|

市場調查報告書

商品編碼

1683876

德國電動商用車電池組:市場佔有率分析、產業趨勢與統計、成長預測(2025-2029 年)Germany Electric Commercial Vehicle Battery Pack - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

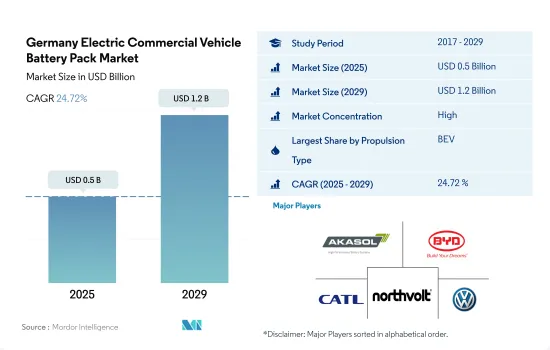

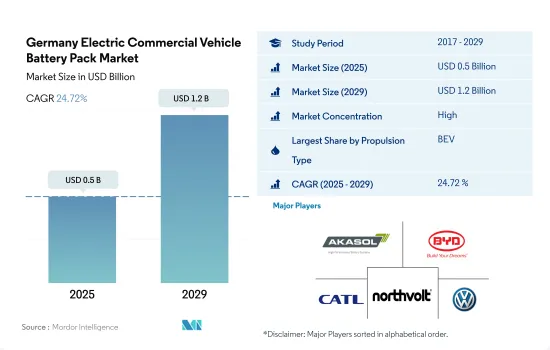

預計 2025 年德國電動商用車電池組市場規模將達到 5 億美元,到 2029 年預計將達到 12 億美元,預測期內(2025-2029 年)的複合年成長率為 24.72%。

需求增加與成本下降推動德國商用電動車電池組市場

- 預計未來幾年德國電動商用車電池組市場將經歷顯著成長。截至 2021 年,電動商用車佔全國商用車持有的不到 1%。然而,隨著電動車越來越受歡迎,在政府法規、環境問題和電池技術成本下降的推動下,電動商用車的市場佔有率預計將快速成長。德國的目標是到2030年,新註冊商用車中40%-50%是電動車,這意味著每年可售出30萬多輛電動商用車。

- 隨著電動商用車需求的不斷成長,德國的電池組市場也大幅成長。電池密度和續航里程逐年穩定提高,鋰離子電池成為市場上使用最廣泛的技術。電池組成本也在下降,過去十年下降了約 80%。然而,電池組的成本仍然是電動商用車普及的重大障礙,需要進一步降低成本,才能使電動商用車與石化燃料商用車具有成本競爭力。

- 由於技術進步和需求增加,德國電動商用車電池組市場前景光明。最近的趨勢是電池組越來越大,一些製造商現在銷售容量高達 1,000 kWh 的電池組。這項發展是為了滿足延長商用車續航里程和減少充電頻率的需求。

德國電動商用車電池組市場趨勢

德國電動車領導者大眾、梅賽德斯-奔馳、特斯拉、寶馬和現代主導著該行業

- 德國電動車市場參與者多樣,其中五大參與者佔據主要地位,2022 年佔據超過 40% 的市場。知名參與者包括大眾、賓士、特斯拉、寶馬和現代。大眾是德國最大的電動車銷售商,佔有約 10.10% 的市場。該公司在包括德國在內的歐洲國家擁有強大的影響力。該公司旗下擁有眾多品牌,並提供一系列電動車產品。憑藉強大的品牌形象和龐大的基本客群,它已成為德國頂級品牌。

- 梅賽德斯-奔馳是德國第二大電動車銷售商,在德國的市場佔有率約為 8.59%。該公司為高階客戶提供各種電動車,並透過遍布德國的強大服務網路為客戶提供服務。德國第三大電動車銷售商是特斯拉,市場佔有率約 7.55%。該公司擁有強大的創新策略,並提供多種純電動車。

- BMW位居第四,佔德國電動車銷量的 6.72% 左右。該品牌擁有強大的生產和供應鏈網路,並提供廣泛的混合動力汽車和純電動車創新和多樣化產品。現代在德國電動車市場排名第五,市場佔有率約6.25%。在德國銷售電動車的其他公司包括奧迪、雷諾、起亞、西亞特和歐寶。

特斯拉和飛雅特領先德國電池組市場

- 過去幾年,德國各地對電動車的需求持續成長。此外,近年來對電池的需求不斷增加。國內有許多不同的品牌和型號。不過,2022年,特斯拉Model Y、特斯拉Model 3、飛雅特500、福特Kuga、豐田Yaris等前五名車型佔據了較大的市場佔有率。特斯拉Model Y在2022年繼續保持榜首位置,銷量為35,426輛。 Model Y 因其續航里程長、座位數多、載貨空間大而廣受歡迎。

- 排名第二的是特斯拉Model 3,2022年在德國的銷售量為33,841輛。該車有後輪驅動和性能版本。由於強大的性能特性,Model 3吸引了客戶的注意。在電動車銷量方面,飛雅特500以29,635輛的銷量在德國排名第三。該車提供混合動力和全電動動力傳動系統選項,對於尋求經濟實惠的小型電動車的消費者來說極具吸引力。

- 銷量第四好的電動車是福特 Kuga,在德國賣出 28,410 輛。該車提供混合動力和插電式混合動力兩種選擇。排名第五的是豐田雅力士,2022 年在德國售出 26,376 輛。其他暢銷車型包括大眾 ID.3、三菱 Eclipse Cross、西雅特 CUPRA Formentor、現代 Kona 和大眾 ID.4。

德國電動商用車電池組產業概況

德國電動商用車電池組市場相當集中,前五大公司佔74.88%的市場。市場的主要企業有:Akasol AG、比亞迪股份有限公司、寧德時代新能源科技股份有限公司(CATL)、NorthVolt AB和上汽大眾動力電池(按字母順序排列)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章執行摘要和主要發現

第2章 報告要約

第 3 章 簡介

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 電動商用車銷售

- 電動商用車銷量(OEM)

- 最暢銷的電動車車型

- 具有首選電池化學成分的OEM

- 電池組價格

- 電池材料成本

- 每種電池化學成分的價格表

- 誰供給誰?

- 電動車電池容量和效率

- 發布的電動車車型數量

- 法律規範

- 德國

- 價值鏈與通路分析

第5章 市場區隔

- 體型

- 公車

- LCV

- M&HDT

- 推進類型

- BEV

- PHEV

- 電池化學

- LFP

- NCA

- NCM

- NMC

- 其他

- 容量

- 15 kWh~40 kWh

- 40 kWh~80 kWh

- 超過80度

- 少於15千瓦時

- 電池形狀

- 圓柱形

- 小袋

- 方塊

- 方法

- 雷射

- 金屬絲

- 成分

- 陽極

- 陰極

- 電解

- 分隔符

- 材料類型

- 鈷

- 鋰

- 錳

- 天然石墨

- 鎳

- 其他材料

第6章 競爭格局

- 重大策略舉措

- 市場佔有率分析

- 業務狀況

- 公司簡介

- Akasol AG

- Automotive Cells Company(ACC)

- BYD Company Ltd.

- Contemporary Amperex Technology Co. Ltd.(CATL)

- Ebusco BV

- LG Energy Solution Ltd.

- Liacon GmbH

- Litens Automotive GmbH & Co. KG

- NorthVolt AB

- Panasonic Holdings Corporation

- SAIC Volkswagen Power Battery Co. Ltd.

- Samsung SDI Co. Ltd.

- SK Innovation Co. Ltd.

- Super B Lithium Power BV

- Valeo Siemens eAutomotive

第7章:執行長的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源和進一步閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

The Germany Electric Commercial Vehicle Battery Pack Market size is estimated at 0.5 billion USD in 2025, and is expected to reach 1.2 billion USD by 2029, growing at a CAGR of 24.72% during the forecast period (2025-2029).

Growing demand and decreasing costs drive the battery pack market for electric commercial vehicles in Germany

- The German commercial electric vehicle battery pack market is expected to grow significantly in the coming years. As of 2021, electric commercial vehicles comprised less than 1% of the country's total commercial vehicle fleet. However, with the increasing adoption of electric vehicles, the market share of electric commercial vehicles is expected to grow rapidly, driven by government regulations, environmental concerns, and the decreasing cost of battery technology. By 2030, Germany aims to have 40-50% of newly registered commercial vehicles to be electric, leading to a potential sales volume of over 300,000 electric commercial vehicles per year.

- With the growing demand for electric commercial vehicles, the battery pack market is also seeing significant growth in Germany. Battery density and range have been steadily increasing over the years, and lithium-ion batteries have become the most widely used technology in the market. The cost of battery packs has also decreased, reducing by around 80% over the past decade. However, battery pack costs remain a significant barrier to adopting electric commercial vehicles, and further cost reductions are required to make electric commercial vehicles more cost-competitive with their fossil fuel counterparts.

- With advancing technology and rising demand, the German market for battery packs for electric commercial vehicles has a bright future. Larger battery packs have been developed more often in recent years, and some manufacturers now sell battery packs with capacities of up to 1,000 kWh. The need to extend the range of commercial vehicles and decrease the charging frequency is driving this development.

Germany Electric Commercial Vehicle Battery Pack Market Trends

TOP GERMAN EV MANUFACTURERS: VOLKSWAGEN, MERCEDES-BENZ, TESLA, BMW, AND HYUNDAI DOMINATE THE INDUSTRY

- The German electric vehicle market has a variety of players and is majorly driven by the five major players, accounting for more than 40% of the market in 2022. Some of the prominent players include Volkswagen, Mercedes-Benz, Tesla, BMW, and Hyundai. Volkswagen is the largest seller of electric vehicles in Germany, accounting for around 10.10% of the market. The company has a strong presence in European countries, including Germany. The company has a wide brand portfolio under its name, with a variety of product offerings in the electric vehicle range. A strong brand image and large customer base have put the brand at the top in Germany.

- Mercedes-Benz is the second largest seller of electric vehicles, accounting for around 8.59% market share across Germany. The company offers a variety of range of EVs for premium customers along with a strong service network across Germany serving customers. Third place in EV sales across Germany is acquired by Tesla, with around 7.55% of the market share. The company has strong innovative strategies and offers a wide variety of pure electric cars under its product offerings.

- BMW is the fourth largest player, acquiring around 6.72% of the market share in EV sales across Germany. The brand has a strong production and supply chain network and wide innovative and diverse product offerings in hybrid and pure electric vehicles. The fifth-largest player operating in the German EV market is Hyundai, maintaining its market share at around 6.25%. Some of the other players selling EVs in Germany include Audi, Renault, Kia, Seat, and Opel.

TESLA AND FIAT DRIVE THE GERMAN BATTERY PACK MARKET

- The demand for electric vehicles has been growing continuously over the past few years across Germany. It has also increased the demand for batteries in recent years. A variety of brands and various models are being sold in the country. However, a major share was acquired by the top five models in 2022, including Tesla Models Y, Tesla Models 3, Fiat 500, Ford Kuga, and Toyota Yaris. Tesla Model Y maintained its position at the top, with 35,426 units sold in 2022. Model Y is highly popular due to its long-range, good seating capacity, and large cargo capacity.

- The Tesla Model 3 took second place with 33,841 sales in Germany in 2022. The car is available in rear-wheel drive and performance versions. Due to its strong performance characteristics, Model 3 is drawing the attention of customers. Fiat 500 took third position in electric car sales, with sales of 29,635 in Germany. The car comes in hybrid and fully electric powertrain options and has highly attracted consumers looking for small electric cars on an affordable budget.

- The fourth place in the electric vehicle models' sales is acquired by the Ford Kuga with 28,410 in Germany. The car comes with the option of a hybrid and a plug-in hybrid option. The fifth place is acquired by the Toyota Yaris, selling 26,376 units in 2022 across Germany. Some of the other top-selling models include Volkswagen ID.3, Mitsubishi Eclipse Cross, Seat CUPRA Formentor, Hyundai Kona, and Volkswagen ID.4

Germany Electric Commercial Vehicle Battery Pack Industry Overview

The Germany Electric Commercial Vehicle Battery Pack Market is fairly consolidated, with the top five companies occupying 74.88%. The major players in this market are Akasol AG, BYD Company Ltd., Contemporary Amperex Technology Co. Ltd. (CATL), NorthVolt AB and SAIC Volkswagen Power Battery Co. Ltd. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Electric Commercial Vehicle Sales

- 4.2 Electric Commercial Vehicle Sales By OEMs

- 4.3 Best-selling EV Models

- 4.4 OEMs With Preferable Battery Chemistry

- 4.5 Battery Pack Price

- 4.6 Battery Material Cost

- 4.7 Price Chart Of Different Battery Chemistry

- 4.8 Who Supply Whom

- 4.9 EV Battery Capacity And Efficiency

- 4.10 Number Of EV Models Launched

- 4.11 Regulatory Framework

- 4.11.1 Germany

- 4.12 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Body Type

- 5.1.1 Bus

- 5.1.2 LCV

- 5.1.3 M&HDT

- 5.2 Propulsion Type

- 5.2.1 BEV

- 5.2.2 PHEV

- 5.3 Battery Chemistry

- 5.3.1 LFP

- 5.3.2 NCA

- 5.3.3 NCM

- 5.3.4 NMC

- 5.3.5 Others

- 5.4 Capacity

- 5.4.1 15 kWh to 40 kWh

- 5.4.2 40 kWh to 80 kWh

- 5.4.3 Above 80 kWh

- 5.4.4 Less than 15 kWh

- 5.5 Battery Form

- 5.5.1 Cylindrical

- 5.5.2 Pouch

- 5.5.3 Prismatic

- 5.6 Method

- 5.6.1 Laser

- 5.6.2 Wire

- 5.7 Component

- 5.7.1 Anode

- 5.7.2 Cathode

- 5.7.3 Electrolyte

- 5.7.4 Separator

- 5.8 Material Type

- 5.8.1 Cobalt

- 5.8.2 Lithium

- 5.8.3 Manganese

- 5.8.4 Natural Graphite

- 5.8.5 Nickel

- 5.8.6 Other Materials

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Akasol AG

- 6.4.2 Automotive Cells Company (ACC)

- 6.4.3 BYD Company Ltd.

- 6.4.4 Contemporary Amperex Technology Co. Ltd. (CATL)

- 6.4.5 Ebusco B.V.

- 6.4.6 LG Energy Solution Ltd.

- 6.4.7 Liacon GmbH

- 6.4.8 Litens Automotive GmbH & Co. KG

- 6.4.9 NorthVolt AB

- 6.4.10 Panasonic Holdings Corporation

- 6.4.11 SAIC Volkswagen Power Battery Co. Ltd.

- 6.4.12 Samsung SDI Co. Ltd.

- 6.4.13 SK Innovation Co. Ltd.

- 6.4.14 Super B Lithium Power B.V.

- 6.4.15 Valeo Siemens eAutomotive

7 KEY STRATEGIC QUESTIONS FOR EV BATTERY PACK CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms