|

市場調查報告書

商品編碼

1685878

歐洲液體肥料:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)Europe Liquid Fertilizers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

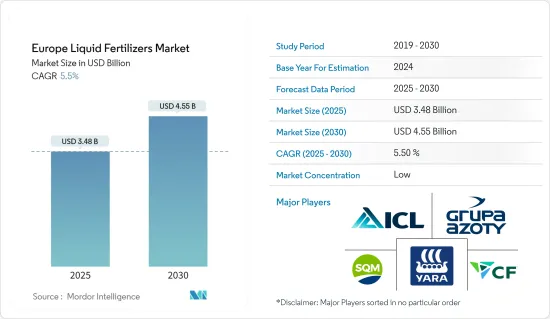

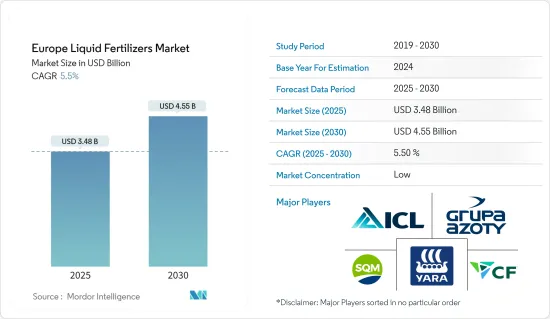

預計 2025 年歐洲液體肥料市場規模將達到 34.8 億美元,預計到 2030 年將達到 45.5 億美元,預測期內(2025-2030 年)的複合年成長率為 5.5%。

受高效和永續農業需求不斷成長的推動,歐洲液體肥料市場正在穩步成長。液體肥料因其施用方便、養分吸收快等特點,已成為該地區農民的首選。提高作物產量、改善土壤肥力和滿足不斷成長的人口日益成長的糧食需求的需求進一步刺激了這些肥料的使用。根據聯合國經濟和社會事務部的數據,德國人口預計將從 2022 年的 8,410 萬成長到 2023 年的 8,460 萬,這將對液體肥料產生巨大的需求,以提高生產力並滿足消費者的需求。另一個好處是,精密農業技術的進步促進了液體肥料的精準施用,減少了浪費並減輕了對環境的影響。

烏克蘭、德國、法國和英國等國家憑藉其發達的農業部門和高度採用現代農業技術,主導歐洲液體肥料市場。例如,根據糧農組織統計資料庫(FAOSTAT)的資料,2022年法國尿素硝酸銨肥料消費量將達190萬噸,與前一年同期比較增加5.5%。對市場需求做出貢獻的主要作物包括穀物、油籽、水果和蔬菜,這些作物都受益於液體肥料的營養效率。

此外,2022 年 11 月進行的一項研究表明,在俄羅斯,在馬鈴薯種植中施用液態氮尿素硝酸銨 (UAN) 可使馬鈴薯的產量提高 6.4%,產量提高 12.2%。 2023年,歐盟統計局報告稱,小農戶佔歐洲地區所有農場的近70%,凸顯了他們在歐洲農業格局中的關鍵作用。農場通常面積小於10公頃,對於培養農村創業精神和保護傳統農業實踐至關重要。這使得液體肥料成為這些農民提高產量最有效的選擇。

永續性已成為歐洲農業領域的焦點,影響著液體肥料市場的成長。日益嚴格的環境法規和歐盟的綠色新政計劃正在鼓勵使用環保肥料,以減少二氧化碳排放。目前,許多液體肥料的開發都考慮到了這些目標,結合生物基和有機成分來支持永續農業。這種轉變不僅滿足了監管要求,也響應了消費者對環保農業方法的需求。因此,由於對高效肥料的持續需求,即在增加產量的同時盡量減少對環境的有害影響,以及企業的積極參與和介入,預計這一領域在預測期內將逐步成長。

歐洲液體肥料市場趨勢

精密農業和消費者需求日益重要

在歐洲,液體肥料市場正在經歷重大變革,受到技術創新和精密農業技術等因素的影響。氣候條件的變化、人口的成長以及由於可耕地減少而導致的對糧食安全的日益擔憂是推動該地區採用精密農業的主要驅動力。液體肥料為現代農民帶來了一系列好處,因為它們可以改善作物對養分供應的反應並提高生產力。

尿素硝酸銨 (UAN) 肥料是植物營養的液體寶庫,是水溶液中尿素和硝酸銨的混合物,專門用於高效的植物營養管理。國際植物營養研究所強調,UAN 的氮效力通常為 28% 至 32%,使其成為該地區精密農業的重要液體肥料。此外,在歐洲尿素硝酸銨肥料市場,市場參與企業正在實施各種策略,包括策略夥伴關係,以保持市場競爭力。 2022年,總部位於大雅茅斯的液體肥料製造商Bryneflow與德國知名肥料製造商HELM AG組成了一家戰略合資企業。透過此次合作,在特立尼達擁有液態氮(UAN)製造能力的HEML AG旨在提高對英國化肥供應的安全性。此次夥伴關係體現了該產業為加強其供應鏈和保持在歐洲市場的競爭力所做的努力。

此外,由於都市化,歐洲的可耕地面積正在逐漸減少。這種趨勢迫使農民在不斷縮小的土地上維持或提高作物產量,增加了他們對肥料的依賴,以最佳化生產力。根據聯合國糧農組織統計資料庫(FAOSTATS)的資料,歐洲穀物種植面積達1.167億公頃,比前一年下降3.42%。由於都市化和工業化加劇了可耕地面積的減少,土耳其在維持糧食安全方面面臨重大挑戰。據土耳其農業和林業部稱,為了緩解這些問題,土耳其的化肥使用量在 2023 年達到了歷史最高水平,全國施用了近 1400 萬噸化肥。這項增產是應對可用耕地減少和確保充足糧食生產的更廣泛努力的一部分。

農產品進口量的增加表明該地區的需求不斷成長,而產量卻出現短缺。例如,根據 ITC 貿易地圖,德國的小麥進口量將從 2022 年的 410 萬噸增加到 2023 年的 513 萬噸。預計在預測期內,耕地面積減少、進口量增加、精密農業的採用率不斷提高以及提高農業生產率的需求將推動液體肥料市場的發展。

俄羅斯主導歐洲液體肥料市場

俄羅斯憑藉其強大的農業基礎和大規模的肥料生產,在歐洲液體肥料市場中發揮關鍵作用。該國是氮基液體肥料的主要生產國,包括尿素硝酸銨(UAN)溶液,這些肥料對歐洲農業生產力至關重要。例如,根據俄羅斯主要肥料製造商PhosAgro的資料,該國每年生產6,000萬噸肥料,其中2023年PhosAgro將貢獻1,100萬噸。

此外,俄羅斯 Life Force LLC 還提供液體肥料 Life Force Acti Grow Fe/B/Zn/Mn,其特點是植物活性成分的創新組合。隨著俄羅斯農業用地面積因都市化和環保努力而不斷縮小,液體肥料的作用變得越來越重要。例如,2022年俄羅斯水稻收穫面積為16.96萬公頃,較上年下降8.94%。透過使用能夠精確施肥的液體肥料,俄羅斯的目標是在有限的土地面積上提高作物產量。

俄羅斯的農產品出口能力,尤其是化肥出口能力,使其能夠滿足國內和歐洲的需求。隨著歐洲農民尋求在日益縮小的土地上提高作物產量,俄羅斯的出口導向策略使該國成為區域和全球肥料市場的關鍵參與者。例如,根據ITC貿易地圖,2023年俄羅斯尿素和硝酸銨液體混合物出口量為2,025,979噸,佔全球出口額的30.9%。據俄羅斯聯邦統計局稱,歐盟最大的俄羅斯化肥買家是波蘭、法國和德國。波蘭的進口量比與前一年同期比較增加了2.7倍,而法國的進口量在2023年增加了18%。

然而,與其他國家的持續衝突擾亂了國內和國際供應鏈,導致化肥供應出現不確定性。儘管面臨這些挑戰,俄羅斯仍然處於歐洲液體肥料市場的前沿,並以創新和永續性為重點,在滿足歐洲日益成長的農業需求方面發揮關鍵作用。

歐洲液體肥料產業概況

歐洲液體肥料市場分散,領先公司之間的競爭日益激烈,以維持穩定的基本客群並佔領相當大的市場佔有率。市場上一些最熱門的公司包括 Yara International ASA、ICL Group Ltd.、Grupa Azoty SA、CF Industries Holdings, Inc. 和 Sociedad Quimica y Minera de Chile SA (SQM)。每家公司都專注於擴大其設施和開發新產品,以加強其產品組合併在歐洲液體肥料市場確立戰略地位。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概覽

- 市場促進因素

- 精密農業的重要性日益增加

- 耕地面積減少

- 擴大政府支持和舉措

- 市場限制

- 有機農業的普及率不斷提高

- 高成本

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章市場區隔

- 複合型

- 直的

- 微量營養素

- 氮

- 磷酸鹽

- 鉀

- 次要微量營養素

- 申請方式

- 受精

- 葉面噴布

- 類型

- 田間作物

- 園藝作物

- 草坪和觀賞作物

- 地區

- 法國

- 德國

- 義大利

- 荷蘭

- 俄羅斯

- 西班牙

- 英國

- 烏克蘭

- 其他歐洲國家

第6章 競爭格局

- 最受歡迎的策略

- 市場佔有率分析

- 公司簡介

- Yara International ASA

- ICL Group Ltd

- Grupa Azoty SA

- BMS Micro-nutrients NV

- CF Industries Holdings, Inc.

- Nordfert

- YILDIRIM Group

- Sociedad Quimica y Minera de Chile SA(SQM)

第7章 市場機會與未來趨勢

The Europe Liquid Fertilizers Market size is estimated at USD 3.48 billion in 2025, and is expected to reach USD 4.55 billion by 2030, at a CAGR of 5.5% during the forecast period (2025-2030).

The European liquid fertilizer market has experienced steady growth, propelled by the increasing demand for efficient and sustainable agricultural practices. Liquid fertilizers, valued for their ease of application and rapid nutrient absorption, are becoming a preferred choice for farmers in the region. The need to enhance crop yields, improve soil fertility, and meet the rising food demand of the growing population has further accelerated the adoption of these fertilizers. According to the United Nations, Department of Economic and Social Affairs, Germany's population increased to 84.6 million in 2023 from 84.1 million in 2022, creating a significant need for liquid fertilizers to boost productivity and satisfy consumer demand. Additionally, the market benefits from technological advancements in precision agriculture, which promote the precise application of liquid fertilizers, reducing wastage and environmental impact.

Countries such as Ukraine, Germany, France, and the United Kingdom dominate the European liquid fertilizer market due to their advanced agricultural sectors and higher adoption rates of modern farming techniques. For instance, according to FAOSTAT data, France's urea ammonium nitrate fertilizer consumption reached 1.9 million metric tons in 2022, an increase of 5.5% from the previous year. Key crops contributing to the market demand include cereals, oilseeds, fruits, and vegetables, all of which benefit from the nutrient efficiency offered by liquid fertilizers.

Furthermore, a research study conducted in November 2022 demonstrated that the application of Urea Ammonium Nitrate (UAN), a liquid nitrogenous fertilizer in potato cultivation resulted in a 6.4% increase in marketable potato yield and up to a 12.2% increase in total yield in Russia. In 2023, Eurostat reported that small-scale farmers constituted nearly 70% of all farms in the European region, underscoring their pivotal role in Europe's agricultural landscape. Typically spanning under 10 hectares, these farms are essential for fostering rural entrepreneurship and upholding traditional farming practices. Hence, liquid fertilizer is the most effective option for better yield for these farmers.

Sustainability has become a central focus in the European agricultural sector, influencing the growth of the liquid fertilizer market. Stricter environmental regulations and the European Union's Green Deal initiatives encourage the use of environmentally friendly fertilizers with reduced carbon footprints. Many liquid fertilizers are now developed to align with these goals, incorporating bio-based or organic ingredients to support sustainable farming. This shift not only meets regulatory requirements but also addresses consumer demand for eco-friendly farming practices. Therefore, due to the continued demand for high-efficiency fertilizers to boost production while minimizing harmful impacts on the environment, coupled with the active participation and involvement of players, the segment is anticipated to grow gradually during the forecast period.

Europe Liquid Fertilizer Market Trends

Rising Importance of Precision Farming and Consumer Demand

In Europe, the liquid fertilizers market is evolving significantly, influenced by factors such as technological innovations, and precision agriculture techniques. Rising food security concerns due to changing climatic conditions, increasing population, and decreasing arable land availability are the primary factors bolstering the adoption of precision farming practices in the region. This, in turn, drives the market for liquid fertilizers as they provide an array of benefits to modern farmers that lead to improved crop response to the availability of nutrients and better productivity.

Urea ammonium nitrate (UAN) fertilizer, a liquid powerhouse of plant nutrition, blends urea and ammonium nitrate in an aqueous solution used precisely for efficient plant nutrient management. The International Plant Nutrition Institute highlights its nitrogen potency, typically ranging from 28% to 32%, hence it is an important liquid fertilizer used in precision farming in the region. Moreover, the European urea ammonium nitrate fertilizer market has witnessed the implementation of various strategies by industry participants, including strategic partnerships, to maintain market competitiveness. In 2022, Brineflow, a liquid fertilizer manufacturer headquartered in Great Yarmouth, established a strategic joint venture with HELM AG, a prominent German fertilizer producer. HEML AG, which possesses substantial liquid nitrogen (UAN) manufacturing capabilities in Trinidad, aims to enhance the security of fertilizer supply for the United Kingdom through this collaborative arrangement. This partnership exemplifies the industry's efforts to strengthen supply chains and maintain a competitive edge in the European market.

Furthermore, Europe has experienced a gradual reduction in arable land due to urbanization. This trend compels farmers to maintain or increase crop yields from a diminishing area, thereby increasing their reliance on fertilizers to optimize productivity. According to FAOSTATS data, the harvested area of cereal grains in Europe has reached 116.7 million hectares, a reduction of 3.42% from the previous year. Turkey has faced significant challenges in maintaining food security due to a decrease in arable land, exacerbated by urbanization, and industrialization. To mitigate these issues, in 2023, Turkey recorded the highest usage of chemical fertilizers in its history, with nearly 14 million metric tons applied across the country, according to the Ministry of Agriculture and Forestry, Turkey. This increase is part of a broader effort to counteract the decline in available agricultural land and ensure sufficient food production.

The growing import of agricultural produce further shows the growing demand and insufficient production in the region. For instance, according to the ITC Trade Map, in Germany, the import of wheat in 2023 reached 5.13 million metric tons which was 4.10 million metric tons in 2022. The reduction in arable land, increasing import, and growing adoption of precision agriculture, coupled with the need for increased agricultural productivity, is anticipated to drive the liquid fertilizer market in the forecast period.

Russia Dominates the European Liquid Fertilizers Market

Russia plays a critical role in the European liquid fertilizer market, driven by its strong agricultural base and extensive production of fertilizers. The country is a major producer of nitrogen-based liquid fertilizers, including urea ammonium nitrate (UAN) solutions, which are essential for European agricultural productivity. For instance, according to the data of PhosAgro, a leading fertilizer producer in Russia, the country has produced 60 million metric tons of fertilizers, with PhosAgro contributing 11 million metric tons in 2023.

Additionally, another Russian company Life Force LLC offers Life Force Acti Grow Fe/B/Zn/Mn, a liquid fertilizer featuring an innovative formula of active phytocomponents. As agricultural land in Russia continues to decrease due to urbanization and environmental initiatives, liquid fertilizers' role becomes even more significant. For instance, in 2022 the harvested area for rice was 169.6 thousand hectares in Russia with a reduction of 8.94% compared to the previous year. Using liquid fertilizer, that enables precise nutrient application, the country is aiming to boost crop yields on limited land.

Russia's agricultural export capacity, particularly in fertilizers, allows it to cater to both domestic and European needs. As European farmers seek to improve their crop yields with shrinking land, Russia's export-oriented strategy positions the country as a critical player in the regional and global fertilizer market. For instance, the export quantity of the liquid mixture of urea and ammonium nitrate in 2023 from Russia was 2,025,979 metric tons which was 30.9% value share worldwide according to the ITC trade map. According to Rosstat, the largest buyers of Russian fertilizers in the EU were Poland, France, and Germany. Poland increased its imports 2.7-fold year-on-year, and France increased its imports by 18% in 2023.

However, the ongoing conflict with other nations has disrupted both domestic and international supply chains, creating uncertainty in the availability of fertilizers. Despite these challenges, Russia continues to remain at the forefront of the European liquid fertilizer market, focusing on innovation and sustainability to maintain its critical role in feeding Europe's growing agricultural demands.

Europe Liquid Fertilizer Industry Overview

The European liquid fertilizer market is fragmented, intensifying competition among major players to maintain a stable customer base and capture significant market shares. Some of the most notable companies in the market are Yara International ASA, ICL Group Ltd., Grupa Azoty S.A., CF Industries Holdings, Inc., and Sociedad Quimica y Minera de Chile SA (SQM) among others. The companies have focused on facility expansions and developing new products to enhance their portfolio and strategize their hold in the European liquid fertilizer market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Importance of Precision Farming

- 4.2.2 Decreasing Arable Land

- 4.2.3 Growing Government Support and Initiative

- 4.3 Market Restraints

- 4.3.1 Increase in Adoption of Oragnic Farming

- 4.3.2 Comparative High Cost

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Complex

- 5.2 Straight

- 5.2.1 Micronutrients

- 5.2.2 Nitrogenous

- 5.2.3 Phosphatic

- 5.2.4 Potassic

- 5.2.5 Secondary Macronutrients

- 5.3 Mode of Application

- 5.3.1 Fertigation

- 5.3.2 Foliar Application

- 5.4 Cop Type

- 5.4.1 Field Crops

- 5.4.2 Horticultural Crops

- 5.4.3 Turf and Ornamental Crops

- 5.5 Geography

- 5.5.1 France

- 5.5.2 Germany

- 5.5.3 Italy

- 5.5.4 Netherlands

- 5.5.5 Russia

- 5.5.6 Spain

- 5.5.7 United Kingdom

- 5.5.8 Ukraine

- 5.5.9 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Yara International ASA

- 6.3.2 ICL Group Ltd

- 6.3.3 Grupa Azoty S.A.

- 6.3.4 BMS Micro-nutrients NV

- 6.3.5 CF Industries Holdings, Inc.

- 6.3.6 Nordfert

- 6.3.7 YILDIRIM Group

- 6.3.8 Sociedad Quimica y Minera de Chile SA (SQM)