|

市場調查報告書

商品編碼

1640656

拉丁美洲軟包裝:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)Latin America Flexible Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

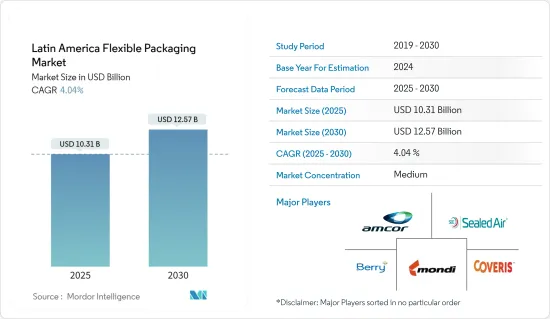

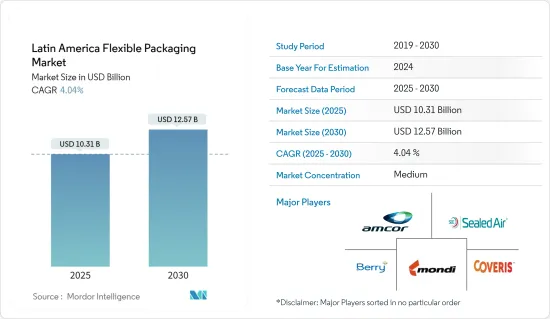

預計 2025 年拉丁美洲軟包裝市場規模為 103.1 億美元,預計到 2030 年將達到 125.7 億美元,預測期內(2025-2030 年)的複合年成長率為 4.04%。

關鍵亮點

- 軟包裝生產時消耗的原料和能源較少,因此製造商可節省大量成本。高效的包裝功能和減少的儲存空間將進一步提升其在市場的需求。

- 創新包裝和數位印刷等趨勢正在推動市場發展並預示著技術進步。其中包括序列化2D碼等富有創意的消費者參與解決方案。軟包裝重量也更輕,降低了運輸成本和燃料使用量,因此在研究區域中成為包裝零嘴零食和薯片的首選。

- 為了滿足日益成長的需求,一些市場參與企業正在建立聯盟和夥伴關係關係,以提高收益。例如,2024年5月,巴西SGK團隊與強生巴西合作推出SEMPRE LIVRE。這項永續性舉措使該公司贏得了第 20 屆 ABRE 巴西包裝獎的最受歡迎投票獎。 SGK 和強生公司首次推出軟性薄膜包裝,開闢了新領域。我們開發了一種用於女性護理用品的低調插入物,其中 33% 使用消費後樹脂,與傳統包裝相比,可減少 10.25% 的碳足跡。

- 阿根廷的包裝產業在景氣衰退,疫情加劇了這一困境。中低收入族群的購買力大幅下降,抑制了創新和奢侈品包裝企業的發展。隨著工資下降、失業率上升和消費者習慣改變,各種類型和尺寸的包裝都受到了影響。

- 過去十年來,公眾對塑膠有害影響的認知顯著提高。拉丁美洲各國政府已經發起了許多公共宣傳活動和舉措來增強這種意識。因此,近年來塑膠包裝消費發生了顯著變化。

拉丁美洲軟包裝市場的趨勢

預計袋裝包裝市場將強勁成長

- 歐洲廣泛使用的袋子有立式袋子和平式袋子兩種。立式袋包括殺菌袋、底折袋、平底袋、側折袋、吸嘴袋、改良袋等。平口袋分為枕頭式、四邊封、三邊封、真空等類型。

- 市場對袋子的需求是由其耐用性和物流便利性決定的。它的成本效益鼓勵製造商擴大採用袋裝包裝,進一步推動這種靈活形式的成長。此外,袋子重量輕,比寶特瓶傳統包裝形式更受歡迎。

- 牛皮紙在包裝、小袋和袋子等領域的需求量很大。環保包裝的日益普及引起了人們對牛皮紙的興趣,特別是因為其製漿過程使得廢棄物更容易回收和再利用。為了順應這一趨勢,總部位於蒙特利爾、業務遍及美國和拉丁美洲的包裝製造商 TC Transcontinental 於 2020 年宣布計劃增加其軟包裝產品(如包裝袋)中的消費後再生紙含量。該公司還投資了設備,將從分類設施和其他地方獲得的軟質塑膠進行轉化。

- 2023 年 2 月,軟包裝和材料科學領域的領導者 ProAmpac 在其主動永續發展產品組合中增加了新產品:ProActive Recyclable R~2050 和 ProActive Post Industrial Recycled Content (PIR)。

- 袋子已成為包裝電子商務產品的熱門選擇。食品飲料、個人護理和醫藥領域越來越青睞包裝袋,尤其是針對電子商務市場的產品。由於袋裝包裝效率高、成本效益高,電子商務參與企業越來越傾向使用袋裝包裝。

預計巴西將佔據很大市場佔有率

- 巴西是拉丁美洲的領先國家,經濟成長強勁,吸引了大量外國直接投資 (FDI)。由於該國對食品和工業產品的需求旺盛,嚴重依賴進口。該地區正在採用靈活的包裝解決方案來保護這些產品免受損壞。隨著中產階級的擴大,對包裝食品的需求也隨之增加,為軟包裝市場的擴張鋪平了道路。

- 根據巴西美容護理協會(ABIHPEC&ApexBrasil)報告,2023年巴西在美容和個人保健產品領域實現了貿易順差。這個南美巨頭向全球市場出口了價值超過 9.11 億美元的化妝品和衛生產品。

- 2024 年 3 月,主要企業SIG 與著名乳製品公司 DPA Brasil 合作,為其 Chamyto 優格品牌推出創新的帶嘴袋包裝。新包裝採用 SIG CloverCap 85RO 封蓋和 SIG Prime 120 填充機制,設計輕巧而堅固,易於使用,尤其是對於兒童而言。草莓口味 Chamyto 優格是 DPA Brasil 首款採用這種尖端包裝形式的產品。 DPA Brasil 還計劃將這種包裝創新擴展到其其他產品,包括 Chamyto 水果維生素優格、Chambinho Recreio 和 Ninho Lancheirinha。

- 此外,市場呈現優質化趨勢。儘管巴西人整體對價格比較敏感,但他們在化妝品上的投資意願卻越來越大。這種轉變正在推動對軟包裝的需求。聚胺和聚丙烯等軟質塑膠材料增強了包裝的可見度和吸引力,並具有必要的安全特性。

拉丁美洲軟包裝產業概況

拉丁美洲軟包裝市場適度整合,由多家全球和區域參與企業組成。由於新參與企業的進入門檻較低,市場一直受到許多新參與企業的推動。該市場的特徵是產品差異化低、產品擴散度高、競爭激烈。透過設計、技術和應用的創新可以獲得永續的競爭優勢。市場的一些主要參與企業包括 Amcor PLC、Berry Global Inc.、Mondi Group 和 Sealed Air Corporation。

- 2024年5月,巴西SGK團隊與強生巴西公司合作推出了SEMPRE LIVRE。為了表彰其永續性的努力,該公司在第 20 屆 ABRE 巴西包裝獎中贏得了大眾投票獎。 SGK 與強生公司合作開發了首個軟膜包裝,一直處於創新前沿。 SGK 為女性護理用品設計了一種低調插入物,該產品使用 33% 的消費後樹脂,與現有包裝相比,碳足跡減少了 10.25%。

- 2023 年10 月,PAC Worldwide 將從墨西哥佩德羅埃斯科韋多搬遷至維斯塔聖胡安德爾裡奧佔地83,000 平方英尺的新工廠,這是提高其在中美洲製造能力的策略的一部分。此綜合軟包裝設施位於墨西哥城以北兩小時車程。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 市場促進因素

- 便捷包裝需求不斷成長

- 市場問題

- 環境和回收問題

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 產業價值鏈分析

- 產業微觀經濟因素評估

5. 拉丁美洲軟包裝市場的永續包裝和技術進步

- 輕的

- 回收/再生聚合物

- 袋裝包裝的永續塗料

- 屏障開發

- 活性包裝

第6章 市場細分

- 材料類型

- 塑膠

- 聚乙烯 (PE)

- 雙軸延伸聚丙烯(BOPP)

- 流延聚丙烯(CPP)

- 聚氯乙烯(PVC)

- 乙烯 - 乙烯醇(EVOH)

- 紙

- 鋁箔

- 塑膠

- 產品類型

- 小袋

- 包包

- 薄膜和包裝

- 其他

- 最終用戶產業

- 食物

- 冷凍食品

- 乳製品

- 水果和蔬菜

- 肉類、家禽和魚貝類

- 烘焙點心和零嘴零食

- 糖果和糖果零食

- 其他

- 飲料

- 藥品和醫療用品

- 家庭和個人護理

- 其他

- 食物

- 地區

- 巴西

- 阿根廷

- 墨西哥

- 其他拉丁美洲國家(哥倫比亞、委內瑞拉等)

第7章 競爭格局

- 公司簡介

- Amcor PLC

- Berry Global Inc.

- Mondi Group

- Sealed Air Corporation

- Coveris Holdings SA

- Tetra Pak International SA

- Cascades Flexible Packaging

- Novolex Holdings Inc.

- WIPF Doypack(Wipf AG)

- FlexPak Services LLC

- Transcontinental Inc.

- American Packaging Corporation

- Sonoco Products Company

- Inteplast Group

- Oben Holding Group

- Toray Plastics(America)Inc.

- Sigma Plastic Group

- Clifton Packaging SA De CV

- PO Empaques Flexibles SA De CV

- ProAmpac LLC

第8章投資分析

第9章:市場的未來

The Latin America Flexible Packaging Market size is estimated at USD 10.31 billion in 2025, and is expected to reach USD 12.57 billion by 2030, at a CAGR of 4.04% during the forecast period (2025-2030).

Key Highlights

- Manufacturers benefit from substantial cost savings as flexible packaging consumes less raw materials and energy during production. Its efficient wrapping capabilities and reduced storage space requirements further boost its demand in the market.

- Trends like innovative packaging and digital printing are energizing the market, showcasing technological advancements. These include creative consumer engagement solutions, such as serialized QR codes. Additionally, the lightweight nature of flexible packaging cuts down transportation costs and fuel usage, making it a favored choice for snacks and potato chip packaging in the studied regions.

- In response to rising demand, several market players are forging collaborations and partnerships to enhance their revenues. For example, in May 2024, SGK's team in Brazil partnered with Johnson & Johnson Brazil to launch SEMPRE LIVRE. Their sustainability efforts earned them the Popular Vote category at the 20th ABRE Brazilian Packaging Award. SGK and Johnson & Johnson broke new ground with their first flexible film packaging. They crafted a thinner insert for female care products, using 33% post-consumer resin, and achieved a commendable 10.25% carbon footprint reduction over traditional packaging.

- The Argentine packaging sector grappled with challenges during the economic downturn, worsened by the pandemic. A significant drop in purchasing power among low and middle-income groups stifled innovation and premium packaging ventures. With wages plummeting, unemployment rising, and consumption habits shifting, the effects were felt across various packaging types and sizes.

- In the past decade, there has been a marked surge in public awareness about the detrimental effects of plastic. Latin American governments have spearheaded numerous public campaigns and initiatives, amplifying this awareness. Consequently, the consumption of plastic packaging has seen a pronounced shift in recent years.

Latin America Flexible Packaging Market Trends

The Pouches Segment is Expected to Grow Significantly

- Pouches, widely utilized across Europe, can be categorized into stand-up and flat types. Stand-up pouches encompass a range of varieties, including retort, bottom gusset, flat bottom, side gusset, spouted, and shaped pouches. Flat pouches are divided into pillow, four-side seal, three-side seal, and vacuum pouches.

- The demand for pouches in the market is fueled by their durability and logistical convenience. Their cost-effectiveness is prompting manufacturers to increasingly adopt pouch packaging, further propelling the growth of this flexible format. Additionally, pouches' lightweight nature makes them a preferred choice over traditional packaging formats like PET bottles.

- Kraft paper is in high demand for applications like wrapping, pouches, and sacks. The rising trend of eco-friendly packaging has spurred interest in kraft papers, especially since their pulping process facilitates easy waste recovery and recycling. In line with this trend, in 2020, TC Transcontinental, a Montreal-based packaging manufacturer with operations in the United States and Latin America, unveiled plans to boost post-consumer recycled content in its flexible offerings, including pouches. The company has also invested in equipment to convert flexible plastics sourced from sorting facilities and other avenues.

- In February 2023, ProAmpac, a frontrunner in flexible packaging and material science, introduced new additions to its ProActive Sustainability Portfolio: ProActive Recyclable R-2050 and ProActive Post Industrial Recycled Content (PIR).

- Pouches emerged as a dominant choice for packaging e-commerce products. They are increasingly favored in the food, beverage, personal care, and pharmaceutical sectors, especially for products targeting the e-commerce market. E-commerce players are gravitating toward pouch packaging due to its efficiency and cost-effectiveness.

Brazil is Expected to Hold a Significant Share in the Market

- Brazil is a frontrunner in Latin America, showcasing robust economic growth and attracting significant foreign direct investment (FDI). The nation, with its substantial appetite for food and industrial goods, heavily relies on imports. The region is increasingly turning to flexible packaging solutions to safeguard these products from damage. As the middle class expands, so does the appetite for packaged foods, paving the way for the expanding flexible packaging market.

- In 2023, Brazil achieved a trade surplus in beauty and personal care products, as per a report by Beautycare Brazil (ABIHPEC & ApexBrasil). The South American powerhouse exported cosmetics and hygiene products worth over USD 911 million to global markets.

- In March 2024, SIG, a leading supplier of aseptic cartons, partnered with DPA Brasil, a prominent dairy company, to roll out innovative spouted pouch packaging for the Chamyto yogurt brand. This new packaging, featuring the SIG CloverCap 85RO closure and SIG Prime 120 filling equipment, has a lightweight yet robust design, making it especially user-friendly for children. The strawberry-flavored Chamyto yogurt marks DPA Brasil's inaugural product to adopt this cutting-edge packaging format. DPA Brasil also plans to expand this packaging innovation to other offerings, including Chamyto fruit vitamin yogurts, Chambinho Recreio, and Ninho Lancheirinha.

- Additionally, the market is witnessing a trend towards premiumization. While Brazilians are generally price-sensitive but increasingly willing to invest in cosmetics. This shift is driving the demand for flexible packaging. Flexible plastic materials like polyamine and polypropylene enhance package visibility and appeal and incorporate essential safety features.

Latin America Flexible Packaging Industry Overview

The Latin American flexible packaging market comprises several global and regional players and is moderately consolidated. As the market poses low barriers to entry for the new players, several new entrants have gained traction. This market is characterized by low product differentiation, growing levels of product penetration, and high levels of competition. Sustainable competitive advantage can be gained through design, technology, and application innovation. Some of the major players operating in the market are Amcor PLC, Berry Global Inc., Mondi Group, and Sealed Air Corporation.

- May 2024: SGK's team in Brazil collaborated with Johnson & Johnson Brazil to introduce SEMPRE LIVRE. Their sustainability initiatives garnered them the Popular Vote category at the 20th ABRE Brazilian Packaging Award. In partnership with Johnson & Johnson, SGK spearheaded innovation by developing the inaugural flexible film packaging. They designed a thinner insert, incorporating 33% post-consumer resin for female care products, achieving a notable 10.25% reduction in carbon footprint compared to existing packaging.

- October 2023: PAC Worldwide relocated its operations from Pedro Escobedo, Mexico, to a new 83,000 sq. ft plant in Vistha San Juan Del Rio as part of its strategy to enhance manufacturing capabilities in Central America. This comprehensive, flexible packaging facility is two hours north of Mexico City.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increased Demand for Convenient Packaging

- 4.3 Market Challenges

- 4.3.1 Concerns Regarding Environment and Recycling

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitutes

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Industry Value Chain Analysis

- 4.6 Assessment of the Microeconomic Factors on the Industry

5 SUSTAINABLE PACKAGING AND TECHNOLOGICAL ADVANCEMENTS IN THE LATIN AMERICAN FLEXIBLE PACKAGING MARKET

- 5.1 Light Weighting

- 5.2 Recycled and Recyclable Polymers

- 5.3 Sustainable Coatings for Pouch Packaging

- 5.4 Barrier Developments

- 5.5 Active Packaging

6 MARKET SEGMENTATION

- 6.1 Material Type

- 6.1.1 Plastics

- 6.1.1.1 Polyethene (PE)

- 6.1.1.2 Bi-orientated Polypropylene (BOPP)

- 6.1.1.3 Cast Polypropylene (CPP)

- 6.1.1.4 Polyvinyl Chloride (PVC)

- 6.1.1.5 Ethylene Vinyl Alcohol (EVOH)

- 6.1.2 Paper

- 6.1.3 Aluminum Foil

- 6.1.1 Plastics

- 6.2 Product Type

- 6.2.1 Pouches

- 6.2.2 Bags

- 6.2.3 Films and Wraps

- 6.2.4 Other Product Types

- 6.3 End-user Industry

- 6.3.1 Food

- 6.3.1.1 Frozen Food

- 6.3.1.2 Dairy Products

- 6.3.1.3 Fruits and Vegetables

- 6.3.1.4 Meat, Poultry, and Seafood

- 6.3.1.5 Baked Goods and Snack Foods

- 6.3.1.6 Candy and Confections

- 6.3.1.7 Other Food Products

- 6.3.2 Beverage

- 6.3.3 Pharmaceutical and Medical

- 6.3.4 Household and Personal Care

- 6.3.5 Other End-user Industries

- 6.3.1 Food

- 6.4 Geography

- 6.4.1 Brazil

- 6.4.2 Argentina

- 6.4.3 Mexico

- 6.4.4 Rest of Latin America (Colombia, Venezuela, etc.)

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor PLC

- 7.1.2 Berry Global Inc.

- 7.1.3 Mondi Group

- 7.1.4 Sealed Air Corporation

- 7.1.5 Coveris Holdings SA

- 7.1.6 Tetra Pak International SA

- 7.1.7 Cascades Flexible Packaging

- 7.1.8 Novolex Holdings Inc.

- 7.1.9 WIPF Doypack (Wipf AG)

- 7.1.10 FlexPak Services LLC

- 7.1.11 Transcontinental Inc.

- 7.1.12 American Packaging Corporation

- 7.1.13 Sonoco Products Company

- 7.1.14 Inteplast Group

- 7.1.15 Oben Holding Group

- 7.1.16 Toray Plastics (America) Inc.

- 7.1.17 Sigma Plastic Group

- 7.1.18 Clifton Packaging SA De CV

- 7.1.19 PO Empaques Flexibles SA De CV

- 7.1.20 ProAmpac LLC