|

市場調查報告書

商品編碼

1683768

中國建築塗料:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)China Architectural Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

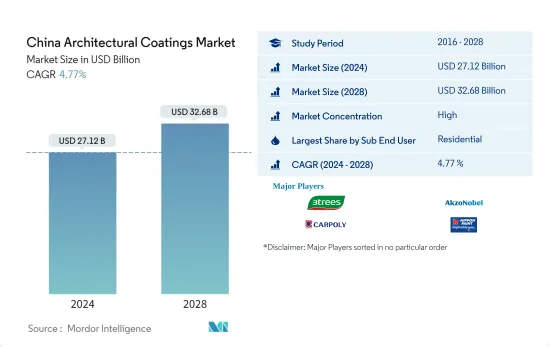

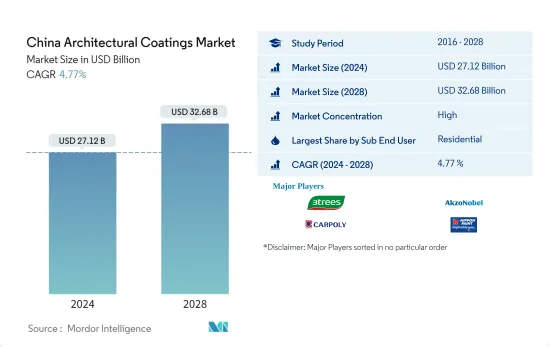

預計 2024 年中國建築塗料市場規模為 271.2 億美元,預計到 2028 年將達到 326.8 億美元,預測期內(2024-2028 年)的複合年成長率為 4.77%。

主要亮點

- 最大的終端用戶群:住宅:由於對住宅領域的持續投資以及世界上最大的人口,住宅領域佔據了建築塗料消費的大部分。

- 按技術分類的最大市場細分:水性塗料:由於中國政府將於 2020 年推出嚴格的建築塗料 VOC 法規,水性塗料將佔據主要佔有率。

- 按樹脂分類的最大細分市場:丙烯酸:由於水性塗料的成長,丙烯酸塗料是該國最大的水性耐腐蝕樹脂,其次是 PVA,因此是最大且成長最快的細分市場。

中國建築塗料市場趨勢

按終端用戶細分,住宅是最大的。

- 受2015年以來長期復甦以及2017與前一年同期比較住宅投資年增9.4%的推動,2017年中國建築塗料消費量達到峰值,與前一年同期比較增7.80%。此外,2017年總占地面積占地面積與前一年同期比較%,而住宅建築銷售占地面積較去年同期成長5.3%。

- 2020年,新冠疫情的蔓延導致新建住宅和商業建築減少,從而導致建築塗料消費低迷,但由於竣工量增加以及2020年流行的DIY建築增加,建築塗料消費將在2021年復甦。

- 政府的舉措,例如從 2022 年 3 月起取消進口油漆和塗料的申請和測試要求,預計將增強塗料公司對該國建築塗料未來前景的信心,從而導致預測期內消費和銷售增加。

中國建築塗料產業概況

中國建築塗料市場較為分散,前五大企業的市佔率為20.63%。該市場的主要企業是:3TREESGROUP、AkzoNobel NV、CARPOLY、Nippon Paint Holdings 和 PPG Industries, Inc.(按字母順序排列)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章執行摘要和主要發現

第 2 章 簡介

- 研究假設和市場定義

- 研究範圍

- 調查方法

第3章 產業主要趨勢

- 占地面積趨勢

- 法律規範

- 價值鏈與通路分析

第 4 章 市場細分

- 次級終端用戶

- 商業的

- 住宅

- 科技

- 溶劑型

- 水性

- 樹脂

- 丙烯酸纖維

- 醇酸

- 環氧樹脂

- 聚酯纖維

- 聚氨酯

- 其他樹脂類型

第5章 競爭格局

- 重大策略舉措

- 市場佔有率分析

- 業務狀況

- 公司簡介

- 3TREESGROUP

- AkzoNobel NV

- Axalta Coating Systems

- CARPOLY

- DAI NIPPON TORYO CO.,LTD.

- Flugger group A/S

- Foshan Caboli Painting Material Co.,Ltd.

- Guangdong Maydos building materials limited company

- Hempel A/S

- Jotun

- Kansai Paint Co.,Ltd.

- Nippon Paint Holdings Co., Ltd.

- PPG Industries, Inc.

- SKK(S)Pte. Ltd

- The China Paint Mfg. Co.(1932)Ltd.

第6章 執行長的關鍵策略問題

第7章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源和進一步閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

簡介目錄

Product Code: 93087

The China Architectural Coatings Market size is estimated at USD 27.12 billion in 2024, and is expected to reach USD 32.68 billion by 2028, growing at a CAGR of 4.77% during the forecast period (2024-2028).

Key Highlights

- Largest Segment by End-user - Residential : The residential sector dominated the architectural coating consumption due to the continuous investment in the housing segment to accompany the world largest population.

- Largest Segment by Technology - Waterborne : The waterborne coatings segment holds the major market share due to the new strict VOC regulations put by the chinese government on the architectural coatings in 2020.

- Largest Segment by Resin - Acrylic : Due to the growth of waterborne coatings, acrylic coating is the largest and fastest-growing segment as it is the country's largest waterborne coatings resin, followed by PVA.

China Architectural Coatings Market Trends

Residential is the largest segment by Sub End User.

- The architectural coating consumption in China peaked in 2017 with an increment of 7.80% from the previous year's total architectural coating consumption, due to the long-time recovery since 2015, and increase in investment in the residential building by 9.4% y-o-y in 2017. Furthermore, rise in sales of total floor space was also observed in 2017, for instance, floor space of commercial buildings sold was up by 7.7% y-o-y in 2017, while the floor space of residential buildings sold went up by 5.3%.

- The normal new housing starts growth was observed in 2018 and 2019, however from 2018 the downturn was observed due to the over rise in housing prices and declining country's GDP.The slow growth in the architectural coating consumption in 2020 due to lower new constructions in both residential cand commercial sector owing to the spread of covid-19 in the country was recovered in 2021 due to stronger completion and the rise in Do-it-yourself segment which got popularity in 2020.

- The increase in consumption and sales is expected to grow in forecasted period due to the government initiatives such as revoking filing and mandatory testing requirements of imported paint and coatings in the country from march, 2022 grows the confidence of coating companies in the positive future of architectural coating in the country.

China Architectural Coatings Industry Overview

The China Architectural Coatings Market is fragmented, with the top five companies occupying 20.63%. The major players in this market are 3TREESGROUP, AkzoNobel N.V., CARPOLY, Nippon Paint Holdings Co., Ltd. and PPG Industries, Inc. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 INTRODUCTION

- 2.1 Study Assumptions & Market Definition

- 2.2 Scope of the Study

- 2.3 Research Methodology

3 KEY INDUSTRY TRENDS

- 3.1 Floor Area Trends

- 3.2 Regulatory Framework

- 3.3 Value Chain & Distribution Channel Analysis

4 MARKET SEGMENTATION

- 4.1 Sub End User

- 4.1.1 Commercial

- 4.1.2 Residential

- 4.2 Technology

- 4.2.1 Solventborne

- 4.2.2 Waterborne

- 4.3 Resin

- 4.3.1 Acrylic

- 4.3.2 Alkyd

- 4.3.3 Epoxy

- 4.3.4 Polyester

- 4.3.5 Polyurethane

- 4.3.6 Other Resin Types

5 COMPETITIVE LANDSCAPE

- 5.1 Key Strategic Moves

- 5.2 Market Share Analysis

- 5.3 Company Landscape

- 5.4 Company Profiles

- 5.4.1 3TREESGROUP

- 5.4.2 AkzoNobel N.V.

- 5.4.3 Axalta Coating Systems

- 5.4.4 CARPOLY

- 5.4.5 DAI NIPPON TORYO CO.,LTD.

- 5.4.6 Flugger group A/S

- 5.4.7 Foshan Caboli Painting Material Co.,Ltd.

- 5.4.8 Guangdong Maydos building materials limited company

- 5.4.9 Hempel A/S

- 5.4.10 Jotun

- 5.4.11 Kansai Paint Co.,Ltd.

- 5.4.12 Nippon Paint Holdings Co., Ltd.

- 5.4.13 PPG Industries, Inc.

- 5.4.14 SKK(S) Pte. Ltd

- 5.4.15 The China Paint Mfg. Co. (1932) Ltd.

6 KEY STRATEGIC QUESTIONS FOR ARCHITECTURAL COATINGS CEOS

7 APPENDIX

- 7.1 Global Overview

- 7.1.1 Overview

- 7.1.2 Porter's Five Forces Framework

- 7.1.3 Global Value Chain Analysis

- 7.1.4 Market Dynamics (DROs)

- 7.2 Sources & References

- 7.3 List of Tables & Figures

- 7.4 Primary Insights

- 7.5 Data Pack

- 7.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219