|

市場調查報告書

商品編碼

1686264

北美液體肥料:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)North America Liquid Fertilizers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

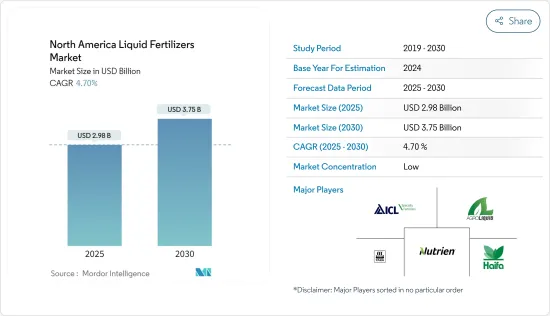

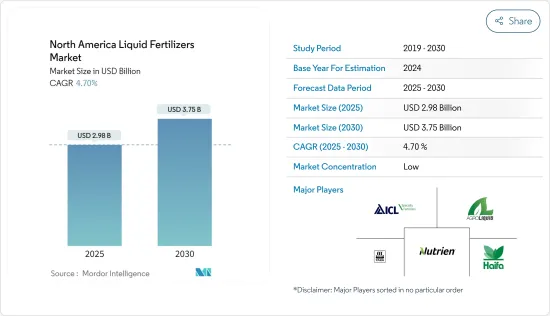

北美液體肥料市場規模預計在 2025 年為 29.8 億美元,預計到 2030 年將達到 37.5 億美元,預測期內(2025-2030 年)的複合年成長率為 4.7%。

在北美地區,COVID-19疫情對液體肥料市場產生了重大影響。這導致 COVID-19 疫情在北美蔓延,影響了該行業的多個方面,包括勞動力短缺、原料採購和貿易限制,從而導致供應鏈中斷。此外,疫情切斷了液體肥料產業透過肥料商店的通路,導致消費者轉向線上銷售管道購買肥料產品。

據估計,北美是液體肥料的第二大消費國。在該地區,美國、加拿大和墨西哥是液體肥料的最大市場,其中美國佔據主導地位。在北美,土壤呈酸性,使用氮肥有助於維持土壤的理想 pH 值,這是推動液態氮基肥料市場成長的主要因素之一。

北美對高效肥料的需求正在增加,隨著對液體肥料的需求,預計未來幾年該地區對高效肥料的需求也將增加。事實證明,高營養液體肥料的近期興起,以及作物產量和種植者生產率的提高,已成為市場的主要動力。

尿素是該地區使用最廣泛的液態氮。北美液體肥料市場的液體微量營養素部分正在快速成長,這種成長歸因於對糧食的需求不斷增加和土壤缺陷的日益增加。

北美液體肥料市場趨勢

採用永續農業實踐

農業生產管理目前專注於解決環境永續性,這導致北美地區擴大採用有機農業,有機農業被視為傳統農業的替代品,被認為是一種環境友善的種植系統,因為礦物肥料與健康問題和環境污染有關。據加拿大化肥公司稱,2019年,加拿大玉米、大豆和油菜作物專用土壤樣本中氮和磷營養的種植者利用率為產量作物65.8%,其次是中產量作物55.6%,低產產量54.8%,這將增加對作物所有施用模式的液體肥料的需求。

2020年8月,美國國家有機計畫(NOP)提案對美國農業部(USDA)的有機法規進行修改,旨在加強對供應鏈中有機原則的監督和遵守,這將影響有機產品的生產、處理和行銷,從而促進該地區液體肥料市場中有機成分的成長。

美國主導市場

液體肥料在美國北美的消費量中佔有最大的佔有率。美國使用的肥料中有四分之一以上是液體。

預計推動美國液體肥料市場發展的因素是施用的便利性和用於填充液體肥料的大型貨車的可用性。此外,精密農業技術的高採用率也推動了市場成長。這是因為使用變數速率技術(VRT)需要使用液體肥料。大約 77% 的 VRT 農業實踐使用肥料。然而,VRT農業在農藥和種子方面的採用率相當低,分別估計為11%和7%。在VRT使用的肥料中,石灰基肥料佔比例最高,其次是單一肥料和複合肥料。由於這些因素,預測期內美國液體肥料消費量可能會快速成長。

在美國,過去幾年來,在玉米和大豆作物生產中使用液體肥料已經變得十分普遍。大豆管理與研究技術 (SMaRT)計劃於 2017 年進行的一項研究發現,處方箋葉面肥料混合物在 20 個地點中的 3 個地點(15%)提高了大豆產量。

北美液體肥料產業概況

北美市場較為集中,主要企業佔39.7%,其他佔60.3%。所研究市場的主要企業包括 Yara International、Nutrien Ltd、ICL Group 和 Agro Liquid。作為研究期間觀察到的一項重大發展,產品發布和合作是市場主要參與者最常採用的策略,其次是併購。為了保持其在市場中的地位,所研究市場的主要參與者正在透過與該地區的其他參與者合作來增加產品系列。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 市場促進因素

- 市場限制

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 營養類型

- 氮

- 鉀

- 磷酸鹽

- 微量營養素

- 成分類型

- 有機的

- 合成

- 如何使用

- 啟動液

- 葉面噴布

- 受精

- 土壤注射

- 空中噴灑

- 受精

- 糧食

- 豆類和油籽

- 經濟作物

- 水果和蔬菜

- 草坪和觀賞植物

- 地區

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

第6章 競爭格局

- Most Adopted Competitor Strategies

- 市場佔有率分析

- 公司簡介

- AgroLiquid

- FoxFarm Soil & Fertilizer Company

- Haifa Group

- Kugler Company

- Nutrien Ltd.

- Planet Natural

- Plant Food Company Inc.

- Sociedad Quimica y Minera(SQM SA)

- Triangle CC

- Yara International ASA

第7章 市場機會與未來趨勢

第 8 章 COVID-19 市場影響評估

The North America Liquid Fertilizers Market size is estimated at USD 2.98 billion in 2025, and is expected to reach USD 3.75 billion by 2030, at a CAGR of 4.7% during the forecast period (2025-2030).

In the North American region, the outbreak of the COVID-19 pandemic has had a significant effect on the liquid fertilizer market. Consequently, the widespread COVID-19 pandemic across North America has impacted various aspects of the industry, such as labor shortages, procurement of raw materials, and restrictions on trade resulting in supply chain disruptions. Further, the pandemic interrupted the distribution channel of the liquid fertilizer industry through fertilizer stores, which caused a shift of consumers toward online sales channels to buy fertilizer products.

North America is estimated to be the second-largest consumer of liquid fertilizers. Within the region, the US, Canada, and Mexico are the largest markets for liquid fertilizer, with the US dominating the market. In the North American region, the lands are acidic, and using nitrogen fertilizers helps maintain the desirable pH level of the soil, which is one of the major drivers for the growth of the liquid nitrogen-based fertilizer market.

The increasing demand for highly efficient fertilizers across North America, along with the demand for liquid fertilizer, is expected to increase during the coming years in the region. The recent rise in high nutrient-based liquid fertilizers, wherein with growing crop yield and productivity among the growers, is proving to be a major driver for the market.

Urea is the most widely used liquid nitrogenous fertilizer in the region. The liquid micronutrient segment of the North American liquid fertilizer market is growing at a rapid pace, and the growth can be attributed to the rising demand for food grains and increasing soil deficiency.

North America Liquid Fertilizer Market Trends

Adoption of Sustainable Agriculture Practices

The management of agricultural production is presently focused on a greater commitment to environmental sustainability, for which the rising adoption of organic agriculture, accepted by the North American region as an alternative to conventional agriculture, appears to be an environmentally friendly growing system since mineral fertilizers are responsible for health problems and environmental pollution. According to Fertilizer Canada, in 2019, the usage of nitrogen and phosphorus nutrients by the growers in the high yield categories for which utilization of 65.8% is used in the high yield category, followed by 55.6% for moderate yield, and 54.8% for low yield in the soil samples exclusively for corn, soybean, and canola crops in Canada, which will boost the demand of the liquid fertilizer for covering all modes of applications in the crops.

In August 2020, the United States of America's National Organic Program (NOP) proposed changes to the US Department of Agriculture (USDA) organic regulation aiming to strengthen oversight and compliance to the organic principles along the supply chain, which will impact the production, handling, and marketing of organic products, thereby, in turn, enhance the growth of the organic ingredients in the liquid fertilizer market in the region.

United States Dominates The Market

Liquid fertilizers hold the largest share of consumption in the United States within the North American region. More than one-fourth of the fertilizers used in the United States are liquid fertilizers.

The factors that are expected to drive the liquid fertilizer market in the United States are the easy application and the availability of large wagons to fill the liquid fertilizers. Additionally, the high adoption of precision agriculture technology is driving market growth, as the use of variable rate technology (VRT) requires the use of liquid fertilizers. Around 77% of VRT farming use fertilizers. However, the adoption of VRT farming for pesticides and seeds is quite low, estimated to be 11% and 7%, respectively. Among the fertilizers used in VRT, lime-based fertilizers have the largest share, followed by single nutrient and multiple nutrient fertilizers. Owing to these factors, the consumption of liquid fertilizers in the United States may increase at a high rate during the forecast period.

Liquid fertilizer applications to corn and soybean plants have become a common practice in crop production during the past few years in the United States. According to the research conducted by the Soybean Management and Research Technology (SMaRT) project in 2017, the prescription-based foliar fertilizer mixture increased soybean yields at three of the 20 sites (15% of the time).

North America Liquid Fertilizer Industry Overview

The North American market is Slightly consolidated, with major players occupying a share of 39.7% and others accounting for 60.3% of the total shares. Yara International, Nutrien Ltd, ICL Group, and Agro Liquid are the key players in the market studied. As per the key developments observed during the review period, product launches and partnerships are the most adopted strategies by the dominant players in the market, followed by mergers and acquisitions. The major players in the market studied are increasing their product portfolio by partnering with other players in the region to maintain their position in the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Nutrient Type

- 5.1.1 Nitrogen

- 5.1.2 Potassium

- 5.1.3 Phosphate

- 5.1.4 Micronutrients

- 5.2 Ingredient Type

- 5.2.1 Organic

- 5.2.2 Synthetic

- 5.3 Mode of Application

- 5.3.1 Starter Solution

- 5.3.2 Foliar Application

- 5.3.3 Fertigation

- 5.3.4 Injection into Soil

- 5.3.5 Aerial Application

- 5.4 Application

- 5.4.1 Grains & Cereals

- 5.4.2 Pulses & Oilseeds

- 5.4.3 Commercial Crops

- 5.4.4 Fruits & Vegetables

- 5.4.5 Turf & Ornamentals

- 5.5 Geography

- 5.5.1 United States

- 5.5.2 Canada

- 5.5.3 Mexico

- 5.5.4 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Competitor Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 AgroLiquid

- 6.3.2 FoxFarm Soil & Fertilizer Company

- 6.3.3 Haifa Group

- 6.3.4 Kugler Company

- 6.3.5 Nutrien Ltd.

- 6.3.6 Planet Natural

- 6.3.7 Plant Food Company Inc.

- 6.3.8 Sociedad Quimica y Minera (SQM SA)

- 6.3.9 Triangle C. C.

- 6.3.10 Yara International ASA