|

市場調查報告書

商品編碼

1685747

資料中心 -市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Data Center - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

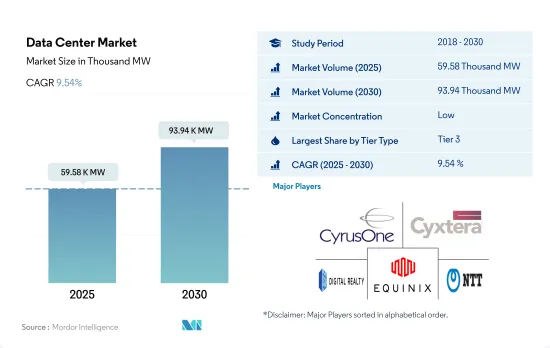

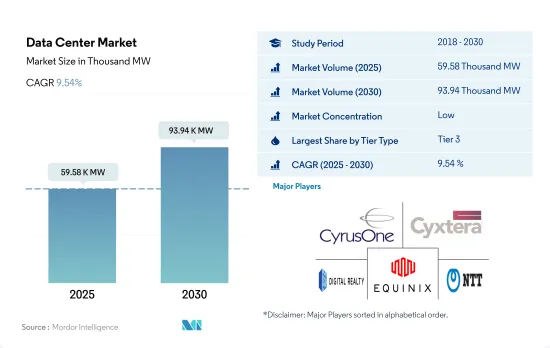

預計 2025 年資料中心市場規模為 59,580 兆瓦,到 2030 年將達到 93,940 兆瓦,複合年成長率為 9.54%。

此外,預計 2025 年主機託管收益將達到 696.325 億美元,2030 年將達到 1326.607 億美元,預測期內(2025-2030 年)的複合年成長率為 13.76%。

2023 年, 層級 3資料中心將佔據大部分市場佔有率,而層級 4 資料中心預計在預測期內成長最快

- 目前,層級市場佔了大部分。這些層的運轉率約為 99.982%,每年停機時間為 1.6 小時。由於邊緣和雲端連接的日益普及,預計未來層級 3 部分將進一步成長。

- 預計2022年IT負載容量為6,857.78MW,其中歐洲佔比最大。英國擁有最多的層級 3資料中心,其中斯勞和大倫敦佔據了最大佔有率。都柏林是愛爾蘭唯一一個擁有超過 98% 的層級 3 設施的地區,其中北都柏林和南都柏林佔據了最大佔有率。預計歐洲層級 3 部分將從 2023 年的 7,979.69 兆瓦成長到 2029 年的 12,110.18 兆瓦,複合年成長率為 7.20%。

- 在預計預測期內, 層級 4 部分的複合年成長率將達到 16.2%。各個已開發國家都致力於採用層級 4 認證,以獲得所有組件完全容錯和冗餘的好處。因此,許多開發區也採用了層級區域。在美國,可再生佔能源結構的20%以上,預計2030年將達到50%。大多數正在開發的資料中心設施都在增加其IT能力。

- 層級 1 和 Tier 2 部分的成長最少,因為超過 70% 的流量都在伺服器之間移動。現代應用程式需要更多的資料在資料中心內以更快的速度傳輸,並且對延遲更加敏感。預計層級和二級資料中心的成長將非常小,因此這種成長可能來自為 IT 負載層級的中小型企業提供服務的設施。

北美將佔很大佔有率,預計亞太地區在研究期間成長最快

- 資料中心市場主要集中在北美、歐洲和亞太地區。北維吉尼亞是美國最大的資料中心熱點地區,2022年佔全美裝置容量資料中心容量的13.07%以上。然而,由於市場已經成熟,預計到2029年其市場佔有率將會下降。維吉尼亞對符合法定投資和就業要求的資料中心購買的合格電腦設備提供零售銷售稅和使用稅豁免。維吉尼亞州是第一個允許主機託管資料中心租戶享受銷售稅豁免的州。維吉尼亞也受益於密集部署的光纖主幹網路。維吉尼亞海灘是四條新的跨洋光纖互連電纜的登陸點。

- 在歐洲,市場集中在法蘭克福、倫敦/斯隆、阿姆斯特丹、巴黎和都柏林等FLAP-D大都會市場。倫敦的土地價格約為每平方英尺 150 美元。預計倫敦的高地價將推動投資流向其他地價較低的城市。例如,阿姆斯特丹在 FLAP資料中心市場建設設施的土地價格較低,為每平方英尺 38 美元。

- 在亞太地區,澳洲是資料中心成長顯著的國家之一。該國高度重視可再生能源,並且是資料中心的主要樞紐。雪梨目前 100% 使用可再生能源,這些能源來自新南威爾斯州的風能和太陽能發電場。在墨爾本,維多利亞州政府已撥出9,500萬美元,用於支持該地區人工智慧Start-Ups的發展。隨著技術開發基地的增加,資料中心的需求預計將大幅增加。

全球資料中心市場趨勢

資料消費量的增加、智慧服務、社交網路、無現金付款和智慧家庭自動化服務等數位化應用數量的增加正在推動市場成長。

- 全球資料消費量將從2016年的1.8GB/月成長至2022年的7.6GB/月,預計2029年將達到26GB/月。智慧服務、社交網路、無現金付款、智慧家庭自動化服務等新興數位化應用正在推動全球資料消費。中國和美國等一些國家已經推出了6G,而其他一些國家仍處於5G階段。

- 然而,非洲的部署速度較慢,計劃先加強 4G 服務,然後再推出 5G。 Netflix、Disney+ 和 Amazon Prime 等線上串流服務的需求不斷成長,正在推高用戶資料消耗。每部智慧型手機的資料消費量將從 2016 年的每月 1.8GB 成長到 2023 年的每月 9.1GB,到 2029 年可能達到每月 26GB。

- 預計預測期內全球資料消費量將進一步成長,達19.2%。資料消費量的主要地區為非洲、北美和中東,分別佔25.8%、24.6%和23.9%。由於頻寬更快、數位化服務和物聯網平台的日益普及而導致的資料消耗不斷增加,可能會推動全球對資料中心的需求。

網路購物、社交網路、計程車預訂、數位交易、食品訂購等數位化服務的擴展預計將推動市場需求。

- 預計2022年世界人口將達79.1億,其中網路用戶49.5億,活躍社群媒體用戶46.2億。平均而言,全球用戶每天上網時間約六小時。預計預測期內(2023-2029 年)使用者數量的複合年成長率將達到 4.6%。網路購物、社交網路、計程車預訂、數位交易和食品訂購等數位化服務的擴展預計將導致資料消費量的增加。預測期內資料消費量預計將成長 18.6%。網路使用者佔比超過90%的地區包括北美、北歐、西歐。

- 然而,亞太地區在智慧型手機用戶數量方面領先全球。預計 2022 年智慧型手機用戶數量將達到 26.47 億,到 2029 年可能達到 44.56 億。預測期內,該地區智慧型手機用戶數量的複合年成長率預計將達到 7.5%。 5G的引入使該地區的用戶能夠存取多種數位化服務。

- 阿拉伯聯合大公國、韓國、中國和荷蘭在全球處於領先地位,網路速度分別為 136.4 Mbps、106.9 Mbps、96.3 Mbps 和 94.9 Mbps。預計未來通訊和智慧型設備領域先進技術的引入以及使用數位化服務的人數增加將推動全球資料中心市場的成長。

資料中心產業概覽

資料中心市場較為分散,前五大公司佔19.69%的市佔率。市場的主要企業有:CyrusOne Inc.、Cyxtera Technologies、Digital Realty Trust Inc.、Equinix Inc. 和 NTT Ltd.。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 市場展望

- 負載能力

- 占地面積

- 主機代管收入

- 安裝的機架數量

- 機架空間利用率

- 海底電纜

第5章 產業主要趨勢

- 智慧型手機用戶數量

- 每部智慧型手機的資料流量

- 行動資料速度

- 寬頻資料速度

- 光纖連接網路

- 法律規範

- 澳洲

- 奧地利

- 比利時

- 巴西

- 加拿大

- 智利

- 中國

- 丹麥

- 法國

- 德國

- 香港

- 印度

- 印尼

- 愛爾蘭

- 以色列

- 義大利

- 日本

- 馬來西亞

- 墨西哥

- 荷蘭

- 紐西蘭

- 奈及利亞

- 挪威

- 菲律賓

- 波蘭

- 俄羅斯

- 沙烏地阿拉伯

- 新加坡

- 南非

- 韓國

- 西班牙

- 瑞典

- 瑞士

- 台灣

- 泰國

- 阿拉伯聯合大公國

- 英國

- 美國

- 越南

- 價值鍊和通路分析

第6章市場區隔

- 資料中心規模

- 大規模

- 大規模

- 中等規模

- 百萬

- 小規模

- 層級類型

- 1層級和2級

- 層級

- 層級

- 吸收量

- 未使用

- 使用

- 按主機託管類型

- 超大規模

- 零售

- 批發的

- 按最終用戶

- BFSI

- 雲

- 電子商務

- 政府

- 製造業

- 媒體與娛樂

- 電信

- 其他最終用戶

- 地區

- APAC

- 非洲

- 歐洲

- 中東

- 北美洲

- 南美洲

第7章競爭格局

- 市場佔有率分析

- 商業狀況

- 公司簡介.

- AirTrunk Operating Pty Ltd

- Chindata Group Holdings Ltd

- CyrusOne Inc.

- Cyxtera Technologies

- Digital Realty Trust Inc.

- Equinix Inc.

- Flexential Corp.

- NTT Ltd

- Quality Technology Services

- Space DC Pte Ltd

- Switch

- Vantage Data Centers LLC

- LIST OF COMPANIES STUDIED

第8章:CEO面臨的關鍵策略問題

第9章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 全球市場規模和DRO

- 資訊來源及延伸閱讀

- 圖表清單

- 關鍵見解

- 資料包

- 詞彙表

The Data Center Market size is estimated at 59.58 thousand MW in 2025, and is expected to reach 93.94 thousand MW by 2030, growing at a CAGR of 9.54%. Further, the market is expected to generate colocation revenue of USD 69,632.5 Million in 2025 and is projected to reach USD 132,660.7 Million by 2030, growing at a CAGR of 13.76% during the forecast period (2025-2030).

Tier 3 data centers accounted for majority market share in 2023, and the Tier 4 segment is expected to be the fastest growing during the forecast period

- The tier 3 segment currently holds a major share of the market. These tiers have an uptime of around 99.982%, translating into a downtime of 1.6 hours per year. With the increasing adoption of edge and cloud connectivity, the tier 3 segment is expected to grow further in the future.

- Europe held a leading market share, with a 6,857.78 MW IT load capacity in 2022. The United Kingdom hosts the maximum number of tier 3 data centers, with Slough and Greater London holding a major share. In Ireland, Dublin is the only region that hosts more than 98% of the tier 3 facilities, with North and South Dublin holding a major share. The tier 3 segment in Europe is expected to grow from 7,979.69 MW in 2023 to 12,110.18 MW in 2029, at a CAGR of 7.20%.

- The tier 4 segment is expected to record a CAGR of 16.2% during the forecast period. Various developed countries are focusing on adopting a Tier 4 certification to get the advantage of complete fault tolerance and redundancy for every component. Therefore, many developing regions are also adopting the tier 4 zone. In the United States, over 20% of the energy mix is contributed by renewable energy, which is expected to reach 50% by 2030. The majority of data center facilities under development are adding more IT power.

- The tier 1 & 2 segment had the least growth as more than 70% of all traffic moves from server to server. Modern applications require significantly more data to travel within a data center at faster speeds and are more particular about latency. Since tier 1 & 2 data centers are projected to witness minimal growth, such growth is only expected from facilities that cater to SMEs with a minimal IT load.

North America holds the major share and APAC is expected to be the fastest growing during the study period

- The data center market has been largely concentrated in North America, Europe, and Asia-Pacific. Northern Virginia is the largest data center hotspot in the United States, accounting for over 13.07% of the data center installed capacity in 2022. However, the future market share is expected to reflect a decreasing trend until 2029, as the market has already reached maturity. Virginia offers an exemption from retail sales and uses tax for qualifying computer equipment purchased by data centers that meet statutory investment and employment requirements. Virginia was the first state to allow the tenants of colocation data centers to receive the benefits of sales tax exemption. Virginia also benefits from densely packed fiber backbones. Virginia Beach is the landing point for four new transoceanic fiber connection cables.

- In Europe, the market is concentrated in FLAP-D metro markets, including Frankfurt, London/Slough, Amsterdam, Paris, and Dublin. The land price in London is around USD 150 per sq. ft. Higher land costs in London are expected to shift investments to other cities with lower land prices. For instance, Amsterdam has a lower land price for building facilities in the FLAP data center market, which is USD 38 per sq. ft.

- In Asia-Pacific, Australia is one of the prominent countries in terms of the growth of data centers. The country is a major hub for data centers due to its focus on renewable energy. Sydney is now powered using 100% renewable electricity generated from wind and solar farms in regional NSW. In Melbourne, the Victorian government has also set aside USD 95 million to support AI startup development in the region. With increasing technology development hubs, the demand for data centers is expected to increase significantly.

Global Data Center Market Trends

Rising data consumption, growing number of digitalization applications, such as smart services, social networking, cashless payments, smart home automation services, and other applications drive the market's growth

- Global data consumption increased from 1.8 GB/month in 2016 to 7.6 GB/month in 2022. It is estimated to reach 26 GB/month by 2029. The growing number of digitalization applications, such as smart services, social networking, cashless payments, smart home automation services, and others, has boosted data consumption globally. A few countries, such as China and the United States, have already implemented 6G, while multiple countries are still implementing phases of 5G.

- However, in Africa, the deployment has been slow as the region plans to strengthen its 4G services first and then roll out 5G. The growing demand for online streaming services such as Netflix, Disney+, and Amazon Prime is boosting the consumption of data among users. The data consumed per smartphone increased from 1.8 GB/month in 2016 to 9.1 GB/month in 2023, which may reach 26 GB/month by 2029.

- Global data consumption is expected to grow further during the forecast period, reaching 19.2%. The leading regions in terms of data consumption are Africa, North America, and the Middle East, with 25.8%, 24.6%, and 23.9%, respectively. The increasing data consumption due to high bandwidth speeds and the growing adoption of digitalization services and IoT platforms may boost the demand for data centers globally.

Growing digitalization services such as online shopping, social networking, cab booking, digital transactions, food orders, and other services are expected to drive the market demand

- The global population was estimated at 7.91 billion in 2022, with 4.95 billion internet users and 4.62 billion active social media users. On average, global users spend around 6 hours using the internet daily. The number of users is expected to record a CAGR of 4.6% during the forecast period (2023-2029). Growing digitalization services such as online shopping, social networking, cab booking, digital transactions, food orders, and other services are expected to increase data consumption. The data consumption is expected to grow by 18.6% during the forecast period. The regions with more than 90% internet users include North America and Northern and Western Europe.

- However, Asia-Pacific leads globally in terms of the number of smartphone users. The number of smartphone users was estimated at 2,647 million in 2022, which may reach 4,456 million by 2029. The region is estimated to record a CAGR of 7.5% in terms of the number of smartphone users during the forecast period. The deployment of 5G has helped users gain access to multiple digitalization services in the region.

- The United Arab Emirates, South Korea, China, and the Netherlands are the leading countries globally, with internet speeds of 136.4 Mbps, 106.9 Mbps, 96.3 Mbps, and 94.9 Mbps, respectively. The implementation of advanced technologies in telecommunication and smart devices and the growing number of people using digitalization services are expected to drive the growth of the global data center market in the future.

Data Center Industry Overview

The Data Center Market is fragmented, with the top five companies occupying 19.69%. The major players in this market are CyrusOne Inc., Cyxtera Technologies, Digital Realty Trust Inc., Equinix Inc. and NTT Ltd (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 MARKET OUTLOOK

- 4.1 It Load Capacity

- 4.2 Raised Floor Space

- 4.3 Colocation Revenue

- 4.4 Installed Racks

- 4.5 Rack Space Utilization

- 4.6 Submarine Cable

5 Key Industry Trends

- 5.1 Smartphone Users

- 5.2 Data Traffic Per Smartphone

- 5.3 Mobile Data Speed

- 5.4 Broadband Data Speed

- 5.5 Fiber Connectivity Network

- 5.6 Regulatory Framework

- 5.6.1 Australia

- 5.6.2 Austria

- 5.6.3 Belgium

- 5.6.4 Brazil

- 5.6.5 Canada

- 5.6.6 Chile

- 5.6.7 China

- 5.6.8 Denmark

- 5.6.9 France

- 5.6.10 Germany

- 5.6.11 Hong Kong

- 5.6.12 India

- 5.6.13 Indonesia

- 5.6.14 Ireland

- 5.6.15 Israel

- 5.6.16 Italy

- 5.6.17 Japan

- 5.6.18 Malaysia

- 5.6.19 Mexico

- 5.6.20 Netherlands

- 5.6.21 New Zealand

- 5.6.22 Nigeria

- 5.6.23 Norway

- 5.6.24 Philippines

- 5.6.25 Poland

- 5.6.26 Russia

- 5.6.27 Saudi Arabia

- 5.6.28 Singapore

- 5.6.29 South Africa

- 5.6.30 South Korea

- 5.6.31 Spain

- 5.6.32 Sweden

- 5.6.33 Switzerland

- 5.6.34 Taiwan

- 5.6.35 Thailand

- 5.6.36 United Arab Emirates

- 5.6.37 United Kingdom

- 5.6.38 United States

- 5.6.39 Vietnam

- 5.7 Value Chain & Distribution Channel Analysis

6 MARKET SEGMENTATION (INCLUDES MARKET SIZE IN VOLUME, FORECASTS UP TO 2030 AND ANALYSIS OF GROWTH PROSPECTS)

- 6.1 Data Center Size

- 6.1.1 Large

- 6.1.2 Massive

- 6.1.3 Medium

- 6.1.4 Mega

- 6.1.5 Small

- 6.2 Tier Type

- 6.2.1 Tier 1 and 2

- 6.2.2 Tier 3

- 6.2.3 Tier 4

- 6.3 Absorption

- 6.3.1 Non-Utilized

- 6.3.2 Utilized

- 6.3.2.1 By Colocation Type

- 6.3.2.1.1 Hyperscale

- 6.3.2.1.2 Retail

- 6.3.2.1.3 Wholesale

- 6.3.2.2 By End User

- 6.3.2.2.1 BFSI

- 6.3.2.2.2 Cloud

- 6.3.2.2.3 E-Commerce

- 6.3.2.2.4 Government

- 6.3.2.2.5 Manufacturing

- 6.3.2.2.6 Media & Entertainment

- 6.3.2.2.7 Telecom

- 6.3.2.2.8 Other End User

- 6.4 Region

- 6.4.1 APAC

- 6.4.2 Africa

- 6.4.3 Europe

- 6.4.4 Middle East

- 6.4.5 North America

- 6.4.6 South America

7 COMPETITIVE LANDSCAPE

- 7.1 Market Share Analysis

- 7.2 Company Landscape

- 7.3 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 7.3.1 AirTrunk Operating Pty Ltd

- 7.3.2 Chindata Group Holdings Ltd

- 7.3.3 CyrusOne Inc.

- 7.3.4 Cyxtera Technologies

- 7.3.5 Digital Realty Trust Inc.

- 7.3.6 Equinix Inc.

- 7.3.7 Flexential Corp.

- 7.3.8 NTT Ltd

- 7.3.9 Quality Technology Services

- 7.3.10 Space DC Pte Ltd

- 7.3.11 Switch

- 7.3.12 Vantage Data Centers LLC

- 7.4 LIST OF COMPANIES STUDIED

8 KEY STRATEGIC QUESTIONS FOR DATA CENTER CEOS

9 APPENDIX

- 9.1 Global Overview

- 9.1.1 Overview

- 9.1.2 Porter's Five Forces Framework

- 9.1.3 Global Value Chain Analysis

- 9.1.4 Global Market Size and DROs

- 9.2 Sources & References

- 9.3 List of Tables & Figures

- 9.4 Primary Insights

- 9.5 Data Pack

- 9.6 Glossary of Terms