|

市場調查報告書

商品編碼

1685925

起重機 -市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Crane - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

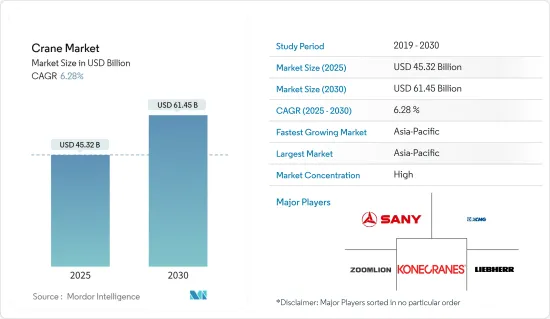

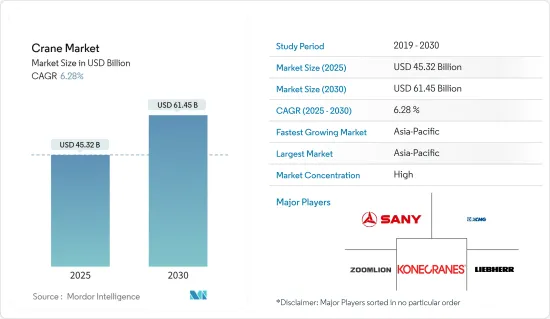

預計 2025 年起重機市場規模為 453.2 億美元,到 2030 年將達到 614.5 億美元,預測期內(2025-2030 年)的複合年成長率為 6.28%。

全球起重機市場充滿活力,對建築和工業機械行業至關重要。該公司的產品涵蓋各種類型的起重機,如移動式起重機、塔式起重機、履帶和架空起重機,服務於建築、製造、航運和物流等行業。

製造商正在實施應急計劃,以減輕未來業務的不確定性並與汽車行業的關鍵行業客戶保持連續性。

在預測期內,起重機行業預計將受益於減少製造設施和辦公室中人工參與的自動化技術的部署。基礎設施和建築業迅速擴展到各種新建設和改造計劃,將對此類設備產生強勁需求。

由於政府和私人增加對新建設和市場開發計劃以改善基礎設施的支出,起重機市場正在成長。通訊、石油天然氣和製造業等一系列產業對改進結構的需求也推動了行銷的發展。由於這些機器比傳統機器具有更優越的性能和效率,因此在各行各業中越來越受歡迎。此外,隨著沙烏地阿拉伯吉達塔和馬來西亞默迪卡 118 塔等高層建築的建設,市場預計將出現健康成長。

2024年3月,全球最大的施工機械製造商之一利勃海爾集團宣布,其沙烏地阿拉伯子公司訂單阿拉伯機械與重型設備公司(AMHEC)的55台新型全地面起重機訂單,這是該公司迄今為止最大的訂單。

2023 年 9 月,義大利首台 65 噸 Terrex TRT 65螃蟹式吊車交付並送往工程服務公司,用於煉油廠的工作。這台新起重機由特雷克斯經銷商 Tecno-Gru 根據長期租賃協議交付給 Welding Duebi,該公司位於威尼托地區費拉拉北部的菲耶索翁貝蒂亞諾。該公司為石油天然氣、石化和能源產業提供工程業務。

由於亞太地區在建高層建築數量眾多、基礎設施發展迅速、港口數量眾多以及起重機OEM製造商眾多,預計該地區將成為全球最大的汽車市場。

起重機市場趨勢

全地面起重機市場可望佔據主導地位

全地形起重機設計用於在各種天氣條件下運作。由於建築業的興起和工業的擴張,全地面起重機預計將在全球範圍內獲得顯著的發展。建築業和其他終端用戶產業嚴重依賴全地面起重機。傳統的起重和建築設備正在被全地形起重機取代,預計這將在整個預測期內推動全地形起重機市場的發展。

全地面起重機由於其高強度輸出以及在惡劣地形和天氣條件下作業的能力,在新建築時代越來越受歡迎,預計在不久的將來會擴大。近年來,隨著高層建築建築建設、採礦和電力資源開發的日益普及,全地面起重機的需求急劇增加。

此外,市場主要企業正在推出新的產品系列,以獲得競爭優勢。例如

- 2024 年 1 月:Kobelco Construction Machinery宣布推出 TKE750G,這是一款新型伸縮臂履帶起重機,最大起重能力為 75 噸。專為歐洲市場設計。其搭載符合歐盟第五階段排放標準的賓士E9H01(戴姆勒OM936LA)引擎,繼承了G系列桁架臂履帶起重機的基本概念。 TKE750G 計劃於 2024 年中期之後發布。

- 2022 年 11 月:徐工集團在 2022 年 BAUMA 展會上推出 10 款新型電子機械,包括世界上第一台插電式混合動力起重機 XCA60EV。

因此,預計所有上述因素的結合將導致全地面起重機領域在未來五年內佔據市場主導地位。

亞太地區預計將成為成長最快的市場

公共基礎設施和住宅的興起預計將推動亞太地區起重機市場的發展。中國是世界上最大的施工機械生產國和消費國之一。起重機在建築市場佔有很大的佔有率,中國是亞太地區最大的起重機市場。在印度,政府在2021-2022年聯邦預算中宣布了幾項改善國家基礎設施的計畫。例如

- 住宅領域銷售強勁,並顯示2022年推出量增加的跡象。預計2022年前七大城市的總銷售量將超過36萬套。 UDAN 的目標是到 2026 年完成約 220 個目的地(機場/直升機場/海港)的服務,並透過 1,000 條航線為印度各地未連通的城市提供空中連接。

此外,由於人為干預減少,施工過程中的工業事故減少,預計起重機的使用將會增加,從而提高建設活動的效率。預計這將對亞太起重機市場的整體成長產生積極影響,尤其是建設產業正在經歷大規模市場發展的日本和印度。

此外,由於都市化加快、大城市住宅短缺嚴重、人口成長迅速,亞太地區高層建築建設正在快速推進。到2022年,全球最高的25棟建築中,有23座將建在亞太地區。在高層建築的建造中,起重機用於吊運和運輸重型建築材料。因此,預計未來五年高層建築建設的增加也將推動亞太起重機市場的發展。

同樣,政府實施的、預計不久將完工的子彈列車計劃的引入也有望為印度起重機市場創造商機。先進的子彈列車建設需要起重機結構在列車結構開發過程中進行重型起重,預計這將導致未來幾年該國對起重機市場的需求大幅增加,有利於該地區的起重機市場,並在預測期內對全球起重機市場產生積極影響。

- 2023年11月,日本領先的城市景觀開發商森大廈株式會社將慶祝位於東京市中心的世界級混合用途開發案麻布台山盛大開幕。

- 2022 年 4 月:多田野宣布將開發世界上第一台電動全地面起重機,這是其實現碳中和目標的一部分,即到 2030 年將產品使用過程中產生的二氧化碳排放減少 25%。該起重機預計將於 2023 年底上市。

起重機產業概況

起重機市場高度集中,並由少數幾家大公司主導。研究涉及的市場主要參與者包括馬尼托瓦克、多田野、神鋼、Kargotec、科力起重機、Liebel、三一環球、帕爾菲格、中聯重科和徐工集團。這些公司正在利用建築、採礦和工業領域主要企業對可靠起重機的巨大需求。

該地區的領先公司投入巨資研發新產品並向全球供應起重機。該公司還專注於推出新產品和獲得大訂單等成長策略,以鞏固其地位。

- 2023年12月,領先的施工機械製造商三一印度在南亞最大的施工機械展覽會EXCON 2023上展出了44台機器,其中包括15種新機型。其中包括專為各種應用而設計的電子機械,例如土方工程、挖掘、重物起重、深基礎施工、採礦作業、道路建設和港口設施。該公司展示了印度首台混合動力汽車起重機,配備柴油和電動模式,可實現環保、省油且安靜的起重機運行。

- 2023年3月,帕爾菲格船舶正式委託為日本北九州響灘離岸風力發電交付25台高剛性動臂起重機。根據這家奧地利公司介紹,起重機的設計推廣8米,完全符合離岸風電服務起重機的要求,特別是EN13852-3標準。

- 2022 年 10 月:特雷克斯起重機推出 CTT 222-10 平頂塔式起重機。為了確保安全,可調節、旋轉的座椅以及整合的加熱和冷卻系統可讓操作員感到舒適、高效並專注於工作。此型號最大起重能力為 10 噸,最大臂長為 65 米,最大獨立高度(C25)分別為 54.35 米、72.95 米和 67.85 米。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場促進因素

- 基礎建設的成長

- 產業成長

- 市場挑戰

- 經濟波動

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章市場區隔

- 按類型

- 移動式起重機

- 全地面起重機

- 螃蟹式吊車

- 履帶起重機

- 車載起重機

- 其他移動式起重機

- 固定起重機

- 單軌列車和懸垂式

- 架空起重機

- 塔式起重機

- 海上起重機

- 移動式港口起重機

- 固定式港口起重機

- 海上

- 船舶起重機

- 移動式起重機

- 按應用

- 建築和採礦

- 船舶和近海工程

- 工業的

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲

- 其他亞太地區

- 世界其他地區

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 巴西

- 其他國家

- 北美洲

第6章競爭格局

- 供應商市場佔有率

- 公司簡介

- Konecranes PLC

- Cargotec OYJ

- Manitowoc

- Terex Corporation

- Tadano Limited

- Kobelco Cranes Co. Ltd

- Palfinger AG

- Liebherr-International AG

- Zoomlion Heavy Industry Science and Technology Co. Ltd

- Favelle Favco Group

- Hitachi Sumitomo Heavy Industries Construction Cranes Co. Ltd

- XCMG Group

- SANY Group

- Shanghai Heavy Industries Co. Ltd(ZPMC)

第7章 市場機會與未來趨勢

- 綠色和永續起重機

The Crane Market size is estimated at USD 45.32 billion in 2025, and is expected to reach USD 61.45 billion by 2030, at a CAGR of 6.28% during the forecast period (2025-2030).

The global crane market is a dynamic and essential part of the construction and industrial machinery industry. It encompasses various crane types, including mobile, tower, crawler, and overhead cranes, serving industries such as construction, manufacturing, shipping, and logistics.

Manufacturers are implementing contingency plans to mitigate future business uncertainties and retain continuity with clients in the critical industries of the automobile sector.

Over the forecast period, the crane industry will benefit from automated technology deployment to decrease human involvement in manufacturing facilities and offices. The fast expansion of the infrastructure and building industry to various new construction and restoration projects creates a strong demand for these types of equipment.

The crane market is expanding due to increased government and private expenditure on new construction and development projects to offer improved infrastructure. The requirement for improved structures in several industry verticals, such as telecommunications, oil and gas, and manufacturing, also supports marketing. These machines are gaining popularity in various industries due to their superior performance and efficiency over traditional choices. The market is also anticipated to display healthy growth due to the construction of high-rise buildings like the Jeddah Tower in Saudi Arabia and the Merdeka 118 Tower in Malaysia.

March 2024: The Liebherr Group, one of the largest construction machine manufacturers in the world, announced that its Saudi Arabian unit had secured a major order of 55 new all-terrain cranes - the biggest order in the company's history - from Arabian Machinery & Heavy Equipment Company (AMHEC).

September 2023: The first 65-tonne Terrex TRT 65 rough terrain crane to be delivered in Italy was delivered and sent to an engineering services company for work at a refinery. The new crane was delivered by Terex dealer Tecno-Gru under a long-term rental agreement to Welding Duebi, based in Fiesso Umbertiano, north of Ferrara in the Veneto region. The company performs engineering work for the oil and gas, petrochemical, and energy industries.

Asia-Pacific is predicted to be the largest market for cars worldwide due to the large number of high-rise buildings under construction, rapid infrastructure development, high number of ports, and presence of many crane OEMs.

Crane Market Trends

All-terrain Crane Segment Expected to Dominate the Market

All-terrain cranes are built to work in a variety of weather situations. All-terrain cranes are expected to acquire substantial traction worldwide, owing to the rising construction sector and industrial expansion. Construction and other end-user sectors rely heavily on all-terrain cranes. Traditional lifting and construction equipment are being replaced by all-terrain cranes, which is expected to drive the market for all-terrain cranes throughout the forecast period.

Due to their high-intensity output and capacity to operate in unfavorable terrains and weather conditions, all-terrain cranes are becoming increasingly popular in the new age of construction, which is anticipated to help in their expansion in the near future. In recent years, the need for all-terrain cranes has risen dramatically due to the growing popularity of tall building construction, mining, and power resource development.

The major players in the market are also launching new product portfolios to gain a competitive edge over their competitors. For instance-

- January 2024: Kobelco Construction Machinery Co. Ltd announced the launch of the TKE750G, its new telescopic boom crawler crane with a maximum lifting capacity of 75 metric tonnes. It has been designed for the European market. The crane has been equipped with an EU Stage V-compliant Mercedes-Benz E9H01 (Daimler OM936LA) engine and continues the same basic concept of the G series' lattice boom crawler crane models. The TKE750G was to be made available from mid-2024 onwards.

- November 2022: XCMG launched ten new electric machines, including XCA60EV, the world's first plug-in hybrid crane, at BAUMA 2022.

Thus, it is predicted that the combination of all the above factors will result in the all-terrain crane segment dominating the market for the next five years.

Asia-Pacific Anticipated to be the Fastest-growing Regional Market

The growth of public infrastructure and housing units is expected to drive the crane market in Asia-Pacific. China is one of the largest manufacturers and consumers of construction equipment globally. In the construction market, cranes hold a large chunk of the market share, making China the largest market for cranes in Asia-Pacific. In India, the government made several announcements in the Union Budget 2021-2022 to improve the country's infrastructure. For instance-

- The residential sector witnessed good sales, and launches also showed signs of an uptick during 2022. Total sales in the top seven cities were projected to exceed 360,000 units in 2022. About 220 destinations (airports/heliports/water aerodromes) under UDAN are targeted to be completed by 2026, with 1,000 routes to provide air connectivity to unconnected destinations across India.

Moreover, less human intervention with physical work, which leads to decreased labor injuries during construction work, is expected to increase the adoption of cranes for carrying forward construction activities effectively. It is expected to positively impact the overall growth in the Asia-Pacific crane market, particularly in Japan and India, where the construction industry is experiencing significant scaling development.

The construction of high-rise buildings is also gaining rapid pace in Asia-Pacific due to growing urbanization, the acute housing shortage in major cities, and high population growth. In 2022, 23 of 25 of the world's highest buildings were constructed in Asia-Pacific. Cranes are used to lift and transport heavy construction materials in the construction of high-rise buildings. Thus, the rise in the construction of high-rise buildings is also anticipated to drive the crane market in Asia-Pacific over the next five years.

Similarly, the introduction of bullet trains, a project the government is working on and will complete in the near future, is expected to provide profitable opportunities in the Indian crane market. The high degree of construction of bullet trains necessitates crane machines to lift heavy objects during the development of train structures, which is expected to generate significant demand projections for crane machines in the country in the coming years, benefiting the region's crane market, which is also expected to have a positive impact on the global crane market during the forecast period.

- November 2023: Mori Building Co. Ltd, a premier urban landscape developer in Japan, celebrated the grand opening of Azabudai Hills, a world-class new neighborhood in central Tokyo that is home to a mixed-use complex.

- April 2022: Tadano Limited announced that it was developing the world's first electric all-terrain crane as a part of its initiative to meet its carbon neutrality goals of achieving a 25% reduction in carbon emissions from product use by 2030. The crane was expected to be launched by late 2023.

Crane Industry Overview

The crane market is highly consolidated and dominated by a few major players. Some of the leading players in the market studied are Manitowoc, Tadano, Kobelco, Cargotec, Kone Cranes, Liebherr, SANY Global, Palfinger, Zoomlion, and XCMG. These players have successfully capitalized on the significant demand for reliable cranes from key players in the construction, mining, and industrial sectors.

The major players in the region are spending heavily on the research and development of new products and delivering cranes globally. They also focus on growth strategies, such as new product launches and securing major orders to strengthen their positions.

- December 2023: SANY India, a leading construction equipment manufacturer, showcased 44 machines, including 15 new models, at EXCON 2023, South Asia's largest construction equipment exhibition. The range includes electric machines designed for various applications, such as earthwork, excavation, heavy lifting, deep foundation works, mining operations, road construction, and port equipment. The company showcased its first Hybrid Truck Crane in India with diesel and electric modes for environmentally friendly, fuel-saving, and silent crane operations.

- March 2023: Palfinger Marine was officially commissioned to deliver 25 of its stiff boom cranes for the Kitakyusyu-Hibikinada offshore wind farm in Japan. The Austria-based company said that the design of the stiff boom cranes with an outreach of eight meters was completely adapted to meet the offshore wind service crane requirements and especially the EN13852-3 standard.

- October 2022: Terex Cranes introduced the CTT 222-10 Flat Top Tower Crane. To maintain safety, the adjustable slewing seat and integrated heating and cooling system keep operators comfortable, productive, and focused on their work. The maximum capacity of this model is 10 tons, the maximum jib length is 65 m, and the maximum free-standing height (C25) is 54.35 m, 72.95 m, and 67.85 m.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Growing Infrastructure Development

- 4.1.2 Industrial Growth

- 4.2 Market Challenges

- 4.2.1 Economic Volatility

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Mobile Crane

- 5.1.1.1 All-terrain Crane

- 5.1.1.2 Rough Terrain Crane

- 5.1.1.3 Crawler Crane

- 5.1.1.4 Truck-mounted Crane

- 5.1.1.5 Other Mobile Cranes

- 5.1.2 Fixed Crane

- 5.1.2.1 Monorail and Underhung

- 5.1.2.2 Overhead Track-mounted Crane

- 5.1.2.3 Tower Crane

- 5.1.3 Marine and Offshore Crane

- 5.1.3.1 Mobile Harbor Crane

- 5.1.3.2 Fixed Harbor Crane

- 5.1.3.3 Offshore

- 5.1.3.4 Ship Crane

- 5.1.1 Mobile Crane

- 5.2 By Application Type

- 5.2.1 Construction and Mining

- 5.2.2 Marine and Offshore

- 5.2.3 Industrial Applications

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 South Korea

- 5.3.3.5 Australia

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 United Arab Emirates

- 5.3.4.2 Saudi Arabia

- 5.3.4.3 South Africa

- 5.3.4.4 Brazil

- 5.3.4.5 Other Countries

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Konecranes PLC

- 6.2.2 Cargotec OYJ

- 6.2.3 Manitowoc

- 6.2.4 Terex Corporation

- 6.2.5 Tadano Limited

- 6.2.6 Kobelco Cranes Co. Ltd

- 6.2.7 Palfinger AG

- 6.2.8 Liebherr-International AG

- 6.2.9 Zoomlion Heavy Industry Science and Technology Co. Ltd

- 6.2.10 Favelle Favco Group

- 6.2.11 Hitachi Sumitomo Heavy Industries Construction Cranes Co. Ltd

- 6.2.12 XCMG Group

- 6.2.13 SANY Group

- 6.2.14 Shanghai Heavy Industries Co. Ltd (ZPMC)

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Green and Sustainable Cranes