|

市場調查報告書

商品編碼

1683816

非洲聚醚醚酮 (PEEK) -市場佔有率分析、行業趨勢和成長預測(2025-2030 年)Africa Polyether Ether Ketone (PEEK) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

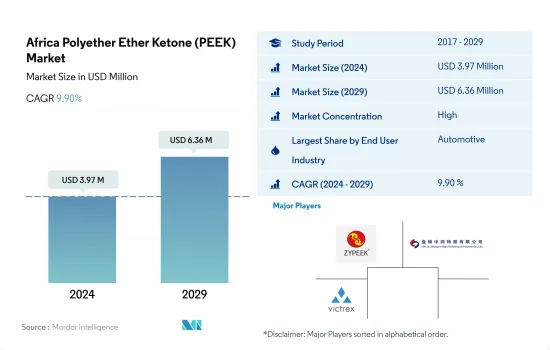

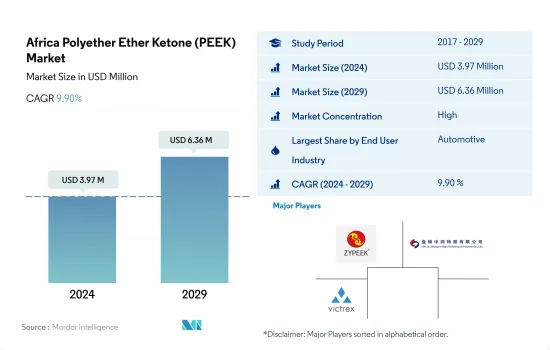

非洲聚醚醚酮 (PEEK) 市場規模預計在 2024 年為 397 萬美元,預計到 2029 年將達到 636 萬美元,在預測期內(2024-2029 年)的複合年成長率為 9.90%。

政府措施推動電氣電子產業市場需求

- PEEK 材料因其重量輕、強度高、低疲勞、低可燃性等優良特性而在許多行業中受到歡迎。它的可燃性較低,可承受高達近 600°C 的溫度。 2022 年,非洲的 PEEK 樹脂消費量與 2021 年相比以以金額為準成長了 18.50%。

- PEEK 樹脂在非洲其他終端用戶工業領域廣泛使用。該地區生產由 PEEK 塑膠製成的廚具、家居用品和家具等消費品。預計未來消費品和醫療設備需求的不斷成長將推動 PEEK 樹脂的需求。非洲各國政府正在投資醫療保健基礎設施,增加醫療設施和醫療設備的消費。到 2030 年,非洲的醫療保健市場價值預計將達到 2,590 億美元。這些因素預計將在未來推動全部區域對 PEEK 樹脂的需求。

- 汽車是該地區 PEEK 樹脂的第二大終端用戶產業。預計未來幾年該地區汽車產量的成長將推動對 PEEK 樹脂的需求。預計汽車產量將從 2023 年的 123 萬輛增加到 2029 年的 174 萬輛。

- 電氣和電子產業是該地區 PEEK 樹脂成長最快的終端用戶產業,預計在預測期內(2023-2029 年)以金額為準複合年成長率為 10.66%。由於技術進步,預測期內對家用電子電器的需求預計會增加。非洲消費電子產業規模金額將從 2023 年的 117.8 億美元成長到 2027 年的 199 億美元。該地區電氣和電子行業的成長預計將在未來推動對 PEEK 樹脂的需求。

預測期內南非將佔據市場主導地位

- 2022 年,非洲將佔全球 PEEK消費量的近 0.5%。 PEEK 樹脂具有高度多功能的特性,可應用於汽車、包裝和電氣/電子等各種行業。

- 由於航太、汽車、電氣電子等產業的蓬勃發展,南非是該地區最大的 PEEK 樹脂消費國。該國的飛機零件產量將從 2021 年的 5.598 億美元達到 2022 年的 5.749 億美元。預計未來幾年飛機零件產量的成長將推動該國對 PEEK 樹脂的需求。

- 非洲其他地區是 PEEK 樹脂成長最快的地區,預計預測期內(2023-2029 年)其以金額為準複合年成長率為 11.75%。由於汽車產量增加以及電氣電子產業的成長,非洲其他地區對 PEEK 樹脂的需求正在大幅成長。電子創新的快速步伐推動著對更新、更快的電氣和電子產品的持續需求。預計在預測期內,智慧型手機、筆記型電腦、個人電腦、相機和電視等技術先進的消費性電子產品的需求激增將推動對消費性電子產品的需求。

- 預計到 2027 年,奈及利亞的家用電子電器產業規模將達到約 26.2 億美元,高於 2023 年的 20.8 億美元。該國不斷成長的電氣和電子市場預計將在未來推動對 PEEK 樹脂的需求。

非洲聚醚醚酮 (PEEK) 市場趨勢

製造業正在崛起以滿足不斷成長的需求

- 南非是非洲主要製造地。其製造能力、高效的物流網路和優惠的區域市場進入使南非成為尋求供應非洲的電子公司的理想之地。南非的電子產業多元化,涵蓋電子機械、家用電器、通訊設備以及消費性電子產品。 2022年,非洲地區約70%的本地電氣和電子設備需求依賴進口。

- 家電業進口依賴度依然較高。據估計,2018年南非進口了非洲60%的消費性電子產品。 2020年,由於政府採取大面積封鎖措施,以及封鎖導致的供應鏈中斷,該國電氣和電子設備產量按與前一年同期比較計算,年增率下降約3.2%。在功能手機領域,由於廠商持續從功能手機轉型為入門級智慧型手機,出貨量較去年與前一年同期比較下降 26.6% 至 2,190 萬台。所有這些因素導致該地區電氣和電子元件產量下降,2020 年至 2022 年的複合年成長率為 -9.41%。

- 政府致力於促進和支持國內製造、研發以及製定電氣和電子製造的安全標準。預測期內(2023-2029 年),電氣和電子元件產量預計將實現 6.28% 的複合年成長率,以滿足非洲新興的中產階級人口的需求。

非洲聚醚醚酮 (PEEK) 產業概況

非洲聚醚醚酮(PEEK)市場相當集中,前三大公司佔據了74.33%的市場佔有率。市場的主要企業有:吉林聯合聚合物、盤錦中潤高性能聚合物、威格斯(按字母順序排列)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章執行摘要和主要發現

第2章 報告要約

第 3 章 簡介

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 最終用戶趨勢

- 航太

- 車

- 建築和施工

- 電氣和電子

- 包裝

- 法律規範

- 奈及利亞

- 南非

- 價值鏈與通路分析

第5章 市場區隔

- 最終用戶產業

- 航太

- 車

- 電氣和電子

- 工業/機械

- 其他最終用戶產業

- 國家

- 奈及利亞

- 南非

- 非洲其他地區

第6章 競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 業務狀況

- 公司簡介包括全球概況、市場層級概況、主要業務部門、財務狀況、員工人數、關鍵資訊、市場排名、市場佔有率、產品和服務以及最新發展分析。

- Jilin Joinature Polymer Co., Ltd.

- Pan Jin Zhongrun High Performance Polymer Co.,Ltd

- Victrex

第7章:執行長的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架(產業吸引力分析)

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源和進一步閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

簡介目錄

Product Code: 5000185

The Africa Polyether Ether Ketone (PEEK) Market size is estimated at 3.97 million USD in 2024, and is expected to reach 6.36 million USD by 2029, growing at a CAGR of 9.90% during the forecast period (2024-2029).

Government initiatives driving the electrical and electronics industry's market demand

- PEEK material is prevalent in many industries due to its lightweight nature and high quality in terms of strength, low fatigue, and low flammability. Because of its low flammability, it can withstand combustion up to nearly 600 °C. In 2022, Africa's PEEK resin consumption increased by 18.50% in terms of value compared to 2021.

- PEEK resin is commonly used in the other-end user industries segments in Africa. The region produces consumer goods, such as kitchen and household utensils and furniture, using PEEK resin. The rising demand for consumer goods and medical equipment, among others, is expected to drive the demand for PEEK resins in the future. Consumption of medical facilities and equipment has increased with governments of different African countries investing in healthcare infrastructure. The African healthcare market is estimated to be worth USD 259 billion by 2030. Such factors are projected to drive the demand for PEEK resin across the region in the future.

- Automotive is the second-largest end-user industry for PEEK resin in the region. The rising vehicle production in the region is expected to drive the demand for PEEK resin in the coming years. Vehicle production is projected to reach 1.74 million units by 2029 from 1.23 million units in 2023.

- The electrical and electronics segment is the fastest-growing end-user industry for PEEK resin in the region, which is projected to register a CAGR of 10.66% in terms of value during the forecast period (2023-2029). Consumer electronics demand is expected to rise during the forecast period as a result of technological advancements. The value of the consumer electronics industry in Africa is projected to reach USD 19.90 billion by 2027 from USD 11.78 billion in 2023. This growth in the electrical and electronics industry in the region is projected to drive the demand for PEEK resin in the future.

South Africa to dominate the market during the forecast period

- Africa accounted for nearly 0.5% of the global PEEK consumption in 2022. PEEK resins exhibit versatile properties, which find applications in various industries, such as automotive, packaging, electrical and electronics, and other industries.

- South Africa is the largest consumer of PEEK resin in the region due to its rising aerospace, automotive, and electrical and electronics industries. The aircraft components production in the country reached a value of USD 574.9 million in 2022 from USD 559.8 million in 2021. The rising aircraft components production is projected to drive the demand for PEEK resin in the country in the coming years.

- The Rest of Africa is the fastest-growing region for PEEK resins, which is anticipated to witness a CAGR of 11.75% in terms of value during the forecast period (2023-2029). The Rest of Africa's demand for PEEK resin is increasing significantly due to rising vehicle production and growing electrical and electronics industries. The rapid pace of electronic technological innovation drives consistent demand for newer and faster electrical and electronic products. The surge in demand for technologically advanced consumer electronics and appliances (such as smartphones, laptops, computers, cameras, and televisions) is expected to boost consumer electronics demand during the forecast period.

- The consumer electronics segment in Nigeria is projected to reach a value of around USD 2.62 billion by 2027 from USD 2.08 billion in 2023. The growth in the electrical and electronics market in the country is projected to drive the demand for PEEK resin in the future.

Africa Polyether Ether Ketone (PEEK) Market Trends

Manufacturing on the rise to tackle the rapidly growing demand

- South Africa is the leading manufacturing hub in Africa. Its manufacturing capabilities, efficient logistics network, and preferential regional market access position the country as an ideal location for electronics companies seeking to supply their products to Africa. South Africa has a diverse electronics industry that ranges from electrical machinery, household appliances, and telecommunication equipment to consumer electronics. In 2022, the African region imported around 70% of its local electrical and electronics demand.

- The consumer electronics industry still relies heavily on imports. According to estimates, South Africa brought 60% of all consumer electronics into Africa in 2018. In 2020, the electrical and electronic production in the country decreased at a growth rate of around 3.2%, by revenue, compared to the previous year, owing to the widespread lockdown adopted by the government and the supply chain disruption faced due to the lockdown. In the feature phone space, shipments were down by 26.6% to 21.9 million units as vendors were transitioning away from these devices toward entry-level smartphones. All such factors led to a decrease in the production of electrical and electronic components in the region at a CAGR of -9.41% from 2020 to 2022.

- The government is focused on promoting and supporting domestic manufacturing, R&D, and developing safety standards for the electrical and electronics manufacturing industry. The output of electrical and electronic industrial components is anticipated to record a CAGR of 6.28% during the forecast period (2023-2029) to supply the emerging African middle-class population.

Africa Polyether Ether Ketone (PEEK) Industry Overview

The Africa Polyether Ether Ketone (PEEK) Market is fairly consolidated, with the top three companies occupying 74.33%. The major players in this market are Jilin Joinature Polymer Co., Ltd., Pan Jin Zhongrun High Performance Polymer Co.,Ltd, Victrex (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End User Trends

- 4.1.1 Aerospace

- 4.1.2 Automotive

- 4.1.3 Building and Construction

- 4.1.4 Electrical and Electronics

- 4.1.5 Packaging

- 4.2 Regulatory Framework

- 4.2.1 Nigeria

- 4.2.2 South Africa

- 4.3 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Aerospace

- 5.1.2 Automotive

- 5.1.3 Electrical and Electronics

- 5.1.4 Industrial and Machinery

- 5.1.5 Other End-user Industries

- 5.2 Country

- 5.2.1 Nigeria

- 5.2.2 South Africa

- 5.2.3 Rest of Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 Jilin Joinature Polymer Co., Ltd.

- 6.4.2 Pan Jin Zhongrun High Performance Polymer Co.,Ltd

- 6.4.3 Victrex

7 KEY STRATEGIC QUESTIONS FOR ENGINEERING PLASTICS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework (Industry Attractiveness Analysis)

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219