|

市場調查報告書

商品編碼

1686539

智慧電網-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Smart Grid Network - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

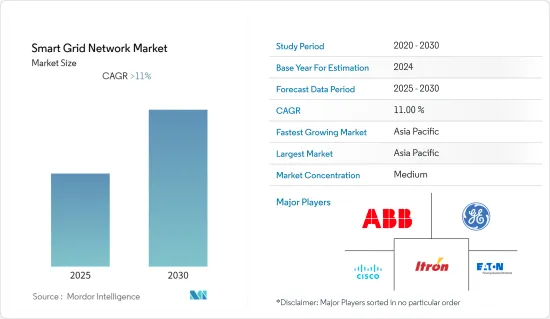

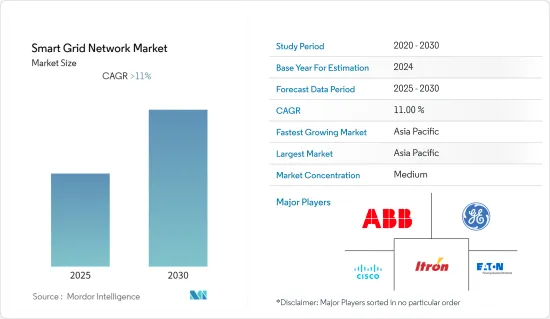

預計預測期內智慧電網市場複合年成長率將超過 11%。

主要亮點

- 由於全球已開發經濟體和新興經濟體擴大採用智慧電網技術,預計高級計量基礎設施 (AMI) 在預測期內將顯著成長。

- 世界各國新興低度開發國家的政府擴大將智慧電網技術視為維持長期經濟繁榮並有助於實現碳排放目標的戰略性基礎設施投資。預計這將在不久的將來為參與智慧電網網路市場的公司創造充足的商機。

- 預計亞太地區將在預測期內佔據市場主導地位,大部分需求來自中國、印度和日本。

智慧電網市場趨勢

先進測量基礎設施 (AMI) 將實現顯著成長

- 先進計量基礎設施 (AMI) 或智慧計量是智慧電錶、通訊網路和資料管理系統的整合系統。它實現了公用事業公司和客戶之間的雙向通訊。

- 近年來,計量行業取得了快速發展,從自動抄表(AMR)過渡到使用雙向通訊的智慧電錶,為配電公司(DISCOM)、客戶和社會帶來了更大的利益。

- AMI 提供了顯著的營運優勢,為公用事業節省了成本並為客戶提供了更多便利。 AMI 可以透過遠端讀取儀表、連接和斷開服務、識別中斷、更快地產生更準確的帳單以及允許公用事業公司為客戶提供使用資訊的數位訪問,顯著降低公用事業營運成本。

- 隨著電網現代化和減少輸配電損耗的力度不斷加大,世界各國政府都在投資先進的計量基礎設施。預計這將在預測期內推動 AMI 市場的發展。

亞太地區佔市場主導地位

- 預計亞太地區將在2021年主導智慧電網市場。在中國、印度和日本等國家的支持下,預計未來這種主導地位將持續下去。

- 中國的目標是到2025年成為全球電力設備領導者。這是《中國製造2025》計畫技術藍圖(2017年)中提出的國家戰略。創新和技術是國家計劃的重點。已撥出大量資金支持發展。

- 2015年,國家發展改革委、國家能源局強調,大力發展智慧電網,提高電網承載能力和最佳化能源資源配置能力,促進清潔能源和分散式能源利用,建構安全、高效、清潔的現代化能源系統。

- 同樣,2020年,印度成為世界第三大發電國。這種電力來自傳統能源和可再生能源。該國透過政府主導的各項「全民用電」計劃,在改善城鄉都市區的電力供應方面取得了巨大進展。

- 國家智慧電網計畫(NSGM)於 2015 年 5 月宣布,預算為 98 億印度盧比,支出為 33.8 億印度盧比,標誌著電力產業現代化的第一步。

- 2019 年 8 月,印度聯邦電力部下屬四家公共部門企業的合資企業能源效率服務有限公司 (EESL) 為印度北方邦的一個智慧電錶計劃投資了 270 億印度盧比。在這個雄心勃勃的計劃下,EESL 計劃在三年內(2019-2022 年)在該州電力消耗處安裝 400 萬個電錶。

- 因此,越來越重視解決傳統電網中普遍存在的問題、越來越關注環境保護、擴大採用智慧電網技術來節約能源和提高消費效率,正在推動該地區智慧電網市場的成長。

智慧電網產業概況

智慧電網網路市場中等程度分散。該市場的主要企業包括 ABB 有限公司、思科系統公司、伊頓公司、通用電氣公司和 Itron 公司。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究範圍

- 市場定義

- 調查前提

第2章調查方法

第3章執行摘要

第4章 市場概述

- 介紹

- 2027 年市場規模與需求預測

- 近期趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 限制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章市場區隔

- 科技應用領域

- 傳播

- 需量反應

- 先進測量基礎設施 (AMI)

- 其他技術應用

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 南美洲

- 中東和非洲

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- ABB Ltd

- Cisco Systems Inc.

- Eaton Corporation PLC

- General Electric Company

- Itron Inc.

- Osaki Electric Co. Ltd

- Hitachi Ltd

- Schneider Electric SE

- Siemens AG

- Honeywell International Inc.

第7章 市場機會與未來趨勢

簡介目錄

Product Code: 52426

The Smart Grid Network Market is expected to register a CAGR of greater than 11% during the forecast period.

Key Highlights

- Advanced Metering Infrastructure (AMI) is expected to witness significant growth during the forecast period due to the increasing deployment of smart grid technologies across the world's developed and emerging economies.

- Governments of both emerging and underdeveloped nations worldwide are increasingly viewing smart grid technology as a strategic infrastructural investment that will sustain their long-term economic prosperity and help them achieve their carbon emission reduction targets. This, in turn, is expected to provide an ample amount of opportunities to the companies involved in the smart grid network market in the near future.

- Asia-Pacific is expected to dominate the market during the forecast period, with the majority of the demand coming from China, India, and Japan.

Smart Grid Market Trends

Advanced Metering Infrastructure (AMI) to Witness Significant Growth

- Advanced metering infrastructure (AMI) or smart metering is an integrated system of smart meters, communications networks, and data management systems. It enables two-way communication between utilities and customers.

- The metering industry has taken rapid strides in the recent past few years by traversing from automated meter reading (AMR) to smart metering, using bi-directional communication, thereby enabling greater benefits to electricity distribution companies (DISCOMs), customers, and society.

- AMI provides significant operational benefits, which leads to cost savings for utility companies and convenience for customers. AMI can significantly reduce operating costs of utility companies by remotely reading meters, connecting/disconnecting service, identifying outages, generating more accurate bills in a faster manner, and enabling utilities to provide customers digital access to their usage information.

- With the increasing efforts to modernize the electricity grid and reduce T&D losses, governments across the world are investing in advanced metering infrastructure. This, in turn, is expected to drive the AMI market during the forecast period.

Asia-Pacific to Dominate the Market

- Asia-Pacific is expected to dominate the smart grid network market in 2021. It is expected to continue its dominance in the coming years, backed up by countries like China, India, and Japan.

- China has the ambition to become a world leader in electrical power equipment by 2025. This is a national strategy outlined in the Technology Roadmap (2017) of the Made in China 2025 program. Innovation and technology are heavily focused on the national program. Large amounts of funding are being allocated to support the development.

- In 2015, the National Development and Reform Commission and National Energy Administration stressed the significance of smart grid development to improve the ability of the grid to allow for and optimize the allocation of energy resources and promote the utilization of clean energy and distributed energy with the purpose to create a safe, efficient, clean, and modern energy system.

- Similarly, in 2020, India was the third-largest electricity-generating nation in the world. This power is generated from both conventional and renewable sources. The country has made major strides in improving access to power among both rural and urban communities through various government-led schemes focused on Power for All.

- The country made its first move to modernize its power utility sector, with the National Smart Grid Mission (NSGM) announced in May 2015, with an outlay of INR 980 crore and a budgetary support of INR 338 crore.

- In August 2019, Energy Efficiency Services Limited (EESL), a joint venture of four public sector enterprises under the Union Ministry of Power of India, lined up investments worth INR 2,700 crore for the smart meter project in Uttar Pradesh, India. Under the ambitious project, EESL is expected to install four million electricity meters on the premises of state power consumers in three years (2019-2022).

- Therefore, increasing focus on dealing with issues prevailing to conventional electric networks, rising concerns about environmental protection, and growth in the adoption of smart grid technology to improve efficiency in energy conservation and consumption are fueling the growth of the smart grid network market in the region.

Smart Grid Industry Overview

The smart grid network market is moderately fragmented. Some of the key players in this market include ABB Ltd, Cisco Systems Inc., Eaton Corporation PLC, General Electric Company, and Itron Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Technology Application Area

- 5.1.1 Transmission

- 5.1.2 Demand Response

- 5.1.3 Advanced Metering Infrastructure (AMI)

- 5.1.4 Other Technology Application Areas

- 5.2 Geography

- 5.2.1 North America

- 5.2.2 Europe

- 5.2.3 Asia-Pacific

- 5.2.4 South America

- 5.2.5 Middle East & Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 ABB Ltd

- 6.3.2 Cisco Systems Inc.

- 6.3.3 Eaton Corporation PLC

- 6.3.4 General Electric Company

- 6.3.5 Itron Inc.

- 6.3.6 Osaki Electric Co. Ltd

- 6.3.7 Hitachi Ltd

- 6.3.8 Schneider Electric SE

- 6.3.9 Siemens AG

- 6.3.10 Honeywell International Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219