|

市場調查報告書

商品編碼

1685885

汽車安全氣囊充氣機:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Automotive Airbag Inflator - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

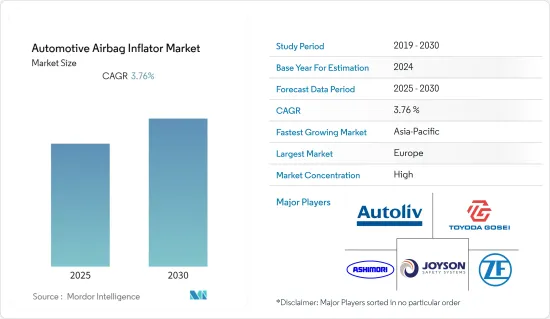

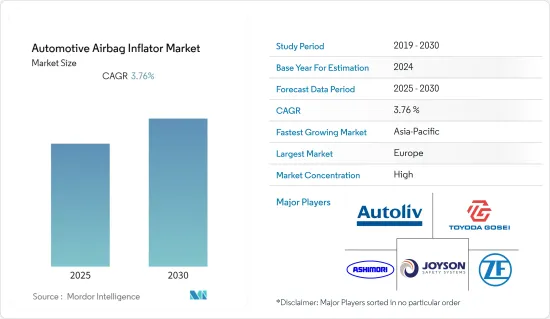

預計預測期內汽車安全氣囊充氣機市場複合年成長率為 3.76%。

新冠疫情爆發後,全球多個主要經濟體被迫封鎖,經濟活動停滯,供應鏈中斷,市場受到重創。所有製造和OEM工廠都已停止生產,以遵守社交距離規範並限制病毒的傳播。在此期間,乘用車需求也大幅下降。然而,隨著經濟逐漸開放,需求正在復甦,隨著消費者偏好從公共運輸轉向私家車,中國和印度等市場對乘用車的需求龐大。預計這一趨勢將在預測期內持續下去。

從長遠來看,汽車安全監管要求的不斷提高以及消費者安全意識的不斷增強正在推動全球汽車安全氣囊充氣機市場的發展。

此外,側面碰撞安全氣囊和側氣囊的普及率不斷提高、汽車產量不斷增加以及每輛車安裝的氣囊數量不斷增加是推動汽車安全氣囊充氣機市場成長的主要因素。

主要亮點

- 2022 年 5 月,在花費近一年時間研發出修復缺陷安全氣囊充氣裝置的方案後,通用汽車準備為 2021 年 7 月召回的 41 萬輛卡車更換有缺陷的安全氣囊充氣裝置。

然而,預計到預測期結束時,亞太地區將引領市場,其中印度和中國等國家預計將在汽車產業中實現較高的複合年成長率。

汽車安全氣囊充氣機市場趨勢

煙火充氣機佔最大市場佔有率

在煙火充氣裝置中,固體推進劑(通常是疊氮化鈉,一種與氧化劑混合的化學物質)以可控的速率燃燒產生氣體(主要是氮氣)。這使得安全氣囊能夠在不到二十分之一秒的時間內充氣。在撞擊瞬間,煙火式充氣氣囊的展開速度比混合式充氣氣囊的展開速度更快。因此,煙火式氣體發生器主要用於車輛正面安全氣囊,例如駕駛座安全氣囊、乘客安全氣囊和側邊安全氣囊。

由於世界各國政府強制使用正面安全氣囊,預計在預測期內煙火式安全氣囊的需求將很高。

煙火式氣體發生器比混合式氣體發生器具有體積更小、重量更輕的優勢,因此吸引了OEM在其安全氣囊中採用它們。

Takata目前正對史上最大的汽車召回事件負責。由於安全氣囊存在爆炸風險,可能會將彈片射入駕駛人或前座乘客的臉部或身體,Takata已召回 12 個汽車品牌的 4,000 萬輛汽車。其中一個主要原因是充氣裝置的煙火設計有缺陷。 2018年4月,Takata被美國市場第五大安全氣囊供應商Key Safety Systems(KSS)收購,更名為Joyson Safety Systems。

此外,廢棄的煙火發生器因含有疊氮化鈉而被發現具有毒性。因此,安全氣囊製造商一直在尋求提供有毒推進劑的替代品。例如,海拉設計了使用不含疊氮化物的其他燃料作為推進劑的安全氣囊。這些燃料不僅排放氮氣,還會排放二氧化碳(~20%)和水蒸氣(~25%)。

在預測期內,煙火產業預計將繼續成長,並且由於技術進步預計將呈現最高的成長率。

亞太地區加速市場成長

亞太地區乘用車和商用車先進安全性的成長主要得益於消費者對安全性和舒適性的偏好不斷提高、中檔車廣泛採用側面和側氣囊和側氣簾、以及對高檔和豪華車的需求不斷成長。此外,政府為確保乘客安全而採取的措施以及系統和零件成本的下降,正在推動整個估計和預測期內對安全氣囊充氣機的需求。

中國是全球最大的汽車市場之一,2020年國內乘用車銷量超過2,017萬輛,年比2019年全年銷量下降5.89%。儘管受到疫情影響,中國仍然是全球最大的汽車銷售國之一。

印度是一個新興經濟體,正在逐步在乘用車中實施先進的安全和駕駛輔助功能。隨著印度逐步涉足電動車、自動駕駛汽車和人工智慧汽車產業,並推出許多新產品,安全氣囊充氣機市場充滿潛力和機會。例如

- 2021 年,Morris Garage 推出了其新款 SUV Gloster 和 Hector 的拉皮版本。這兩款車型在市場上一直暢銷,並且這些車的頂級版本標配 6 個安全氣囊。

- Mahindra 於 2021 年推出了 XUV 700。根據最近的新聞稿,XUV 700 的 70% 以上的預訂都是頂級配置。該車在前幾個月就收到了超過 50,000 份預訂單,目前已向客戶交付了超過 78,000 輛。

- 2021 年,瑪魯蒂鈴木推出了 Baleno、Ertiga 和 XL6 的拉皮版本。所有車型均標配四個和六個安全氣囊。

預計在預測期內,對更安全車輛的需求不斷增加將推動亞太地區安全氣囊充氣機市場的發展。

汽車安全氣囊充氣機產業概況

汽車安全氣囊充氣機市場高度整合,主要參與者佔全球65%以上的市佔率。

市場的主要企業包括 Autoliv Inc.、Joyson Safety Systems、ZF Friedrichshafen AG、Toyoda Gosei 和工業。

- 2022年5月,大型汽車零件供應商延鋒與美國公司、汽車安全氣囊全程序充氣機系統的全球製造商ARC Automotive宣布成立新的合資企業,生產安全氣囊充氣機。

- 2021年1月,DAICEL株式會社將在清奈設立安全氣囊充氣機製造廠。第一階段將投資約 23 億盧比。這將是DAICEL在印度的首家安全氣囊充氣機生產廠。該公司透過位於泰國和其他國家的生產基地滿足印度市場的需求。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場促進因素

- 市場限制

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 安全氣囊類型

- 駕駛座安全氣囊

- 乘客安全氣囊

- 側邊氣簾

- 膝部安全氣囊

- 行人保護氣囊

- 側邊安全氣囊

- 充氣機類型

- 煙火製造術

- 儲氣

- 混合

- 車輛類型

- 搭乘用車

- 商用車

- 地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 其他亞太地區

- 歐洲

- 英國

- 德國

- 法國

- 俄羅斯

- 其他歐洲國家

- 世界其他地區

- 巴西

- 南非

- 其他國家

- 北美洲

第6章 競爭格局

- 供應商市場佔有率

- 公司簡介

- Autoliv Inc.

- ZF Friedrichshafen AG

- Joyson Safety Systems(Key Safety Systems)

- HUAYU Automotive Systems

- Toyoda Gosei Co., Ltd.

- Daicel Corporation

- Nippon Kayaku Co.,Ltd

- Ashimori Industry;Co., Ltd

第7章 市場機會與未來趨勢

The Automotive Airbag Inflator Market is expected to register a CAGR of 3.76% during the forecast period.

During the outbreak of pandemic COVID-19, the market was hit adversely because of the disruptions caused in the supply chain as several major economies of the world were forced into lockdown and economic activities were halted during this period. All the manufacturing units and OEM plants stopped their production to adhere the social distancing norms and restrict the spread of virus. The demand for passenger vehicles also fell drastically during this period. Yet with the gradual opening up of economies the demand returned to the market and markets like China and India witnessed huge demand for passenger cars as the consumer preference changed from public transport to personal vehicles. The trend is expected to continue during the forecast period.

Over the long term, Increasing regulatory requirements regarding vehicle safety and rising awareness about customer safety, globally, are driving the automotive airbag inflator market.

Furthermore, the increase in the penetration of side-impact and curtain airbags, and vehicle production, the introduction of more bags per car, are the major factors that drive the growth of the automotive airbag inflator market.

Key Highlights

- In May 2022, After almost a year spent developing a fix for faulty airbag inflators, General Motors is getting ready to replace faulty airbag inflators in 410,019 trucks that were recalled in July 2021.

However, Asia-Pacific is expected to lead the market by the end of forecast period, because of countries, like India and China are anticipated to record high CAGR in the automotive industry

Automotive Airbag Inflator Market Trends

Pyrotechnic Inflator to Holds the Highest Market Share

In a pyrotechnic inflator, solid propellant (typically a chemical material - sodium azide mixed with oxidizers) burns at a controlled rate to produce gas (majorly nitrogen gas). This, in turn, inflates the airbag in less than one-twentieth (1/20) of a second. At the moment of a crash, the deployment of a pyrotechnic inflator airbag is faster, as compared to that of a hybrid inflator airbag. Thus, pyrotechnic inflators have been majorly deployed in the vehicle's frontal airbags, such as driver airbags, passenger airbags, and side airbags.

With governments around the world making frontal airbags compulsory, Pyrotechnic airbags are expected to see high demand during the forecasted period.

Pyrotechnic inflators have an added advantage of small size and low weight compared to that of hybrid inflators which is attracting OEMs to use them for airbags.

Takata is now responsible for the largest auto recall in history. Takata has already recalled 40 million vehicles across 12 vehicle brands for "Airbags that could explode and potentially send shrapnel into the face and body of both the driver and front seat passenger". One of the major reason was detected to be a flaw in pyrotechnics design which is used in the inflator. In April 2018, Takata was acquired by the fifth largest airbag supplier in the United States market, Key Safety Systems (KSS), and renamed as Joyson Safety Systems.

Additionally, the disposal of pyrotechnic inflators have turned out to be toxic due to the presence of sodium azide. Thus, airbag manufacturers have been trying to provide other alternatives to replace the toxic propellant. For instance, Hella has been designing airbags with other azide-free fuels as propellants. They do not just release nitrogen gas, but also CO2 (~20%) and water vapor (~25%).

During the forecast period, the pyrotechnic segment is anticipated to continue to grow, and with technological advancements it is expected to see highest growth rate.

Asia-Pacific to Witness Faster Market Growth

The growth of advanced safety in passenger cars and commercial vehicles in the Asia-Pacific region is mainly attributed to increasing consumers' preferences for safety and comfort features, increasing penetration of Side and Curtain airbags in mid-level cars, and growing demand for premium and luxury cars. Furthermore, government initiative toward passenger safety and decreasing system and component costs is estimated to fuel the demand for airbag inflators over the forecast period.

China is one of the largest automotive markets across the world, and more than 20.17 million passenger cars were sold in the country in 2020 and recorded a 5.89% of the yearly decline in sales compared to 2019. Despite the pandemic, China is still one of the largest sellers of automobiles globally.

India is an emerging economy where the implementation of advanced safety and driver assistance features in passenger cars is taking place gradually. India has a potential and opportunity for airbag inflator market as India is stepping gradually into the electric, autonomous and artificial intelligence oriented automotive industry along with many new product launches. For instance,

- In 2021, Morris Garage has launched its new SUV Gloster and the facelifted version of the Hector. Both the vehicle models have gained good sales in the market and the top-spec variant of these cars get 6-airbags as standard.

- Mahindra in 2021 has launched the XUV 700. The top-spec variant of the car features 7-airbags and in a recent press release, it was identified that, more than 70% of the bookings for the XUV 700 have been the top-spec trim. The vehicle has received more then 50,000 bookings within the first few months and has more than 78,000 units to delivered to customers.

- Maruti Suzuki in 2021 has launched the facelifted versions of the Baleno, Ertiga, and the XL6. All the models on the to-spec variants get 4-airbags and 6-airbags as standard.

With increasing demand for safe cars, the market for airbag inflators over the forecast period in Asia-Pacific is expected to grow.

Automotive Airbag Inflator Industry Overview

The automotive airbag inflator market is fairly consolidated, with the major companies capturing more than 65% of the global market studied.

Some of the prominent players in the market, includes Autoliv Inc., Joyson Safety Systems, ZF Friedrichshafen AG, Toyoda Gosei Co., Ltd., and Ashimori Industry;Co., Ltd.

- In May 2022, Yanfeng, a leading global automotive supplier, and U.S.-based company ARC Automotive, a global manufacturer that offers a full program of inflation systems for vehicle airbags, announced the formation of a new joint venture for the production of airbag inflators for airbag applications.

- In January 2021, Daicel Corporation will set up an airbag inflator manufacturing plant in Chennai. The company will invest around Rs 230 crore during the phase-I. This will be Daicel Corporation's first airbag inflator manufacturing plant in India. The company was catering to Indian market from its production site in Thailand and other countries.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Force Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Airbag Type

- 5.1.1 Driver Airbag

- 5.1.2 Passenger Airbag

- 5.1.3 Curtain Airbag

- 5.1.4 Knee Airbag

- 5.1.5 Pedestrian Protection Airbag

- 5.1.6 Side Airbag

- 5.2 Inflator Type

- 5.2.1 Pyrotechnic

- 5.2.2 Stored Gas

- 5.2.3 Hybrid

- 5.3 Vehicle Type

- 5.3.1 Passenger Cars

- 5.3.2 Commercial Vehicles

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Asia-Pacific

- 5.4.2.1 China

- 5.4.2.2 Japan

- 5.4.2.3 India

- 5.4.2.4 South Korea

- 5.4.2.5 Rest of Asia-Pacific

- 5.4.3 Europe

- 5.4.3.1 United Kingdom

- 5.4.3.2 Germany

- 5.4.3.3 France

- 5.4.3.4 Russia

- 5.4.3.5 Rest of Europe

- 5.4.4 Rest of the World

- 5.4.4.1 Brazil

- 5.4.4.2 South Africa

- 5.4.4.3 Other Countries

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Autoliv Inc.

- 6.2.2 ZF Friedrichshafen AG

- 6.2.3 Joyson Safety Systems (Key Safety Systems)

- 6.2.4 HUAYU Automotive Systems

- 6.2.5 Toyoda Gosei Co., Ltd.

- 6.2.6 Daicel Corporation

- 6.2.7 Nippon Kayaku Co.,Ltd

- 6.2.8 Ashimori Industry;Co., Ltd