|

市場調查報告書

商品編碼

1686304

汽車塗料:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Automotive Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

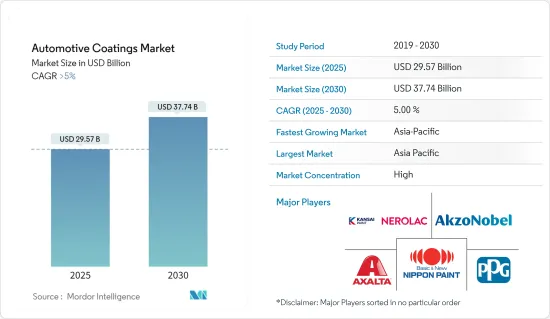

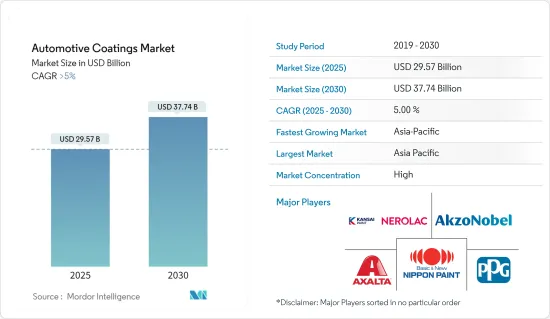

預計 2025 年汽車塗料市場規模為 295.7 億美元,到 2030 年將達到 377.4 億美元,預測期內(2025-2030 年)的複合年成長率將超過 5%。

主要亮點

- 汽車產量的成長、投資的增加以及政府對汽車OEM製造商的優惠政策預計將推動汽車塗料市場的發展。

- 然而,嚴格的 VOC 法規預計會阻礙市場成長。

- 預計電動車市場的成長將在預測期內為市場創造機會。

- 預計亞太地區將主導市場,並在預測期內實現最高的複合年成長率。這是由於該地區汽車OEM和煉油行業對汽車塗料的需求不斷成長。

汽車塗料市場趨勢

OEM領域將迎來強勁成長

- 汽車,包括乘用車和輕型商用車,會暴露在各種惡劣的環境中,包括溫度變化、酸雨、灰塵和水,這些都會劣化其外觀和性能。這些塗層有助於減輕車輛重量並改善輪胎的滾動阻力,從而提高車輛的整體效率。

- 聚氨酯基塗料可使汽車表面長期保持良好的外觀和高光澤度。雖然聚氨酯樹脂體系的初始成本高於環氧樹脂體系,但從長遠來看,聚氨酯樹脂體系更具成本效益,因為聚氨酯樹脂體系的壽命約為環氧樹脂體系的 1.5 到 2 倍。

- 丙烯酸和聚酯基塗料是汽車OEM應用中發現的其他類型的樹脂塗料。環氧樹脂是一種比丙烯酸樹脂更堅固的塑膠。這使得汽車OEM應用中精細細節的加工更加有效,同時還具有出色的磨料性能。

- 溶劑在汽車OEM塗料中起著至關重要的作用。消費者的偏好正轉向油漆和被覆劑中 VOC 含量較低的產品,預計在預測期內,這將導致消費者對水性塗料的偏好增加。然而,與水性塗料相比,溶劑型塗料具有更優異的性能。

- 全球汽車產量的成長可能會增加對汽車OEM塗料市場的需求。例如,根據歐洲汽車工業協會(ACEA)的預測,2022年全球汽車產量將達到8,540萬輛,較2021年成長5.7%。

- 由於這些因素,所研究市場的OEM應用部分在預測期內可能會呈現成長。

亞太地區預計將實現最高成長

- 亞太地區是汽車塗料最大的市場,其次是北美和歐洲。印度和東南亞國協汽車產量的成長預計將推動該地區對汽車塗料的需求。

- 根據中國工業協會預測,2023年中國汽車產量將達3,016萬輛,與前一年同期比較增加11.6%。根據國際汽車工業組織(OICA)預測,2022年中國汽車產量將達2,702萬輛,較2021年同期成長3%。

- 據國際貿易辦公室稱,到 2025 年,中國國內汽車產量預計將達到 3,500 萬輛。中國汽車產量的增加可能會導致汽車塗料消費量的增加。

- 印度汽車工業是印度經濟的重要指標,在技術進步和宏觀經濟擴張中發揮關鍵作用。根據行業趨勢,印度汽車行業近年來經歷了巨大的成長。

- 預計未來幾年汽車產量的成長將推動汽車塗料的需求。許多國內外製造商正在該國投資,以增加汽車產量並滿足該國的需求。例如,2023年5月,印度最大的汽車製造商瑪魯蒂鈴木印度公司透露,計畫在2030年投資超過55億美元,將產能翻倍。

- 日本的汽車產業是世界第三大產業,全國有78家汽車工廠,員工超過550萬人。汽車製造業佔日本第一大製造業(運輸機械工業)的89%,汽車零件製造商是日本經濟的重要組成部分。

- 根據日本汽車工業協會(JAMA)發布的新車註冊資料,2023年9月日本新車市場較上月的395,163輛成長約11%至437,493輛。 9月的強勁成長延續了8月的市場發展動能。在連續三個月放緩之後,日本市場8月開始加速。 8月汽車年銷量達到5.36億輛,較7月的低迷成長了28%。

- 由於這些因素,預計該地區的汽車塗料市場在預測期內將以穩定的速度成長。

汽車塗料產業概況

汽車塗料市場比較分散。市場的主要企業包括阿克蘇諾貝爾公司 (AkzoNobel NV)、艾仕得塗料系統公司 (Axalta Coating Systems)、關西塗料公司 (Kansai Nerolac Paints)、日本塗料控股公司 (Nippon Paint Holdings) 和 PPG 工業公司 (PPG Industries)(排名不分先後)。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場促進因素

- 汽車產量成長

- 增加對汽車OEM和政府政策的投資

- 其他促進因素

- 市場限制

- 嚴格的VOC法規

- 其他阻礙因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 按類型

- 聚氨酯

- 環氧樹脂

- 丙烯酸纖維

- 其他樹脂類型

- 依技術

- 溶劑型

- 水

- 粉末

- 分層

- 電著底漆

- 底漆

- 底塗層

- 透明塗層

- 按應用

- OEM

- 精煉

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲和紐西蘭

- 印尼

- 馬來西亞

- 泰國

- 其他東南亞國協

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 法國

- 英國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 埃及

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作與協議

- 市場佔有率(%)分析

- 主要企業策略

- 公司簡介

- Akzo Nobel NV

- Axalta Coating Systems Ltd

- BASF SE

- Beckers Group

- Cabot Corporation

- Eastman Chemical Company

- HMG Paints Limited

- Jotun

- Kansai Nerolac Paints Limited

- KCC Corporation

- Nippon Paint Holdings Co. Ltd

- Parker Hannifin Corp.

- PPG Industries Inc.

- RPM International Inc.

- Shanghai Kinlita Chemical Co. Ltd

- The Sherwin-Williams Company

第7章 市場機會與未來趨勢

- 電動車市場的成長機會

- 其他機會

The Automotive Coatings Market size is estimated at USD 29.57 billion in 2025, and is expected to reach USD 37.74 billion by 2030, at a CAGR of greater than 5% during the forecast period (2025-2030).

Key Highlights

- The growing automotive production, increasing investments, and favorable government policies for automotive OEMs are expected to drive the market for automotive coatings.

- However, stringent VOC regulations are expected to hinder the market's growth.

- Growth in the electric vehicle market is expected to create opportunities for the market during the forecast period.

- The Asia-Pacific region is expected to dominate the market, registering the highest CAGR during the forecast period. This is due to the rising demand for automotive coatings from automotive OEM and refinish industries in the region.

Automotive Coatings Market Trends

OEM Segment is Likely to Show Significant Growth

- Automotive vehicles such as passenger cars and light commercial vehicles are subjected to various harsh environments, such as changing temperatures, acid rains, dust, and water, which deteriorate the aesthetics and performance of the vehicle. Coatings help in increasing the vehicle's overall efficiency by making it lighter or enhancing the tires' rolling resistance.

- Polyurethane-based coatings deliver an improved appearance and high gloss for a longer period to automotive surfaces. While a polyurethane resin system will initially cost more compared to an epoxy resin system, it is more cost-effective in the long term as its lifespan is roughly one and a half to double that of the epoxy resin system.

- Acrylic-based coatings and polyester-based coatings are other types of resin coatings found in automotive OEM applications. Epoxy resin is a tougher plastic than acrylic resin. Hence, it provides minor details more effectively and also offers good polishing properties for automotive OEM applications.

- In automotive OEM coatings, solvents play a significant role. Consumer preferences are shifting toward lesser VOC in paints and coatings, and hence, water-borne coatings are expected to be more preferred during the forecast period. However, solvents offer greater properties when compared to water-borne coatings.

- Rising automotive production globally is likely to increase the demand for the automotive OEM coating market. For instance, according to the European Automotive Manufacturers Association (ACEA), global vehicle production reached 85.4 million in 2022, which increased by 5.7% compared to 2021.

- Owing to these factors, the OEM application segment of the market studied is likely to witness growth during the forecast period.

Asia-Pacific is Expected to Witness the Highest Growth Rate

- Asia-Pacific is the largest market for automotive coatings, followed by North America and Europe. Automotive production in India and ASEAN countries is expected to boost the demand for automotive coatings in the region.

- According to the China Association of Automobile Manufacturers (CAAM), vehicle production in China reached 30.16 million units in 2023, witnessing a growth of 11.6% compared to the previous year. According to the International Organization of Motor Vehicle Manufacturers (OICA), vehicle production in China reached a total of 27.02 million units in 2022, which is an increase of 3% over 2021 for the same period.

- Domestic production in China is expected to reach 35 million units by 2025, according to the International Trade Administration. The growing production of automobiles in the country is likely to create a hike in the consumption of automotive coatings.

- The automotive industry in India is an essential indicator of the Indian economy, as this sector plays a vital role in both technological advancements and macroeconomic expansion. As per industry trends, the automotive industry in India has been growing on a huge scale in recent times.

- The rising vehicle production is projected to increase the demand for automobile coatings in the coming years. Several domestic and international manufacturers are investing in the country to increase vehicle production and meet the country's demand. For instance, in May 2023, Maruti Suzuki India, the largest vehicle producer in India, revealed its plans to invest over USD 5.5 billion to double capacity by 2030.

- Japan's automotive industry is the world's third-largest automotive manufacturing industry, with 78 factories spread across the country employing more than 5.5 million workers. Automotive manufacturing accounts for 89% of the largest manufacturing sector (transportation machinery industry) in the country, while auto parts suppliers have become a significant part of the Japanese economy.

- In September 2023, Japan's new vehicle market grew by nearly 11% to reach 437.493 units from 395.163 units in the previous month, according to new vehicle registration data published by the Japan Automotive Manufacturers Association (JAMA). The strong September growth followed a positive market development in August. After slowing for three consecutive months, the Japanese market picked up speed in August. The August sales rate reached an impressive 5,36 million units per year, a 28% increase from the weak July.

- Due to all these factors, the market for automotive coatings in the region is expected to show steady growth during the forecast period.

Automotive Coatings Industry Overview

The automotive coatings market is fragmented in nature. Some of the major players in the market include (not in any particular order) Akzo Nobel NV, Axalta Coating Systems Ltd, Kansai Nerolac Paints Limited, Nippon Paint Holdings Co. Ltd, and PPG Industries Inc., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Growing Automotive Production

- 4.1.2 Increasing Investments and Government Policies for Automotive OEM

- 4.1.3 Other Drivers

- 4.2 Market Restraints

- 4.2.1 Stringent VOC Regulations

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 By Type

- 5.1.1 Polyurethane

- 5.1.2 Epoxy

- 5.1.3 Acrylic

- 5.1.4 Other Resin Types

- 5.2 By Technology

- 5.2.1 Solvent-Borne

- 5.2.2 Water-Borne

- 5.2.3 Powder

- 5.3 By Layers

- 5.3.1 E-Coat

- 5.3.2 Primer

- 5.3.3 Base Coat

- 5.3.4 Clear Coat

- 5.4 By Application

- 5.4.1 OEM

- 5.4.2 Refinish

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Australia and New Zealand

- 5.5.1.6 Indonesia

- 5.5.1.7 Malaysia

- 5.5.1.8 Thailand

- 5.5.1.9 Rest of ASEAN

- 5.5.1.10 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 France

- 5.5.3.3 United Kingdom

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Egypt

- 5.5.5.4 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Akzo Nobel NV

- 6.4.2 Axalta Coating Systems Ltd

- 6.4.3 BASF SE

- 6.4.4 Beckers Group

- 6.4.5 Cabot Corporation

- 6.4.6 Eastman Chemical Company

- 6.4.7 HMG Paints Limited

- 6.4.8 Jotun

- 6.4.9 Kansai Nerolac Paints Limited

- 6.4.10 KCC Corporation

- 6.4.11 Nippon Paint Holdings Co. Ltd

- 6.4.12 Parker Hannifin Corp.

- 6.4.13 PPG Industries Inc.

- 6.4.14 RPM International Inc.

- 6.4.15 Shanghai Kinlita Chemical Co. Ltd

- 6.4.16 The Sherwin-Williams Company

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Opportunity in the Electric Vehicle Market

- 7.2 Other Opportunities