|

市場調查報告書

商品編碼

1683973

美國室內 LED 照明:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)US Indoor LED Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

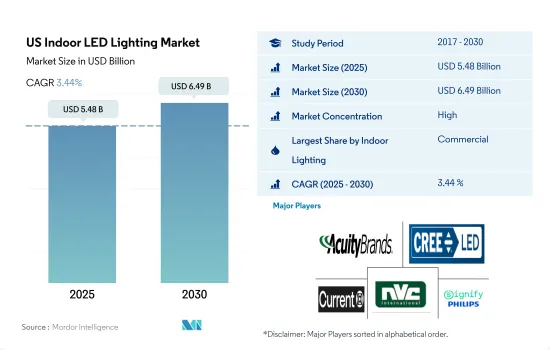

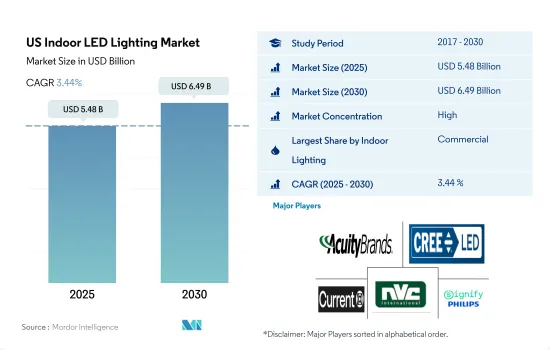

預計 2025 年美國室內 LED 照明市場規模為 54.8 億美元,到 2030 年將達到 64.9 億美元,預測期內(2025-2030 年)的複合年成長率為 3.44%。

該地區可支配收入的增加、政府投資和商業建築的增加正在推動 LED 照明市場的成長。

- 從金額佔有率來看,商業設施將在2023年佔據大部分市場佔有率,其次是工業/倉庫和住宅。推動工業部門韌性增強的主要因素包括中國勞動力水準的變化、美國生產的低監管負擔以及製造業收入相對於美國國內生產總值的高度動態性。

- 從2023年的成交量佔有率來看,商業領域將佔多數,其次是住宅領域和工業及倉儲領域。美國對於儲存空間的需求前景光明。隨著電子商務的加速發展,倉儲產業可能會迎來比以往更多的成長機會。 2020年第三季美國零售電商銷售額預計為2,095億美元。與 2019 年第三季相比,成長了 36.7%。

- 建設產業是各行各業中一個正在成長的行業。其中包括私營和商業部門的建築商、承包商和土木工程師。預計 2019 年至 2029 年期間建築和採礦業的就業人數將增加 4%,與總就業人數的平均成長率大致相同。這種成長的部分原因是由於人口成長導致對新建築、道路和其他建築的需求不斷增加。

- 2022年,美國小型企業數量將達3,320萬家。五家成長最快的新興企業的總部設在舊金山。 40% 的美國新興企業至少有一名女性擔任領導職務。到2022年,超過65%的中小企業累計盈利。由於上述案例,未來幾年室內LED的需求預計會增加。

美國室內 LED 照明市場趨勢

私人住宅數量增加和政府法規推動 LED 市場

- 截至 2021 年,美國約有 1.24 億個家庭。 2017年至2021年每戶人口為2.6人,至2022年總登記住宅為1.437億套。預計2020年人口將達3.314億,2022年將增至3.332億,成長率為0.6%。房屋自有率也高達64.6%。考慮上述案例顯示家庭規模正在減少,需要新的住宅,而人口正在成長。基於這些案例,預計LED將得到更廣泛的應用,以滿足家庭照明需求。在美國,可支配收入正在上升,這反過來又增加了個人的消費能力,使他們有能力在新的居住空間上花更多的錢。 2021年12月,美國人均收入將達36,430美元,2020年12月為33,740.8美元。與其他開發中國家相比,美國的收入較高。例如,截至2020年,墨西哥的人均收入為2,639.7美元,而加拿大的人均收入為29,330美元,較低。

- 5月份私人住宅開工數以年度為基礎為163.1萬套。這比 2022 年 5 月的 154.3 萬套高出 5.7%,比 2023 年 4 月修訂後的 134 萬套高出 21.7%。根據 2023 年的新法規,由於《能源政策法》(EPAct)第 179D 條的規定,最高稅額扣抵抵免額將躍升至每平方英尺升級空間 5 美元。 2022 年,免稅額為每平方英尺 1.88 美元(但計劃上漲至每平方英尺 2 美元)。涵蓋的計劃涉及室內照明、空調和建築外部。預計此類案例將進一步推動日本對 LED 照明的需求。

2025年,商業建築LED安裝量將成長72%,住宅將成長56%,工業建築LED安裝量將成長83%,推動LED市場的成長

- 美國住宅和商業照明總合消費量約為2130億度。 2017年安裝了約14億盞LED照明,到2035年這數字將增加至79億盞以上。到2025年,預計72%的商業建築、56%的住宅和83%的工業建築將安裝LED照明。 2021年美國住宅數量為1.42億套,較上年增加20萬套。與 2020 年的 1.408 億套住宅存量相比,增加了近 100 萬套。住宅存量的增加很可能會推動 LED 的成長。

- 商業領域的電力需求往往在營業時段最高。通常每天大約8到10個小時。工業部門的用電量在一天和一年中往往更加穩定。住宅用電需求在7-9小時左右波動。此外,芝加哥市將於2022年2月完成芝加哥智慧照明計劃,將超過28萬盞老化路燈更換為高效LED照明,提高夜間能見度,預計未來10年將為芝加哥納稅人節省1億美元的電費。

- 密西根州運輸部和高速公路照明合作夥伴有限責任公司簽署了一項為期 15 年的協議,共同資助、建造和設計現有隧道照明系統和高速公路照明系統的維護和改進。 LED節能環保,幫助市民節省電費。

美國室內 LED 照明產業概況

美國室內LED照明市場比較集中,前五大公司佔79.54%的市佔率。該市場的主要企業是:ACUITY BRANDS, INC.、Cree LED(SMART Global Holdings, Inc.)、Current Lighting Solutions, LLC.、NVC INTERNATIONAL HOLDINGS LIMITED 和 Signify (Philips)(按字母順序排列)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章執行摘要和主要發現

第2章 報告要約

第 3 章 簡介

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 人口

- 人均收入

- LED進口總量

- 照明電力消耗量

- 家庭數量

- LED滲透率

- 園藝區

- 法律規範

- 美國

- 價值鏈與通路分析

第5章 市場區隔

- 室內照明

- 農業照明

- 商業照明

- 辦公室

- 零售

- 其他

- 工業/倉庫

- 住宅

第6章 競爭格局

- 主要策略趨勢

- 市場佔有率分析

- 業務狀況

- 公司簡介(包括全球概況、市場層級概況、主要業務部門、財務狀況、員工人數、關鍵資訊、市場排名、市場佔有率、產品和服務、最新發展分析)

- ACUITY BRANDS, INC.

- ams-OSRAM AG

- Cree LED(SMART Global Holdings, Inc.)

- Current Lighting Solutions, LLC.

- Dialight

- EGLO Leuchten GmbH

- Feit Electric Company, Inc.

- LEDVANCE GmbH(MLS Co Ltd)

- NVC INTERNATIONAL HOLDINGS LIMITED

- Signify(Philips)

第7章:執行長的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源和進一步閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

The US Indoor LED Lighting Market size is estimated at 5.48 billion USD in 2025, and is expected to reach 6.49 billion USD by 2030, growing at a CAGR of 3.44% during the forecast period (2025-2030).

The increasing disposable income, government investments, and rising commercial construction in the region drive the growth of led lighting market

- In terms of value share, in 2023, commercial accounted for the majority of the share, followed by industrial and warehouse, and residential. The main factors contributing to the growth of the industrial sector's resilience are changes in labor force levels in China, less regulatory burden for US production than European counterparts, and greater vitality of manufacturing income relative to the United States Gross Domestic Product.

- In terms of volume share, in 2023, commercial accounted for the majority of the share, followed by the residential sector and industrial and warehouse sector. America's need for storage space is advancing toward a brighter future. With the acceleration of e-commerce, the warehousing industry may see more growth opportunities than ever. The US retail e-commerce sales in Q3 2020 are estimated at USD 209.5 billion. This is a 36.7% increase over Q3 2019.

- The construction industry is a growth industry in all areas. These include builders, contractors, and civil engineers in the private and commercial sectors. Employment in the construction and mining sector is expected to increase by 4% from 2019 to 2029, about the same rate as the average for all jobs. Part of the driver of this growth is the increasing demand for new buildings, roads, and other structures due to population growth.

- In 2022, there were 33.2 million small businesses in the United States. The five fast-growing startups are headquartered in San Francisco. 40% of US startups have at least one woman in leadership. Over 65% of small businesses reported profits in 2022. The above instances are expected to create more demand for Indoor LEDs in the coming years.

US Indoor LED Lighting Market Trends

Increase in the number of private-owned dwellings and government regulations to drive the market for LEDs

- As of 2021, there were around 124 million households in the United States. Person per household between 2017 and 2021 was 2.6 persons, and the total housing units registered were 143.7 million by 2022. Furthermore, the population in 2020 was 331.4 million, which increased to 333.2 million by 2022, representing 0.6% growth. The owner-occupied housing unit rate was 64.6%, which is higher. Considering the above instances, it suggested that the household size is smaller and requires new housing units, and the population is growing, which also represents the same. Such instances are expected to create more LED penetration for the need for illumination in the country. In the United States, disposable income is growing, resulting in the rising spending power of individuals who can spend more on new residential spaces. The United States per Capita income reached USD 36,430 in December 2021, compared with USD 33,740.8 in December 2020. Compared to other developing nations, the US is getting more. For instance, Mexico had a per capita income of USD 2,639.7 as of 2020, and Canada had USD 29,330, which is lower.

- The number of privately owned home starts in May was 1,631,000 on an annual basis. This is 5.7% above the May 2022 rate of 1,543,000 and is 21.7% higher than the revised April 2023 estimate of 1,340,000. As per the Energy Policy Act (EPAct) section 179D, the maximum tax deduction jumped to USD 5 per sq. ft. of upgraded space in 2023 under the new regulations. Which had USD 1.88 per sq. ft. deductions in 2022 (but is set to rise to USD 2.00 per sq. ft.). Eligible projects include those related to interior lighting, HVAC, and building envelopes. Such instances are further expected to surge the demand for LED lighting in the country.

Increase in LED installation by 72% in commercial buildings, 56% in residential houses, and 83% in industries by 2025 to drive the growth of the LED market

- The combined consumption of residential and commercial lighting in the United States was roughly 213 billion kWh. From roughly 1.4 billion units installed in 2017 to over 7.9 billion units in 2035, the number of LED light installations in the US is rising. By 2025, 72% of commercial, 56% of residential, and 83% of industrial structures are expected to have LED lighting installed. There were 142 million housing units in the US in 2021, an increase of 200,000 from the previous year. In comparison to 2020, when the entire housing stock stood at 140.8 million units, there represented an increase of nearly one million. The growth of LED will be influenced by the rise in housing stock.

- Electricity demand in the commercial sector tends to be highest during operating business hours. Usually, in a day, it is around 8-10 hours. Electricity use in the industrial sector tends not to fluctuate through the day or year. Electricity demand in the residential sector varies for about 7 to 9 hours. In addition, the City of Chicago completed the Chicago Smart Lighting Programme in February 2022, which replaced more than 280,000 outdated streetlights with high-efficiency LED lights to improve visibility at night and save Chicago taxpayers an estimated USD 100 million in electricity costs over the next ten years.

- The Michigan Department of Transportation and Motorway Lighting Partner LLC entered a 15-year deal to jointly fund, construct, and design upgrades to existing tunnel lighting systems and motorways for the maintenance of the existing and improved lighting systems. LEDs can help with energy efficiency and conservation, which helps the nation's citizens save money on electricity use.

US Indoor LED Lighting Industry Overview

The US Indoor LED Lighting Market is fairly consolidated, with the top five companies occupying 79.54%. The major players in this market are ACUITY BRANDS, INC., Cree LED (SMART Global Holdings, Inc.), Current Lighting Solutions, LLC., NVC INTERNATIONAL HOLDINGS LIMITED and Signify (Philips) (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.2 Per Capita Income

- 4.3 Total Import Of Leds

- 4.4 Lighting Electricity Consumption

- 4.5 # Of Households

- 4.6 Led Penetration

- 4.7 Horticulture Area

- 4.8 Regulatory Framework

- 4.8.1 United States

- 4.9 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Indoor Lighting

- 5.1.1 Agricultural Lighting

- 5.1.2 Commercial

- 5.1.2.1 Office

- 5.1.2.2 Retail

- 5.1.2.3 Others

- 5.1.3 Industrial and Warehouse

- 5.1.4 Residential

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 ACUITY BRANDS, INC.

- 6.4.2 ams-OSRAM AG

- 6.4.3 Cree LED (SMART Global Holdings, Inc.)

- 6.4.4 Current Lighting Solutions, LLC.

- 6.4.5 Dialight

- 6.4.6 EGLO Leuchten GmbH

- 6.4.7 Feit Electric Company, Inc.

- 6.4.8 LEDVANCE GmbH (MLS Co Ltd)

- 6.4.9 NVC INTERNATIONAL HOLDINGS LIMITED

- 6.4.10 Signify (Philips)

7 KEY STRATEGIC QUESTIONS FOR LED CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms