|

市場調查報告書

商品編碼

1687073

微灌溉系統:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Micro-Irrigation Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

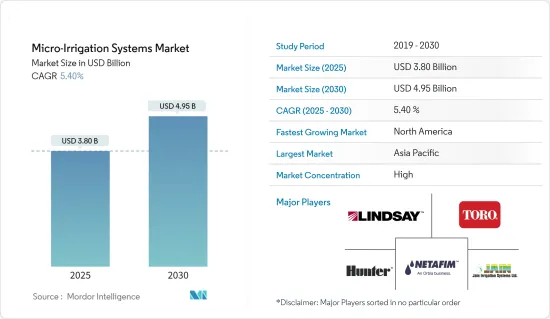

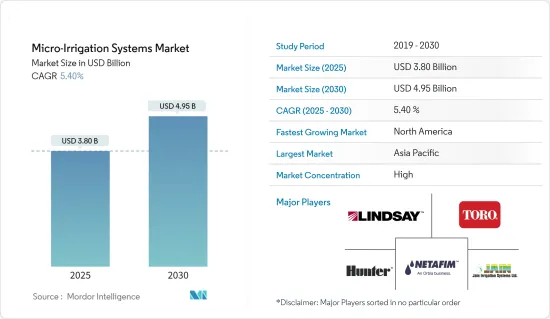

微型灌溉系統市場規模預計在 2025 年為 38 億美元,預計到 2030 年將達到 49.5 億美元,預測期內(2025-2030 年)的複合年成長率為 5.4%。

主要亮點

- 微灌溉系統市場正在經歷令人矚目的成長。推動這項擴張的關鍵因素包括全球水資源短缺、水肥一體化的廣泛應用以及世界各國政府機構的大力支持。

- 值得注意的是,世界銀行等知名組織正在透過微灌溉計畫支持並積極推動烏干達的微灌溉,該計畫是烏干達政府間財政轉移結果計畫(UgIFT)的一部分。對精密農業、永續農業和增加糧食產量的迫切需求進一步加強了微灌溉系統市場。

- 全球範圍內微灌溉的普及正在加速,其中亞太地區處於領先地位。繼中國之後,印度在該地區脫穎而出。印度多個邦政府正在推廣使用微灌溉。例如,在安得拉邦微灌溉計劃(APMIP)下,安得拉邦政府向擁有少於五英畝土地的農民提供灌溉設施(包括微灌溉)90%的補貼,並向擁有五英畝以上的農民提供70%的補貼。

- 由於精密農業,尤其是變數灌溉(VRI)技術的日益融合,微灌溉系統市場正在成長。這一趨勢是由快速成長的食品需求所驅動,在開發中國家均有出現。透過利用監測土壤濕度和作物健康狀況的感測器,基於 VRI 的微灌溉系統可以最佳化用水量、提高作物產量並降低投入成本。然而,高昂的初始成本和持續的維護成本對市場成長構成了障礙。

微灌溉系統市場趨勢

戶外種植引領細分市場

- 目前的食品生產方法高度依賴土地、水和清潔劑等資源,這引發了人們對其長期永續性的擔憂。聯合國預測,到2050年世界人口將接近96億人。 2023年全球小麥產量將達7.885億噸,米的生產量將達5.381億噸。消費和生產趨勢表明,糧食產量需要增加兩倍才能充分養活世界人口。

- 農業消耗了全世界70%的水資源,而且大多數作物都是在露天田地種植的,需要耗水。這至關重要,因為農業用水直接影響飲用水和其他基本用水需求的供應。為了解決農業過度用水問題,各國政府和國際組織正大力推廣微灌溉系統。

- 這些計劃中常見的種植作物包括玉米、高粱、大豆、向日葵、各種穀物和豆類。此外,大量水果、蔬菜和種植作物都在露天田地中生產。灌溉系統主要有樞軸灌溉系統、噴水灌溉系統及滴灌系統。

- 有效的水資源管理對於提高埃及和其他東方國家等半乾旱國家的作物水分生產率至關重要。 2023年,埃及國家水資源研究中心(NWRC)水資源管理實驗室對茄子作物進行了研究。該研究重點比較了露天灌溉和地下滴灌系統對露天田土壤特性、水分生產率和產量指標的影響。研究結果強調了露地種植在節水、提高生產力和產量的有效性,尤其是在黏土條件下。

亞太地區是一個快速成長的市場

- 亞太地區引領微灌溉市場,主要原因是農業所有權分散、政府在人口密集的情況下大力推行節水措施以及提高農業產量。

- 中國是亞太地區的主要企業,也是微灌溉系統零件製造領域的全球領導者。這一有影響力的地位很大程度上歸功於政府對農業實踐現代化的重視。中國雄心勃勃的五年計畫旨在大幅擴大其市場。至2030年,預計75%的灌溉區將採用節水微灌系統。

- 印度的農業高度依賴季風,因此與許多已開發國家相比,灌溉農業的比例較低。根據印度國家轉型研究所(NITI)的報告,由於微灌溉技術和各種舉措措施的使用增加,2022-23年間,受益於可靠灌溉的耕地面積將增加 52%,達到 7,300 萬公頃。

- 除中國和印度外,日本、越南、菲律賓、孟加拉和巴基斯坦等國家也對微灌溉市場產生了重大影響。微灌溉系統在這些國家的普及得益於各組織的支持和政府的大力支持。對該地區小農戶來說,一個關鍵的獎勵是該系統能夠減少消費量,同時顯著提高產量。

微灌溉系統產業概況

微灌溉系統市場由五大主要企業主導。隨著各國政府擴大透過微灌溉系統提倡節約用水,市場有望實現強勁的兩位數成長。塑造這一市場格局的主要企業是 Jain Irrigation Systems Limited、Netafim Limited、Lindsay Corporation、Hunter Industries 和 The Toro Company。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 市場促進因素

- 推廣緩解缺水問題的措施

- 施肥技術推廣應用

- 增加政府支持

- 市場限制

- 較大的初始資本要求

- 複雜的設定帶來部署挑戰

- 波特五力分析– 產業吸引力

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 機制

- 滴灌系統

- 噴水灌溉系統

- 其他微灌溉系統

- 成分

- 滴灌組件

- 滴頭

- 管子

- 閥門和過濾器

- 壓力調節器

- 其他滴灌組件

- 噴水灌溉組件

- 管子

- 噴嘴

- 壓力調節器

- 其他噴水灌溉組件

- 滴灌組件

- 栽培技術

- 戶外種植

- 保護地栽培

- 應用

- 大田作物

- 果園和葡萄園

- 蔬菜

- 種植作物

- 其他用途

- 地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 俄羅斯

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 非洲

- 南非

- 埃及

- 非洲其他地區

- 北美洲

第6章 競爭格局

- 最受歡迎的策略

- 市場佔有率分析

- 公司簡介

- Jain Irrigation Systems Limited

- Netafim Limited

- Lindsay Corporation

- The Toro Company

- Deere & Company

- Harvel Agua

- Mahindra and Mahindra(EPC Irrigation Limited)

- Nelson Irrigation Corporation

- Rain Bird Corporation

- Elgo Irrigation Ltd

- Antelco Pty Ltd

- Kothari Agritech Private Limited

第7章 市場機會與未來趨勢

The Micro-Irrigation Systems Market size is estimated at USD 3.80 billion in 2025, and is expected to reach USD 4.95 billion by 2030, at a CAGR of 5.4% during the forecast period (2025-2030).

Key Highlights

- The micro irrigation systems market is witnessing impressive growth. Key drivers fueling this expansion include global water scarcity, the rising adoption of fertigation practices, and robust backing from government entities worldwide.

- Notably, esteemed organizations like the World Bank are supporting and actively promoting micro-irrigation in Uganda through its Micro-scale Irrigation Program, which is part of the Uganda Intergovernmental Fiscal Transfers Program for Results (UgIFT). Precision farming, sustainable agriculture, and the urgent need for increased food production further bolster the micro irrigation systems market.

- Micro-irrigation adoption has accelerated globally, with Asia-Pacific leading the charge. Within this region, India stands out as the dominant player after China. Several Indian state governments are promoting the use of micro-irrigation. For instance, under the Andhra Pradesh Micro Irrigation Project (APMIP), the state government of Andhra Pradesh is offering a 90% subsidy on irrigation equipment (including micro irrigation) to farmers with less than five acres and 70% for those with larger holdings.

- The micro irrigation systems market is expanding, driven by the rising integration of precision agriculture, especially variable rate irrigation (VRI) technology. This trend is observable in developing and developed nations, fueled by surging food demand. VRI-based micro-irrigation systems optimize water usage, boost crop yields, and reduce input costs by leveraging sensors to monitor soil moisture and crop health. However, significant upfront costs and ongoing maintenance expenses challenge the market's growth.

Micro-Irrigation Systems Market Trends

Open Field Cultivation Leads the Market Segment

- Current food production methods heavily depend on resources like land, water, and detergents, sparking concerns about long-term sustainability. The United Nations (UN) forecasts the global population will near 9.6 billion by 2050. In 2023, global wheat and rice production reached 788.5 million metric tons and 538.1 million metric tons, respectively. Due to consumption and production trends, a threefold increase in food output is necessary to feed the world's population adequately.

- Agriculture consumes 70% of the world's water, with most crops grown in open fields where water use is prevalent. This is crucial, as water used in agriculture directly affects its availability for drinking and other essential needs. To address water overuse in agriculture, governments and international agencies are rigorously promoting the use of micro-irrigation systems.

- The crops commonly grown in these projects include maize, sorghum, soybean, sunflower, various grains, and legumes. Additionally, large quantities of fruits, vegetables, and plantation crops are being produced in open-field cultivation. The main irrigation systems used are pivot center systems, sprinkler irrigation systems, and drip irrigation.

- Effective water resource management is crucial for improving crop water productivity in semiarid countries like Egypt and other Eastern nations. In 2023, the Water Management Research Institute at the National Water Research Center (NWRC) in Egypt conducted a study on eggplant crops. The study focused on comparing the impact of surface and subsurface drip irrigation systems, soil characteristics, water productivity, and yield indices in open field settings. The research findings highlighted the effectiveness of open-field methods in conserving water and improving productivity and yield, particularly in clay soil conditions.

Asia-Pacific is the Fastest-growing Market

- Asia-Pacific leads the micro-irrigation market, driven by fragmented agricultural ownership, robust government initiatives aimed at water conservation for its dense population, and a heightened agricultural output.

- China, a major player in Asia-Pacific, is a global leader in manufacturing components for micro-irrigation systems. This influential position is primarily attributed to the government's dedication to modernizing agricultural practices. China's ambitious five-year plans aim for significant market expansion. By 2030, 75% of its irrigated areas will adopt water-saving micro-irrigation systems.

- Indian agriculture heavily relies on the monsoon, resulting in a lower percentage of irrigated farming than many developed nations. With the increasing use of micro-irrigation techniques and various irrigation initiatives, the amount of cultivated land benefiting from reliable irrigation has risen to 52%, which equals 73 million hectares in the 2022-23 period, according to a report by the National Institute for Transforming India (NITI) Aayog.

- Apart from China and India, countries such as Japan, Vietnam, the Philippines, Bangladesh, and Pakistan significantly impact the micro-irrigation market. The popularity of micro-irrigation systems in these nations can be attributed to endorsements from various organizations and strong government support. A key incentive for small-scale farmers across the region is the system's ability to reduce water consumption while simultaneously increasing production significantly.

Micro-Irrigation Systems Industry Overview

The micro irrigation systems market is dominated by five key players holding a significant share. As governments increasingly promote water conservation through micro-irrigation systems, the market is poised for robust double-digit growth. The leading companies shaping this market landscape are Jain Irrigation Systems Limited, Netafim Limited, Lindsay Corporation, Hunter Industries, and The Toro Company.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Widespread Adoption Could Alleviate Water Scarcity Issues

- 4.2.2 Growing Adoption of Fertigation Techniques

- 4.2.3 Rising Government Support

- 4.3 Market Restraints

- 4.3.1 Significant Initial Capital Requirements

- 4.3.2 Challenges in Implementing Due to Their Intricate Setup

- 4.4 Porter's Five Forces Analysis-Industry Attractiveness -

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Mechanism

- 5.1.1 Drip Irrigation System

- 5.1.2 Sprinkler Irrigation System

- 5.1.3 Other Micro-irrigation Systems

- 5.2 Component

- 5.2.1 Drip Irrigation Components

- 5.2.1.1 Drippers

- 5.2.1.2 Tubing

- 5.2.1.3 Valves and Filters

- 5.2.1.4 Pressure Regulators

- 5.2.1.5 Other Drip Irrigation Components

- 5.2.2 Sprinkler Irrigation Components

- 5.2.2.1 Tubing

- 5.2.2.2 Nozzles

- 5.2.2.3 Pressure Regulators

- 5.2.2.4 Other Sprinkler Irrigation Components

- 5.2.1 Drip Irrigation Components

- 5.3 Cultivation Technology

- 5.3.1 Open Field

- 5.3.2 Protected Cultivation

- 5.4 Application

- 5.4.1 Field Crops

- 5.4.2 Orchards and Vineyards

- 5.4.3 Vegetables

- 5.4.4 Plantation Crops

- 5.4.5 Other Applications

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Spain

- 5.5.2.5 Italy

- 5.5.2.6 Russia

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Egypt

- 5.5.5.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Jain Irrigation Systems Limited

- 6.3.2 Netafim Limited

- 6.3.3 Lindsay Corporation

- 6.3.4 The Toro Company

- 6.3.5 Deere & Company

- 6.3.6 Harvel Agua

- 6.3.7 Mahindra and Mahindra (EPC Irrigation Limited)

- 6.3.8 Nelson Irrigation Corporation

- 6.3.9 Rain Bird Corporation

- 6.3.10 Elgo Irrigation Ltd

- 6.3.11 Antelco Pty Ltd

- 6.3.12 Kothari Agritech Private Limited