|

市場調查報告書

商品編碼

1685955

北美軟質包裝:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)North America Flexible Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

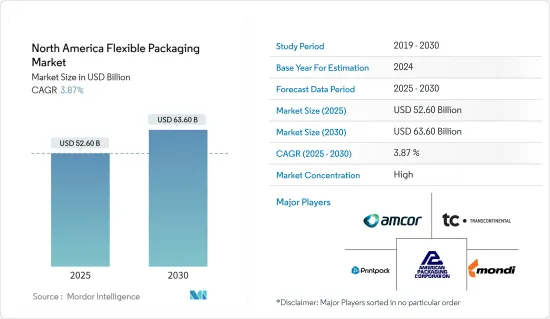

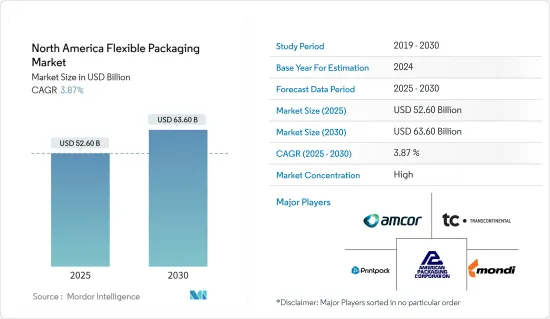

北美軟質包裝市場規模預計在 2025 年為 526 億美元,預計到 2030 年將達到 636 億美元,預測期內(2025-2030 年)的複合年成長率為 3.87%。

就出貨量而言,預計市場將從 2025 年的 1,087 萬噸成長到 2030 年的 1,289 萬噸,預測期內(2025-2030 年)的複合年成長率為 3.48%。

便捷包裝需求的不斷成長將推動市場成長

受便利包裝解決方案需求不斷成長的推動,北美軟質包裝市場正經歷強勁成長。這種快速成長很大程度上歸功於消費行為的不斷演變和電子商務的快速擴張。例如,美國超級市場和雜貨店的銷售額預計將從 2021 年的 7,478.4 億美元成長到 2022 年的 8,102.8 億美元,凸顯了對包裝商品的需求日益成長。軟質包裝產業正在透過提供便攜性、延長保存期限和易於使用的創新解決方案來應對。

主要亮點

- 立式袋的流行:立式袋越來越受歡迎,因為它們重量輕、生產成本低,而且製造商和消費者都易於使用。

- 冷凍食品需求量大:冷凍食品產業是軟質包裝需求的主要驅動力,需要高性能的阻隔性能以防止冷凍並延長保存期限。

- 電子商務銷售成長:美國電子商務產業預計將在 2023 年第二季創造 2,775.82 億美元的銷售額,凸顯了對線上零售產品有效保護包裝的需求。

人口結構和生活方式的變化將影響市場趨勢:

人口結構和生活方式的變化正在重塑軟質包裝市場。當今的消費者重視健康、便利性和永續性,從而推動了包裝創新。

主要亮點

- 消費者偏好:根據軟質包裝協會的一項調查,60% 的消費者願意為易於存放、可重新密封和延長保存期限的包裝支付更多費用。

- 人口老化:老年人口的不斷成長推動了對易於打開的包裝解決方案的需求,並促進了黏合劑和包裝設計的先進包裝。

- 都市化和便利化:快速的都市化和快節奏的生活方式推動了對攜帶式包裝形式的需求,尤其是提高便利性的份量控制解決方案。

永續性措施推動創新和市場成長:

永續性已成為軟質包裝產業關注的重點。公司正在投資環保材料和可回收包裝,以滿足消費者的偏好和監管要求。

主要亮點

- 致力於循環經濟:2023 年 9 月,加拿大塑膠公約 (CPP) 發布了一項五年計劃,旨在推動加拿大軟質塑膠包裝的循環經濟。

- 新的可回收產品:2023 年 8 月,Amcor 在北美推出了路邊可回收的 AmFiber 高性能紙包裝。

- 防水包裝:JBM Packaging 推出的可回收防水包裝 HydroBlox 就是永續性推動產業產品開發的一個例子。

- 技術進步和市場擴張推動成長:

軟質包裝市場對新技術和產能擴張的投資正在增加,推動創新和成長。

主要亮點

- 開發單一材料包裝:TC Transcontinental Packaging 已投資 6,000 萬美元開發可回收的軟塑膠解決方案,包括在北美生產雙向拉伸聚乙烯 (BOPE) 的新薄膜生產線。

- 設施擴建 Accredo Packaging 已在德克薩斯州完成了耗資 1000 萬美元的擴建,增加了 83,000 平方英尺的空間以支持永續的軟質包裝生產。

- 智慧包裝:RFID 標籤、2D碼和感測器等技術擴大被整合到軟質包裝中,以增強可追溯性、改善品管並推動消費者參與。

- 市場整合和策略收購將塑造產業格局:

隨著公司尋求擴大其投資組合和市場範圍,併購變得越來越普遍。

最近的收購 Sonoco 於 2023 年 9 月以 1.05 億美元收購了 Graphic Packaging Corporation 的軟質包裝部門,使其在軟質包裝市場的佔有率加倍。

主要亮點

- SEE 收購 Liquibox:2023 年 2 月,SEE 完成對 Liquibox 的 11.5 億美元收購,以加速 CRYOVAC 品牌在液體和流體包裝領域的成長。

- 未來展望 走在創新與永續性的前沿

在永續性、創新和不斷變化的消費者需求的推動下,北美軟質包裝市場正在經歷重大變化。

主要亮點

- 專注於循環經濟:整個價值鏈的協作努力正在朝著建立更永續的軟質包裝方法的方向發展。

- 數位印刷的擴展:高品質的數位印刷技術可以實現可客製化、經濟高效的包裝解決方案,進一步加速該領域的成長。

- 電子商務的影響:電子商務的持續成長將推動對保護性和高效包裝解決方案的持續需求。

- 技術採用:公司將使用技術來提高可追溯性,減少廢棄物,最佳化供應鏈中的物流,並將更依賴資料主導的決策。

北美軟質包裝市場趨勢

食品佔大部分

北美軟質包裝市場以食品業為主,市場佔有率在 2023 年將達到 52.60%。該產業預計將從 2023 年的 255 億美元成長到 2029 年的 311.2 億美元,複合年成長率穩定在 3.27%。

- 對便利性和生活方式的需求:現代快節奏的生活方式推動了對方便和易於準備的食品的需求,從而推動了對軟質包裝的需求,尤其是塑膠立式袋。

- 環保包裝創新:JBM Packaging 的 HydroBlox 防水性能比標準紙包裝高出 200%。

- 季節性糖果零食銷售:糖果零食包裝的需求受到萬聖節、復活節和情人節等主要節日的影響,這些節日推動了季節性包裝設計的創新。

加拿大正在經歷強勁成長

加拿大正成為北美軟質包裝市場成長最快的地區,預計 2024 年至 2029 年的複合年成長率為 5.27%。預計該市場規模將從 2023 年的 61 億美元成長到 2029 年的 83.5 億美元。

- 紙質包裝的成長:紙質包裝產品在加拿大正在強勁擴張,糧農組織預測到 2024 年該國的紙張生產能力將達到 1,062 萬噸。

- 產業和政府支持:加拿大森林產品委員會(FPAC)等組織正在透過宣傳和支持木材、紙漿和造紙業來推動靈活和可回收包裝解決方案的採用。

北美軟質包裝市場概況

北美軟質包裝市場的競爭格局由大型跨國公司和專業化企業主導。 Amcor PLC、Berry Global Group Inc.和Sealed Air Corporation是擁有全球資源和技術實力的領先公司。

創新是關鍵驅動力,像 Amcor 這樣的公司專注於永續性,並將在 2023 年推出可回收解決方案,例如 AmFiber Performance Paper。

投資產能擴張:TC Transcontinental Packaging 正在投資 6,000 萬美元用於可回收軟質包裝,凸顯其對創新和永續性的持續關注。

永續性策略:為了保持競爭力,市場競爭對手正在積極投資可回收材料和數位印刷等技術。

未來市場成功的策略

為了在北美軟質包裝市場保持競爭力,企業需要採用幾個關鍵策略:

永續性第一:優先考慮環保材料和可回收解決方案對於滿足消費者需求和監管要求至關重要。

技術投資:對智慧包裝技術和數位印刷的投資將有助於提高生產效率和創新包裝。

策略性收購:透過併購擴大市場範圍和產品系列非常重要,正如 Sonoco 收購 Graphic Packaging 所見。

電子商務準備:為蓬勃發展的電子商務市場量身訂做包裝解決方案,同時利用區塊鏈和資料分析等先進技術最佳化供應鏈,將成為未來成功的關鍵。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 評估近期地緣政治發展對軟質包裝市場的影響

- 進出口分析-北美軟質包裝市場

第5章 市場動態

- 市場促進因素

- 便利包裝需求不斷成長推動市場成長

- 人口和生活方式的變化

- 永續性措施推動創新和市場成長

- 市場挑戰

- 環境和回收問題

- 永續包裝輕質可回收/可回收聚合物

- 軟質包裝市場的關鍵技術發展

- 美國軟質包裝市場專利分析

- 行業標準和法規

第6章 市場細分

- 依材料類型

- 塑膠

- 聚乙烯 (PE)

- 雙軸延伸聚丙烯(BOPP)

- 流延聚丙烯(CPP)

- 乙烯 - 乙烯醇(EVOH)

- 其他(PVC、PA、生質塑膠)

- 紙

- 鋁箔

- 塑膠

- 依產品類型

- 小袋

- 包包

- 薄膜包裝

- 其他產品類型

- 按最終用戶產業

- 食物

- 冷凍和冷藏食品

- 肉類、家禽和魚類

- 水果和蔬菜

- 麵包和糖果零食

- 乾燥和已調理食品

- 寵物食品

- 其他食品

- 飲料

- 菸草

- 化妝品和個人護理

- 其他最終用戶產業

- 食物

- 按國家

- 美國

- 加拿大

7. 北美可堆肥包裝市場分析

- 市場規模及成長預測

- 根據產品類型和應用的當前需求分析

- 依樹脂類型細分:樹脂類型:塑膠 PLA、PHA 等。紙基:模製纖維、塗佈未漂白等。

- 北美主要市場參與企業名單

- 家用和工業用可堆肥包裝的分類

第8章 競爭格局

- 公司簡介

- Amcor PLC

- Mondi PLC

- Transcontinental Inc.

- American Packaging Corporation

- Printpack Inc.

- Sigma Plastics Group Inc.

- Novolex Holdings Inc.

- Berry Global Inc.

- Sealed Air Corp.

- PPC Flexible Packaging LLC

- Constantia Flexibles

- ProAmpac LLC

- Emmerson Packaging

- Charter Next Generation Inc.

第9章投資分析

第 10 章:市場的未來

The North America Flexible Packaging Market size is estimated at USD 52.60 billion in 2025, and is expected to reach USD 63.60 billion by 2030, at a CAGR of 3.87% during the forecast period (2025-2030). In terms of shipment volume, the market is expected to grow from 10.87 million tons in 2025 to 12.89 million tons by 2030, at a CAGR of 3.48% during the forecast period (2025-2030).

Increased Demand for Convenient Packaging Drives Market Growth:

The North America Flexible Packaging Market is experiencing robust growth, driven by the increasing demand for convenient packaging solutions. This surge is largely due to evolving consumer behaviors and the rapid expansion of e-commerce. For instance, supermarket and grocery store sales in the U.S. reached USD 810.28 billion in 2022, up from USD 747.84 billion in 2021, underscoring the rising demand for packaged goods. The flexible packaging industry is responding with innovative solutions that offer portability, extended shelf life, and user-friendliness.

Key Highlights

- Popularity of stand-up pouches: Stand-up pouches are increasingly popular due to their lightweight, lower production costs, and ease of use for both manufacturers and consumers.

- High demand in frozen foods: The frozen food sector is a major driver of flexible packaging demand, requiring high-performance barrier properties to prevent freezer burn and prolong shelf life.

- E-commerce sales growth: The U.S. e-commerce sector generated USD 277.582 billion in Q2 2023, highlighting the need for effective, protective packaging for online retail products.

Changing Demographics and Lifestyle Factors Shape Market Trends:

Demographic shifts and lifestyle changes are reshaping the flexible packaging market. Consumers today prioritize health, convenience, and sustainability, prompting new packaging innovations.

Key Highlights

- Consumer preferences: A study by the Flexible Packaging Association found that 60% of consumers are willing to pay more for packaging that offers easy storage, resealability, and extended shelf life.

- Aging population: The growing elderly demographic is driving demand for easy-to-open packaging solutions, pushing advancements in adhesives and packaging design.

- Urbanization and convenience: Rapid urbanization and fast-paced lifestyles are fueling the demand for on-the-go packaging formats, particularly portion-controlled solutions that enhance convenience.

Sustainability Initiatives Drive Innovation and Market Growth:

Sustainability has become a critical focus in the flexible packaging industry. Companies are investing in eco-friendly materials and recyclable packaging to align with consumer preferences and regulatory demands.

Key Highlights

- Circular economy initiatives: In September 2023, the Canada Plastics Pact (CPP) announced a five-year plan aimed at boosting the circular economy for flexible plastic packaging across Canada.

- New recyclable products: In August 2023, Amcor introduced its curbside-recyclable AmFiber Performance Paper packaging in North America, designed to meet repulpability standards for curbside recycling.

- Water-resistant packaging: JBM Packaging's launch of HydroBlox, a recyclable and water-resistant packaging paper, is an example of how sustainability drives product development in the industry.

- Technological Advancements and Market Expansions Fuel Growth:

The flexible packaging market is seeing increased investment in new technologies and capacity expansions, fostering innovation and growth.

Key Highlights

- Mono-material packaging development: TC Transcontinental Packaging invested USD 60 million in developing recyclable flexible plastic solutions, such as a new film line to produce biaxially oriented polyethylene (BOPE) in North America.

- Facility expansion: Accredo Packaging completed a USD 10 million expansion in Texas, adding 83,000 square feet of space to support sustainable flexible packaging production.

- Smart packaging: Technologies like RFID tags, QR codes, and sensors are increasingly being integrated into flexible packaging to enhance traceability, improve quality control, and drive consumer engagement.

- Market Consolidation and Strategic Acquisitions Shape Industry Landscape:

Mergers and acquisitions are becoming increasingly common as companies seek to expand their portfolios and market reach.

Recent acquisitions: Sonoco acquired Graphic Packaging Corporation's flexible packaging division for USD 105 million in September 2023, doubling its presence in the flexible packaging market.

Key Highlights

- SEE's acquisition of Liquibox: In February 2023, SEE completed the USD 1.15 billion acquisition of Liquibox, accelerating the growth of its CRYOVAC brand in fluids and liquids packaging.

- Future Outlook: Innovation and Sustainability at the Forefront:

The North American flexible packaging market is on the cusp of significant changes, driven by sustainability, innovation, and evolving consumer demands.

Key Highlights

- Circular economy focus: Collaborative efforts across the value chain are increasingly geared towards establishing more sustainable approaches to flexible packaging.

- Digital printing expansion: High-quality digital printing technologies are enabling customizable, cost-effective packaging solutions, further enhancing the sector's growth.

- E-commerce impact: The continued rise of e-commerce will drive ongoing demand for protective and efficient packaging solutions.

- Tech adoption: Companies are expected to increasingly rely on data-driven decision-making, using technologies to improve traceability, reduce waste, and optimize logistics within their supply chains.

North America Flexible Packaging Market Trends

Food to Holds Major Share

The food industry dominates the North America Flexible Packaging Market, representing a 52.60% market share in 2023. This segment is expected to grow from USD 25.50 billion in 2023 to USD 31.12 billion by 2029, with a steady CAGR of 3.27%.

- Convenience and lifestyle demands: Modern, fast-paced lifestyles are boosting demand for convenient, easy-to-prepare food, driving flexible packaging needs, particularly for plastic stand-up pouches.

- Eco-friendly packaging innovations: Sustainability is shaping product development, as seen with JBM Packaging's HydroBlox, which boasts 200% greater water resistance than standard paper packaging.

- Seasonal confectionery sales: Packaging demand from the confectionery industry is influenced by major holidays like Halloween, Easter, and Valentine's Day, driving innovation in seasonal packaging designs.

Canada to Witness Major Growth

Canada is emerging as the fastest-growing region within the North America Flexible Packaging Market, with a projected CAGR of 5.27% from 2024 to 2029. The market is expected to grow from USD 6.10 billion in 2023 to USD 8.35 billion by 2029.

- Growth in paper-based packaging: Canada is seeing strong expansion in paper-based packaging products, supported by projections from the FAO that the country's paper production capacity will reach 10.62 million metric tons by 2024.

- Industry and government support: Organizations like the Forest Products Association of Canada (FPAC) are driving the adoption of flexible, recyclable packaging solutions through advocacy and support for the wood, pulp, and paper industries.

North America Flexible Packaging Market Overview

The competitive landscape of the North American flexible packaging market is dominated by large multinational corporations and specialized firms. Amcor PLC, Berry Global Group Inc., and Sealed Air Corporation are among the leading players, leveraging their global resources and technological strengths.

Innovation as a key driver: Companies like Amcor are focusing on sustainability, launching curbside-recyclable solutions such as AmFiber Performance Paper in 2023.

Investment in capacity expansion: TC Transcontinental Packaging's USD 60 million investment in recyclable flexible packaging highlights the ongoing emphasis on innovation and sustainability.

Sustainability strategies: To remain competitive, market leaders are heavily investing in recyclable materials and technologies like digital printing, while also seeking expansion through mergers and acquisitions.

Strategies for Future Success in the Market

To stay competitive in the North America Flexible Packaging Market, companies must adopt several key strategies:

Sustainability first: Prioritizing eco-friendly materials and recyclable solutions is essential to meet both consumer demand and regulatory requirements.

Technological investments: Investing in smart packaging technologies and digital printing will help enhance production efficiency and packaging innovation.

Strategic acquisitions: Expanding market reach and product portfolios through mergers and acquisitions, as seen with Sonoco's acquisition of Graphic Packaging, will be crucial.

E-commerce readiness: Tailoring packaging solutions for the booming e-commerce market while optimizing supply chains with advanced technologies like blockchain and data analytics will be key for future success.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of the Recent Geopolitical Developments on the Flexible Packaging Market

- 4.4 Exim Analysis - North America Flexible Packaging Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Demand for Convenient Packaging Drives Market Growth

- 5.1.2 Changing Demographic and Lifestyle Factors

- 5.1.3 Sustainability Initiatives Drive Innovation and Market Growth

- 5.2 Market Challenges

- 5.2.1 Concerns Regarding the Environment and Recycling

- 5.3 Sustainable Packaging Light Weighting Recycled and Recyclable Polymers

- 5.4 Key Technological Developments in Flexible Packaging Allied Markets

- 5.5 Patent Analysis For Flexible Packaging Market in the United States

- 5.6 Industry Standards and Regulations

6 MARKET SEGMENTATION

- 6.1 By Material Type

- 6.1.1 Plastics

- 6.1.1.1 Polyethene (PE)

- 6.1.1.2 Bi-orientated Polypropylene (BOPP)

- 6.1.1.3 Cast Polypropylene (CPP)

- 6.1.1.4 Ethylene Vinyl Alcohol (EVOH)

- 6.1.1.5 Other Types (PVC, PA, Bioplastics)

- 6.1.2 Paper

- 6.1.3 Aluminium Foil

- 6.1.1 Plastics

- 6.2 By Product Type

- 6.2.1 Pouches

- 6.2.2 Bags

- 6.2.3 Films and Wraps

- 6.2.4 Other Product Types

- 6.3 By End-User Industry

- 6.3.1 Food

- 6.3.1.1 Frozen & Chilled Food

- 6.3.1.2 Meat, Poultry & Fish

- 6.3.1.3 Fruits & Vegetables

- 6.3.1.4 Bakery & Confectionary

- 6.3.1.5 Dried & Ready Meals

- 6.3.1.6 Pet Food

- 6.3.1.7 Other Food Products

- 6.3.2 Beverages

- 6.3.3 Tobacco

- 6.3.4 Cosmetics & Personal Care

- 6.3.5 Other End-user Industries

- 6.3.1 Food

- 6.4 By Country

- 6.4.1 United States

- 6.4.2 Canada

7 NORTH AMERICA COMPOSTABLE PACKAGING MARKET ANALYSIS

- 7.1 Market Size and Growth Forecast

- 7.2 Current Demand Analysis Based on Product Types and Application

- 7.3 Breakdown By Resin Type: Plastic PLA, PHA, Etc., Paper-based - Molded Fiber, Coated Unbleached, Etc.

- 7.4 List of Key Market Participants in North America

- 7.5 Breakdown By Home & Industrial Compostable Packaging

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Amcor PLC

- 8.1.2 Mondi PLC

- 8.1.3 Transcontinental Inc.

- 8.1.4 American Packaging Corporation

- 8.1.5 Printpack Inc.

- 8.1.6 Sigma Plastics Group Inc.

- 8.1.7 Novolex Holdings Inc.

- 8.1.8 Berry Global Inc.

- 8.1.9 Sealed Air Corp.

- 8.1.10 PPC Flexible Packaging LLC

- 8.1.11 Constantia Flexibles

- 8.1.12 ProAmpac LLC

- 8.1.13 Emmerson Packaging

- 8.1.14 Charter Next Generation Inc.