|

市場調查報告書

商品編碼

1687067

ADAS(高級駕駛輔助系統):市場佔有率分析、行業趨勢和統計數據、成長預測(2025-2030 年)Advanced Driver Assistance Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

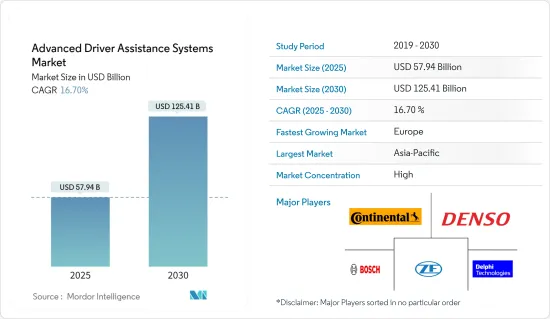

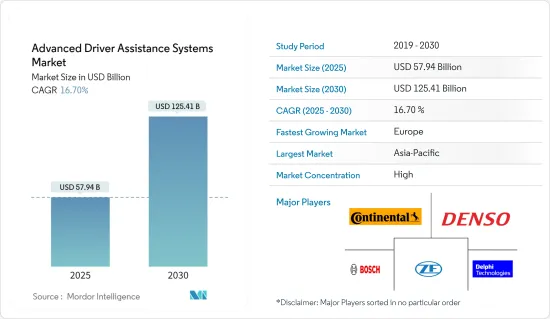

預計 2025 年 ADAS(高級駕駛輔助系統)市場規模為 579.4 億美元,到 2030 年將達到 1,254.1 億美元,預測期內(2025-2030 年)的複合年成長率為 16.7%。

隨著整合 ADAS 功能的車輛產量不斷增加,人們對乘客舒適度和安全性的認知不斷提高,以及政府對安全功能要求的法規不斷增多,可能會推動市場需求。此外,自動駕駛汽車的日益普及也有助於推動市場成長。全球汽車產業的動態也在迅速變化。

中等價格分佈的汽車的基本部件的設計和製造都符合消費者的偏好。對具有先進安全功能的小型和中型車輛的持續成長的需求預計也將推動汽車 ADAS 市場的成長。

ADAS技術有助於降低維護成本。它有助於減少煞車和輪胎的磨損,使車輛運行更平穩。歐盟已實施通用車輛安全法規,強制使用各種ADAS(高級駕駛輔助系統)以提高道路安全,並建立了自動駕駛和完全無人駕駛汽車批准的法律體制。

成熟市場和新興市場參與企業正在美國、印度、中國、德國和法國等目標國家創造新的收益來源,這可能會提高亞太地區、北美和歐洲的需求。區域需求也受到政府法規的推動。

2022 年,法國四級自動駕駛人員和貨物運輸技術供應商 Navya 宣布計劃擴大其自動駕駛電動接駁車在中東、日本、美國和蘇格蘭的地理覆蓋範圍。

預計此類發展將對市場產生正面影響。

ADAS(進階駕駛輔助系統)市場趨勢

乘用車佔最高市場佔有率

近年來,乘用車以其時尚的設計、緊湊的尺寸和經濟的價格等特點,受到了廣大駕駛員的歡迎。乘用車是許多已開發國家最常見的交通途徑。生活方式的改善、購買力的增強、可支配收入的增加、品牌知名度的提高以及經濟狀況的改善正在改變全球消費者的偏好並促進乘用車的銷售。

根據印度汽車工業協會的數據,2022-23 年乘用車銷量從 14,67,039 輛增加到 17,47,376 輛。

亞太地區對電動車的需求不斷成長也帶動了市場成長。 2023 年第一季,印度電動車銷量與 2022 年同期相比加倍。

對 SUV 日益成長的需求為市場參與者創造了商機,並成為全球乘用車市場成長的主要動力。 SUV 在乘用車 (PV) 總銷量中的比例將從 2016 年的 18% 上升至 2023 年的 41%。

世界各國政府正致力於設計多項立法政策和法規來監控使用者。一些國家正在提案政策,強制並鼓勵消費者在車輛上安裝 ADAS 組件,以減輕道路事故的增加。印度政府已強制要求二輪車安裝 ABS,重點是提高車輛安全性。

2023年11月,公路運輸和公路部提案為某些類別的車輛配備「起步資訊系統(MOIS)」。作為新草案的一部分,交通部可能會將「盲點監控」等 ADAS 安全功能作為乘用車和商用車的標準功能。

隨著中國、印度和美國等國家對 ADAS 要求的監管越來越嚴格,要求所有汽車都配備停車援助系統,汽車製造商希望在其大多數車輛中配備這些功能。曾經只在高級汽車中才有的 ADAS 功能現在也開始進入其他車輛領域。

例如,2023年2月,大陸集團持續與各大汽車廠商合作開發駕駛輔助系統。大陸集團正在與包括瑪魯蒂鈴木和塔塔汽車在內的多家印度OEM進行談判,以提供其 ADAS 技術。

由於這樣的發展,該領域預計將佔據最高的市場佔有率。

亞太地區可望成為成長最快的市場

在快速都市化、經濟繁榮和人口成長的推動下,亞洲國家對人員和貨物的流動需求日益成長。中國、印度和日本等國家構成了世界最大的汽車市場。

據國際貿易辦公室稱,按年銷量和製造產量計算,中國仍然是全球最大的汽車市場,預計到 2025 年國內產量將達到 3,500 萬輛。

亞太地區各國政府正在鼓勵採用電池式電動車(BEV)、插電式混合動力電動車 (PHEV),以及一些國家採用更有效率的汽車,以減少運輸部門的排放。據 IBEF 稱,印度有潛力到 2030 年成為共享出行領域的領導者,為電動和自動駕駛汽車提供機會。

由於世界各國政府推出的「2026汽車使命計畫」、報廢政策和與生產連結獎勵計畫( PIA)等舉措,預計亞太地區將佔據最高佔有率。推廣汽車 ADAS 和安全氣囊等各種安全功能的立法的實施也可能對市場產生積極影響。

2023年6月,中國工業與資訊化部宣布計畫支持3級以上自動駕駛技術的商業化發展。該部門專注於與其他公司的合作、建立蜂窩車聯網技術基礎設施以及 3 級先導計畫。

隨著印度眾多新產品的推出以及汽車產業逐漸進入自動駕駛和人工智慧領域,ADAS市場潛力巨大。

2023年8月,大陸集團宣布,到2030年,印度30%的新車銷售將配備2級ADAS技術。印度的中檔乘用車市場已開始引入 2 級和 2+ 級 ADAS 功能。

現在,其他每家科技公司都專注於在這個市場上創建自己的連網汽車解決方案並獲得一定的收益佔有率。

ADAS(高階駕駛輔助系統)產業概況

ADAS(高級駕駛輔助系統)市場由全球和地區的知名公司鞏固和主導。為了維持市場地位,公司正在採取新產品發布、合作和合併等策略。

- 2023 年 1 月,ADAS 公司 Seeing Machines 和 ADI 公司 (ADI) 宣布計劃合作開發基於熱像儀的 DMS/OMS 系統。與使用傳統攝影機的 DMS/OMS 系統相比,使用熱像儀的系統可以在黑暗和其他照度條件下進行監控。

市場的主要參與者包括大陸集團、羅伯特博世有限公司、奧托立夫公司、電裝公司和德爾福汽車公司。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場促進因素

- 自動駕駛汽車銷售不斷上升

- 市場限制

- ADAS系統實施成本高

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章市場區隔

- 按類型

- 停車輔助系統

- 自我調整頭燈

- 夜視系統

- 盲點偵測系統

- 先進的自動緊急煞車系統

- 碰撞警告

- 駕駛員疲勞警告

- 交通標誌識別

- 車道偏離預警

- 主動式車距維持定速系統

- 依技術

- 雷達

- LiDAR

- 相機

- 按車輛類型

- 搭乘用車

- 商用車

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 俄羅斯

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲

- 其他亞太地區

- 世界其他地區

- 南美洲

- 中東和非洲

- 北美洲

第6章競爭格局

- 供應商市場佔有率

- 公司簡介

- Aisin Seiki Co. Ltd

- Delphi Automotive

- DENSO Corporation

- Infineon Technologies

- Magna International

- WABCO Vehicle Control Services

- Continental AG

- ZF Friedrichshafen AG

- Mobileye

- Hella KGAA Hueck & Co.

- Robert Bosch GmbH

- Valeo SA

- Hyundai Mobis

- Autoliv Inc.

第7章 市場機會與未來趨勢

The Advanced Driver Assistance Systems Market size is estimated at USD 57.94 billion in 2025, and is expected to reach USD 125.41 billion by 2030, at a CAGR of 16.7% during the forecast period (2025-2030).

The growing production of vehicles with integrated ADAS features in the wake of rising awareness toward the comfort and safety of passengers and government regulations mandating safety features may drive demand in the market. The rising acceptance of self-driving or automated vehicles further contributes to the enhanced growth of the market. The dynamics of the global automotive industry are also changing rapidly.

Cars in the mid-price segment are equipped with basic components designed and manufactured according to consumer preferences. A consistent increase in the demand for compact and mid-sized automobiles equipped with advanced safety features is also expected to propel the growth of the automotive ADAS market.

ADAS technology helps cut maintenance costs. It helps with brake wear and tear and tires relative to the vehicle operating more smoothly. The European Union applied the Vehicle General Safety Regulation, introduced a range of mandatory advanced driver assistant systems to improve road safety, and established the legal framework for the approval of automated and fully driverless vehicles, which will be applied to all new vehicles from July 07, 2024.

Established and emerging market participants are generating new sources of revenue in target countries such as the United States, India, China, Germany, and France, which may improve demand across Asia-Pacific, North America, and Europe. Demand in the regions is also being driven by government regulations.

In 2022, Navya, the French provider of Level 4 autonomous mobility technology for transporting people and goods, announced its plans to expand the geographical presence of its autonomous electric shuttles in the Middle East, Japan, the United States, and Scotland.

Thus, such developments are expected to have a positive impact on the market.

Advanced Driver Assistance Systems Market Trends

Passenger Cars Hold the Highest Market Share

Passenger cars have gained immense popularity among drivers over the past few years due to features such as stylish design, compact size, and economic value. Passenger cars are the most common mode of transportation in numerous advanced countries. The improving lifestyles, increasing purchasing power, rising disposable incomes, growing brand awareness, and improving economy are leading to a shift in customer preferences worldwide, resulting in high sales of passenger cars.

According to the Society of Indian Automobile Manufacturers, sales of passenger cars increased from 14,67,039 to 17,47,376 units during 2022-2023.

The increased demand for electric vehicles in Asia-Pacific also resulted in market growth. Electric car sales in India doubled in the first quarter of 2023 compared to the same period in 2022.

A rise in the demand for SUVs creates profitable opportunities for the market players and acts as a major driving factor for the global passenger car market's growth. The share of SUVs in overall passenger vehicle (PV) sales rose from 18% in 2016 to 41% in 2023.

Governments across the world are focusing on designing several legislative policies and regulations to monitor users. They are proposing policies mandating and encouraging consumers to install ADAS components in vehicles to mitigate rising road accidents across several countries. The Indian government has already mandated a requirement for ABS on motorcycles with a focus on improving vehicle safety.

In November 2023, the Ministry of Road Transport and Highways proposed installing a 'Moving Off Information System' (MOIS) in a specific category of vehicles. As a part of the fresh draft, the Ministry could make ADAS-safety functions like 'blind spot monitoring' a standard feature across passenger and commercial vehicles.

Due to increased regulations on ADAS requirements, like mandatory installation of parking system assistance in all cars in China, India, the United States, etc., automakers are trying to include these features in most of their cars. The ADAS features, which were only available in premium cars, are now being brought to other car segments.

For instance, in February 2023, Continental was constantly working with major automotive manufacturers toward the development of driving assistance systems. Continental is in talks with multiple Indian OEMs, including Maruti Suzuki and Tata Motors, to supply its ADAS technologies.

Thus, such developments are expected to lead the segment to record the highest market share.

Asia-Pacific is Expected to be the Fastest-growing Market

Driven by rapid urbanization, economic prosperity, and a rising population, mobility needs in Asian countries have increased for people and goods. Countries like China, India, and Japan contribute to the world's largest automotive markets.

According to the International Trade Administration, China continues to be the world's largest vehicle market in terms of annual sales and manufacturing output, with domestic production expected to reach 35 million vehicles by 2025.

Governments in Asian and Asia-Pacific countries are encouraging the deployment of battery electric vehicles (BEVs), plug-in hybrid electric vehicles (PHEVs), and, in some countries, more efficient vehicles to lower emissions from the transportation sector. According to the IBEF, India could be a leader in shared mobility by 2030, providing opportunities for electric and autonomous vehicles.

Initiatives taken by the various governments, such as the Automotive Mission Plan 2026, scrappage policy, and production-linked incentive schemes, are expected to lead to Asia-Pacific holding the highest share. Implementing laws to promote various safety features, such as ADAS and airbags in vehicles, may also positively impact the market.

In June 2023, China's Ministry of Industry and Information Technology announced its plan to support the country's commercial development of Level 3 and higher autonomous driving technology. The agency is focused on collaborating with other companies, building infrastructure for cellular vehicle-to-everything technology, and Level 3 pilot projects.

India has potential and opportunity for the ADAS market as the country is gradually stepping into the autonomous and AI-oriented automotive industry, along with many new product launches.

In August 2023, Continental announced that 30% of new car sales in India will have Level 2 ADAS tech by 2030. The mid-level Indian passenger vehicle segment has started seeing the introduction of Level 2 and Level 2+ ADAS functions.

Currently, every other technology company is focusing on creating connected car solutions unique to this market and acquiring a share of the revenue.

Advanced Driver Assistance Systems Industry Overview

The advanced driver assistance system market is consolidated and led by globally and regionally established players. The companies adopt strategies such as new product launches, collaborations, and mergers to sustain their market positions.

- In January 2023, the ADAS company Seeing Machines and Analog Devices (ADI) announced their plan to collaborate on developing DMS/OMS systems that are based on infrared cameras. In contrast with DMS/OMS systems with traditional cameras, systems that use infrared cameras can monitor in the dark or other low-light conditions.

Some of the major players in the market include Continental AG, Robert Bosch GmbH, Autoliv Inc., Denso Corporation, and Delphi Automotive PLC.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increasing Sales of Autonomous Vehicles

- 4.2 Market Restraints

- 4.2.1 High Cost of Installation Related to ADAS Systems

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size - Value in USD billion)

- 5.1 By Type

- 5.1.1 Parking Assist Systems

- 5.1.2 Adaptive Front-lighting

- 5.1.3 Night Vision Systems

- 5.1.4 Blind Spot Detection

- 5.1.5 Advanced Automatic Emergency Braking Systems

- 5.1.6 Collision Warning

- 5.1.7 Driver Drowsiness Alerts

- 5.1.8 Traffic Sign Recognition

- 5.1.9 Lane Departure Warning

- 5.1.10 Adaptive Cruise Control

- 5.2 By Technology

- 5.2.1 Radar

- 5.2.2 LiDAR

- 5.2.3 Camera

- 5.3 By Vehicle Type

- 5.3.1 Passenger Cars

- 5.3.2 Commercial Vehicles

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Russia

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 South America

- 5.4.4.2 Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Aisin Seiki Co. Ltd

- 6.2.2 Delphi Automotive

- 6.2.3 DENSO Corporation

- 6.2.4 Infineon Technologies

- 6.2.5 Magna International

- 6.2.6 WABCO Vehicle Control Services

- 6.2.7 Continental AG

- 6.2.8 ZF Friedrichshafen AG

- 6.2.9 Mobileye

- 6.2.10 Hella KGAA Hueck & Co.

- 6.2.11 Robert Bosch GmbH

- 6.2.12 Valeo SA

- 6.2.13 Hyundai Mobis

- 6.2.14 Autoliv Inc.