|

市場調查報告書

商品編碼

1686609

石墨烯:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Graphene - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

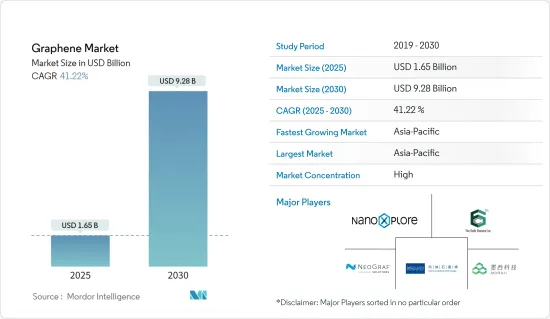

預計 2025 年石墨烯市場規模為 16.5 億美元,到 2030 年將達到 92.8 億美元,預測期內(2025-2030 年)的複合年成長率為 41.22%。

主要亮點

- 在新冠疫情期間,石墨烯的需求受到各產業不確定性的影響。然而,隨著各國取消限制,醫療保健和生物醫學等領域對石墨烯的需求正在上升。

- 石墨烯的需求主要受到其在航太、電子和通訊行業的廣泛應用的推動。

- 然而,高昂的生產成本和與現有材料的競爭可能會阻礙市場成長。

- 用於 DNA定序的石墨烯奈米裝置的開發以及石墨烯在檢測器中的應用預計將為研究市場提供成長機會。

- 預計亞太地區將成為石墨烯消費量最大的地區。該市場受到中國、日本、印度和韓國電子和通訊產業快速發展的支持。

石墨烯市場趨勢

電子和通訊產業主導市場

- 石墨烯及其衍生物在電子、通訊產業有廣泛的應用。在該領域,石墨烯被廣泛應用於各種應用,包括防碎觸控螢幕、電晶體、增強型鋰離子電池、光學電子、印刷電子和導電油墨。

- 石墨烯具有多種有用的特性,包括高機械強度、高電子遷移率和優異的導熱性。

- 電子業是全球規模最大、成長最快的產業之一。在數位時代,電子設備發揮著至關重要的作用。這些產品的需求正在激增,鞏固了它們作為全球重要經濟驅動力的地位。

- 為了滿足日益成長的需求,各公司最近都在投資建立電子製造工廠。值得注意的投資包括:

- 台灣晶片巨擘台積電於 2023 年 8 月表示,將採取戰略舉措,在 2023 年歐洲建造第一家晶圓廠,投資 38 億美元,該晶圓廠將設在德國。這項投資是在政府大力支持這座價值 110 億美元的工廠之後進行的,該工廠旨在解決歐洲供應鏈本地化計劃。

- 2024 年 6 月,義法半導體公司 (STMicroelectronics NV) 宣布打算在義大利卡塔尼亞投資 50 億歐元(54 億美元)建立晶片製造和封裝工廠。該多年計劃部分資金來自歐盟晶片法案。義大利政府計劃向意法半導體提供20億歐元的補貼。

- 此外,各國政府也推出了各種舉措來發展電子製造業。例如,2024年5月,英國政府宣佈建立英國半導體研究所的計畫。該獨立研究所旨在成為研究人員、學者以及公共和私營部門的中心樞紐,將在實現政府雄心勃勃的國家戰略中發揮至關重要的作用。

- 所有這些因素預計將推動電子和通訊行業的石墨烯消費。

亞太地區佔市場主導地位

- 受快速工業化和石墨烯應用專利激增的推動,亞太地區引領石墨烯市場。因此,氧化石墨烯將迎來巨大的成長。

- 中國是全球最大的電子產品生產基地之一,為韓國、新加坡和台灣等現有的上游製造商帶來了激烈的競爭。智慧型手機、OLED 電視和平板電腦等電子產品在市場家用電子電器領域的需求成長最快。

- 石墨烯由於其多種技術優勢,在電子產業的應用正在迅速擴大。最近值得注意的投資:

- 2024年1月,美國科研人員聯合研發出新型穩定半導體石墨烯,其性能為矽的10倍、其他2D半導體的20倍。

- 醫療設備製造和醫療保健產業也是石墨烯近期的主要消費者。近年來,醫療設備製造業的投資不斷增加。例如:

- 2024年5月,日本Omron Healthcare宣布將斥資1,550萬美元在印度泰米爾納德邦建立一家醫療設備製造廠。

- 2023年7月,深圳先進技術研究院開始大量生產其新開發的磁振造影(MRI)技術。

- 預計所有這些因素都將推動亞太地區對石墨烯的需求。

石墨烯產業概況

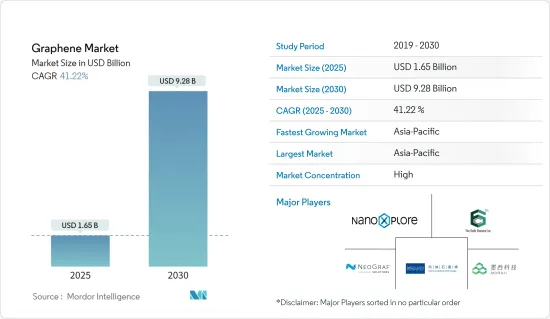

石墨烯市場本質上是整合的。主要參與者(不分先後順序)包括 NanoXplore Inc.、第六元素(常州)材料科技、NeoGraf、Morsh(寧波墨希科技)和廈門科納石墨烯科技。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場促進因素

- 石墨烯支持航太工業

- 印刷電子產品需求不斷成長

- 其他促進因素

- 市場限制

- 生產成本高

- 替代方案的可用性

- 其他限制因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場區隔

- 依產品類型

- 石墨烯片和薄膜

- 奈米帶

- 奈米血小板

- 氧化石墨烯

- 其他產品類型

- 按最終用戶產業

- 電子和通訊

- 生醫保健

- 能源

- 航太和國防

- 其他最終用戶產業

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 東南亞國協

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 西班牙

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作、協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- ACS Material

- 2D Carbon Graphene Material Co. Ltd

- Elcora Advanced Materials Corp.

- First Graphene

- G6 Materials Corp.

- Global Graphene Group

- Grafoid Inc.

- Grupo Graphenano

- Graphene Manufacturing Group Ltd

- Graphene Production

- Graphenea

- Haydale Graphene Industries PLC

- Morsh(Ningbo Moxi Technology Co. Ltd)

- Nanoxplore Inc.

- Neograf

- Perpetuus Advanced Materials Plc

- The Sixth Element(Changzhou)Materials Technology Co. Ltd

- Thomas Swan & Co. Ltd

- Universal Matter

- Versarien PLC

- Vorbeck Materials Corp.

- Xiamen Knano Graphene Technology Corporation Limited

第7章 市場機會與未來趨勢

- 用於 DNA定序的石墨烯奈米裝置的開發

- 檢測器中的石墨烯

- 其他機會

簡介目錄

Product Code: 53191

The Graphene Market size is estimated at USD 1.65 billion in 2025, and is expected to reach USD 9.28 billion by 2030, at a CAGR of 41.22% during the forecast period (2025-2030).

Key Highlights

- During the COVID-19 pandemic, the demand for graphene experienced volatility from various industries. However, the demand for graphene has seen a rise from sectors such as healthcare and biomedical as various countries have lifted lockdowns.

- The demand for graphene is majorly driven by its increased utilization from aerospace and electronics and communication industry.

- However, the high cost of production and the competition from existing materials is likely to hamper the market growth.

- The development of graphene nanodevices for DNA sequencing and adoption of graphene in photodetectors are expected to create growth opportunities for the market studied.

- The Asia-Pacific region is expected to become the largest region consuming graphene. The fast-developing electronics & telecommunication industry in China, Japan, India, and South Korea is supporting the market.

Graphene Market Trends

Electronics and Telecommunication Segment to Dominate the Market

- Graphene and its derivatives are extensively used in the electronics and telecommunications industry. This sector harnesses graphene for a myriad of applications, such as unbreakable touchscreens, transistors, enhanced lithium-ion batteries, optical electronics, printed electronics, and conductive inks.

- Graphene has several useful properties, including high mechanical strength, electron mobility, and superior thermal conductivity.

- The electronics industry stands as one of the largest and fastest-growing sectors globally. In the digital age, electronic devices play a pivotal role. The demand for these gadgets is set to surge, solidifying their status as a key economic driver globally.

- Inorder to meet the growing demand, various companies have invested in the setting up electronic manufacturing plants in recent times. Some of the notable investments include:

- In August 2023, in a strategic move, Taiwanese chip giant TSMC pledged USD 3.8 billion for its inaugural European factory, to be based in Germany. This investment follows significant support from the state, with the USD 11 billion facility corresponding to Europe's initiative to localize its supply chains.

- In June 2024, STMicroelectronics NV announced its intention to invest EUR 5 billion (USD 5.4 billion) in a chip manufacturing and packaging facility in Catania, Italy. This multi-year project is receiving partial funding from the European Union's Chips Act. The Italian government is set to provide STMicro with EUR 2 billion in subsidies.

- Furthermore, various governments have started various initiatives inorder to develop the electronic product manufacturing. For instance, In May 2024, The UK government unveiled plans to establish the UK Semiconductor Institute. Designed as a central hub for researchers, academics, and both public and private entities, this independent institute will play a pivotal role in executing the government's ambitious national strategy.

- All such factors are expected to drive the consumption of graphene in the electronics and telecommunication industry.

Asia Pacific to Dominate the Market

- Asia-Pacific leads the graphene market, driven by swift industrialization and a surge in graphene-based application patents. As a result, graphene oxide is set for significant growth.

- China has one of the world's largest electronics production bases and offers tough competition to the existing upstream producers, such as South Korea, Singapore, and Taiwan. Electronic products, such as smartphones, OLED TVs, and tablets, have the highest growth rates in the consumer electronics segment of the market in terms of demand.

- In the electronics industry, the usage of graphene has been growing at a rapid pace owing to its various technological advantages. Some of the notable investments in recent times include:

- In January 2024, researchers from China and the United States jointly created a new type of stable semiconductor graphene, which performs ten times higher than silicon and 20 times larger than the other two-dimensional semiconductors.

- The Medical device manufacturing and healthcare industry is another major consumer of graphene in recent times. There has been growing investments in the medical device production in recent times. For instance:

- In May 2024, Omron Healthcare, a Japanese company, announced that it would establish a medical device manufacturing plant in Tamil Nadu, India for USD15.5 million

- In July 2023, the Shenzen Institute of Advanced Technology commenced mass production of its newly developed magnetic resonance imaging (MRI) technology.

- All these factors are expected to drive the demand of graphene in the Asia-Pacific region.

Graphene Industry Overview

The graphene market is consolidated in nature. The major players (not in any particular order) include NanoXplore Inc., The Sixth Element (Changzhou) Materials Technology Co. Ltd, NeoGraf, Morsh (Ningbo Moxi Technology Co. Ltd), and Xiamen Knano Graphene Technology Co. Ltd .

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Graphene Aiding the Aerospace Industry

- 4.1.2 Rising Demand for Printed Electronics

- 4.1.3 Other Drivers

- 4.2 Market Restraints

- 4.2.1 High Production Cost

- 4.2.2 Availability of Substitutes

- 4.2.3 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 By Product Type

- 5.1.1 Graphene Sheets and Films

- 5.1.2 Nanoribbons

- 5.1.3 Nanoplatelets

- 5.1.4 Graphene Oxide

- 5.1.5 Other Product Types

- 5.2 By End-user Industry

- 5.2.1 Electronics and Telecommunication

- 5.2.2 Bio-medical and Healthcare

- 5.2.3 Energy

- 5.2.4 Aerospace and Defense

- 5.2.5 Other End-user Industries

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Spain

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ACS Material

- 6.4.2 2D Carbon Graphene Material Co. Ltd

- 6.4.3 Elcora Advanced Materials Corp.

- 6.4.4 First Graphene

- 6.4.5 G6 Materials Corp.

- 6.4.6 Global Graphene Group

- 6.4.7 Grafoid Inc.

- 6.4.8 Grupo Graphenano

- 6.4.9 Graphene Manufacturing Group Ltd

- 6.4.10 Graphene Production

- 6.4.11 Graphenea

- 6.4.12 Haydale Graphene Industries PLC

- 6.4.13 Morsh (Ningbo Moxi Technology Co. Ltd)

- 6.4.14 Nanoxplore Inc.

- 6.4.15 Neograf

- 6.4.16 Perpetuus Advanced Materials Plc

- 6.4.17 The Sixth Element (Changzhou) Materials Technology Co. Ltd

- 6.4.18 Thomas Swan & Co. Ltd

- 6.4.19 Universal Matter

- 6.4.20 Versarien PLC

- 6.4.21 Vorbeck Materials Corp.

- 6.4.22 Xiamen Knano Graphene Technology Corporation Limited

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Development of Graphene Nanodevices for DNA Sequencing

- 7.2 Adoption of Graphene into Photodetectors

- 7.3 Other Opportunities

02-2729-4219

+886-2-2729-4219