|

市場調查報告書

商品編碼

1685850

歐洲飼料酸味劑:市場佔有率分析、行業趨勢和統計數據、成長預測(2025-2030 年)Europe Feed Acidifiers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

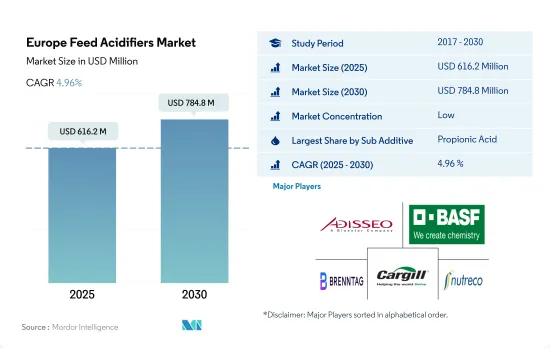

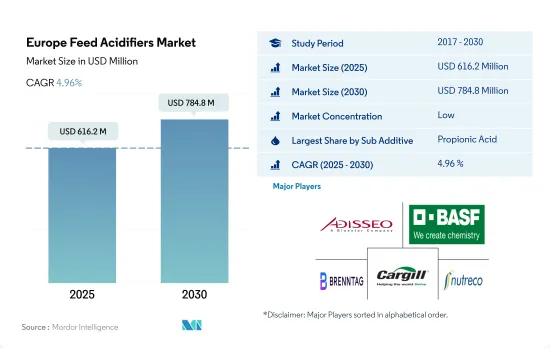

預計 2025 年歐洲飼料酸味劑市場規模為 6.162 億美元,到 2030 年將達到 7.848 億美元,預測期內(2025-2030 年)的複合年成長率為 4.96%。

- 酸味劑是動物營養的重要組成部分,因為它們可以提高飼料的性能並減少病原生物和有毒代謝物的吸收。在歐洲,酸化劑市場將在2022年佔整個飼料添加劑市場的7.0%,2017年至2022年間市值將成長12.9%。

- 該地區使用最廣泛的酸味劑是丙酸,2022 年的市值為 1.827 億美元,預計該部分在預測期內的複合年成長率為 5%。它是理想的動物飼料,因為它可以改善營養吸收並減少致病微生物。

- 家禽是歐洲飼料酸味劑市場中最大的動物品種,佔 2022 年市場佔有率的 35.4%。預計該部分在預測期內的複合年成長率為 5.0%。飼料酸味劑廣泛用於家禽,以促進生長、增強新陳代謝、增加飼料攝取量並抵抗有害病原體。

- 預計乳酸和富馬酸將成為該地區成長最快的領域,預測期內複合年成長率為 5.1%。當添加到複合飼料中時,乳酸有助於改善動物的胃腸道健康、消化率和高營養利用率。

- 西班牙、德國和法國是歐洲的主要市場,2022 年的市場佔有率合計為 45.3%。西班牙的高佔有率是由於該國飼料產量大,佔 2022 年該地區飼料總產量的 12.1%。基於飼料產量的增加和飼料酸味劑在動物營養中的重要性,預計該市場在預測期內的複合年成長率將達到 4.9%。

- 歐洲地區是飼料酸味劑的主要市場之一,因為飼料酸味劑在改善動物營養飼料性能和減少病原生物和有毒代謝物的吸收方面發揮關鍵作用。截至 2022 年,飼料酸味劑佔歐洲飼料添加劑市場以金額為準的 7.0%,2017 年至 2022 年間成長 12.9%。

- 在歐洲,西班牙、德國、法國和俄羅斯是飼料酸味劑的主要市場,其中西班牙預計2022年的市值將達到8,180萬美元。西班牙佔有率較高是由於2022年其飼料產量與前一年同期比較增加了2.5%。預計到 2029 年西班牙的市值將達到 1.164 億美元,預測期內的複合年成長率為 5.2%。

- 德國也是飼料酸味劑的主要市場,2022 年市場價值為 8,140 萬美元。預計在預測期內複合年成長率將達到 4.6%。這一成長是由2020年至2022年間德國飼料產量增加0.9%所推動的。

- 預計在預測期內,英國將成為歐洲飼料酸味劑市場成長最快的國家,複合年成長率為 5.8%。這是由於該國牲畜數量和飼料產量的增加,2017年至2022年間飼料總產量將增加4.7%。

- 飼料產量和牲畜數量增加是歐洲地區的市場驅動力。截至 2022 年,歐洲飼料總產量為 2.629 億噸,比 2017 年增加 2.0%。因此,預計預測期內市場複合年成長率將達到 4.9%。

歐洲飼料酸味劑市場趨勢

歐洲是第三大家禽出口區,肉雞產量佔禽肉產量的82.6%,預計將推動禽肉需求。

- 歐洲是世界主要的雞肉生產和出口國之一,2021 年雞肉年產量預計約 1,340 萬噸。儘管歐洲是該地區第二大肉類消費國,人均年肉類消費量為 26.9 公斤,但歐洲的雞肉產量仍未滿足日益成長的全球需求。歐洲地區最大的雞肉生產國是波蘭(佔產量的 19.2%,即 250 萬噸)、法國(12.5%,即 160 萬噸)、西班牙(12.3%)、德國(12%)和義大利(10.4%)。

- 在歐盟,2021 年肉雞肉產量佔禽肉總產量的大部分(82.6%),其次是鴨肉,佔 3.3%。 2021年歐洲雞群數量估計約24.5億隻,其中俄羅斯、法國、荷蘭、烏克蘭、波蘭和英國總合佔50%以上。由於雞蛋消費量的增加,歐洲各地的蛋雞子區隔正在經歷成長,從 2017 年的 5,864 噸增加到 2021 年的 613.5 萬噸。

- 歐洲作為全球第四大禽肉進口國和第三大禽肉出口國,在全球禽肉市場中佔有重要參與企業。 2021年,歐盟向英國、加納和烏克蘭等國家出口了約2,252,000噸(胴體重量)禽肉。預計家禽產量的增加、家禽產品需求的增加以及雞蛋消費量的增加將成為歐洲市場成長的主要驅動力。

魚飼料佔總產量的82%,需求量大,水產品進口量急劇增加,對水產養殖飼料結構產生了負面影響。

- 2022年,歐洲將佔全球水產養殖配合飼料產量的8.0%的佔有率,產量達450萬噸。 2018 年至 2022 年,配合飼料產量顯著增加了 15%,這得益於對營養均衡飼料的需求不斷成長,以降低疾病風險並提高飼料效率。然而,2018年水產飼料產量下降了21.2%,這可能是受到水產品進口量急劇增加和進口水產品價格相對較低的影響,從而影響了2018年歐洲複合飼料市場。

- 歐洲主要的水產飼料生產國為土耳其、英國、荷蘭、西班牙、義大利和法國,該地區2021年水產飼料產量達1,740萬噸,比2018年增加1.7%。這一成長是由人口和人均水產品消費量量的增加所推動的,從而推動了該地區水產養殖生產的發展。這反過來又會推動複合飼料的需求,預計預測期內(2023-2029 年)複合飼料需求將增加 18.2%。

- 水產飼料生產以魚飼料為主,2022年佔82%,其次是蝦飼料,佔4.3%,其他水產飼料佔13.7%。魚飼料是該地區消費量最大的海鮮,產量比其他水生物種更大。水產養殖業的擴張、對水產品和水產養殖產品的需求不斷成長以及對肉類品質的認知不斷提高是促進研究市場成長的主要因素。

歐洲飼料酸味劑產業概況

歐洲飼料酸味劑市場分散,前五大公司佔37.31%。該市場的主要企業有:安迪蘇、BASFSE、Brenntag SE、嘉吉公司和 SHV(Nutreco NV)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 動物數量

- 家禽

- 反芻動物

- 豬

- 飼料生產

- 水產養殖

- 家禽

- 反芻動物

- 養豬業

- 法律規範

- 法國

- 德國

- 義大利

- 荷蘭

- 俄羅斯

- 西班牙

- 土耳其

- 英國

- 價值鍊和通路分析

第5章市場區隔

- 副添加劑

- 富馬酸

- 乳酸

- 丙酸

- 其他酸味劑

- 動物

- 水產養殖

- 按亞動物

- 魚

- 蝦

- 其他養殖物種

- 家禽

- 小動物

- 肉雞

- 圖層

- 其他鳥類

- 反芻動物

- 小動物

- 肉牛

- 乳牛

- 其他反芻動物

- 豬

- 其他動物

- 水產養殖

- 國家

- 法國

- 德國

- 義大利

- 荷蘭

- 俄羅斯

- 西班牙

- 土耳其

- 英國

- 其他歐洲國家

第6章 競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 商業狀況

- 公司簡介.

- Adisseo

- Alltech, Inc.

- BASF SE

- Borregaard AS

- Brenntag SE

- Cargill Inc.

- Kemin Industries

- MIAVIT Stefan Niemeyer GmbH

- SHV(Nutreco NV)

- Yara International ASA

第7章:CEO面臨的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 全球市場規模與DRO

- 資訊來源及延伸閱讀

- 圖表清單

- 關鍵見解

- 資料包

- 詞彙表

簡介目錄

Product Code: 48525

The Europe Feed Acidifiers Market size is estimated at 616.2 million USD in 2025, and is expected to reach 784.8 million USD by 2030, growing at a CAGR of 4.96% during the forecast period (2025-2030).

- Acidifiers are a crucial component of animal nutrition as they enhance feed performance and reduce the uptake of pathogenic organisms and toxic metabolites. In Europe, the acidifiers market held a share of 7.0% in the total feed additives market in 2022, with a market value increase of 12.9% between 2017 and 2022.

- Propionic acid was the most widely used acidifier in the region, with a market value of USD 182.7 million in 2022, and the segment is projected to record a CAGR of 5% during the forecast period. It improves nutrient absorption and reduces pathogenic microbes, making it an ideal choice for animal feed.

- Poultry is the largest animal type segment in the European feed acidifiers market, and it accounted for 35.4% of the market share value in 2022. The segment is projected to register a CAGR of 5.0% during the forecast period. Feed acidifiers are extensively used in poultry birds to promote growth, increase metabolism, increase feed intake, and provide resistance to harmful pathogens.

- Lactic acid and fumaric acid are expected to be the fastest-growing segments in the region, recording a CAGR of 5.1% during the forecast period. Lactic acid helps improve gastrointestinal tract health in animals, digestibility, and high nutrient utilization when added to the compound feed.

- Spain, Germany, and France are the major markets in Europe, and they together held a market share of 45.3% in 2022. Spain's higher share was attributed to the country's higher feed production, with 12.1% of the total feed production in the region in 2022. Based on increased feed production and the importance of feed acidifiers in animal nutrition, the market is projected to record a CAGR of 4.9% during the forecast period.

- The European region is one of the key markets for feed acidifiers, as it plays a crucial role in improving feed performance in animal nutrition and reducing the uptake of pathogenic organisms and toxic metabolites. As of 2022, feed acidifiers accounted for 7.0% of the European feed additives market in terms of value, and they increased by 12.9% between 2017 and 2022.

- Spain, Germany, France, and Russia are the major markets for feed acidifiers in the European region, with Spain, in particular, holding a significant market value of USD 81.8 million in 2022. The high share of Spain was due to the increased feed production by 2.5% in 2022 compared to the previous year. Spain's market value is anticipated to reach USD 116.4 million in 2029, with a CAGR of 5.2% during the forecast period.

- Germany is also a major market for feed acidifiers, with a market value of USD 81.4 million in 2022. This is projected to register a CAGR of 4.6% during the forecast period. This growth is attributed to the increased feed production in Germany by 0.9% between 2020 and 2022.

- The United Kingdom is expected to be the fastest-growing country in the feed acidifiers market in the European region during the forecast period, with a CAGR of 5.8%. This is due to the increased livestock population and feed production in the country, with total feed production increasing by 4.7% between 2017 and 2022.

- The increased feed production and livestock population are the key drivers for the market in the European region. As of 2022, the total feed production in Europe was 262.9 million metric tons, which increased by 2.0% from 2017. Consequently, the market is anticipated to register a CAGR of 4.9% during the forecast period.

Europe Feed Acidifiers Market Trends

Europe is 3rd largest exporter of poultry meat and broiler meat production accounted for 82.6% of poultry meat production which is expected to drive the demand for poultry production

- Europe is a prominent global poultry meat producer and exporter, and it had an estimated annual poultry meat production of approximately 13.4 million metric tons in 2021. Despite being the second-most consumed meat in the region at 26.9 kg per capita per year, European poultry production has not kept pace with rising global demand. The largest poultry meat producers in the European region include Poland (accounting for 19.2% of production, or 2.5 million metric tons), France (12.5%, or 1.6 million metric tons), Spain (12.3%), Germany (12%), and Italy (10.4%).

- Within the European Union, broiler meat production constituted the majority (82.6%) of total poultry meat production in 2021, followed by duck meat at 3.3%. Europe's poultry flock numbered approximately 2.45 billion birds in 2021, with Russia, France, the Netherlands, Ukraine, Poland, and the United Kingdom collectively comprising more than 50% of the population. The layer sub-segment is experiencing growth across Europe due to increased egg consumption, which rose to 6,135 thousand metric tons in 2021 from 5,864 metric tons in 2017.

- As the fourth-largest importer and the third-largest exporter of poultry meat, Europe is a significant participant in the global poultry meat market. In 2021, the European Union exported roughly 2,252 thousand metric tons (carcass weight) of poultry meat to various countries, including the United Kingdom, Ghana, and Ukraine. The rising production of poultry birds, increasing demand for poultry products, and growing consumption of eggs are expected to be the key drivers of market growth in Europe.

High demand for fish feed which accounted for 82% and surge in seafood imports had a negative impact on compound feed for aquaculture

- In 2022, Europe held a significant share of 8.0% in the global aquaculture compound feed production, with a production volume of 4.5 million metric tons. Compound feed production saw a notable increase of 15% between 2018 and 2022, driven by the growing demand for nutrient-balanced feed to reduce disease risk and improve feed efficiency. However, aquaculture feed production observed a decline of 21.2% in 2018, which may have been influenced by the surge in seafood imports and the relatively low prices of imported seafood, impacting the European compound feed market in 2018.

- The major aquaculture feed producers in Europe are Turkey, the United Kingdom, the Netherlands, Spain, Italy, and France, and the region produced 17.4 million metric tons of aquaculture species in 2021, indicating a growth of 1.7% since 2018. The growth was attributed to the rise in population and per capita seafood consumption, which is driving aquaculture production in the region. This, in turn, propels the demand for compound feed, which is expected to increase by 18.2% during the forecast period (2023-2029).

- Fish feed dominated aquaculture feed production, accounting for 82% share in 2022, followed by shrimp feed and other aquatic species feed, with shares of 4.3% and 13.7%, respectively, in the region. Fish food is the most consumed aquatic food across the region, and it is highly produced in comparison to other aquatic species. The expanding aquaculture industry, the rising demand for seafood and aquaculture products, and the growing awareness regarding quality meat are the major factors augmenting the growth of the market studied.

Europe Feed Acidifiers Industry Overview

The Europe Feed Acidifiers Market is fragmented, with the top five companies occupying 37.31%. The major players in this market are Adisseo, BASF SE, Brenntag SE, Cargill Inc. and SHV (Nutreco NV) (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Animal Headcount

- 4.1.1 Poultry

- 4.1.2 Ruminants

- 4.1.3 Swine

- 4.2 Feed Production

- 4.2.1 Aquaculture

- 4.2.2 Poultry

- 4.2.3 Ruminants

- 4.2.4 Swine

- 4.3 Regulatory Framework

- 4.3.1 France

- 4.3.2 Germany

- 4.3.3 Italy

- 4.3.4 Netherlands

- 4.3.5 Russia

- 4.3.6 Spain

- 4.3.7 Turkey

- 4.3.8 United Kingdom

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Sub Additive

- 5.1.1 Fumaric Acid

- 5.1.2 Lactic Acid

- 5.1.3 Propionic Acid

- 5.1.4 Other Acidifiers

- 5.2 Animal

- 5.2.1 Aquaculture

- 5.2.1.1 By Sub Animal

- 5.2.1.1.1 Fish

- 5.2.1.1.2 Shrimp

- 5.2.1.1.3 Other Aquaculture Species

- 5.2.2 Poultry

- 5.2.2.1 By Sub Animal

- 5.2.2.1.1 Broiler

- 5.2.2.1.2 Layer

- 5.2.2.1.3 Other Poultry Birds

- 5.2.3 Ruminants

- 5.2.3.1 By Sub Animal

- 5.2.3.1.1 Beef Cattle

- 5.2.3.1.2 Dairy Cattle

- 5.2.3.1.3 Other Ruminants

- 5.2.4 Swine

- 5.2.5 Other Animals

- 5.2.1 Aquaculture

- 5.3 Country

- 5.3.1 France

- 5.3.2 Germany

- 5.3.3 Italy

- 5.3.4 Netherlands

- 5.3.5 Russia

- 5.3.6 Spain

- 5.3.7 Turkey

- 5.3.8 United Kingdom

- 5.3.9 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 Adisseo

- 6.4.2 Alltech, Inc.

- 6.4.3 BASF SE

- 6.4.4 Borregaard AS

- 6.4.5 Brenntag SE

- 6.4.6 Cargill Inc.

- 6.4.7 Kemin Industries

- 6.4.8 MIAVIT Stefan Niemeyer GmbH

- 6.4.9 SHV (Nutreco NV)

- 6.4.10 Yara International ASA

7 KEY STRATEGIC QUESTIONS FOR FEED ADDITIVE CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Global Market Size and DROs

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219