區更多的消費者。

例如,2021 年 4 月,多元化國際運輸服務公司 Penske Automotive Group Inc. 及其全資商用車子公司 Premier Truck Group(「PTG」)收購了中重型商用卡車零售商 Kansas City Freightliner(「KCFL」)。此次收購將為該公司在堪薩斯州和密蘇裡州的現有業務增加五家全方位服務經銷商、四家零件和服務中心以及兩家碰撞修復中心。

2021年12月,美國最大的汽車零售和服務公司之一Asbury Automotive Group從Larry H. Miller Group(LHM)手中收購了Larry H. Miller Dealers(LHM Dealers)和LHM,包括Total Care Auto和Powered by Land Car(TCA),獲得54家新車經銷店、77家經銷店、7家經銷中心、二手車公司碰撞

2020 年 8 月,亨德里克汽車集團從 Neuwirth Motors 收購了威爾明頓的 Neuwirth Chrysler Dodge Jeep Ram Fiat。亨德里克在威爾明頓的業務包括傑夫戈登雪佛蘭 (Jeff Gordon Chevrolet)。在北卡羅來納州,我們擁有 41 家經銷商和 60 家專利權。該公司在 14 個州經營 95 家經銷店、26 個碰撞修理中心和 4 個配件經銷店。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場促進因素

- 市場限制

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 按類型

- 新車經銷商

- 二手車經銷商

- 零件與服務

- 金融和保險

- 按零售商

- 專利權零售商

- 非專利權零售商

- 按車型

- 搭乘用車

- 商用車

第6章 競爭格局

- 供應商市場佔有率

- 公司簡介

- Group 1 Automotive Inc.

- AutoNation Inc.

- Penske Automotive Group

- Lithia Motors Inc.

- Hendrick Automotive Group

- Asbury Automotive Group Inc.

- Larry H. Miller Dealerships

- Ken Garff Automotive Group

- Staluppi Auto Group

- Sonic Automotive Inc.

第7章 市場機會與未來趨勢

The United States Automotive Dealership Market is expected to register a CAGR of greater than 4% during the forecast period.

The COVID-19 pandemic harmed the growth of the US automotive dealership market as the shutdown and lockdown of manufacturing activities and dealerships of major OEMs resulted in a halt in demand in the first half of 2020. However, as restrictions eased by the end of the year, the recovery of key franchised and non-franchised dealers across the country in the wake of growing new and used car sales helped the market regain its momentum.

As the automotive industry expands, substantial investments in new technologies, such as connected cars, electric cars, autonomous cars, etc., by major manufacturers are expected to support the market's growth in the medium term. In addition, the growing presence of automotive dealers, coupled with consumer inclination towards a hassle-free buying experience, is anticipated to further enhance the market growth in the coming years.

For instance, according to NADA's mid-year 2022 report, the nation's 16,752 franchised light-vehicle dealers sold 6.8 million light-duty vehicles, and total light-vehicle dealership sales stood at USD 618 billion. In addition, in 2021, motor vehicle parts stores and automobile dealers witnessed an increase in revenue of around 23% over the previous year. US motor vehicle and part dealers generated revenue of almost USD 1.53 trillion from retail trade.

However, factors such as inventory shortages are caused by numerous supply chain disruptions. Also, the growing preference of consumers for online purchases over showroom experience poses challenges for market growth. Despite such challenges, technological advancements in dealer management systems, such as Artificial Intelligence (AI), cloud computing, data analytics, etc., are expected to further propel demand in the market.

For instance, in June 2022, Advanced Business Computers of America Inc. (ABCoA), a software-as-a-service company entrenched in the used car industry and known for Deal Pack(R) and cyclCRM, announced new and revolutionary dealer management software (DMS) called DST Dealership Sales Tools.

Further, factors such as the launch of standalone stores, the adoption of omnichannel retail strategies, and the growing consumer interest in certified used cars, coupled with the active expansion of the dealership network in the country by key OEMs, are expected to support the growth of the market in the future.

US Automotive Dealership Market Trends

Rising Focus of Automotive Dealers on Enhancing Consumer Experience and Dealer Network to Drive Demand

The automotive and mobility industries have certainly been among the hardest hit during the COVID-19 pandemic. However, as restrictions ease across the country, vehicle dealerships are becoming busier, and many are eager to buy more inventory. Several consumers have started to choose personal transportation over public transportation as a result of the pandemic, which spurred opportunities for dealers who are most inclined to offer financial services for new and used vehicles. Thus, with a variety of financing options available in the country, the dealership network is expected to flourish in the coming years.

For original equipment manufacturers (OEMs), car dealers remain a vital link in the chain, holding the keys to local and meaningful customer interaction and playing a crucial role in the aftermarket and ongoing consumer interaction. Over the last decade, large dealership networks have been able to maintain margins and build the scale necessary to invest and adapt.

For instance, in November 2022, Kia announced the launch of the revised 2023 Telluride SUV as it makes its way to dealerships across the United States. The 2023 Telluride builds upon the success of the original with two new rugged trim levels (X-Line and X-Pro) that help the Telluride track further through urban, suburban, off-road, and ranch-style landscapes.

As a result of such an optimistic environment, companies are focusing on meeting the expectations of authorized and unauthorized dealers and making themselves available to provide custom solutions. For instance, in March 2021, HGreg.com, one of the fastest-growing automotive groups in North America, acquired Buena Park Nissan and Puente Hills Nissan, two established car retailers located in the Greater Los Angeles area. The acquisition enables HGreg.com to continue its growth plans for the West Coast, expand its inventory of quality pre-owned vehicles, and, ultimately, offer the omnichannel car buying journey that it has committed to streamlining.

In addition, growing electric mobility and the fast adoption of new technologically equipped vehicles are expected to create an optimistic environment in the market. Such trends in the market pose a positive outlook for demand over the coming years.

Rising Used Car Sales Expected to Augment Market Growth in the Next Five Years

Due to unprecedented circumstances, such as global semiconductor shortages and supply chain disruptions in the wake of the ongoing Russia-Ukraine war, used cars are gaining popularity in the United States. This has impacted new car sales, reducing the positive outlook for used vehicles in the country. In addition, the inability of customers to buy new cars became one of the reasons for the growing used car sales volume, which is complemented by the investments made by industry participants to establish their dealership network in the market. These dealership networks helped market participants to brand and make used car options viable.

For instance, used vehicles accounted for around 36.7% of sales generated by franchised car dealerships in 2021, up from about 33% the previous year. The contribution of new vehicles fell from 55% in 2020 to 52.2% in 2021. This shift toward used vehicles is linked to the rising price of new vehicles in the United States.

Further, factors such as affordability, the availability of used cars, and the requirement for personal mobility, are expected to help dealers operating in the United States to emerge in the coming years. For instance, in October 2021, used car dealer CarLotz announced that it expanded North Texas with a new hub in Plano. This marks its first location in the metro area and second in the state as part of its expansion plans. The company has 20 retail locations across California, Colorado, Florida, Georgia, Illinois, Missouri, North Carolina, Tennessee, Texas, Virginia, and Washington. Other retail locations are planned for Alabama and Nevada by the end of 2022.

Various leading companies have set up online and offline stores to offer seamless used car buying experiences. For instance, in September 2020, AutoNation Inc. expanded its pre-owned vehicle store and opened two new stores in the USA Denver market. The organization also announced its goal to open 130 AutoNation Inc. stores by 2026. Such developments and trends are expected to enhance the overall growth of the market in the coming years.

US Automotive Dealership Industry Overview

The US automotive dealership market is considered to be fragmented owing to its competitive nature, and the presence of a large number of players operating in it across the country. These players are expected to focus on the development of new products and innovations, which will help them expand their product portfolio and attract a large number of consumers not only across the country but also in the region.

For instance, in April 2021, Penske Automotive Group Inc., a diversified international transportation services company, and Premier Truck Group ("PTG"), its wholly-owned commercial vehicle subsidiary, acquired Kansas City Freightliner ("KCFL"), a retailer of medium and heavy-duty commercial trucks. The acquisition adds five full-service dealerships, four parts and service centers, and two collision centers located in Kansas and Missouri to the company's existing operation.

In December 2021, Asbury Automotive Group Inc., one of the largest automotive retail and service companies in the United States, acquired LHM, which includes Larry H. Miller Dealerships (LHM Dealerships) and Total Care Auto, Powered by Landcar (TCA) from the Larry H. Miller Group of Companies (LHM), acquiring 54 new vehicle dealerships, seven used vehicle dealerships, 11 collision centers, a used vehicle wholesale business and an F&I product provider.

In August 2020, Hendrick Automotive Group acquired Neuwirth Chrysler Dodge Jeep Ram FIAT in Wilmington from Neuwirth Motors. Hendrick's Wilmington operations include Jeff Gordon Chevrolet. In North Carolina, the company has 41 dealerships and 60 franchises. The company has 95 dealership locations, 26 collision centers, and four accessory distributors in 14 states.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value USD billion)

- 5.1 By Type

- 5.1.1 New Vehicle dealership

- 5.1.2 Used Vehicle dealership

- 5.1.3 Parts and Services

- 5.1.4 Finance and Insurance

- 5.2 By Retailer

- 5.2.1 Franchised Retailer

- 5.2.2 Non-Franchised Retailer

- 5.3 By Vehicle Type

- 5.3.1 Passenger Cars

- 5.3.2 Commercial Vehicles

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Group 1 Automotive Inc.

- 6.2.2 AutoNation Inc.

- 6.2.3 Penske Automotive Group

- 6.2.4 Lithia Motors Inc.

- 6.2.5 Hendrick Automotive Group

- 6.2.6 Asbury Automotive Group Inc.

- 6.2.7 Larry H. Miller Dealerships

- 6.2.8 Ken Garff Automotive Group

- 6.2.9 Staluppi Auto Group

- 6.2.10 Sonic Automotive Inc.