|

市場調查報告書

商品編碼

1692157

中東和非洲軟包裝:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)Middle East And Africa Flexible Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

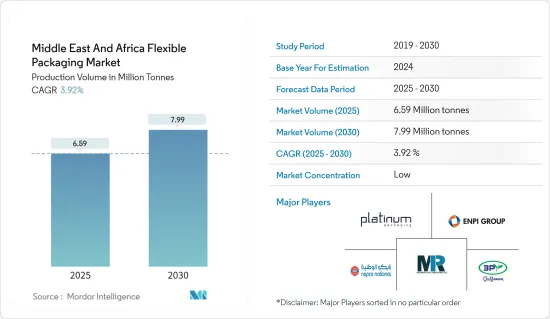

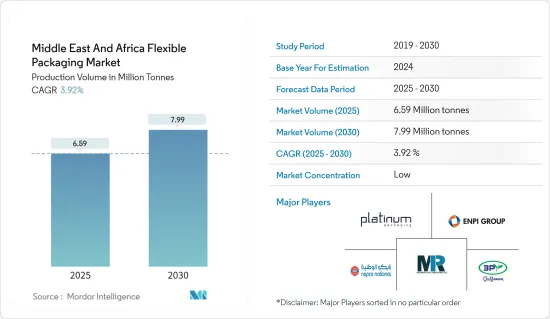

根據產量計算,中東和非洲的軟包裝市場規模預計將從 2025 年的 659 萬噸擴大到 2030 年的 799 萬噸,預測期內(2025-2030 年)的複合年成長率為 3.92%。

靈活的包裝可以提供更經濟、更可客製化的產品包裝選擇。它在需要多功能包裝的行業中特別有用,例如食品和飲料、個人護理和藥物。軟包裝由於其效率和成本效益而變得越來越受歡迎。

主要亮點

- 受消費者期望變化和人口成長的推動,該地區的包裝業務在過去十年中一直保持持續成長。隨著該地區見證包裝材料的各種創新,它可能會繼續關注永續性和環境方面。對紙張、紙板、再生 PET (rPET) 和生質塑膠等可回收和永續包裝材料的需求不斷成長,正在推動市場成長。

- 此外,阿拉伯聯合大公國消費者食品偏好的變化為包裝行業,尤其是食品和飲料行業帶來了巨大的成長機會。根據阿拉伯聯合大公國金融機構 Alpen Capital 的報告,由於中東和非洲地區的戰略定位和不斷成長的人口,該地區的食品業預計將實現成長。疫情爆發以來,網路食品宅配激增,增加了對包裝紙、套標和標籤等軟包裝的需求,推動了產業成長。

- 此外,西方飲食習慣在國內消費者的影響日益增強,也推動了對包裝食品的需求。移民、遊客和年輕消費者進一步推動了這一趨勢,他們推動了對已調理食品、包裝和冷凍食品的需求。

- 立式袋對於包裝食品製造商非常有利,因為與硬包裝相比,它們更輕、使用的材料更少且運輸成本更低。由於該地區飲料業對袋裝飲料的消費量不斷增加,預計市場需求將會增加。

- 由於回收基礎設施有限,中東地區的軟包裝產業面臨重大挑戰。隨著全球和地區對永續性問題的關注日益加深,這個問題變得越來越突出。儘管人們對環境問題的意識不斷增強,政府也採取了各種措施來促進回收和減少廢棄物,但對適當的回收設施和系統的需求仍然是一個主要障礙。這種情況為該地區的軟包裝製造商和用戶帶來了複雜的動態,他們難以平衡市場需求和新興的永續性要求。

中東和非洲軟包裝市場的趨勢

食品業是最大的終端用戶

- 由於食品加工技術的進步和消費者生活方式的改變,中東包裝食品市場正在成長。預計這些因素將在預測期內增加產品需求並推動軟包裝的成長。

- 此外,中東地區人口不斷成長,對肉類、魚貝類和家禽的需求不斷增加,也推動了對軟質塑膠包裝的需求。由於製造商尋求滿足消費者對便利性和延長保存期限的偏好,包裝材料和設計的創新也助長了這一趨勢。

- 此外,阿拉伯聯合大公國和沙烏地阿拉伯等中東國家的電子商務成長也推動了對簡便食品的需求。這一趨勢正在重塑薄膜、包裝紙、小袋和袋子等軟包裝的模式,這些包裝有助於長時間保持食物的新鮮和溫暖。

- 海灣合作理事會地區是中東和非洲的主要地區,該地區的食品業在疫情後已經恢復。人口的成長、勞動人口的增加以及大量外籍人士的湧入推動了該地區食品產業的發展。該地區追求高營養價值的消費者對健康飲食習慣的認知不斷提高,導致對生鮮食品食品和有機食品的需求增加。由於塑膠袋重量輕、強度高,因此在食品包裝中使用塑膠袋和塑膠袋推動了對軟質塑膠包裝的需求。

- 根據Alpen Capital的報告,隨著人均收入和人口成長,海灣合作理事會國家的食品消費量預計將在2027年增加到5,620萬噸。據估計,沙烏地阿拉伯是該地區最大的食品消費量,其次是阿拉伯聯合大公國和巴林。

沙烏地阿拉伯佔主要市場佔有率

- 沙烏地阿拉伯位於三大洲交匯處的戰略位置,使其成為進入中東、非洲和亞洲市場的關鍵網路基地台。沙烏地阿拉伯發達的基礎設施、高效的交通網路和先進的物流設施為全球貿易和投資機會提供了顯著優勢。

- 對於尋求新機會和成長的企業來說,沙烏地阿拉伯是一個具有吸引力的目的地。沙烏地阿拉伯雄心勃勃的經濟改革、戰略舉措和不斷發展的商業環境正在將該國轉變為潛在的全球商業中心。這項轉型體現了沙烏地阿拉伯在國際市場上日益成長的重要性,並正在吸引全球包裝企業越來越多的關注。

- 隨著食品、零售、消費品和醫藥等行業對軟包裝解決方案的需求不斷成長,越來越多的公司將目光轉向沙烏地阿拉伯。沙烏地阿拉伯的戰略位置使其在塑造區域和國際貿易、投資和創新方面發揮關鍵作用。

- 已調理食品和冷凍食品部門提供食用前無需或只需極少準備的已調理食品。由於快節奏的城市生活方式和多元文化的影響,這個細分市場在中東國家,尤其是沙烏地阿拉伯越來越受歡迎。

- 沙烏地阿拉伯加工肉品、海鮮和肉類替代品的市場正在成長。 2023年的市場規模約為1,499.10噸。預計到 2027 年這一數量將增加到約 1,839.50 噸,反映出消費者對加工肉品的偏好不斷變化和增加。

中東和非洲軟包裝產業概況

中東和非洲的軟包裝市場較為分散,有多家參與者分佈在該地區。競爭程度取決於影響市場的各種因素,例如品牌識別、強大的競爭策略、透明度和公司集中度。市場的主要參與者包括 Napco National、3P Gulf Group、Platinum Packaging Ltd、Aalmir Plastic Industries LLC、ENPI Group 等。

- 2024 年 6 月 - 領先的永續包裝解決方案主要企業Furutamaiki 透露了整合其在阿拉伯聯合大公國 (UAE) 的軟包裝製造業務的計劃。該策略包括維護傑貝阿里的設施,同時大幅擴大拉斯海馬的設施。該公司表示,此舉旨在精簡業務,提高競爭地位,為未來的區域擴張做好準備。

- 2024 年 5 月 - Napco National 策略性收購阿拉伯聯合大公國品牌 Alsharq Plas LLC,以擴大其包裝部門。收購完成後,Alsharq Plas LLC 將更名為 Napco Sharq Plas LLC。此舉增強了兩家公司滿足海灣合作理事會地區客戶不斷變化的需求的能力。此外,此次收購預計將提高 Napco National 的市佔率。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業生態系分析:供應商、材料製造商等。

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 競爭對手之間的競爭強度

- 替代品的威脅

- 進出口分析

第5章 市場動態

- 市場促進因素

- 加工食品需求穩定成長

- 市場限制

- 原料成本高且回收基礎設施有限

- 市場機會

- 對永續包裝解決方案的需求不斷增加

第6章 市場細分

- 依材料類型

- 塑膠

- 聚乙烯 (PE)

- 聚丙烯(PP)

- 聚對苯二甲酸乙二醇酯(PET)

- 其他塑膠(PVC、PA等)

- 紙

- 鋁

- 可堆肥材料(PLA、PBS、PHA、PBAT等)

- 塑膠

- 依產品類型

- 袋子和包包

- 薄膜包裝

- 熱成型薄膜

- 拉伸膜

- 收縮膜

- 捲邊膜

- 標籤和套管

- 蓋子和內襯

- 泡殼包裝

- 按最終用戶產業

- 食物

- 飲料

- 藥品

- 化妝品和個人護理

- 家居用品

- 寵物護理

- 菸草

- 其他終端用戶產業(電子、化工、農產品等)

- 按國家

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 摩洛哥

- 埃及

- 南非

第7章 競爭格局

- 公司簡介

- Napco National

- 3P Gulf Group

- Platinum Packaging Ltd

- Aalmir Plastic Industries LLC

- ENPI Group

- Amber Packaging Industries LLC

- Emirates Printing Press(LLC)

- Huhtamaki Flexibles UAE(Huhtamki Oyj)

- Gulf East Paper and Plastic Industries LLC

- Radiant Packaging Industry LLC

- Arabian Flexible Packaging LLC

- Integrated Plastics Packaging LLC

- Constantia Flexibles Afripack(Constantia Flexibles)

- SwissPac UAE

- Hotpack Packaging Industries LLC

- Falcon Pack

第8章 投資展望

第9章:未來市場展望

The Middle East And Africa Flexible Packaging Market size in terms of production volume is expected to grow from 6.59 million tonnes in 2025 to 7.99 million tonnes by 2030, at a CAGR of 3.92% during the forecast period (2025-2030).

Flexible packaging allows more economical and customizable options for packaging products. It is particularly useful in industries requiring versatile packaging, including food and beverage, personal care, and pharmaceutical industries. Flexible packaging has grown popular due to its high efficiency and cost-effectiveness.

Key Highlights

- The packaging business in the region has experienced consistent growth over the last decade due to changing consumer expectations and a rising population. Sustainability and environmental aspects might continue to be emphasized in the region as the market is witnessing various innovations in packaging materials. Increased demand for recyclable and sustainable packaging materials, such as paper and cardboard, recycled PET (rPET), and bioplastics, are driving market growth.

- Moreover, the changing consumer food preferences in the United Arab Emirates have created significant growth opportunities in the packaging industry, especially for the food and beverage industry. According to a report by Alpen Capital, a financial institute in the United Arab Emirates, the food industry in the Middle East and African region is estimated to grow due to its strategic location and growing population. Post-pandemic, the surge in online food delivery has enhanced the demand for flexible packaging such as wraps, sleeves, labels, and others, driving industry growth.

- Additionally, the increasing influence of Western eating habits among domestic consumers has boosted the demand for packaged foods. This trend is further supported by immigrants, tourists, and young consumers driving the demand for ready-to-eat, processed, and frozen foods.

- The lighter weight, reduced material use, and lower shipping cost of stand-up pouches than the rigid packaging benefit the packaged food producers. With the beverage industry increasingly consuming pouches in the region, the demand from the market is expected to increase.

- The Middle East faces significant challenges in the flexible packaging industry due to its limited recycling infrastructure. This issue has become increasingly prominent as sustainability concerns gain traction globally and within the region. Despite growing awareness of the environmental problems and implementing various government initiatives to promote recycling and waste reduction, the need for adequate recycling facilities and systems continues to pose a substantial obstacle. This situation creates a complex dynamic for flexible packaging manufacturers and users in the region as they strive to balance market demands with emerging sustainability requirements.

Middle East and Africa Flexible Packaging Market Trends

Food Industry to be the Largest End User

- The Middle East packaged food market is experiencing growth due to advancements in food processing techniques and changing consumer lifestyles. These factors are expected to increase product demand, driving the growth of flexible packaging during the forecast period.

- Further, the rising Middle Eastern population and a growing appetite for meat, seafood, and poultry fuel the demand for flexible plastic packaging. Innovations in packaging materials and designs also contribute to this trend, as manufacturers seek to meet consumer preferences for convenience and extended shelf life.

- In addition, the growth of e-commerce in Middle Eastern countries, such as the United Arab Emirates and Saudi Arabia, is driving demand for convenience food. This trend is reshaping the flexible packaging landscape, including films, wraps, pouches, and bags, which help maintain food freshness and warmth for extended periods.

- The food industry in the GCC region, a major chunk of Middle East and Africa, recovered after the pandemic. The growing population, coupled with the increasing number of working professionals and many expatriates, is a major driver for the region's food industry. Growing awareness of healthy eating habits of consumers in the region seeking high nutritional value has led to rising demand for fresh and organic food items. The use of plastic bags and pouches for food packaging, as pouches are low in weight and strength, drives the demand for flexible plastic packaging.

- According to a report by Alpen Capital, food consumption in GCC countries is estimated to grow to 56.2 million metric tons in 2027, driven by the increase in per capita income and growing population. Saudi Arabia is estimated to be the largest country in the region in terms of food consumption, followed by the United Arab Emirates and Bahrain.

Saudi Arabia Holds Major Market Share

- Saudi Arabia's strategic location at the intersection of three continents positions it as a critical access point to markets in the Middle East, Africa, and Asia. The country's well-developed infrastructure, efficient transportation networks, and advanced logistics facilities provide significant advantages for global trade and investment opportunities.

- Saudi Arabia has positioned itself as an attractive destination for businesses seeking new opportunities and growth. The Kingdom's ambitious economic reforms, strategic initiatives, and evolving business landscape transform it into a potential global business center. This transformation has garnered increasing attention from packaging businesses worldwide, reflecting Saudi Arabia's growing importance in the international market.

- With the demand for flexible packaging solutions rising in sectors like food, retail, consumer goods, and pharmaceuticals, businesses are increasingly eyeing Saudi Arabia. The country's strategic positioning will make it a key player in shaping regional and international trade, investment, and innovation.

- The Ready-to-Eat Meals and Frozen Food segment offers prepared food that requires minimal or no preparation before consumption. This segment is gaining popularity in Middle Eastern countries, particularly in Saudi Arabia, due to the fast-paced urban lifestyle and diverse cultural influences.

- The Saudi Arabian market for processed meat, seafood, and meat alternatives is experiencing growth. In 2023, the market volume was approximately 1,499.10 metric tons. Projections indicate an increase to about 1,839.50 metric tons by 2027, reflecting the country's changing and growing consumer preferences for processed meat.

Middle East and Africa Flexible Packaging Industry Overview

The Middle East and Africa Flexible Packaging Market are fragmented, with multiple players in the market operating regionally. The degree of competition depends on various factors affecting the market, such as brand identity, powerful competitive strategy, degree of transparency, and firm concentration ratio. Some of the major players in the market are Napco National, 3P Gulf Group, Platinum Packaging Ltd, Aalmir Plastic Industries LLC, and ENPI Group, among others.

- June 2024 - Huhtamaki, a key player in sustainable packaging solutions, has revealed plans to consolidate its Flexible Packaging manufacturing operations in the United Arab Emirates (UAE). The strategy involves retaining its Jebel Ali facility while significantly enlarging its Ras Al Khaimah site. According to the company, this move aims to streamline operations, elevate competitiveness, and fortify its foothold for future regional expansion.

- May 2024 - Napco National expanded its packaging division by strategically acquiring Alsharq Plas LLC, a brand based in the United Arab Emirates. Post-acquisition, Alsharq Plas LLC will be rebranded as Napco Sharq Plas LLC. This move is poised to bolster both companies' capabilities in meeting the increasingly sophisticated demands of customers in the GCC region. Furthermore, the acquisition is expected to bolster Napco National's market presence.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Ecosystem Analysis Suppliers, Material Manufacturers, etc.

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitute Products

- 4.4 Import-Export Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Steady Rise in Demand for Processing Food

- 5.2 Market Restraints

- 5.2.1 High Raw Material Costs and Limited Recycling Infrastructure

- 5.3 Market Opportunities

- 5.3.1 Growing Demand for Sustainable Packaging Solution

6 MARKET SEGMENTATION

- 6.1 By Material Type

- 6.1.1 Plastics

- 6.1.1.1 Polyethene (PE)

- 6.1.1.2 Polypropylene (PP)

- 6.1.1.3 Polyethylene Terephthalate (PET )

- 6.1.1.4 Other Plastics (PVC, PA, etc.)

- 6.1.2 Paper

- 6.1.3 Aluminum

- 6.1.4 Compostable Materials (PLA, PBS, PHA, PBAT, etc.)

- 6.1.1 Plastics

- 6.2 By Product Type

- 6.2.1 Pouches And Bags

- 6.2.2 Films And Wraps

- 6.2.2.1 Thermoforming Film

- 6.2.2.2 Stretch Films

- 6.2.2.3 Shrink Film

- 6.2.2.4 Cling Film

- 6.2.3 Labels And Sleeves

- 6.2.4 Lidding And Liners

- 6.2.5 Blister Packaging

- 6.3 By End-user Industry

- 6.3.1 Food

- 6.3.2 Beverages

- 6.3.3 Pharmaceuticals

- 6.3.4 Cosmetics And Personal Care

- 6.3.5 Household Care

- 6.3.6 Pet Care

- 6.3.7 Tobacco

- 6.3.8 Other End-user Industries (Electronics, Chemicals, Agricultural Products etc.)

- 6.4 By Country

- 6.4.1 Saudi Arabia

- 6.4.2 United Arab Emirates

- 6.4.3 Morocco

- 6.4.4 Egypt

- 6.4.5 South Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Napco National

- 7.1.2 3P Gulf Group

- 7.1.3 Platinum Packaging Ltd

- 7.1.4 Aalmir Plastic Industries LLC

- 7.1.5 ENPI Group

- 7.1.6 Amber Packaging Industries LLC

- 7.1.7 Emirates Printing Press (LLC)

- 7.1.8 Huhtamaki Flexibles UAE (Huhtamki Oyj)

- 7.1.9 Gulf East Paper and Plastic Industries LLC

- 7.1.10 Radiant Packaging Industry LLC

- 7.1.11 Arabian Flexible Packaging LLC

- 7.1.12 Integrated Plastics Packaging LLC

- 7.1.13 Constantia Flexibles Afripack (Constantia Flexibles)

- 7.1.14 SwissPac UAE

- 7.1.15 Hotpack Packaging Industries LLC

- 7.1.16 Falcon Pack