|

市場調查報告書

商品編碼

1687045

油漆和塗料:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Paints And Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

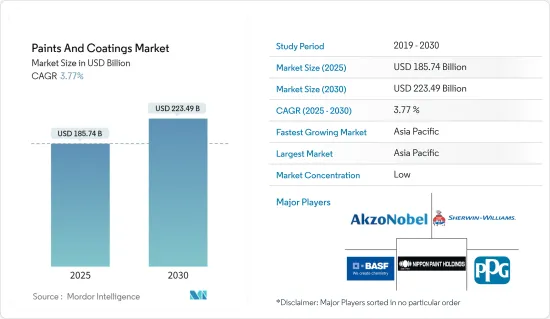

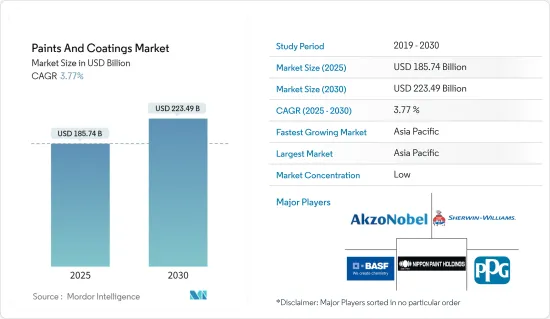

預計 2025 年油漆和塗料市場規模為 1,857.4 億美元,到 2030 年將達到 2,234.9 億美元,預測期內(2025-2030 年)的複合年成長率為 3.77%。

COVID-19 疫情對油漆和塗料市場產生了負面影響。不過,目前市場估計已達到疫情前的水準。

主要亮點

- 推動市場發展的關鍵因素是住宅投資激增和汽車生產投資加強。

- 預計全球嚴格的 VOC 法規將阻礙市場成長。

- 預計預測期內,沙烏地阿拉伯對永續塗料的需求不斷成長以及汽車產業的發展將帶來機會。

- 亞太地區佔全球市場主導地位,其中中國、印度和日本等國家佔最大消費量。

油漆和塗料市場趨勢

建築業佔市場主導地位

- 油漆和被覆劑具有多種顏色、飾面和紋理,使建築師和設計師能夠實現他們所期望的美學理念。無論是光滑的霧面飾面、光澤的表面或紋理的表面,油漆和塗料都可以增強室內和室外空間的視覺吸引力。

- 在許多亞太國家,油漆和塗料可以保護表面免受陽光、濕氣、污染和機械損壞等環境因素的影響。

- 外牆塗料可保護表面免受紫外線、雨水、暴風雨和腐蝕的影響。室內塗料還可以保護牆壁和表面免受污漬、磨損和污垢的侵害。

- 在亞太國家中,印度的建築業不斷擴張,脫穎而出,預計將成為世界第三大建築市場。印度政府的智慧城市計劃、全民住宅和永續城市發展等措施主導推動印度的建築業發展。

- 到2024年,印度的經濟適用住宅供應量預計將激增約70%。隨著都市化的推進,預計到2030年,印度將有超過30%的人口居住在都市區,這將需要額外2,500萬住宅中產階級和經濟適用住宅。牛津經濟研究院和全球建築展望共同進行的一項研究強調了這一需求,估計到 2030 年將建造 1.7 億套住宅。

- 在越南,政府制定了2021-2030年國家住宅發展策略,主要針對低收入者。特別是在總理雄心勃勃地宣佈到2030年建造超過120萬套住宅之後,各大開發商都在積極推出住宅計劃。

- 北美商業建設目前正經歷經濟放緩。這一趨勢的主要促進因素是供應鏈中斷和某些建築類型的需求減少。這種變化與遠距和混合工作方式的普及密切相關。根據美國人口普查局的資料,2024年1月至8月美國商業建築支出達11.8394億美元,低於2023年的11.51719億美元。

- 美國在北美的建築領域佔據主導地位。加拿大和墨西哥也做出了重大貢獻,尤其是在住宅建築領域,但美國憑藉其龐大的建築業脫穎而出。根據美國人口普查局的數據,2023 年住宅建築支出約為 8,775.96 億美元,低於 2022 年的 9,327.68 億美元。然而,2024 年 1 月至 8 月期間的支出激增至約 7,416,658 億美元,比 2023 年同期的 6,956,948 億美元成長 6.60%。

- 由於上述因素,油漆和塗料市場預計在預測期內將顯著成長。

中國主導亞太市場

- 中國國家VOC排放標準:中國對各種塗料,包括汽車和建築塗料,實施了嚴格的VOC法規。 GB/T 33372-2020(溶劑型塗料)、GB/T 38508-2020(水性塗料)、GB 30981-2020(建築塗料)等主要國家標準都規定了具體的VOC限值及相關調查方法。

- GB 標準:GB/T 23985-2009 等標準涵蓋汽車重漆塗料,設定 VOC 限值並規定應用製程以減少排放。

- 2024年8月,BASF歐洲公司塗料業務部在中國江門正式開設新的應用與技術中心。該中心位於BASF塗料(廣東)有限公司(BCG)園區,是BASF塗料精細化工技術網路全球擴張的重要里程碑。

- 2024 年 6 月,立邦中國母公司立邦集團在天津開設了一家新工廠,投資 9.6 億元人民幣(1.33 億美元),利用中國蓬勃發展的汽車生產。位於新加坡的天津工廠將生產工業塗料,以滿足中國汽車產業日益成長的需求。

- 此外,2023 年 9 月,Hempel A/S 宣佈建立新的油漆和塗料製造工廠,以更好地服務海洋、能源和基礎設施產業。到 2025 年,該公司的目標是每年生產約 1 億公升油漆和塗料。

- 中國是全球最大的建築市場,佔全球整體建築投資的20%。預計到 2030 年,中國將在建築領域投入約 13 兆美元,這對受訪的市場來說是一個樂觀的前景。不斷成長的住宅需求可能會推動該國公共和私營部門的住宅建設。高層建築和酒店建設的增加預計也將推動受調查市場的發展。

- 在中國,香港住宅委員會已推出多項舉措,推動經濟適用住宅建設。當局的目標是到 2030 年提供 301,000 套公共住宅。

- 中國政府已啟動大規模建設計畫,包括到2025年將2.5億農村居民遷移到新的特大城市,將為油漆和塗料創造巨大的潛力。

- 根據中國工業協會最新發布的資料,預計2023年汽車產量將超過3,016萬輛,與前一年同期比較增11.6%。預計2023年乘用車銷量為3,009萬輛,與前一年同期比較成長12%。

- 預計這些因素將在預測期內影響該地區對油漆和被覆劑的需求。

油漆和塗料行業概況

全球油漆和塗料市場較為分散。市場上的主要企業(不分先後順序)包括剪切機-Williams Company、PPG Industries、Akzo Nobel NV、Nippon Paint Holdings 和BASF SE。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場概述

- 驅動程式

- 住宅建設投資激增

- 汽車生產投資增加導致油漆和塗料需求增加

- 限制因素

- 嚴格的VOC法規阻礙市場成長

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 樹脂

- 丙烯酸纖維

- 醇酸

- 聚氨酯

- 環氧樹脂

- 聚酯纖維

- 其他樹脂

- 塗層技術

- 水性塗料

- 溶劑型塗料

- 粉末塗料

- 紫外線固化技術

- 最終用戶產業

- 建築學

- 車

- 木頭

- 防護漆

- 一般工業

- 運輸

- 包裝塗料

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 印尼

- 澳洲和紐西蘭

- 韓國

- 泰國

- 馬來西亞

- 菲律賓

- 孟加拉

- 越南

- 新加坡

- 斯里蘭卡

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 比荷盧經濟聯盟

- 俄羅斯

- 土耳其

- 瑞士

- 斯堪地那維亞國家

- 波蘭

- 葡萄牙

- 西班牙

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 智利

- 南美洲其他地區

- 中東

- 沙烏地阿拉伯

- 卡達

- 阿拉伯聯合大公國

- 科威特

- 埃及

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 阿爾及利亞

- 摩洛哥

- 其他非洲國家

- 亞太地區

第6章競爭格局

- 併購、合資、合作與協議

- 市場佔有率(%)分析

- 主要企業策略

- 公司簡介

- Akzo Nobel NV

- Asian Paints

- Axalta Coating Systems Ltd.

- BASF SE

- Berger Paints India Limited

- Hempel AS

- Jotun

- Kansai Paint Co. Ltd

- Nippon Paint Holdings Co. Ltd

- PPG Industries Inc.

- RPM International Inc.

- The Sherwin-Williams Company

- List of Other Prominent Companies

第7章 市場機會與未來趨勢

- 對永續塗料的需求不斷增加

- 沙烏地阿拉伯汽車產業的發展

The Paints And Coatings Market size is estimated at USD 185.74 billion in 2025, and is expected to reach USD 223.49 billion by 2030, at a CAGR of 3.77% during the forecast period (2025-2030).

The COVID-19 pandemic had a negative impact on the paints and coatings market. However, the market has now been estimated to have reached pre-pandemic levels.

Key Highlights

- The major factors driving the market studied are the surge in investments in residential construction and enhanced investments in automotive production.

- Stringent global VOC regulations are expected to hinder the growth of the market studied.

- Rising demand for sustainable coatings and development in Saudi Arabia's automotive sector are expected to offer opportunities in the forecast period.

- Asia-Pacific dominated the global market, with the largest consumption coming from countries such as China, India, and Japan.

Paints And Coatings Market Trends

Architectural Segment to Dominate the Market

- Paints and coatings are available in various colors, finishes, and textures, allowing architects and designers to achieve their desired aesthetic vision. Whether it's a smooth matte finish, a glossy sheen, or a textured surface, paints and coatings can enhance the visual appeal of the interior and exterior spaces.

- In most selected Asia-Pacific countries, paints and coatings protect surfaces from environmental factors such as sunlight, moisture, pollution, and mechanical damage.

- Exterior paints protect against UV radiation, rain, storms, and corrosion. Additionally, interior paints safeguard walls and surfaces from stains, abrasion, and wear.

- Among the Asia-Pacific nations, India stands out with its expansive construction sector, poised to emerge as the world's third-largest construction market. Initiatives like the Smart Cities project, Housing for All, and Sustainable Urban Development, spearheaded by the Indian government, are set to invigorate the nation's construction landscape.

- India's affordable housing availability will surge by approximately 70% by 2024. With urbanization on the rise, by 2030, over 30% of India's populace is anticipated to reside in urban areas, spurring the need for an additional 25 million mid-end and affordable housing units. A collaborative study by Oxford Economics and Global Construction Perspective underscores this demand, estimating the construction of 170 million housing properties by 2030.

- In Vietnam, the government has rolled out a national housing development strategy for 2021-2030, targeting low-income earners. Major developers are actively launching housing projects, especially after the Prime Minister's ambitious announcement to construct over 1.2 million houses by 2030.

- North America's commercial construction sector is currently navigating a slowdown. Supply chain disruptions and declining demand for certain building types primarily drive this trend. This shift is largely linked to the increasing prevalence of remote and hybrid work. Data from the United States Census Bureau indicates that commercial construction spending in the U.S. for the first eight months of 2024 reached USD 1,018,394 million, a decrease from USD 1,151,719 million in 2023.

- The United States dominates North America's construction landscape. While Canada and Mexico also make significant contributions, especially in residential construction, it's the U.S. that stands out with its vast construction sector. According to the US Census Bureau, residential construction spending in 2023 was approximately USD 877,596 million, down from USD 932,768 million in 2022. However, in the first eight months of 2024, spending surged to about USD 7,416,658 million, marking a 6.60% increase from USD 6,956,948 million during the same period in 2023.

- Due to all the above-mentioned factors, the market for paints and coatings is expected to witness significant growth during the forecast period.

China to Dominate the Market in the Asia-Pacific Region

- China's National Standards for VOC Emissions: China has implemented stringent VOC limits across a range of coatings, encompassing automotive and architectural paints. Key national standards, including GB/T 33372-2020 (targeting solvent-based coatings), GB/T 38508-2020 (focusing on waterborne coatings), and GB 30981-2020 (pertaining to construction coatings), delineate specific VOC limits and associated testing methodologies.

- GB Standards: Standards such as GB/T 23985-2009 oversee automotive refinishing coatings, establishing VOC limits and governing application processes to mitigate emissions.

- In August 2024, BASF SE's Coatings division officially inaugurated its new Application and Technical Center in Jiangmen, China. Situated within the premises of BASF Coatings (Guangdong) Co., Ltd. (BCG), this center signifies a significant milestone in the ongoing global expansion of BASF Coatings' refinish technology network.

- In June 2024, capitalizing on China's booming automobile production, Nipsea Group, the parent company of Nippon Paint China, inaugurated a new plant in Tianjin with an investment of CNY 960 million (USD 133 million). This Singapore-based facility in Tianjin is set to produce industrial coatings, catering to the escalating demands of China's automotive industry.

- Further, in September 2023, Hempel A/S announced that it had opened a new manufacturing facility for manufacturing paints and coatings to enhance its capacity to serve the marine, energy, and infrastructure industries better. By the year 2025, the company aims to manufacture approximately 100 million liters/annum of paints and coatings.

- The country has the largest construction market in the world, encompassing 20% of all construction investments globally. China is expected to spend nearly USD 13 trillion on buildings by 2030, creating a positive outlook for the market studied. The growing demand for housing is likely to drive residential construction in the country, both in the public and private sectors. The increase in the construction of tall buildings and hotels is expected to drive the market studied.

- In China, the housing authorities of Hong Kong launched several measures to push start the construction of low-cost housing. The officials aim to provide 301,000 public housing units by 2030.

- The Chinese government has rolled out massive construction plans, which include making provisions for the movement of 250 million rural people to its new megacities by 2025, creating a significant scope for paints and coatings.

- According to the latest data released by the China Association of Automobile Manufacturers (CAAM), car production in the country exceeded 30.16 million units in the year 2023, registering an 11.6% increase compared to the previous year. A total of 30.09 million units of passenger cars were sold in the country in 2023 registering a 12% increase compared to the previous year.

- These factors, in turn, are expected to affect the demand for paints and coatings in the region during the forecast period.

Paints And Coatings Industry Overview

The global paints and coatings market is fragmented in nature. Some of the major players in the market (not in any particular order) include The Sherwin-Williams Company, PPG Industries Inc., Akzo Nobel NV, Nippon Paint Holdings Co. Ltd, and BASF SE, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Drivers

- 4.1.1 Surge In Investments for Residential Constructions

- 4.1.2 Enhanced Investments in Automotive Production to Drive Up the Demand for Paints and Coatings

- 4.2 Restraints

- 4.2.1 Stringent Global VOC Regulations to Hamper Market Growth

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Resin

- 5.1.1 Acrylic

- 5.1.2 Alkyd

- 5.1.3 Polyurethane

- 5.1.4 Epoxy

- 5.1.5 Polyester

- 5.1.6 Other Resins

- 5.2 Technology

- 5.2.1 Water-Borne Coatings

- 5.2.2 Solvent-Borne Coatings

- 5.2.3 Powder Coatings

- 5.2.4 UV-cured Technologies

- 5.3 End-user Industry

- 5.3.1 Architectural

- 5.3.2 Automotive

- 5.3.3 Wood

- 5.3.4 Protective Coatings

- 5.3.5 General Industrial

- 5.3.6 Transportation

- 5.3.7 Packaging Coatings

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 Indonesia

- 5.4.1.5 Australia and New Zealand

- 5.4.1.6 South Korea

- 5.4.1.7 Thailand

- 5.4.1.8 Malaysia

- 5.4.1.9 Philippines

- 5.4.1.10 Bangladesh

- 5.4.1.11 Vietnam

- 5.4.1.12 Singapore

- 5.4.1.13 Sri Lanka

- 5.4.1.14 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Benelux

- 5.4.3.6 Russia

- 5.4.3.7 Turkey

- 5.4.3.8 Switzerland

- 5.4.3.9 Scandinavian Countries

- 5.4.3.10 Poland

- 5.4.3.11 Portugal

- 5.4.3.12 Spain

- 5.4.3.13 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Chile

- 5.4.4.5 Rest of South America

- 5.4.5 Middle East

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 Qatar

- 5.4.5.3 United Arab Emirates

- 5.4.5.4 Kuwait

- 5.4.5.5 Egypt

- 5.4.5.6 Rest of Middle East

- 5.4.6 Africa

- 5.4.6.1 South Africa

- 5.4.6.2 Nigeria

- 5.4.6.3 Algeria

- 5.4.6.4 Morocco

- 5.4.6.5 Rest of Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Akzo Nobel NV

- 6.4.2 Asian Paints

- 6.4.3 Axalta Coating Systems Ltd.

- 6.4.4 BASF SE

- 6.4.5 Berger Paints India Limited

- 6.4.6 Hempel AS

- 6.4.7 Jotun

- 6.4.8 Kansai Paint Co. Ltd

- 6.4.9 Nippon Paint Holdings Co. Ltd

- 6.4.10 PPG Industries Inc.

- 6.4.11 RPM International Inc.

- 6.4.12 The Sherwin-Williams Company

- 6.5 List of Other Prominent Companies

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Demand for Sustainable Coatings

- 7.2 Development in the Automotive Sector in Saudi Arabia