|

市場調查報告書

商品編碼

1685677

英國可再生能源:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)United Kingdom Renewable Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

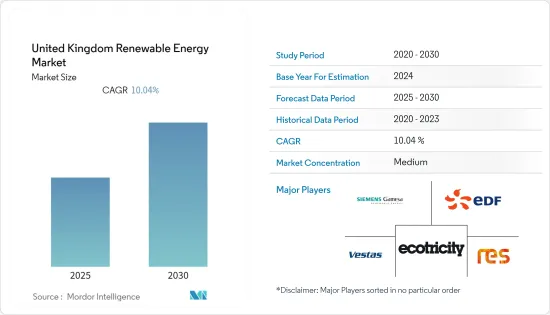

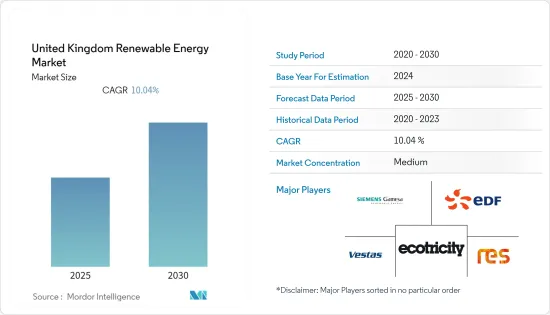

預測期內英國可再生能源市場預計複合年成長率為 10.04%

主要亮點

- 從中期來看,政府的支持性政策和利用再生能源來源滿足日益成長的電力需求、減少對石化燃料的依賴以減少二氧化碳排放等措施將對市場成長做出重大貢獻。

- 然而,預計在預測期內,政府對各種清潔能源技術增加增值稅以及取消小規模太陽能發電補貼等政策的變化將阻礙市場成長。

- 然而,隨著2030年雄心勃勃的可再生能源目標的製定,可再生能源公司在不久的將來將面臨巨大的市場機會。

英國可再生能源產業的趨勢

風力發電可望主導市場

- 對可靠、廉價、清潔和多樣化電力供應的日益成長的需求促使全國各地的政府和公用事業公司考慮使用風力發電。此外,該國擁有無與倫比的風能資源,有充足的機會最大限度地發揮風力發電開發的經濟和環境效益。

- 2022年,英國風電裝置容量將達到5,242萬千瓦,高於2021年的4,889萬千瓦。英國也是世界領先的離岸風力發電國家之一,預計2022年裝置容量將超過1,345萬千瓦。目前,英國已有多個雄心勃勃的計劃正在開發中,政府的目標是到2030年終達到20吉瓦。

- 2022 年 1 月,殼牌公司與蘇格蘭電力有限公司的合資企業贏得了該風電場的開發競標。該合資企業贏得了在英國開發 5GW浮動式風力發電的競標。兩家公司計劃在英國建造和營運全球首批兩座大型浮體式海上風電場,發電容量分別為3GW和2GW。預計此類計劃將在未來幾年促進市場成長。

- 該國的目標是到 2030 年將離岸風力發電擴大到 50GW 。風力發電機在 2023 年第一季提供了英國總電力的 32.4%,比 2022 年第一季高出 3%。

- 因此,風力發電的高成長率使英國成為可再生能源市場的領導者之一,並正在推動邁向更綠色的未來。

政府政策不確定性抑制市場需求

- 英國對上網電價進行監管,即當某個物業或組織使用風能和太陽能等再生能源來源發電時,能源供應商需要支付費用。

- 英國政府決定將屋頂太陽能板的補貼削減 65%,使該國成為上網電價下採用家用太陽能發電最慢的國家。此外,2019 年 3 月,政府關閉了該計劃,對英國太陽能光電市場的成長產生了負面影響。

- 自2022年起,受嚴重影響的太陽能光電新增裝置容量總合將維持在約613兆瓦,而2022年太陽能光電累積設置容量約為14,412兆瓦。太陽能上網電價計畫鼓勵一些家庭在屋頂安裝太陽能發電系統。政府還推出了其他幾項計劃,例如智慧出口保證(SEG),以抵消取消上網電價對市場造成的負面影響,但預計市場成長將比以前更慢。

- 在SEG系統下,很少有公司(例如特斯拉和社會能源)提供高於5披索/千瓦時的費率方案,但EDF和AEON等大型老牌能源供應商很少提供低於3.5披索/千瓦時的費率方案。這些公司也有可能在未來幾年降低費率。因此,與 FiT 計劃相比,預測期內 SEG 提供的電價透明度預計會較低。

- 英國政府的政策和法規將成為決定可再生能源市場未來的關鍵因素。無論如何,上述因素都可能抑制市場成長。

英國可再生能源產業概況

英國可再生能源產業相當分散。市場的主要企業(不分先後順序)包括 Vestas Wind Systems AS、Siemens Gamesa Renewable Energy SA、Electricite de France SA、Renewable Energy Systems Ltd 和 Ecotricity Group Ltd。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究範圍

- 市場定義

- 調查前提

第2章執行摘要

第3章調查方法

第4章 市場概述

- 介紹

- 可再生能源裝置容量及2028年預測

- 近期趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 政府支持政策

- 加強減少對石化燃料的依賴,以減少二氧化碳排放

- 限制因素

- 政府政策變化,涉及增加各種清潔能源技術的增值稅

- 驅動程式

- 供應鏈分析

- PESTLE分析

第5章市場區隔

- 來源

- 風

- 太陽的

- 水力發電

- 生質能源

- 其他能源(地熱、潮汐)

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- Ecotricity Group Ltd.

- Octopus Energy Ltd.

- Tonik Energy Ltd.

- E.ON UK PLC

- Electricite de France SA

- Good Energy Group PLC

- Renewable Energy Systems Ltd.

- Vestas Wind Systems AS

- Mitsubishi Corp.

- Siemens Gamesa Renewable Energy SA

第7章 市場機會與未來趨勢

- 雄心勃勃的2030年海上風力發電目標

簡介目錄

Product Code: 46208

The United Kingdom Renewable Energy Market is expected to register a CAGR of 10.04% during the forecast period.

Key Highlights

- Over the medium term, factors such as supportive government policies and efforts to meet the rising power demand using renewable energy sources and decrease the dependency on fossil fuels to reduce carbon emissions are significant contributors to the market growth.

- On the other hand, changes in government policies related to increasing VAT on various clean energy technologies and the withdrawal of subsidies on small-scale solar are expected to hinder market growth during the forecast period.

- Nevertheless, with ambitious renewable energy targets in place by 2030, huge market opportunities exist for renewable energy market companies in the near future.

UK Renewable Energy Sector Trends

Wind Energy is Expected to Dominate the Market

- With the increasing need for a reliable, affordable, clean, and diverse electricity supply, the government and utilities nationwide are increasingly considering wind power. Moreover, with the country's unparalleled wind resources, ample opportunities exist to maximize wind energy development's economic and environmental benefits.

- The country's installed wind energy reached 52.42 GW in 2022, representing an increase from 48.89 GW in 2021. The United Kingdom is also one of the leading countries worldwide in offshore wind energy, with an installed capacity of more than 13.45 GW in 2022. With several ambitious projects already in development, the government aims to reach 20 GW by the end of 2030.

- In January 2022, Shell plc and Scottish Power Ltd. Joint ventures won bids to develop 5 GW of floating wind power in the United Kingdom. Both companies plan to build and operate two of the world's first large-scale floating offshore wind farms in the United Kingdom with a power generation capacity of 3 GW and 2 GW. Such projects are expected to aid market growth in the coming years.

- The country aims to expand the offshore wind sector to around 50 GW capacity by 2030. Wind turbines provided 32.4% of Britain's total electricity in the first quarter of 2023, which 3% is higher than the first quarter of 2022.

- Therefore, the high growth rate of wind energy makes the United Kingdom one of the renewable market leaders and drives toward a green future.

Uncertainties in Government Policies are Restraining the Market Demand

- The United Kingdom regulated the feed-in tariff, through which energy suppliers give payments if a property or organization generates its electricity using a renewable source like wind or solar.

- The United Kingdom government decided to reduce the subsidies for rooftop solar panels installed by 65%, leading to the slowest deployment of domestic solar seen under the FiT scheme in the country. Further, in March 2019, the government closed this scheme, which negatively affected the growth of the solar market in the United Kingdom.

- The total new installed solar energy capacity was only around 613 MW, which had been severely affected since 2022, and the cumulative installed solar power was around 14,412 MW in 2022. The solar feed-in tariffs had encouraged several homes to install solar PV systems on their rooftop. Although the government rolled out several other schemes to counter the adverse effects of removing the tariff on the market, such as the Smart Export Guarantee (SEG), the market is expected to attain a lower growth rate than before.

- Under the SEG scheme, although few companies, like Tesla and Social Energy, offer tariff rates above 5 p/kWh, major and well-established energy suppliers, such as EDF and EON, offer very few tariffs - below 3.5 p/kWh. There is also a chance that these companies can lower the tariff rates in the coming years. Therefore, the tariff prices offered under SEG are expected to remain uncertain during the forecast period compared to the FiT scheme.

- The United Kingdom government's policies and regulations are significant factors that will decide the future of the renewable energy market. The above factors can restrain the market growth in either way.

UK Renewable Energy Industry Overview

The United Kingdom's renewable energy sector is moderately fragmented. Some of the major players in the market (in no particular order) include Vestas Wind Systems AS, Siemens Gamesa Renewable Energy SA, Electricite de France SA, Renewable Energy Systems Ltd, and Ecotricity Group Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Renewable Energy Installed Capacity and Forecast in GW, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Supportive Government Policies in the Country

- 4.5.1.2 Rising Efforts to Decrease the Dependency on Fossil Fuels to Reduce Carbon Emissions

- 4.5.2 Restraints

- 4.5.2.1 Changes in Government Policies Related to Increasing VAT on Various Clean Energy Technologies

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 Source

- 5.1.1 Wind

- 5.1.2 Solar

- 5.1.3 Hydro

- 5.1.4 Bioenergy

- 5.1.5 Other Sources (Geothermal, Tidal)

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Ecotricity Group Ltd.

- 6.3.2 Octopus Energy Ltd.

- 6.3.3 Tonik Energy Ltd.

- 6.3.4 E.ON UK PLC

- 6.3.5 Electricite de France SA

- 6.3.6 Good Energy Group PLC

- 6.3.7 Renewable Energy Systems Ltd.

- 6.3.8 Vestas Wind Systems AS

- 6.3.9 Mitsubishi Corp.

- 6.3.10 Siemens Gamesa Renewable Energy SA

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Ambitious Offshore Wind Energy Targets in Place by 2030

02-2729-4219

+886-2-2729-4219