|

市場調查報告書

商品編碼

1686243

冷凍:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Refrigeration Lubricants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

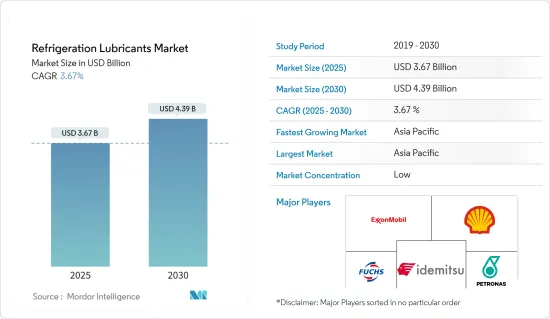

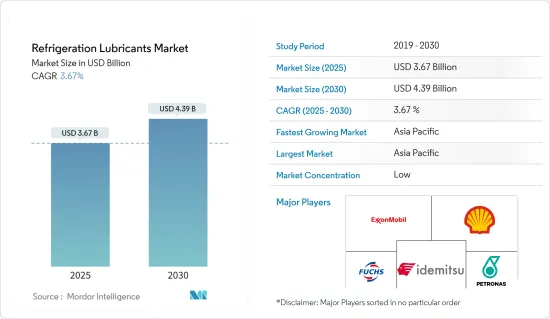

預計 2025 年冷凍潤滑油市場規模將達到 36.7 億美元,預計到 2030 年將達到 43.9 億美元,預測期內(2025-2030 年)的複合年成長率為 3.67%。

COVID-19 疫情導致全國範圍的封鎖、製造活動和供應鏈的中斷以及全球範圍內的生產停頓,對所研究的市場產生了不利影響。不過,預計情況將在 2021 年開始好轉,且市場的成長軌跡預計將在預測期內恢復。

主要亮點

- 針對能源效率最佳化的新一代冷凍潤滑劑的出現、全球 HVACR 行業的成長勢頭以及汽車行業的復甦預計將推動冷凍潤滑劑市場的成長。

- 另一方面,由於法規的不斷變化,現有冷媒的逐步淘汰預計將阻礙市場成長。

- 人們對奈米潤滑技術的日益關注和對低溫應用的需求不斷增加預計將為所研究的市場創造新的機會。

- 亞太地區佔據全球市場主導地位,其中最大的消費國是印度和中國等國家。

冷凍潤滑油市場趨勢

全球暖通空調冷凍產業發展勢頭強勁

- 空調(AC)裝置用於調節封閉區域的濕度和溫度。空調的主要部件是壓縮機、蒸發器、膨脹閥和冷凝器。該潤滑劑可減少管道腐蝕等副作用,並與常見的冷凍氣體具有更好的相容性。

- 冷凍潤滑劑具有多種用途,包括散熱、潤滑運動部件、充當密封劑以及冷卻重要的壓縮機部件。

- 根據國際能源總署(IEA)的數據,2021年空間冷凍需求在所有建築最終用途中錄得最高年成長率,佔建築業最終電力消耗量的近16%(約2,000 TWh)。預計這將有利於預測期內的空調潤滑油市場。

- 2021 年 11 月,印度政府根據白色家電生產掛鉤激勵 (PLI) 計畫選出了 26 份申請。這些項目用於空調製造,承諾投資額為 3,898 千萬印度盧比。預計這項措施將促進國內生產並對冷凍潤滑油市場產生正面影響。

- 電動車的成長趨勢可能會進一步支持冷凍潤滑油市場。 2021年,中國在電動車產量方面處於領先地位。根據中國乘用車資訊聯席會(CPCA)的數據,2021年中國銷量超過330萬輛,較2020年成長169%。

- 印度的電動車市場主要由二輪車市場推動,到 2021 年,這一市場將佔 48% 以上。根據印度公路運輸和公路部 (MoRTH) 的數據,該國售出了 3,29,190 輛電動車,與 2020 年的銷量相比成長了 168%。

- 預計上述因素將對冷凍潤滑油市場產生正面影響。

亞太地區可望主導市場

- 亞太地區是最大的冷凍潤滑油市場。由於家用和工業空調系統的使用日益增多,對冷凍潤滑劑的需求也日益增加。

- 中國是世界上最大的汽車樞紐。根據 OICA 的數據,2021 年該國汽車總產量為 26,082,220 輛,比 2020 年成長 3%。

- 中國領先的電動車製造商包括特斯拉、比亞迪和蔚來。該國對電動車的需求不斷成長,推動了汽車壓縮機冷凍潤滑油市場的發展。

- 根據OICA報告,2021年前第一季歐洲汽車產量為11,886,776輛,而中國同期汽車產量為18,242,588輛。因此,汽車對空調的需求不斷增加。

- 根據韓國汽車技術研究院 (KAII) 收集的資料,2021 年前九個月,韓國電動車銷量飆升 96%,達到 71,006 輛。由於歐洲、亞太和美洲等進口經濟體的需求增加,預計銷售額將進一步成長。

- 2021年前第三季印度電動車產量為3,289,683輛,較2020年大幅成長53%。預計汽車行業的成長將在預測期內推動市場擴張。

- 印度是繼美國、俄羅斯和中國之後,鐵路規模位居世界第四的國家,軌道總長123,542公里,路線總長67,415公里,車站超過7,300個。

- 這個世界第二人口大國的鐵路網路定期運行 13,523 列客運列車和 9,146 列貨運列車。 2020-2021會計年度,鐵路貨運量達12.3億噸。

- 由於這些因素,預計亞太地區將在未來幾年佔據市場主導地位。

冷凍潤滑油行業概況

由於不同國家有多種排放法規,冷凍潤滑油市場高度分散。市場上的主要企業(不分先後順序)包括埃克森美孚、殼牌、福克斯、出光興產和馬來西亞國家石油潤滑油國際公司。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 推出新一代針對能源效率最佳化的冷凍潤滑劑

- 全球暖通空調冷凍產業發展勢頭強勁

- 汽車產業復甦

- 限制因素

- 法規不斷變化,導致現有冷媒逐步淘汰

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 按基油油

- 礦物油潤滑劑

- 石蠟油

- 環烷油

- 芳香油

- 合成潤滑油

- 合成碳氫化合物

- 聚α烯烴(PAO)

- 甲醇烷基化芳烴

- 聚丁烯

- 按酯

- 雙酯

- 多元醇酯

- 磷酸酯

- 聚合物酯

- 聚亞烷基二醇(PAG)

- 其他合成潤滑油

- 礦物油潤滑劑

- 按應用

- 空調

- 運輸

- 車

- 其他運輸方式(鐵路、空運、海運)

- 其他空調應用(固定式)

- 冷凍(家用、工業用、低溫用)

- 空調

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章競爭格局

- 併購、合資、合作與協議

- 市場排名分析

- 主要企業策略

- 公司簡介

- BASF SE

- BP PLC

- BVA Oil

- Chevron Corporation

- China National Petroleum Corporation

- China Petroleum & Chemical Corporation(SINOPEC Group)

- CPI Fluid Engineering

- ENEOS Corporation

- ExxonMobil Corporation

- Fuchs

- HP Lubricants

- Idemitsu Kosan Co. Ltd

- Isel

- Kluber Lubrication

- Kuwait Petroleum

- Matrix Specialty Lubricants BV

- Parker Hannfin Corp

- PETRONAS Lubricants International

- Shell plc

- Tazzetti SpA

- TotalEnergies

- Xaerus Performance Fluids International

第7章 市場機會與未來趨勢

- 人們對奈米潤滑技術的興趣日益濃厚

- 低溫應用的需求不斷增加

The Refrigeration Lubricants Market size is estimated at USD 3.67 billion in 2025, and is expected to reach USD 4.39 billion by 2030, at a CAGR of 3.67% during the forecast period (2025-2030).

Due to the COVID-19 outbreak, nationwide lockdowns around the globe, disruption in manufacturing activities and supply chains, and production halts negatively impacted the market studied. However, the conditions started recovering in 2021, which is expected to restore the market's growth trajectory during the forecast period.

Key Highlights

- The emergence of new-generation refrigeration lubricants optimized for energy efficiency, increasing momentum in the global HVACR industry, and recovering automotive industry are expected to drive the growth of the refrigeration lubricants market.

- On the flip side, phasing out of existing refrigerants due to constant regulations amendments is expected to hinder the market's growth.

- Augmenting prominence for nano lubricant technology and a gain in demand for cryogenic applications are expected to unveil new opportunities for the market studied.

- Asia-Pacific dominated the global market, with the most significant consumption from the countries such as India and China.

Refrigeration Lubricants Market Trends

Increasing Momentum in the Global HVACR Industry

- Air conditioning (AC) units are designed to modify humidity and air temperature in an enclosed area. The primary components of an air conditioner are compressor, evaporator, expansion valve, and condenser. Lubricants reduce side effects, such as pipeline corrosion, and provide better compatibility with common refrigeration gases.

- Refrigeration lubricants have multiple purposes, such as removing heat, lubricating moving parts, acting as a sealant, and cooling the critical components of compressors.

- According to the International Energy Agency, space cooling demand experienced the highest annual growth among all buildings end uses in 2021 and accounted for nearly 16% of the buildings sector's final electricity consumption (about 2 000 TWh). This is expected to benefit the air conditioning lubricant market over the forecast period.

- The Government of India, in November 2021, selected 26 applications under the production-linked incentive (PLI) scheme for white goods. These are for air-conditioning (AC) manufacturing with a committed investment of INR 3,898 crore. This initiative is likely to boost production in the country and have a positive impact on the refrigeration lubricants market.

- The rising trends for electric vehicles are further likely to support the refrigeration lubricant market. China was the leading producer of electric vehicles in 2021. According to the China Passenger Car Association (CPCA), the country sold over 3.3 million units in 2021, which also accounted for an increase of 169% compared to 2020.

- The electric vehicles market in India is majorly driven by the two-wheeler segment that accounted for over 48% in 2021. According to the Ministry of Road Transport & Highways (MoRTH), 3,29,190 electric vehicles were sold in the country, representing an increase of 168% compared to the sales in 2020.

- The factors mentioned above are likely to impact the refrigeration lubricants market positively.

Asia-Pacific is Expected to Dominate the Market

- The Asia-Pacific region was the largest market for refrigeration lubricants. The rising demand for refrigeration lubricants can be attributed to the increasing usage of air conditioning systems for domestic and industrial applications.

- China is the largest automotive hub in the world. According to OICA, the overall automotive production in the country in 2021 stood at 2,60,82,220, a 3% increase from 2020.

- China's leading electric car manufacturers include Tesla, BYD Co., and Nio Inc. The growing demand for electric vehicles in the country is driving the market for refrigeration lubricants for automotive compressors.

- As per the report by OICA, Europe produced 11,886,776 units from quarter 1 to quarter 3 of 2021, whereas China produced 18,242,588 vehicles in the same period. Therefore the demand for AC in automobiles continues to increase.

- South Korean sales of electric vehicles surged by 96% to 71,006 units in the first nine months of 2021, according to data collected by the Korea Automotive Technology Institute (KAII). The sales figure is further expected to increase with growing demand from the importing economies in Europe, Asia Pacific, and the Americas.

- In 2021, India produced 32,89,683 electric vehicles for the first three quarters of 2021, a massive increase of 53% from 2020. The growing automotive sector is expected to augment the market in the forecast period.

- India ranks fourth in the most extensive railway system in the world after the United States, Russia, and China, with 123,542 km of tracks, 67,415 km of route, and more than 7,300 stations.

- The second-largest populated country in the world runs 13,523 passenger trains and 9,146 freight trains regularly on its network. The railways carried 1.23 billion metric tons of freight in FY2020-FY2021.

- Due to all the factors above, Asia-Pacific is expected to dominate the market in the upcoming years.

Refrigeration Lubricants Industry Overview

The refrigeration lubricants market has a higher degree of fragmentation owing to multiple emission regulations in various countries. Key players (not in any particular order) in the market include ExxonMobil Corporation, Shell PLC, Fuchs, IdemitsuKosan Co. Ltd, and PETRONAS Lubricants International.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Emergence of New Generation Refrigeration Lubricants Optimized for Energy Efficiency

- 4.1.2 Increasing Momentum in the Global HVACR Industry

- 4.1.3 Recovering Automotive Industry

- 4.2 Restraints

- 4.2.1 Phasing out of Existing Refrigerants due to Constant Regulations Amendments

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Revenue)

- 5.1 By Base Oil

- 5.1.1 Mineral Oil Lubricant

- 5.1.1.1 Paraffinic Oil

- 5.1.1.2 Naphthenic Oil

- 5.1.1.3 Aromatic Oil

- 5.1.2 By Synthetic Lubricant

- 5.1.2.1 Synthetic Hydrocarbon

- 5.1.2.1.1 Polyalphaolefin (PAO)

- 5.1.2.1.2 Alkylated Aromatics

- 5.1.2.1.3 Polybutene

- 5.1.2.2 By Ester

- 5.1.2.2.1 Diester

- 5.1.2.2.2 Polyol Ester

- 5.1.2.2.3 Phosphate Ester

- 5.1.2.2.4 Polymer Ester

- 5.1.2.3 Polyalkylene Glycols (PAG)

- 5.1.2.4 Other Synthetic Lubricants

- 5.1.1 Mineral Oil Lubricant

- 5.2 By Application

- 5.2.1 Air Conditioning

- 5.2.1.1 Transportation

- 5.2.1.1.1 Automotive

- 5.2.1.1.2 Other Modes of Transportation (Rail Road, Airways, and Marine)

- 5.2.1.2 Other Air Conditioning Applications (Stationary Applications)

- 5.2.2 Refrigeration (Household, Industrial, and Cryogenics)

- 5.2.1 Air Conditioning

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BASF SE

- 6.4.2 BP PLC

- 6.4.3 BVA Oil

- 6.4.4 Chevron Corporation

- 6.4.5 China National Petroleum Corporation

- 6.4.6 China Petroleum & Chemical Corporation (SINOPEC Group)

- 6.4.7 CPI Fluid Engineering

- 6.4.8 ENEOS Corporation

- 6.4.9 ExxonMobil Corporation

- 6.4.10 Fuchs

- 6.4.11 HP Lubricants

- 6.4.12 Idemitsu Kosan Co. Ltd

- 6.4.13 Isel

- 6.4.14 Kluber Lubrication

- 6.4.15 Kuwait Petroleum

- 6.4.16 Matrix Specialty Lubricants B.V.

- 6.4.17 Parker Hannfin Corp

- 6.4.18 PETRONAS Lubricants International

- 6.4.19 Shell plc

- 6.4.20 Tazzetti S.p.A

- 6.4.21 TotalEnergies

- 6.4.22 Xaerus Performance Fluids International

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Augmenting Prominence for Nano Lubricant Technology

- 7.2 Gain in Demand for Cryogenic Applications