|

市場調查報告書

商品編碼

1683873

法國電動商用車電池組:市場佔有率分析、產業趨勢與統計、成長預測(2025-2029 年)France Electric Commercial Vehicle Battery Pack - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

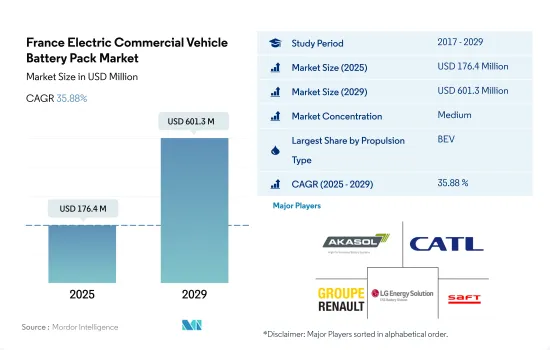

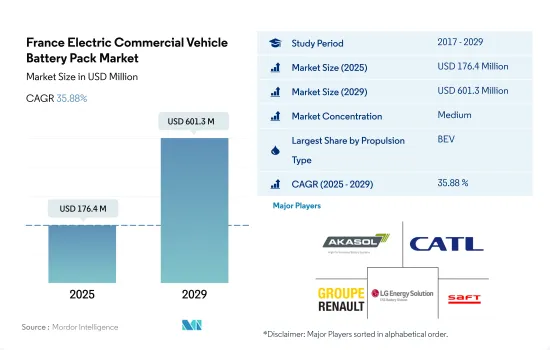

預計 2025 年法國電動商用車電池組市場規模為 1.764 億美元,到 2029 年將達到 6.013 億美元,預測期內(2025-2029 年)的複合年成長率為 35.88%。

法國政府措施與技術進步推動電動車電池組市場成長

- 近年來,法國電動商用車電池組市場經歷了顯著成長。截至 2020 年,法國道路上約有 13,000 輛電動車,預計到 2025 年將上升到 20 萬多輛。法國政府已設定目標,到 2029 年使 30% 的商用車實現零排放。為了支持這一目標,政府正在提供一系列獎勵來鼓勵人們採用電動車。

- 對電動車的需求正在推動對更密集、更長距離電池組的需求。 2020年,法國電動車的平均電池組容量將達到約50度,續航里程約190公里。電池成本一直在穩步下降,每千瓦時成本從 2010 年的 1,100 美元下降到 2020 年的 137 美元左右。預計這一趨勢將持續下去,一些預測認為到 2029 年電池成本將降至每千瓦時 58 美元。

- 技術進步和製造流程的改進推動了電池組產業的發展。主要電池組公司也在提高產能,以滿足電動車日益成長的需求。此外,我們也專注於開發新型電池化學材料,例如固態電池,它可以提供比現有鋰離子電池更高的能量密度和安全性。法國政府也推出了多項舉措,鼓勵國內電池製造和回收能力的發展。例如,2019 年,政府與法國電池製造商 Saft 合作開發新一代電動車高性能電池。這些努力有望振興法國ECV電池組市場。

法國電動商用車電池組市場趨勢

雷諾、豐田集團、標緻、現代和起亞是法國電動車市場的主要企業

- 法國電動車電池組市場競爭激烈,但截至 2022 年,五家公司佔了 50% 以上的市場佔有率。這些公司分別是雷諾、豐田集團、標緻、現代和起亞。雷諾在法國電動車電池組市場佔有23.12%的佔有率,是電動車銷量最多的品牌。作為一家全國性公司,它在法國消費者中享有盛譽,在全國擁有 500 多家經銷商。

- 豐田集團在法國電動車電池組市場佔有15.94%的佔有率,是電動車銷售第二大公司。廣泛的服務網路、多樣化的產品陣容和值得信賴的品牌形象推動著公司的成長。另一家法國品牌標緻在法國電動車電池組市場佔有第三名,佔有率為 8.67%。為了滿足各種客戶需求,公司依靠可靠的供應和分銷鏈蓬勃發展。

- 現代在法國電動車電池組市場排名第四,市場佔有率6.28%。其多樣化的產品吸引了中檔和豪華汽車客戶。起亞是法國電動車電池組市場第五大參與者,市場佔有率約 4.90%。法國電動車電池組市場的其他知名參與者包括梅賽德斯-奔馳、達契亞、飛雅特、寶馬和大眾。

雷諾和豐田在法國銷售了 50% 以上的電動車,並且擁有最多的電池組。

- 歐洲對電動車的需求正在成長,在法國,這一趨勢也持續成長。隨著消費者偏好轉向更具運動感、更具冒險精神的駕駛體驗,加上可與轎車相媲美的價格優勢,對電動緊湊型 SUV 的需求正在上升。

- 在這個快速成長的市場中,雷諾Arkana的銷售成長強勁。該車型吸引了那些想要一款兼具高效續航能力和實惠價格的電動緊湊型 SUV 的人。這款小型SUV的積極反響在法國電動車電池組市場也顯而易見。因此,雷諾 Captur 也成為了 2022 年最暢銷的車款。其銷售成功得益於其全混合動力和稍貴的插電式混合動力產品、出色的燃油效率、舒適的座椅和有競爭力的價格。

- 在法國電動車市場,一些國際品牌正在透過一系列電動 SUV 和轎車來實現產品組合多元化。豐田雅力士混合動力車在 2022 年的銷售令人印象深刻,成為受歡迎的選擇。廣泛的服務網路、有競爭力的定價和值得信賴的品牌形像等因素正在推動豐田汽車的成長,例如 2022 年豐田雅力士 Cross,其銷量為 23,576 輛。雷諾 Clio、標緻 208、特斯拉 Model 3、達契亞 Spring Electric 和雷諾梅甘娜等競爭對手正在改善法國的電動車市場。

法國電動商用車電池組產業概況

法國電動商用車電池組市場格局中等整合,前五大公司佔60.50%的市場。市場的主要企業是:Akasol AG、寧德時代新能源科技(CATL)、雷諾集團、LG Energy Solution Ltd. 和 Saft Groupe SA(按字母順序排列)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章執行摘要和主要發現

第2章 報告要約

第 3 章 簡介

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 電動商用車銷售

- 電動商用車銷量(OEM)

- 最暢銷的電動車車型

- 具有首選電池化學成分的OEM

- 電池組價格

- 電池材料成本

- 每種電池化學成分的價格表

- 誰供給誰?

- 電動車電池容量和效率

- 發布的電動車車型數量

- 法律規範

- 法國

- 價值鏈與通路分析

第5章 市場區隔

- 體型

- 公車

- LCV

- M&HDT

- 推進類型

- BEV

- PHEV

- 電池化學

- LFP

- NCA

- NCM

- NMC

- 其他

- 容量

- 15 kWh~40 kWh

- 40 kWh~80 kWh

- 超過80度

- 少於15千瓦時

- 電池形狀

- 圓柱形

- 小袋

- 方塊

- 方法

- 雷射

- 金屬絲

- 成分

- 陽極

- 陰極

- 電解

- 分隔符

- 材料類型

- 鈷

- 鋰

- 錳

- 天然石墨

- 鎳

- 其他材料

第6章 競爭格局

- 重大策略舉措

- 市場佔有率分析

- 業務狀況

- 公司簡介

- Akasol AG

- Automotive Cells Company(ACC)

- Blue Solutions SA(Bollore Group)

- BMZ Batterien-Montage-Zentrum GmbH

- Contemporary Amperex Technology Co. Ltd.(CATL)

- Elecsys France

- Forsee Power

- Groupe Renault

- IRIZAR S.COOP.

- Leclanche SA

- LG Energy Solution Ltd.

- Liten CEA Tech(COMMISSARIAT A L'ENERGIE ATOMIQUE ET AUX ENERGIES ALTERNATIVES)

- Microvast Holdings Inc

- Saft Groupe SA

- Samsung SDI Co. Ltd.

- Vehicle Energy Japan Inc.

第7章:執行長的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源和進一步閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

The France Electric Commercial Vehicle Battery Pack Market size is estimated at 176.4 million USD in 2025, and is expected to reach 601.3 million USD by 2029, growing at a CAGR of 35.88% during the forecast period (2025-2029).

French government initiatives and technological advancements drive the growth of the BEV battery pack market

- France's electric commercial vehicle battery pack market has seen significant growth in recent years. As of 2020, there were approximately 13,000 ECVs on French roads, projected to increase to over 200,000 by 2025. The French government has set a target of achieving 30% of commercial vehicles as zero-emission vehicles by 2029. To support this goal, the government offers various incentives to encourage the adoption of ECVs.

- The demand for ECVs has led to an increase in the demand for battery packs with higher density and range. The average battery pack capacity for an ECV in France was approximately 50 kWh in 2020, with a range of around 190 km. Battery costs have been decreasing steadily, with the cost per kWh dropping from USD 1,100 in 2010 to approximately USD 137 in 2020. This trend is projected to continue, with some estimates suggesting that battery costs could fall to as low as USD 58 per kWh by 2029.

- Technological advancements and improvements in manufacturing processes have driven the battery pack industry. Key battery pack companies have also been increasing their production capacity to meet the growing demand for ECVs. In addition, there have been efforts to develop new battery chemistries, such as solid-state batteries, which could offer even higher energy density and safety than existing lithium-ion batteries. The French government has also launched various initiatives to promote the development of battery manufacturing and recycling capabilities in the country. For example, in 2019, the government partnered with Saft, a French battery manufacturer, to develop a new generation of high-performance batteries for ECVs. These initiatives are expected to boost the ECV battery pack market in France.

France Electric Commercial Vehicle Battery Pack Market Trends

Renault, Toyota Group, Peugeot, Hyundai, and Kia are the leading players in the French electric vehicle market

- The electric vehicle battery pack market in France is competitive, although five companies accounted for over 50% of the market as of 2022. These companies are, namely, Renault, Toyota Group, Peugeot, Hyundai, and Kia. Renault has witnessed the largest electric car sales, boasting a 23.12% share of the French electric vehicle battery pack market. As a domestic company, it enjoys a robust reputation among French consumers and has over 500 dealerships nationwide.

- The Toyota Group has a 15.94% share in the French electric vehicle battery pack market, ranking it second in terms of electric vehicle sales. The company's expansive service network, diverse product lineup, and trusted brand image contribute to its growth. Peugeot, another French brand, occupies the third place in the French electric vehicle battery pack market, with an 8.67% share. Catering to various client needs, the company thrives on a dependable supply and distribution chain.

- Hyundai, capturing 6.28% of the market share, stands as the fourth largest player in the French electric vehicle battery pack market. Its diverse offerings appeal to both mid-range and premium customers. Kia, holding roughly 4.90% of the market share, is the fifth largest player in the French electric vehicle battery pack market. Other notable companies in the French electric vehicle battery pack market include Mercedes-Benz, Dacia, Fiat, BMW, and Volkswagen.

Renault and Toyota sell more than 50% of EVs in France while employing the most battery packs

- Demand for electric vehicles in Europe is escalating, and France is witnessing a consistent uptick in this trend. The demand for electric compact SUVs is on the rise as consumer preference shifts toward sportier, adventurous driving experiences, accompanied by benefits comparable in price to sedans.

- In this burgeoning market, Renault Arkana sales have seen significant growth. The model appeals to those desiring an electric compact SUV that combines efficient mileage with affordability. The positive response to compact SUVs is evident in the French electric vehicle battery pack market. Consequently, the Renault Captur also emerged as a best-seller in 2022. Its offerings of a full hybrid and a slightly pricier plug-in hybrid, along with superior fuel efficiency, comfortable seating, and competitive pricing, have fueled its sales success.

- Several international brands are diversifying their portfolios in the French EV market with a range of electric SUVs and sedans. The Toyota Yaris hybrid has been a popular choice, registering impressive sales in 2022. Factors such as an extensive service network, competitive pricing, and a trusted brand image have driven the growth of Toyota models, exemplified by the 23,576 units of Toyota Yaris Cross sold in 2022. Competing alongside are models like Renault Clio, Peugeot 208, Tesla Model 3, Dacia Spring Electric, and Renault Megane, improving the EV landscape in France.

France Electric Commercial Vehicle Battery Pack Industry Overview

The France Electric Commercial Vehicle Battery Pack Market is moderately consolidated, with the top five companies occupying 60.50%. The major players in this market are Akasol AG, Contemporary Amperex Technology Co. Ltd. (CATL), Groupe Renault, LG Energy Solution Ltd. and Saft Groupe S.A. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Electric Commercial Vehicle Sales

- 4.2 Electric Commercial Vehicle Sales By OEMs

- 4.3 Best-selling EV Models

- 4.4 OEMs With Preferable Battery Chemistry

- 4.5 Battery Pack Price

- 4.6 Battery Material Cost

- 4.7 Price Chart Of Different Battery Chemistry

- 4.8 Who Supply Whom

- 4.9 EV Battery Capacity And Efficiency

- 4.10 Number Of EV Models Launched

- 4.11 Regulatory Framework

- 4.11.1 France

- 4.12 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Body Type

- 5.1.1 Bus

- 5.1.2 LCV

- 5.1.3 M&HDT

- 5.2 Propulsion Type

- 5.2.1 BEV

- 5.2.2 PHEV

- 5.3 Battery Chemistry

- 5.3.1 LFP

- 5.3.2 NCA

- 5.3.3 NCM

- 5.3.4 NMC

- 5.3.5 Others

- 5.4 Capacity

- 5.4.1 15 kWh to 40 kWh

- 5.4.2 40 kWh to 80 kWh

- 5.4.3 Above 80 kWh

- 5.4.4 Less than 15 kWh

- 5.5 Battery Form

- 5.5.1 Cylindrical

- 5.5.2 Pouch

- 5.5.3 Prismatic

- 5.6 Method

- 5.6.1 Laser

- 5.6.2 Wire

- 5.7 Component

- 5.7.1 Anode

- 5.7.2 Cathode

- 5.7.3 Electrolyte

- 5.7.4 Separator

- 5.8 Material Type

- 5.8.1 Cobalt

- 5.8.2 Lithium

- 5.8.3 Manganese

- 5.8.4 Natural Graphite

- 5.8.5 Nickel

- 5.8.6 Other Materials

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Akasol AG

- 6.4.2 Automotive Cells Company (ACC)

- 6.4.3 Blue Solutions SA (Bollore Group)

- 6.4.4 BMZ Batterien-Montage-Zentrum GmbH

- 6.4.5 Contemporary Amperex Technology Co. Ltd. (CATL)

- 6.4.6 Elecsys France

- 6.4.7 Forsee Power

- 6.4.8 Groupe Renault

- 6.4.9 IRIZAR S.COOP.

- 6.4.10 Leclanche SA

- 6.4.11 LG Energy Solution Ltd.

- 6.4.12 Liten CEA Tech (COMMISSARIAT A L' ENERGIE ATOMIQUE ET AUX ENERGIES ALTERNATIVES)

- 6.4.13 Microvast Holdings Inc

- 6.4.14 Saft Groupe S.A.

- 6.4.15 Samsung SDI Co. Ltd.

- 6.4.16 Vehicle Energy Japan Inc.

7 KEY STRATEGIC QUESTIONS FOR EV BATTERY PACK CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms