|

市場調查報告書

商品編碼

1686223

農業酵素-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Agricultural Enzymes - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

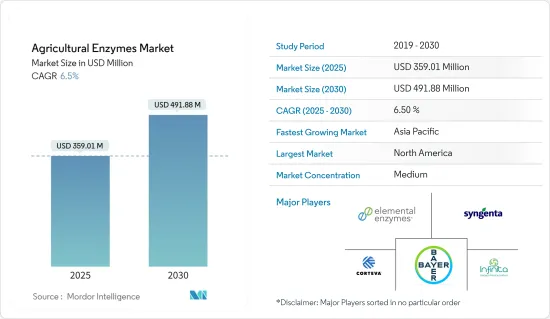

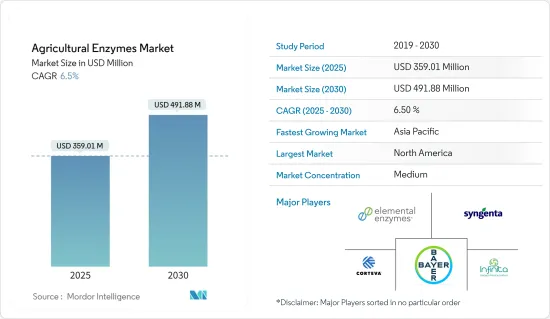

預計 2025 年農業酵素市場規模為 3.5901 億美元,到 2030 年將達到 4.9188 億美元,預測期內(2025-2030 年)的複合年成長率為 6.5%。

主要亮點

- 農業酵素市場是更廣泛的農業產業的一個重要部分,其重點是提高作物生產力、土壤健康和永續的農業實踐。在消費者需求和永續農業實踐監管壓力的推動下,酵素在農業中的應用正在蓬勃發展。這些酶減少了對化學物質的依賴並支持環保農業。根據有機農業研究所的數據,從 2021 年到 2023 年,有機食品銷售額從 1,320 億美元成長到 1,340 億美元。有機食品消費的成長趨勢正在推動有機農業的發展,並刺激對農業酵素的需求。有機農民使用這些酵素來增強土壤健康並提高作物產量,而無需依賴合成化學物質。此外,酵素和精選微生物在農業中被用作化學品更健康、更有機的替代品,進一步推動了市場的成長。

- 此外,人們越來越認知到保持土壤健康對於維持農業生產力的必要性。農業酵素有助於分解有機物、增加養分利用率和改善土壤結構,這些結構對於維持土壤健康至關重要。儘管可耕地有限,但提高作物產量的需求進一步增加了對農業酵素的需求。例如,根據匈牙利中央統計局的數據,匈牙利的耕地面積總體上正在減少。預計2024年耕地面積為413.2萬公頃,比上年的415.4萬公頃減少。因此,對永續農業和有機農產品的需求不斷成長,使農業酵素市場走上成長軌道。儘管農業酶市場呈現成長趨勢,但仍面臨酵素生產成本高、區域認知差距和監管環境多樣化等挑戰。結合技術進步和對酵素益處的認知不斷提高,市場預計將繼續擴大,凸顯其對全球農業未來的重要性。

農業酵素市場趨勢

依作物類型分類,穀物和穀類比最大

農業酵素的應用正在增加,特別是在穀類和穀類種植。人們對農業中過量使用化學物質的環境問題的擔憂,凸顯了作物中化學殘留的問題。例如,糧農組織2022年的資料顯示,安提瓜和巴布達在農藥使用量方面位居榜首,每公頃使用36.59公斤。這導致人們轉向使用酵素等更安全的替代品。此外,酵素在穀物生產中的使用已顯示出諸如提高保濕性、增加根生物量和加快有機物分解等好處,進一步支持了酵素在穀物和穀類種植中的全球普及。

此外,隨著消費者健康意識的增強,他們明顯轉向有機食品,以避免化學防腐劑對健康的不利影響。這一趨勢正在擴大有機農業的範圍。例如,根據FibL的資料,有機穀物種植面積從2021年的550萬公頃擴大到2022年的560萬公頃。這些發展支持酵素在有機農業中的使用日益增加。隨著有機食品產業的成長和對食品安全的日益重視,農業酵素在穀物和穀類作物中的應用正在增加,未來幾年該產業將迎來良好的發展前景。

北美佔據市場主導地位

北美在農業酶消費方面居世界領先地位,其中美國居首。美國農業部門迅速採用了現代技術。化學投入成本上升、對土壤和環境的有害影響以及對平衡植物營養的認知不斷提高等因素正在推動美國對農業酶的需求。例如,2022年8月,美國農業部(USDA)推出了一項耗資3億美元的有機轉型計劃,旨在培訓下一代有機生產者並加強有機供應鏈。預計這些措施將促進包括農業酵素在內的生物基投入的採用,並擴大北美市場。

加拿大已明確轉向生物基農業,從早期發展階段就專注於提高作物的生產力和品質。在政府的推動下,人們對有機產品的偏好日益成長,這鼓勵了產業參與者加大在該地區的產品供應。例如,Novonesis 於 2024 年 3 月擴大了與 FMC 的合作夥伴關係,任命 FMC 從 2025 年生長季節開始為 Novonesis 農業生物解決方案在加拿大的獨家經銷商。在墨西哥,人們對有機和天然食品的需求日益成長,加上永續農業的趨勢,推動了對天然來源農業投入品的需求。根據2023年農業生產統計年鑑,墨西哥有超過54,000公頃土地用於種植有機作物,其中約52,000公頃土地成功收穫。預計這些趨勢將在未來幾年進一步推動市場成長。因此,由於政府的支持政策和對有機農業的日益重視,農業酶市場預計將在預測期內蓬勃發展。

農業酵素產業概況

農業酵素市場適度整合,主要企業包括:主要企業包括拜耳作物科學、Elemental Enzymes、Corteva Agriscience、Infinita Biotech Private Limited. 和先正達股份公司。公司正在進行各種策略活動,包括產品創新、業務擴展、合作夥伴關係、併購。我們也與其他公司合作進行聯合研究,以在市場上佔據強大的地位。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概覽

- 市場促進因素

- 有機食品需求不斷成長

- 生物農產品的採用率不斷提高

- 主要企業加大研發和市場策略

- 市場限制

- 政府監管障礙

- 化工產品需求旺盛

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章市場區隔

- 依酶類型

- 氧化酵素

- 去氫酶

- 尿素酶

- 蛋白酶

- 其他酵素類型

- 按應用

- 作物保護

- 生育能力

- 植物生長調節

- 按作物類型

- 糧食

- 油籽和豆類

- 水果和蔬菜

- 其他作物

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 南非

- 其他中東和非洲地區

- 北美洲

第6章 競爭格局

- 最受歡迎的策略

- 市場佔有率分析

- 公司簡介

- Bayer Cropscience AG

- Syngenta AG

- American Vanguard Corporation

- Bioworks Inc.

- Corteva Agrisciences

- Infinita Biotech Private Limited

- Creative Enzymes

- Kemin Industries Inc

- Novozymes Inc

- Elemental Enzymes

第7章 市場機會與未來趨勢

The Agricultural Enzymes Market size is estimated at USD 359.01 million in 2025, and is expected to reach USD 491.88 million by 2030, at a CAGR of 6.5% during the forecast period (2025-2030).

Key Highlights

- The agricultural enzymes market has become a pivotal segment in the broader agricultural industry, emphasizing enhancements in crop productivity, soil health, and sustainable farming practices. Driven by consumer demand and regulatory pressures for sustainable practices, the adoption of agricultural enzymes has surged. These enzymes diminish the dependence on chemical inputs, championing eco-friendly farming. According to the Research Institute of Organic Agriculture, organic food sales grew from USD 132 billion to USD 134 billion from 2021 to 2023. This rising trend of organic food consumption has raised organic farming which has fueled the demand for agricultural enzymes. Organic farmers utilize these enzymes to bolster soil health and boost crop yields, all without resorting to synthetic chemicals. Moreover, enzymes along with select microbes are being used in agriculture as a healthier and organic replacement for chemicals, thus driving the market's growth.

- Moreover, there's an increasing recognition of the need to uphold soil health for sustained agricultural productivity. Agricultural enzymes are instrumental in decomposing organic matter, boosting nutrient availability, and refining soil structure, all vital for robust soil health. The need for increased crop yields, despite limited arable land, has further fueled the demand for agricultural enzymes. For instance, according to the Hungarian Central Statistical Office, the arable land area decreased overall in Hungary. In 2024, the arable land area totaled around 4,132 thousand hectares in the country which decreased from 4,154 thousand hectares compared to the previous year. Therefore, with the rising demand for sustainable farming and organic produce, the agricultural enzymes market is on a growth path. Despite its growth trajectory, the agricultural enzymes market grapples with challenges such as high enzyme production costs, regional awareness gaps, and diverse regulatory landscapes. Coupled with technological strides and heightened awareness of enzyme benefits, the market is set for continued expansion, underscoring its significance in the future of global agriculture.

Agricultural Enzymes Market Trends

Cereals and Grains Holds Significant Shares by Crop Type

The adoption of agricultural enzymes is on the rise, particularly in the cultivation of cereals and grains. Environmental concerns about the overuse of chemicals in agriculture have highlighted the issue of chemical residues in crops. For example, FAO data from 2022 revealed that Antigua and Barbuda led in agricultural pesticide consumption, using over 36.59 kilograms per hectare of cropland, with Qatar closely following at 35.11 kilograms per hectare. This has driven a shift towards safer alternatives like enzymes. Additionally, the use of enzymes in cereal production has shown benefits such as improved moisture retention, increased root biomass, and faster organic matter decomposition, further encouraging their global adoption in cereal and grain cultivation.

Moreover, as consumers become more health-conscious, there is a noticeable shift towards organic foods to avoid the negative health effects associated with chemical preservatives. This trend has expanded the scope of organic farming. For instance, FibL data indicates that the organic area for cereals grew from 5.5 million hectares in 2021 to 5.6 million hectares in 2022. These developments underscore the increasing use of enzymes in organic farming. With the organic food industry growing and a strong emphasis on food safety, the adoption of agricultural enzymes in cereal and grain crops is set to increase, signaling a positive trend for the segment in the coming years.

North America Dominates the Market

North America leads the globe in the consumption of agricultural enzymes, with the United States taking the forefront. The U.S. agriculture sector swiftly adopts modern technologies. Factors such as rising costs of chemical inputs, their harmful impacts on soil and the environment, and an increased awareness of balanced plant nutrition are driving the demand for agricultural enzymes in the U.S. Additionally, strong government initiatives in the region further fuel this market's expansion. For instance, in August 2022, the U.S. Department of Agriculture (USDA) launched the USD 300 million Organic Transition Initiative, aiming to nurture the next generation of organic producers and strengthen organic supply chains. Such measures are likely to boost the adoption of bio-based inputs, including agricultural enzymes, thus broadening the market in North America.

Canada is witnessing a clear pivot towards bio-based agriculture, focusing on improved crop productivity and quality from the early growth stages. This rising inclination towards organic products, supported by government backing, is encouraging industry players to enhance their services in the region. For example, in March 2024, Novonesis expanded its partnership with FMC, appointing FMC as the exclusive distributor for select Novonesis agricultural bio-solutions in Canada, effective from the 2025 growing season. In Mexico, a growing appetite for organic and natural foods, coupled with a trend towards sustainable farming, has increased the demand for naturally sourced agricultural inputs. According to the 2023 Statistical Yearbook of Agricultural Production, over 54 thousand hectares in Mexico were dedicated to organic crops, with approximately 52 thousand hectares successfully harvested. These trends are poised to further drive the market's growth in the coming years. Thus, with supportive government measures and a rising emphasis on organic farming, the agricultural enzymes market is set to flourish during the forecast period.

Agricultural Enzymes Industry Overview

The Agricultural Enzymes market is moderately consolidated, with major players such as Bayer CropScience, Elemental Enzymes, Corteva Agriscience, Infinita Biotech Private Limited., and Syngenta AG occupying a significant market shares. The companies are adopting various strategic activities, such as product innovation, expansion, partnership, and mergers & acquisitions. The players are partnering with other companies to build a strong presence in the market while researching collaboratively.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope Of The Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Demand for Organic Food

- 4.2.2 Increasing Adoption of Biological Agricultural Products

- 4.2.3 Rising R&D and Market Strategies by Key Players

- 4.3 Market Restraints

- 4.3.1 Government Regulatory Barriers

- 4.3.2 High Demand for Chemical Products

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Enzyme Type

- 5.1.1 Phosphatases

- 5.1.2 Dehydrogenases

- 5.1.3 Ureases

- 5.1.4 Proteases

- 5.1.5 Other Enzyme Types

- 5.2 By Application

- 5.2.1 Crop Protection

- 5.2.2 Fertility

- 5.2.3 Plant Growth Regulation

- 5.3 By Crop Type

- 5.3.1 Grains and Cereals

- 5.3.2 Oil Seeds and Pulses

- 5.3.3 Fruits and Vegetables

- 5.3.4 Other Crop Types

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Russia

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East & Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Rest of Middle East & Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Bayer Cropscience AG

- 6.3.2 Syngenta AG

- 6.3.3 American Vanguard Corporation

- 6.3.4 Bioworks Inc.

- 6.3.5 Corteva Agrisciences

- 6.3.6 Infinita Biotech Private Limited

- 6.3.7 Creative Enzymes

- 6.3.8 Kemin Industries Inc

- 6.3.9 Novozymes Inc

- 6.3.10 Elemental Enzymes