|

市場調查報告書

商品編碼

1685882

資料中心建置:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Data Center Construction - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

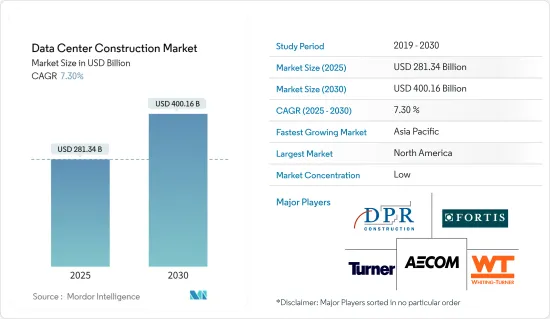

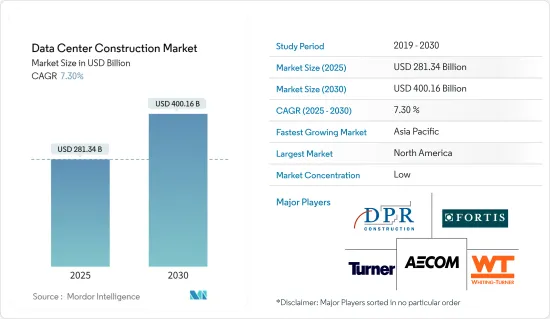

2025年資料中心建設市場規模估計為2,813.4億美元,預計2030年將達到4,001.6億美元,預測期間(2025-2030年)的複合年成長率為7.3%。

主要亮點

- 在建IT負載容量:預計到2029年全球資料中心市場即將到來的IT負載容量將超過73,000MW。

- 在建架空地板面積:預計到 2029 年,全球架空地板面積將超過 2.85 億平方英尺。

- 計畫安裝的機架:預計到 2029 年安裝的機架總數將超過 1,400 萬台。預計到 2029 年,北美將安裝最多的機架。

- 世界各地正在建造超大規模資料中心來儲存大量資料,為企業創造豐厚的利潤機會。許多產業正在轉向超大規模資料中心來增加運算能力、記憶體、網路能力和儲存資源。有效地大規模擴展計算工作負載的能力以及支援資料中心的實體基礎設施和分發系統是超大規模資料中心的眾多組成部分中的兩個。

- 此外,根據 Flexera 2023 年雲端運算狀況報告,72% 的企業受訪者表示他們已在業務中採用了混合雲。轉向混合雲端解決方案通常以運行私有雲端雲和公共雲端為代價。

資料中心建設市場趨勢

第四層級資料中心設施的日益普及將推動市場成長

- Tier-IV 認證目前是資料中心設施的最高等級。這些設施與美國政府使用的資料中心相當。它安全、可靠且冗餘。 Tier-IV 提供者在所有流程和資料保護流中均具有冗餘(2N+1)。任何單一的中斷或錯誤都不會導致系統崩潰,每年可提供 99.995% 的運轉率。但是,IV 級基礎設施必須擁有至少 96 小時的獨立電力才有資格達到此層級。此電源必須完全專用,且不能連接到任何外部電源。

- 這種層次結構也確保了最佳效率。伺服器被放置在最有利的實體位置。保持溫度和濕度恆定將大大延長硬體的使用壽命。甚至備份和冗餘電源也被視為主要訊息。 層級 IV資料中心需要高達 3:1 的空間比例來容納其 IT 空間。對於層級 IV,IT 冗餘 UPS 容量的千瓦成本部分為 25,000 美元/kWh。

- 此外,各公司正在投資超大規模資料中心,這推動了該領域的成長。例如,中東和北非最大的超大規模 Tier 4資料中心網路 Kazuna 資料中心(Kazuna)於 2023 年 5 月宣布計劃與埃及領先的綜合解決方案、數位化轉型和 ICT 基礎設施供應商 Benya 集團合作進入中東和非洲以及埃及區域市場。這個耗資 2.5 億美元的全新先進資料中心將成為埃及首個超大規模資料中心,並將建於埃及首個專門投資區馬迪科技園區。

- 2023 年 7 月,領先的營運商和雲端中立資料中心、互連和主機託管解決方案供應商 Digital Realty 宣布與 GI Partners 合作成立一家實體,出售兩棟穩定的超大規模資料Tier 4 中心大樓 65% 的權益。該公司預計將從合資企業和相關融資中獲得約7.43億美元的總收益。

- 隨著人工智慧、物聯網、5G等技術進步引領數位轉型,政府、金融、媒體、製造等各行各業都開始需要高可靠、先進的資料中心。該地區的知名技術供應商利用其多年的專業知識,推出服務來幫助最終用戶更好地管理資料中心營運。

北美佔很大佔有率

- 北美在全球資料中心建設市場佔據主導地位。強勁的經濟和先進的網路基礎設施是推動市場擴張的關鍵因素。美國在該地區市場佔據主導地位,擁有許多重要的雲端服務供應商,包括亞馬遜、Google和 Facebook。由於這些公司投資建造大型資料中心以增加資料儲存和處理能力,市場前景龐大。

- 此外,對資料安全和隱私的需求不斷增加,也推動了對資料中心的需求。根據身分盜竊資源中心的數據,2022 年美國發生了 1,802 起資料外洩事件。然而,同年約有 4.22 億人受到資料外洩的影響,包括資料外洩、破壞和暴露。這是三個不同的事件,但它們有一個共同的特徵。未經授權的惡意行為者可以在三種情況下存取敏感資料:隨著資料外洩和網路威脅的增加,組織和企業正在尋找只有先進的資料中心才能提供的安全可靠的資料處理和儲存解決方案。

- 預計美國將佔很大佔有率。該國新資料中心的興起可能會推動市場的發展。例如,波蘭軟體公司 Comarch 於 2023 年 5 月在亞利桑那州鳳凰城開設了一個 32,000 平方英尺(3,000平方公尺)的資料中心。新資料中心預計將從其宣布的當年起全面運作。提案的資料中心將由四個伺服器機房組成,共有 160 個機架,並將提供託管服務、主機託管、雲端託管、災難復原和備份服務等服務。也計劃提供 Meet Me Rooms (MMR)。這些發展為美國資料中心電力市場創造了成長機會。

- 此外,2024 年 1 月,Vertiv Group Corp. 宣布,自 2021 年收購 E&I Engineering 和 PowerBar Gulf LLC 的開關設備、母線槽和 IMS 業務以來,其開關設備、母線槽和整合模組化解決方案 (IMS) 業務的生產能力已提高 100% 以上,並計劃進一步擴建設施。

- 北美通訊業者和商業技術經銷商對整合通訊即服務(UCaaS) 解決方案的需求也在推動市場成長。為了最大限度地提高 MSP、VAR、ISP 和互連商的系統彈性,SkySwitch 等公司從地理位置不同的站點提供白牌UCaaS。

資料中心建設產業概況

資料中心建設市場較為分散,由幾家大型企業組成。隨著技術進步和產品創新,許多公司透過贏得新契約和探索競爭激烈的新市場來擴大其市場影響力。主要公司包括 AECOM、Whiting-Turner Contracting Company 和 DPR Construction。

2023 年 5 月,歐洲資料中心營運和投資領域的法國領導者 Data4 集團宣布將在法國埃松省諾澤的原諾基亞工廠上建造一個新的資料中心園區。該計劃預計到 2030 年投資約 10 億歐元,旨在振興 22 公頃的工業和辦公空間,並強調該集團在巴黎的強大影響力。

2023年4月,微軟宣布將在波蘭開設其在中東歐地區首個值得信賴的現代化雲端中心。微軟波蘭雲端區域由華沙周圍的三個實體位置組成,每個位置由一個或多個資料中心組成。這可確保資料儲存在遵守最高安全、隱私和監管合規標準的國家/地區。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

- 研究框架

- 二次調查

- 初步調查

- 資料三角測量與洞察生成

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 市場動態

- 市場促進因素

- 雲端應用、人工智慧和巨量資料的成長

- 超大規模資料中心的採用率不斷提高

- 市場限制

- 房地產成本上漲,安裝和維修成本飆升

- 市場促進因素

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 全球主要資料中心建設專案統計

- 全球資料中心數量(2023年)

- 在建資料中心數量(2024-2029)

- 全球資料中心建置平均資本支出與資本支出

- 2022 年及 2023 年各地區資料中心容量吸收量(MW)

- 全球投資資料中心基礎設施的頂級公司

第5章市場區隔

- 市場區隔-按基礎設施

- 市場區隔-電力基礎設施

- 配電解決方案

- PDU - 基本型和智慧型 - 計量和開關解決方案

- 傳輸開關

- 靜止的

- 自動(ATS)

- 開關設備

- 低壓

- 高壓

- 電源面板和組件

- 其他

- 電源備援解決方案

- UPS

- 發電機

- 服務——設計與諮詢、整合、支援與維護

- 市場區隔-按機械基礎設施

- 冷卻系統

- 浸入式冷卻

- 直接晶片冷卻

- 後門熱交換器

- 行內和機架內冷卻

- 架子

- 其他機械基礎設施

- 整體結構

- 市場區隔-電力基礎設施

- 市場區隔-依層級類型

- 層級和二級

- 第三層級

- IV層級

- 市場區隔:按最終用戶

- 銀行、金融服務和保險

- 資訊科技/通訊

- 政府和國防

- 衛生保健

- 其他最終用戶

- 市場區隔-按地區

- 北美洲

- 歐洲

- 亞太地區

- 中東和非洲

- 拉丁美洲

第6章競爭格局

- 公司簡介

- AECOM

- Whiting-turner Contracting Company

- Turner Construction Co.

- Jacobs Solutions Inc.

- DPR Construction

- Skanska USA

- Balfour Beatty US

- Hensel Phelps

- PT Jaya Obayashi

- Hibiya Engineering Ltd

- Goodman Group

- Fortis Construction Inc.

第7章投資分析

第8章 市場機會與未來趨勢

第9章:關於出版商

The Data Center Construction Market size is estimated at USD 281.34 billion in 2025, and is expected to reach USD 400.16 billion by 2030, at a CAGR of 7.3% during the forecast period (2025-2030).

Key Highlights

- Under Construction IT Load Capacity: The upcoming IT load capacity of the Global data center market is expected to reach above 73,000 MW by 2029.

- Under Construction Raised Floor Space: The global construction of raised floor areas is expected to exceed 285 million sq. ft. by 2029.

- Planned Racks: The total number of racks to be installed is expected to reach more than 14 million units by 2029. North America is expected to house the maximum number of racks by 2029.

- Hyper-scale data centers are being built more often worldwide to store massive volumes of data, opening up lucrative opportunities for business players. Many industries use hyper-scale data centers to increase computing power, memory, networking capabilities, and storage resources. The ability to effectively scale up computer workloads at a large scale and the physical infrastructure and distribution systems supporting the data centers are two of the many components of hyper-scale data centers.

- Moreover, According to Flexera State of the Cloud Report 2023, 72% of companies' respondents stated they had deployed a hybrid cloud in their business. Migrating to hybrid cloud solutions often comes at the expense of operating private and public clouds.

Data Center Construction Market Trends

Growing Adoption of Tier 4 Data Center Facilities is Driving the Market's Growth

- The Tier-IV certification is currently the highest classification among data center facilities. These facilities are equivalent to data centers used by the US government. They are highly secure, reliable, and redundant. Tier-IV providers have redundancies (2N+1) for every process and the data protection stream. No single outage or error can shut down the system, and it provides 99.995% uptime per annum, which is the highest guaranteed uptime. However, the level IV infrastructure should have at least 96 hours of independent power to qualify for this tier. This power must not be connected with any outside source and is entirely proprietary.

- This tier also ensures optimized efficiency. The servers are housed in the most physically advantageous locations. This drastically extends the life of the hardware if temperature and humidity levels are kept consistent. Even the backups and dual power sources are treated like primaries. The Tier-IV data center can require up to 3 to 1 of the space required to facilitate the IT footprint. For tier IV, the kW Cost Component is USD 25,000/kW of redundant UPS capacity for IT.

- Moreover, market players are investing in hyperscale data centers, which is, in turn, driving segment growth. For instance, in May 2023, Kazuna Data Centers (Kazuna), the largest hyperscale Tier 4 data center network in the Middle East and North Africa, announced its plans to partner with Benya Group, a leading provider of integrated solutions, digital transformation, and ICT infrastructure in Egypt to enter the markets of the Middle East and Africa and Egypt region. The new USD 250 million state-of-the-art data center will be Egypt's first hyperscale data center built in Maadi Technology Park, Egypt's first dedicated investment area.

- In July 2023, Digital Realty, a leading provider of carrier- and cloud-neutral data center, interconnection, and colocation solutions, announced its partnership with GI Partners in order to start a corporation for the sale of a 65% interest in two hyperscale data Tier 4 center buildings, which are stabilized. The company will receive around USD 743 million in gross proceeds from the joint venture and the associated financing.

- As with technological advancements such as AI, IoT, and 5G leading the digital transformation, various industry sectors, such as government, finance, media, and manufacturing, are starting to demand advanced data centers with high reliability. A few prominent technological vendors in the region, leveraging their years of expertise, are launching services that allow the end user to manage data center operations better.

North America Accounts for a Major Share

- North America dominates the global market for building data centers. A strong economy and cutting-edge network infrastructure are critical drivers for the market's expansion. The United States dominates the regional market and has many significant cloud service providers, including Amazon.com, Google Inc., and Facebook. These businesses invest in building massive data centers and increased data storage and processing capabilities, which present enormous market prospects.

- Furthermore, the growing demand for data security and privacy is driving the demand for data centers. According to the Identity Theft Resource Center, the count of data breaches in the United States in 2022 was 1,802. However, around 422 million individuals were affected by data breaches in the same year, including data leaks, breaches, and exposures. Although these are three separate events, they have one feature. An unauthorized malicious actor can access sensitive data under three circumstances. With the rise of data breaches and cyber threats, organizations and businesses seek secure and reliable data handling and storage solutions that only advanced data centers can offer.

- The United States is analyzed to hold a significant share. The rise in the new data centers in the country would drive the market. For instance, in May 2023, Polish software organization Comarch launched a data center of around 32,000 square feet (3,000 sqm) in the city of Phoenix, Arizona. The new data center is anticipated to be fully active starting the year of its announcement. The proposed data center comprises four server rooms with 160 racks and is expected to offer services with managed services, colocation, cloud hosting, disaster recovery, and backup services. It is also projected to provide meet-me rooms (MMR). Such developments are creating growth opportunities for the data center power market in the United States.

- Moreover, in January 2024, Vertiv Group Corp. announced that it increased the production capacity of its switchgear, busway, and integrated modular solutions (IMS) business by more than 100% since it acquired E&I Engineering and PowerBar Gulf LLC, switchgear, busway, and IMS business in 2021 and further, it is planning to expand its existing facilities through the end of 2025.

- The demand for Unified Communications-as-a-Service (UCaaS) solutions from telecom and business technology resellers in North America is also a factor in the market's expansion. To maximize system resilience to MSPs, VARs, ISPs, and interconnects, a player like SkySwitch offers white-label UCaaS from geographically varied sites.

Data Center Construction Industry Overview

The data center construction market is fragmented, consisting of several major players. With technological advancements and product innovations, many companies are increasing their presence in the market by securing new contracts and tapping new markets that cater to an intense rivalry. A few of the key players are AECOM, Whiting-Turner Contracting Company, and DPR Construction.

May 2023: Data4 Group, the French leader in data center operations and investments in Europe, announced that it would build a new data center campus on the former Nokia site in Nosee, Essonne, France. The project, which plans to invest around EUR 1 billion by 2030, aims to revitalize 22 hectares of industrial and office land and underscore the Group's strong presence in Paris.

April 2023: Microsoft announced the opening of its newest trusted cloud center in Poland, which will be the first in Central and Eastern Europe. Microsoft Poland's cloud region consists of three physical locations around Warsaw, each consisting of a single or several data centers. It ensures that data are stored in a country that is in compliance with the highest standards of security, privacy, and regulatory compliance.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Research Framework

- 2.2 Secondary Research

- 2.3 Primary Research

- 2.4 Data Triangulation and Insight Generation

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Market Dynamics

- 4.2.1 Market Drivers

- 4.2.1.1 Growing Cloud Applications, AI, and Big Data

- 4.2.1.2 Rising Adoption of Hyperscale Data Centers

- 4.2.2 Market Restraints

- 4.2.2.1 Rising Real Estate Cost Coupled with High Cost of Installment and Maintenance

- 4.2.1 Market Drivers

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Key Global Data Center Construction Statistics

- 4.4.1 Number of Data Centers, Global, 2023

- 4.4.2 Data Center Under Construction, Global, n MW, 2024 - 2029

- 4.4.3 Average Capex and Opex For the Global Data Center Construction

- 4.4.4 Data Center Power Capacity Absorption in MW, Selected Region, 2022 and 2023

- 4.4.5 The Top CAPEX Spenders on Data Center Infrastructure in the World

5 MARKET SEGMENTATION

- 5.1 Market Segmentation - By Infrastructure

- 5.1.1 Market Segmentation - Electrical Infrastructure

- 5.1.1.1 Power Distribution Solution

- 5.1.1.1.1 PDU - Basic & Smart - Metered & Switched solutions

- 5.1.1.1.2 Transfer Switches

- 5.1.1.1.2.1 Static

- 5.1.1.1.2.2 Automatic (ATS)

- 5.1.1.1.3 Switchgear

- 5.1.1.1.3.1 Low-voltage

- 5.1.1.1.3.2 Medium-voltage

- 5.1.1.1.4 Power Panels and Components

- 5.1.1.1.5 Others

- 5.1.1.2 Power Back up Solutions

- 5.1.1.2.1 UPS

- 5.1.1.2.2 Generators

- 5.1.1.3 Service - Design & Consulting, Integration, Support & Maintenance

- 5.1.2 Market Segmentation - By Mechanical Infrastructure

- 5.1.2.1 Cooling Systems

- 5.1.2.1.1 Immersion Cooling

- 5.1.2.1.2 Direct-To-Chip Cooling

- 5.1.2.1.3 Rear Door Heat Exchanger

- 5.1.2.1.4 In-row and In-rack Cooling

- 5.1.2.2 Racks

- 5.1.2.3 Other Mechanical Infrastructure

- 5.1.3 General Construction

- 5.1.1 Market Segmentation - Electrical Infrastructure

- 5.2 Market Segmentation - By Tier Type

- 5.2.1 Tier-I and II

- 5.2.2 Tier-III

- 5.2.3 Tier-IV

- 5.3 Market Segmentation - By End User

- 5.3.1 Banking, Financial Services, and Insurance

- 5.3.2 IT and Telecommunications

- 5.3.3 Government and Defense

- 5.3.4 Healthcare

- 5.3.5 Other End Users

- 5.4 Market Segmentation - By Region

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.5 Latin America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 AECOM

- 6.1.2 Whiting-turner Contracting Company

- 6.1.3 Turner Construction Co.

- 6.1.4 Jacobs Solutions Inc.

- 6.1.5 DPR Construction

- 6.1.6 Skanska USA

- 6.1.7 Balfour Beatty US

- 6.1.8 Hensel Phelps

- 6.1.9 PT Jaya Obayashi

- 6.1.10 Hibiya Engineering Ltd

- 6.1.11 Goodman Group

- 6.1.12 Fortis Construction Inc.