|

市場調查報告書

商品編碼

1687064

資料中心電源:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Data Center Power - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

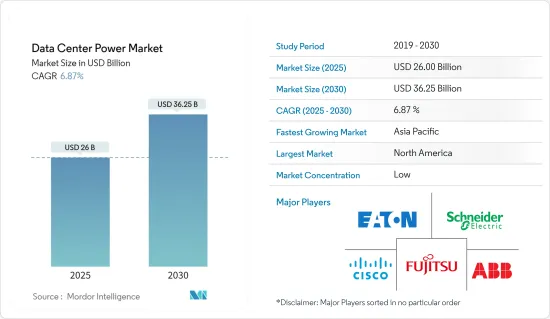

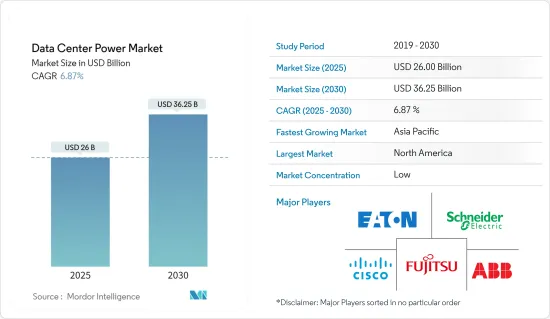

2025 年資料中心電力市場規模預估為 260 億美元,預計到 2030 年將達到 362.5 億美元,預測期內(2025-2030 年)的複合年成長率為 6.87%。

隨著人口不斷成長並且越來越依賴數位基礎設施,對資料中心的需求也日益增加。全球範圍內產生的數位資料量正在迅速成長。

主要亮點

- 隨著網路的發展和覆蓋範圍的擴大,5G 預計將在需要高頻寬、低延遲資料傳輸的新邊緣用例中發揮關鍵作用。超大規模提供者要求配電盤(PDU) 實現下一代自動化,並正在不斷發展以適應這種轉變。隨著容量的增加和空間的縮小,PDU 的建置注重模組化和提高安全性。

- 隨著資料及其各自應用的不斷成長,增加儲存容量的需求對於幾乎每個主要企業來說都變得至關重要。據Edge Delta稱,產生的資料量約為Zetta位元組,其中包括每天產生的Petabyte。

- 此外,人工智慧、機器人、物聯網和其他技術的採用預計也將增加。這方面很可能支持偏遠地區資料中心的發展。 PDU 和 UPS 等關鍵元件可協助資料中心營運商減少資料中斷並確保系統化管理電源需求。隨著資料中心變得越來越普及,備用電源解決方案的使用預計也會增加。

- 直流電源解決方案的需求增加了直流環境中配電單元、交換器和UPS等電源組件的安裝和維護成本。這對全球各地的直流營運商採用先進的直流電源解決方案提出了重大挑戰,因為他們的資本支出預算有限,這可能會阻礙未來的市場成長。

資料中心電力市場的趨勢

UPS 成為成長最快的解決方案類型

- 對於關鍵的IT設備,大型資料中心採用集中式、高容量的不斷電系統進行電源保護。透過整合最新的電源保護技術,這些系統達到了新的可靠性和效率水準。線上雙轉換是資料中心最可靠的 UPS 類型,可適應各種輸入條件,包括備用發電機的電力,同時為所需的負載提供電腦級輸出。

- 根據GSMA預測,2020年至2030年間,物聯網(IoT)連線數量將持續成長,預計2030年企業物聯網連線總合將達到240億個,這與社群媒體一起,推動全球產生和儲存的資料量呈指數級成長。資料產生的增加刺激了對資料中心基礎設施的需求以及對新技術和創新的投資,以提高能源效率、降低成本和增強性能。

- 此外,亞太地區數位化的提高也導致該地區資料中心的數量不斷增加,從而增加了該地區對UPS的需求。此外,為滿足日益成長的需求,UPS 技術創新的不斷提升預計將提高市場成長率。

- 例如,2023年7月,ABB印度電氣化業務針對資料中心推出了創新的UPS解決方案。這是世界上第一款永續UPS,是 ABB 生態解決方案產品組合的一部分,與 ABB 的循環框架保持一致。此 UPS 專為高密度運算環境而設計,具有最高的效率和最小的佔用空間。這與 ABB 電氣化的「智慧城市零排放使命」一致。這表明,所有人都將走向零排放,這也凸顯了 ABB 致力於為全球資料中心產業提供智慧、安全和永續的電力技術。

亞太地區預計將成長

- 在電子商務、雲端運算、巨量資料分析和人工智慧的推動下,中國經濟正經歷快速的數位轉型。數位活動的激增導致全國資料中心的數量和規模大幅增加。

- 此外,中國政府認知到資料中心在支持經濟成長、創新和國家發展目標方面的戰略重要性。作為「網際網路+」計畫和「十四五」規劃的一部分,政府正在大力投資資料中心等數位基礎設施,並提供獎勵來吸引投資。

- 日本對電子商務、串流媒體、線上遊戲和社交網路等網路服務的依賴日益增加,推動了其資料中心對高可用性和可靠性的需求。隨著網路使用量的不斷成長,日本的資料中心營運商正在投資電源解決方案,以防止停機並確保資料中心不間斷運作。

- 此外,日本城市中心人口的快速成長和都市化導致對巨量資料生成雲端服務和全球雲端服務供應商的需求增加,以東京、大阪和名古屋等主要城市的大型雲端平台為代表。智慧城市計畫包括物聯網感測器、智慧電網和能源管理系統的部署,需要可靠的資料中心電力基礎設施來支援其實施。因此,資料中心公司正在與電力設備製造商合作以獲得市場佔有率。

資料中心電力市場概覽

資料中心電力市場比較分散,有多家供應商。供應商正在採用各種策略,包括併購、聯盟和夥伴關係。目前,政府和私部門正在大力興建資料中心,競爭十分激烈。主要參與者包括施耐德電氣有限公司、富士通有限公司、思科科技有限公司、伊頓公司和 ABB 有限公司。

- 2023 年 10 月,ABB 有限公司宣布已將 ZincFive 加入為 UPS 系統的認證供應商。 ZincFive 提供鎳鋅電池、鋰離子電池和鉛酸電池選項,目前作為 ABB不斷電系統的一部分進行安裝和支援。

- 2023 年 10 月,Vertive 與美國電力 (AEP) 合作開設 Vertive 客戶體驗中心。 Vertiv 的 1.0 兆瓦 (MW) 微電網包括不斷電系統(UPS) 系統、鋰離子電池、系統控制設備和其他關鍵組件,可滿足客戶評估微電網和能源儲存系統在關鍵任務電力系統中的作用的需求。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場動態

- 市場促進因素

- 超級資料中心和雲端運算的日益普及

- 降低營運成本的需求日益增加

- 市場限制

- 安裝和維護成本高

- 行業法律法規

- 不同情況下的電力需求分析

第6章 技術展望

- 液體冷卻將如何影響資料中心

- 資料中心的 H2 和燃料電池

- 資料中心的永續能源

第7章 市場區隔

- 按類型

- 解決方案

- 電源分配單元

- UPS

- 公車專用道

- 其他解決方案

- 服務

- 諮詢

- 系統整合

- 專業服務

- 解決方案

- 按最終用戶應用

- IT

- 製造業

- BFSI

- 政府

- 電信

- 其他最終用戶

- 按資料中心規模

- 小型至中型

- 大規模

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

第8章 競爭格局

- 公司簡介

- Schneider Electric SE

- Fujitsu Ltd

- Cisco Technology Inc.

- ABB Ltd

- Eaton Corporation

- PDU Experts UK Ltd

- Rittal GmbH & Co. KG

- Schleifenbauer Products BV

- Vertiv Holdings Co.

- Legrand SA

- Black Box Corporation

第9章投資分析

第 10 章:市場的未來

The Data Center Power Market size is estimated at USD 26.00 billion in 2025, and is expected to reach USD 36.25 billion by 2030, at a CAGR of 6.87% during the forecast period (2025-2030).

The need for data centers has increased as the population grows increasingly connected and dependent on digital infrastructure. The amount of digital data produced globally is growing rapidly.

Key Highlights

- As networks evolve and coverage expands, 5G is expected to play the role of a major enabler of emerging edge use cases that need high-bandwidth and low-latency data transmission. Hyper-scale providers seek next-generation automation with power distribution units (PDUs) to evolve to accommodate the shift. With rising capacities and lower space, PDUs are being constructed with a focus on modularity and providing extra safety.

- The need to increase storage capacity has become critical for almost every major enterprise, as there is a continuous rise in data and its respective applications. According to the Edge Delta, the amount of data generated is around 120 zettabytes, which includes 337,080 petabytes (PB) of daily data generation.

- Further, the incorporation of Al, robotics, IoT, and other technologies is also expected to increase. This aspect will support the development of data centers in remote places. Critical components such as PDUs and UPS can assist data center operators in decreasing data outages and ensuring systematic management of the power requirement. As data centers grow in popularity, the use of backup power solutions is also expected to grow.

- The demand for DC power solutions is raising the need for installation and maintenance costs of the power components, including the power distribution units, switches, and UPS, in the DC environment, which can be a major challenge for the DC operators worldwide to adopt the advance DC power solutions due to their limited CAPEX budget, which could hinder the market's growth in the future.

Data Center Power Market Trends

UPS to be the Fastest Growing Solution Type

- In the case of critical IT equipment, large data centers use centralized, high-capacity, and uninterruptible power supply systems for power protection. By integrating the most recent power protection technologies, these systems have reached a new level of reliability and efficiency. The most reliable type of data center, UPS, or online double conversion, is capable of handling different input conditions, including power from backup generators, while providing computer-grade output to the essential load.

- According to GSMA, the number of Internet of Things (IoT) connections is expected to grow from 2020 to 2030, with an expected total of 24 billion enterprise IoT connections in 2030, along with social media, which has increased the amount of data generated and stored worldwide exponentially. Demand for data center infrastructure and investment in new technologies and innovations to improve energy efficiency, reduce costs, and enhance performance has been stimulated by this growth of data generation.

- Further, the growing digitalization in Asia-Pacific is boosting the number of data centers in the region, thereby contributing to the demand for UPS in the region. Moreover, the growing innovations in UPS that meet the increasing demand are analyzed to boost the market growth rate.

- For instance, in July 2023, ABB India's Electrification business launched innovative UPS solutions for data centers. The first-of-its-kind sustainable UPS is part of the ABB EcoSolutions portfolio and complies with the ABB circularity framework. It was designed for high-density computing environments with the greatest efficiency rating and smallest footprint. This aligns with ABB Electrification's Mission to Zero for smart cities. It envisions a zero-emission reality for all and underscores its dedication to providing smart, safe, and sustainable power technologies to the worldwide data center industry.

Asia Pacific is Expected to Witness Growth

- The Chinese economy is witnessing a rapid digital transformation driven by the expansion of e-commerce, cloud computing, big data analytics, and artificial intelligence. This surge in digital activities led to a substantial increase in the number and size of data centers nationwide.

- Further, the Chinese government has recognized the strategic importance of data centers in supporting economic growth, innovation, and national development goals. As part of its "Internet Plus" initiative and the 14th Five-Year Plan, the government invests heavily in digital infrastructure, including data centers, and provides incentives to attract investments.

- The increasing reliance on internet services, including e-commerce, streaming media, online gaming, and social networking in Japan, has driven the need for high availability and reliability of data centers. As internet usage continues to grow, data center operators in Japan are investing in power solutions to ensure uninterrupted operations and prevent downtime within the data centers.

- In addition, urban centers in Japan are experiencing rapid population growth and urbanization, leading to increased demand for cloud services and global cloud service providers that generate big data represented by mega cloud platformers in major cities like Tokyo, Osaka, and Nagoya. Smart city initiatives, including deploying IoT sensors, smart grids, and energy management systems, require reliable data center power infrastructure to support their implementation. Hence, data center companies collaborate with power equipment companies to increase their market share.

Data Center Power Market Overview

The data center power market is fragmented, with multiple vendors present. Players are adopting various strategies, such as mergers and acquisitions, collaborations, and partnerships. Various initiatives are being undertaken by governmental bodies and private data center construction, creating intense competition. Key players are Schneider Electric SE, Fujitsu Ltd, Cisco Technology Inc., Eaton Corporation, and ABB Ltd.

- In October 2023, ABB Ltd announced that it had added ZincFive as an approved supplier for its UPS systems, offering nickel-zinc as a battery option alongside lithium-ion and lead-acid, which is now installed and supported as part of an ABB uninterruptible power supply system.

- In October 2023, Vertiv partnered with American Electric Power (AEP) and opened its Vertiv Customer Experience Center, featuring a microgrid power solution to help data centers address electrical grid capacity challenges. Vertiv 1.0-megawatt (MW) microgrid includes an Uninterruptible Power Supply (UPS) system, lithium-ion battery, system controls, and other critical components to cater to customer demand who are evaluating the role of microgrids and energy storage systems for their mission-critical power systems.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products and Services

- 4.2.5 Degree of Competition

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Adoption of Mega Data Centers and Cloud Computing

- 5.1.2 Increasing Demand to Reduce Operational Costs

- 5.2 Market Restraints

- 5.2.1 High Cost of Installation and Maintenance

- 5.3 Legal and Regulatory Landscape for Industry

- 5.4 Analysis of Power Requirements in Different Cases

6 TECHNOLOGY LANDSCAPE

- 6.1 Impact of Liquid Cooling on Data Center

- 6.2 H2 and Fuel Cell for Data Center

- 6.3 Sustainable Energy for Data Center

7 MARKET SEGMENTATION

- 7.1 By Type

- 7.1.1 Solutions

- 7.1.1.1 Power Distribution Unit

- 7.1.1.2 UPS

- 7.1.1.3 Busway

- 7.1.1.4 Other Solutions

- 7.1.2 Services

- 7.1.2.1 Consulting

- 7.1.2.2 System Integration

- 7.1.2.3 Professional Services

- 7.1.1 Solutions

- 7.2 By End-user Application

- 7.2.1 Information Technology

- 7.2.2 Manufacturing

- 7.2.3 BFSI

- 7.2.4 Government

- 7.2.5 Telecom

- 7.2.6 Other End-user Applications

- 7.3 By Data Center Size

- 7.3.1 Small and Medium

- 7.3.2 Large

- 7.4 By Geography

- 7.4.1 North America

- 7.4.2 Europe

- 7.4.3 Asia

- 7.4.4 Australia and New Zealand

- 7.4.5 Latin America

- 7.4.6 Middle East and Africa

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Schneider Electric SE

- 8.1.2 Fujitsu Ltd

- 8.1.3 Cisco Technology Inc.

- 8.1.4 ABB Ltd

- 8.1.5 Eaton Corporation

- 8.1.6 PDU Experts UK Ltd

- 8.1.7 Rittal GmbH & Co. KG

- 8.1.8 Schleifenbauer Products BV

- 8.1.9 Vertiv Holdings Co.

- 8.1.10 Legrand SA

- 8.1.11 Black Box Corporation