|

市場調查報告書

商品編碼

1686276

食品加工機械:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Food Processing Machinery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

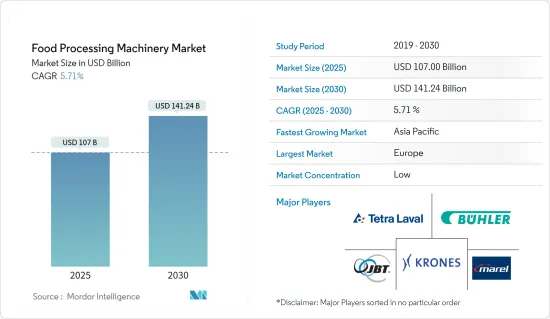

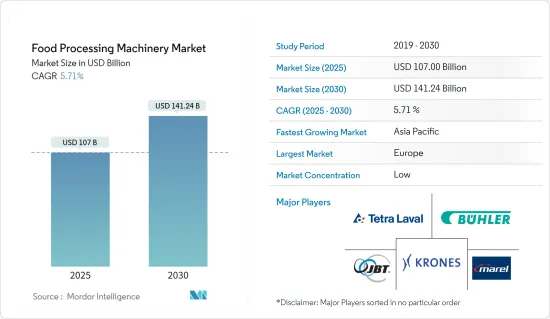

食品加工機械市場規模預計在 2025 年為 1,070 億美元,預計到 2030 年將達到 1,412.4 億美元,預測期內(2025-2030 年)的複合年成長率為 5.71%。

消費者偏好轉向方便、即食食品,推動了對先進加工設備的需求。消費者生活方式的演變特徵是越來越依賴節省時間的解決方案和即食食品。這種模式轉移要求食品加工設備不斷發展,以滿足對簡便食品生產效率、種類和品質日益成長的要求。製造商正在投資能夠高效加工各種簡便食品的設備。全球新興經濟體對加工食品的需求不斷成長,以及設備回扣等政府激勵措施也推動了新興市場的需求。

例如,根據印度農業和加工食品出口發展局 (APEDA) 的數據,2021 年印度加工食品出口額為:加工蔬菜 3,909.9 億美元,加工水果、果汁和堅果 7,801.9 億美元。

加工食品的需求和消費正在穩步成長,這是該行業發展的主要推動力。儘管這是一種全球現象,但這種願望在低度開發國家尤其普遍。印度和中國等國的食品加工行業由於近年來經濟的成功和市場向國際商品的日益開放而發生了根本性的變化。肉食攝取量的增加是最重要的後果之一。肉類加工設備產業是成長最快的領域之一,尤其是在開發中國家。

西歐、美國和加拿大等新興市場對烘焙和飲料行業的加工和包裝設備的需求強勁。機能飲料的日益流行,也增加了對用於生產非酒精和乳製品的設備的需求。

此外,食品設備製造商正在透過投資高級資料和分析、機器人和自動化等新功能來開發新的工作方式,以吸引更多的加工商。物聯網(IoT)技術和智慧感測器在食品加工設備中的整合是一個值得關注的趨勢。這實現了即時監控、預測性維護和資料主導的決策,從而提高了整體業務效率。主要市場參與者專注於提供高效機械以滿足食品加工商的需求。

食品加工機械市場趨勢

食品飲料加工自動化程度提高

食品加工設備技術的進步正在提高效率、生產力和產品品質。自動化、機器人、物聯網整合、人工智慧、資料分析等擴大被採用,以簡化營運、降低人事費用並提高食品安全和可追溯性。隨著需求和成本不斷上升,自動化有助於增加生產量並縮短生產時間。食品加工商越來越意識到資料主導洞察力在充分利用原料、確保可追溯性、支持持續改進和提高食品品質和安全方面的價值。機器人屠宰機是最常見的自動化設備之一,有助於加速屠宰過程。自動化設備還可以減少操作潛在有害工具和設備的人員數量,從而提高設施的安全性。

例如,2023 年 11 月,伯明翰大學企業宣布了 EvoPhase。它使用進化 AI 演算法結合工業攪拌機等系統內的顆粒模擬來最佳化混合葉片和混合容器的形狀或尺寸。 EvoPhase 提供廣泛的製程設備,包括研磨機、乾燥機、焙燒機、塗佈機、流體化床和攪拌槽,預計將為產業節省大量成本和能源。

肉類、烘焙和乳製品市場是加工和包裝自動化的主要採用者,從而提高了市場的生產效率。隨著大量參與者進入市場,自動化技術進步預計將在未來幾年推動市場發展。

歐洲佔有最大市場佔有率

歐洲是主要的區域市場之一,由於對高品質系統的需求不斷增加,預計未來幾年將經歷顯著成長。法國、德國、荷蘭、英國、西班牙和丹麥是主要的歐洲市場。這家歐洲公司也是食品和飲料產品的主要出口商。法國是食品的主要出口國,包括乳製品、肉類、葡萄酒和加工食品。為了滿足國際市場對法國食品日益成長的需求,食品加工商需要有效率、可靠的設施,能夠擴大生產規模以滿足出口需求,同時保持產品品質和一致性。例如,根據歐盟統計局的數據,到 2022 年,法國起司產量將達到 665,400 噸,而 2020 年為 657,060 噸。同樣,根據聯合國商品貿易統計資料庫的數據,法國新鮮、冷藏和冷凍形式的羊肉或山羊肉出口額將增加,到 2022 年將達到 3.4061 億歐元,高於 2021 年的 2.9729 億歐元。

永續性和環境責任在食品業變得越來越重要。為了實現永續性目標並減少對環境的影響,食品加工商正在投資能夠減少能源消耗、減少廢棄物和最佳化資源利用的設備。需要具有節能技術、水循環系統和廢棄物減少措施等特點的設施來支持永續的食品生產實踐。這促使公司開始生產配備節能技術的食品加工機器。例如,OctoFrost Processing Solutions 提供節能的食品加工機械,特別是在冷凍和熱處理領域。該公司提供創新的解決方案,旨在最佳化能源使用,同時保持食品品質和完整性。

食品加工機械產業概況

全球食品加工機械市場由各國的區域性和國家性參與者主導,其中國內參與者比跨國參與者更受青睞,擁有更高的市場佔有率。全球食品加工機械市場的主要參與者包括 JBT Corporation、Buhler AG、Krones AG、Marel 和 Tetra Laval。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場促進因素

- 加工食品需求不斷增加

- 技術進步支持市場成長

- 市場限制

- 能源和人事費用上升導致生產成本上升

- 波特五力分析

- 新進入者的威脅

- 購買者和消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 類型

- 加工機械設備

- 包裝器材及設備

- 實用工具

- 應用

- 乳製品和乳製品替代品

- 肉類、魚貝類以及肉類和魚貝類替代品

- 麵包和糖果零食

- 飲料

- 水果、蔬菜和堅果

- 其他用途

- 地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 歐洲

- 英國

- 德國

- 法國

- 俄羅斯

- 義大利

- 西班牙

- 其他歐洲國家

- 亞太地區

- 印度

- 中國

- 日本

- 澳洲

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 其他中東和非洲地區

- 北美洲

第6章 競爭格局

- 最受歡迎的策略

- 市場佔有率分析

- 公司簡介

- Anko Food Machine

- Buhler AG

- GEA

- Krones AG

- Tetra Laval

- Atlas Pacific Engineering Co. Inc.

- Bean(John)Technologies Corp.

- Hosokawa Micron Corp.

- Nichimo Co. Ltd

- Satake Corp.

- Spx Corp.

- Tomra Systems ASA

第7章 市場機會與未來趨勢

The Food Processing Machinery Market size is estimated at USD 107.00 billion in 2025, and is expected to reach USD 141.24 billion by 2030, at a CAGR of 5.71% during the forecast period (2025-2030).

The shift in consumer preferences toward convenient and ready-to-eat food products is driving the need for sophisticated processing equipment. Evolving consumer lifestyles are characterized by an increasing reliance on time-saving solutions and ready-to-consume food products. This paradigm shift necessitates an evolution in food processing equipment to meet the growing expectations for efficiency, variety, and quality in the production of convenience foods. Manufacturers are investing in equipment that allows for the efficient processing of a wide variety of convenience food products. The growing demand for processed foods from developing nations worldwide and government incentives, such as reimbursement on equipment, are also among the factors driving demand from the growing markets.

For instance, according to the Agricultural & Processed Food Products Export Development Authority (APEDA), the export value of processed food and products from India in 2021 amounted to USD 390.99 billion for processed vegetables and USD 780.19 for processed fruits, juices, and nuts.

Processed food demand and consumption have been steadily increasing, which is a major driver for the industry. Despite being a global phenomenon, this desire is particularly prevalent in underdeveloped countries. The food processing industry in nations like India and China has fundamentally evolved as a result of recent economic success and increased market openness to international commodities. An increase in meat eating is one of the most significant consequences of this. One of the fastest-expanding segments, especially in developing nations, is the meat processing equipment segment.

The developed markets of Western Europe, the United States, and Canada are witnessing a strong demand for processing and packaging equipment from the bakery and beverage industries. The increasing popularity of functional beverages has escalated the demand for equipment that is utilized in the production of non-alcoholic drinks and dairy-based beverage products.

Moreover,food equipment manufacturers are developing new ways of working by investing in new capabilities, like advanced data and analytics, robotics, and automation, to attract more processors. The integration of Internet of Things (IoT) technologies and smart sensors in food processing equipment is a notable trend. This enables real-time monitoring, predictive maintenance, and data-driven decision-making, enhancing overall operational efficiency. The key market players are focused on providing machinery with high efficiency to cater to the demand from food processors.

Food Processing Machinery Market Trends

Increasing Automation in Food and Beverage Processing

Advances in food processing equipment technology have led to improved efficiency, productivity, and product quality. Automation, robotics, IoT integration, artificial intelligence, and data analytics are being increasingly adopted to streamline operations, reduce labor costs, and enhance food safety and traceability. Automation is helping reduce production time while increasing output as demand and costs continue to rise. Food processors are increasingly aware of the value of data-driven insights in maximizing the utilization of raw materials, ensuring traceability and support for constant improvement, and improving food quality and safety. The robotic butchery machine, which helps speed up the process, is among the most common types of automation gear. This automated equipment also makes facilities safer since it reduces the amount of personnel handling potentially harmful tools and apparatus.

For instance, in November 2023, the University of Birmingham Enterprise launched EvoPhase. It uses evolutionary AI algorithms, coupled with simulations of particulates in systems such as industrial mixers, to evolve an optimized design for the mixing blade and the shape or size of the blending vessel. EvoPhase offers a diverse range of process equipment, including mills, dryers, roasters, coaters, fluidized beds, and stirred tanks, and is expected to result in huge cost and energy savings for the industry.

The meat, baking, and dairy segments of the market are among the major segments adopting automation in terms of processing and packaging, resulting in increased production efficiency in the market. With a significant number of players operating in the market, technical advancements in terms of automation are expected to drive the market in a positive direction over the coming years.

Europe Holds the Largest Market Share

Europe, one of the prominent regional markets, is likely to witness significant growth over the coming years owing to the growing demand for high-quality systems. France, Germany, the Netherlands, the United Kingdom, Spain, and Denmark are the important markets in Europe. Firms belonging to Europe are also major exporters of food and beverage products. France is a major exporter of food products, including dairy, meats, wines, and processed foods. To meet the growing demand for French food products in international markets, food processors require efficient and reliable equipment that can scale production to meet export requirements while maintaining product quality and consistency. For example, according to Eurostat, the volume of cheese from France reached 665.4 thousand tons in 2022, while it was 657.06 thousand tons in 2020. Similarly, according to UN Comtrade, the export of meat from sheep or goats, in fresh, chilled, and frozen forms, in France increased and reached EUR 340.61 million in 2022, registering an increase from EUR 297.29 million in 2021.

There is a growing emphasis on sustainability and environmental responsibility in the food industry. Food processors are investing in equipment that reduces energy consumption, minimizes waste, and optimizes the use of resources to achieve sustainability goals and reduce their environmental footprint. Equipment with features such as energy-efficient technologies, water recycling systems, and waste reduction measures are in demand to support sustainable food production practices. Thus, companies have started to manufacture food processing machinery with energy-efficient technology. For example, OctoFrost Processing Solutions provides energy-efficient food processing machinery, particularly in the fields of freezing and thermal processing. The company offers innovative solutions designed to optimize energy usage while maintaining the quality and integrity of food products.

Food Processing Machinery Industry Overview

The global food processing machinery market includes the presence of large regional and domestic players across different countries, with domestic companies having gained preference over multinationals with a higher market share. Some of the major players in the global food processing machinery market include JBT Corporation, Buhler AG, Krones AG, Marel, and Tetra Laval.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increasing Demand for Processed Food Products

- 4.1.2 Technological Advancements Supporting Market Growth

- 4.2 Market Restraints

- 4.2.1 Increasing Cost of Production Due to Rise in Energy and Labor Cost

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Processing Machinery and Equipment

- 5.1.2 Packaging Machinery and Equipment

- 5.1.3 Utilities

- 5.2 Application

- 5.2.1 Dairy and Dairy Alternatives

- 5.2.2 Meat/Seafood and Meat/Seafood Alternatives

- 5.2.3 Bakery and Confectionery

- 5.2.4 Beverages

- 5.2.5 Fruits, Vegetables, and Nuts

- 5.2.6 Other Applications

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 France

- 5.3.2.4 Russia

- 5.3.2.5 Italy

- 5.3.2.6 Spain

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Japan

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Anko Food Machine

- 6.3.2 Buhler AG

- 6.3.3 GEA

- 6.3.4 Krones AG

- 6.3.5 Tetra Laval

- 6.3.6 Atlas Pacific Engineering Co. Inc.

- 6.3.7 Bean (John) Technologies Corp.

- 6.3.8 Hosokawa Micron Corp.

- 6.3.9 Nichimo Co. Ltd

- 6.3.10 Satake Corp.

- 6.3.11 Spx Corp.

- 6.3.12 Tomra Systems ASA