|

市場調查報告書

商品編碼

1687155

地熱能-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Geothermal Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

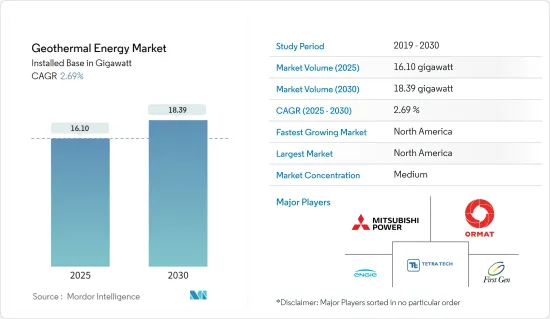

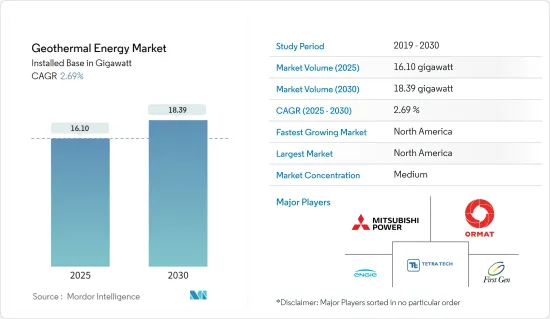

基於安裝基數,地熱能市場規模預計將從 2025 年的 16.10 吉瓦成長到 2030 年的 18.39 吉瓦,預測期內(2025-2030 年)的複合年成長率為 2.69%。

關鍵亮點

- 從中期來看,人們對清潔環保能源電力安全的興趣日益濃厚,以及對地源熱泵和區域供熱等供暖和製冷系統的需求不斷增加等因素,正在推動地熱能市場的成長。

- 然而,太陽能和風能等替代清潔能源來源利潤豐厚,可能會在預測期內阻礙市場成長。

- 預計政府主導的財政誘因和退稅等促進永續能源生產的措施將在預測期內為地熱能市場創造大量成長機會。

- 預計北美將成為預測期內最大的市場,大部分需求來自美國、加拿大和墨西哥等國家。

地熱能市場趨勢

雙回圈地熱發電廠預計將強勁成長

- 雙回圈地熱發電廠採用低於 182 攝氏度(360 華氏度)的低溫流體,該流體通過由二次流體組成的熱交換器。這種二次或二元流體使地熱流體蒸發,然後推動渦輪機發電。

- 雙回圈地熱發電廠的運作方式與其他兩種地熱技術不同,因為地熱流體不會直接接觸渦輪機。

- 雙回圈發電廠的優勢在於中溫地熱流體比高溫地熱資源更容易獲得,根據美國能源局的數據,雙回圈發電廠有可能成為利用這一特性的一種流行的發電形式。

- 雙回圈發電廠的組成部分包括熱交換器、膨脹機、冷凝器、發電機、生產井、回注井和渦輪機。這些電廠的平均額定容量約為6MW。相反,較大的額定容量在二元設計循環中共存,例如雙壓循環、雙流體循環和卡林納雙回圈。

- 雙回圈發電廠的優勢在於中溫地熱流體比高溫地熱資源更容易獲取,根據美國能源局的數據,這項特性意味著雙回圈發電廠可能會變得更加受歡迎。

- 近年來,已宣布了許多新設施,這可能會在預測期內支持地熱能市場的成長。自 2023 年 9 月起,土耳其 MTN 能源公司再次開始為巴巴德雷地熱發電廠 2 號機組實施環境影響評估 (EIA) 法規。進行此項審查是為了擴建這座 11.8 兆瓦的雙回圈發電廠,以滿足該地區的電力需求。

- 截至 2023 年,義大利政府已批准在托斯卡納開發一座提案的10 兆瓦雙回圈地熱發電廠。義大利首座雙燃料發電廠計畫於2027年投入運作,預計將滿足3.2萬戶家庭的電力需求,並減少高達4萬噸的二氧化碳排放。因此,此類計劃的啟動可能有助於在預測期內利用雙回圈發電廠。

- 此外,到2023年,全球整體地熱能總設備容量將達到約14,846兆瓦,高於2022年的14,653兆瓦。全球裝置容量正在大幅成長。

- 因此,由於上述因素和最近的趨勢,雙回圈發電廠部分預計在預測期內將大幅成長。

北美預計將主導市場

- 北美是全球地熱能主要市場之一,美國在裝置容量方面領先於地區和全球市場。 2023年,美國地熱發電量約為16.5兆瓦時。這比 2022 年增加了約半兆瓦時。

- 美國大部分地熱發電廠都位於西部各州和夏威夷島,這些地方的地熱資源更接近地表。加州是利用地熱能發電最多的州,北加州的蓋瑟斯乾蒸氣儲層被稱為世界上最大的乾蒸氣田。

- 此外,加州的地熱發電廠數量比美國其他州都多。截至 2023 年,加州有 31 座由公用事業公司營運的地熱發電廠。其次是內華達州,擁有26座地熱發電廠。當年,美國地熱發電量達到高峰164.6億度。

- 根據國際可再生能源機構2024年的預測,2023年美國地熱發電總合裝置容量約為26.74 GkW。此外,2023 年 5 月,Contact Energy 宣布與微軟簽署了一份為期 10 年的購電協議。根據協議,Contact Energy 將供應其位於紐西蘭的 51.4 兆瓦 Te Huka 3 號機組地熱發電廠所持有的所有可再生能源。 Contact Energy 於 2022 年 8 月宣布將啟動 Te Huka 3 號地熱發電廠項目,預計耗資 1.89 億美元。預計2023年底投入營運。

- 2024年2月,美國能源局地熱技術辦公室宣佈為支持利用低溫地熱能進行地熱井鑽井工具和工業系統的計劃提供高達3,100萬美元的資助機會。此外,高達 2,310 萬美元的資金將用於加強井下固井和案例評估工具計劃。

- 此外,該地區還計劃開展新計劃,預計將支持該地區的市場成長。例如,2023年3月,墨西哥政府宣布透過聯邦電力委員會(CFE)下屬的競標進行探勘計劃。

- 因此,由於上述因素,預計北美將在預測期內主導地熱能市場。

地熱能產業概況

地熱能市場分散。市場的主要企業(不分先後順序)包括三菱電力有限公司、Ormat Technologies Inc.、Engie SA、Tetra Tech Inc. 和 First Gen Corporation。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究範圍

- 市場定義

- 調查前提

第2章執行摘要

第3章調查方法

第4章 市場概述

- 介紹

- 地熱能裝置容量及2029年預測

- 近期趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 人們越來越擔心清潔環保能源的電力安全

- 對暖氣和冷氣系統(包括地熱熱泵)的需求不斷增加

- 限制因素

- 太陽能和風能等替代清潔能源來源的良好市場機會

- 驅動程式

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 投資分析

第5章市場區隔

- 植物類型

- 乾蒸氣廠

- 閃蒸蒸氣廠

- 雙回圈發電廠

- 市場分析:按地區(截至 2029 年按地區分類的市場規模和需求預測)

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 法國

- 英國

- 西班牙

- 北歐的

- 土耳其

- 俄羅斯

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 泰國

- 印尼

- 越南

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 奈及利亞

- 卡達

- 埃及

- 其他中東和非洲地區

- 北美洲

第6章競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- Geothermal Power Plant Equipment Manufacturers

- Toshiba Corporation

- Ansaldo Energia SpA

- Fuji Electric Co. Ltd.

- Baker Hughes Company

- Doosan Skoda Power

- Geothermal Power Plant EPC Companies and Operators

- Mitsubishi Power Ltd

- Ormat Technologies Inc.

- Kenya Electricity Generating Company(KenGen)

- Sosian Energy Limited

- Tetra Tech Inc.

- Engie SA

- First Gen Corporation

- PT Pertamina Geothermal Energy

- Enel SpA

- Aboitiz Power Corporation

- Geothermal Power Plant Equipment Manufacturers

- 市場排名/佔有率(%)分析

第7章 市場機會與未來趨勢

- 增加政府主導的舉措,如財政轉移支付和退稅

簡介目錄

Product Code: 55756

The Geothermal Energy Market size in terms of installed base is expected to grow from 16.10 gigawatt in 2025 to 18.39 gigawatt by 2030, at a CAGR of 2.69% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as increasing electricity security concerns due to clean and eco-friendly resources and increasing demand for heating and cooling systems, including ground source heat pumps and district heating, are driving the growth of the geothermal energy market.

- On the other hand, the lucrative market for alternative clean energy sources like solar and wind is likely to hinder the market growth during the forecast period.

- Nevertheless, government-undertaken initiatives such as financial benefits and tax refunds to promote sustainable energy production are estimated to generate numerous growth opportunities for the geothermal energy market during the forecast period.

- North America is expected to be the largest market during the forecast period, with most of the demand coming from countries like the United States, Canada and Mexico, etc.

Geothermal Energy Market Trends

The Binary Cycle Power Plants Segment is Expected to Witness Significant Growth

- The binary cycle geothermal power plants incorporate low-temperature fluids below 182 degrees Celsius (or 360 degrees Fahrenheit) that are made to pass through a heat exchanger consisting of a secondary fluid. This secondary or binary fluid vaporizes the geothermal liquid and propels the turbine to produce electricity.

- In a binary-cycle geothermal power plant, the geothermal fluid does not directly come into contact with turbines, which makes it function differently from the other two geothermal technologies.

- The advantage of binary cycle power plants is that as the geothermal fluid of moderate temperature has greater availability than high-temperature geothermal resources, binary cycle power plants might become more prevalent to take advantage of this attribute in electricity generation, as per the US Department of Energy.

- The components of a binary cycle power plant include a heat exchanger, expander, condenser, generator, production well, reinjection well, and turbine. The average rated capacity of these power plants is around 6 MW. Conversely, large rated capacities co-exist with binary design cycles such as dual pressure, dual-fluid, and Kalinabinary cycles.

- The advantage of binary cycle power plants is that as the geothermal fluid of moderate temperature has greater availability than high-temperature geothermal resources, binary cycle power plants might become more prevalent to take advantage of this attribute in electricity generation, as per the US Department of Energy.

- Many new installations have been announced in recent years, which may support the growth of the geothermal energy market during the forecast period. As of September 2023, MTN Energy in Turkey re-initiated the process to conduct an Environmental Impact Assessment (EIA) method for the 2nd unit of the Babadere geothermal power plant. The examination is done to expand 11.8 MW of binary cycle plant to fulfill the electricity requirement of the region.

- As of 2023, the government of Italy consented to develop the proposed 10 MW binary cycle geothermal plant in Tuscany. Italy's first-ever binary cycle plant is expected to become active in 2027. It holds the potential to fulfill the power requirement of nearly 32,000 households and curtail carbon emissions of up to 40,000 tonnes. Hence, the onset of such projects could likely help in utilizing binary cycle plants in the forecast period

- Moreover, in 2023, the total geothermal energy installed capacity globally was around 14,846 MW, increasing from 14,653 MW in 2022. The capacity is increasing significantly across the world.

- Therefore, based on the abovementioned factors and recent developments, the binary cycle power plants segment is expected to grow significantly during the forecast period.

North America is Expected to Dominate the Market

- North America is one of the leading markets for geothermal energy worldwide, with the United States leading the regional and global markets regarding installed capacity. In 2023, approximately 16.5 terawatt hours of geothermal electricity were generated in the United States. This was an increase of roughly 0.5 terawatt hours from the 2022.

- Most of the geothermal power plants in the country are in the western states and the island state of Hawaii, where geothermal energy resources are close to the Earth's surface. California generates the most of the electricity from geothermal energy, whereas Northern California's Geysers dry steam reservoir is the world's largest known dry steam field.

- Moreover, California is home to the greatest number of geothermal power plants in the country. As of 2023, there were 31 such plants operated by electric utilities in the state. Nevada followed, with 26 geothermal power plants. That year, geothermal electricity generation across the United States reached a peak of 16.46 billion kilowatt hours.

- According to the International Renewable Energy Agency 2024, the total geothermal installed capacity in United States was around 2,674 MW in 2023. Moreover, in May 2023, Contact Energy announced that the company had signed a 10-year Power Purchase Agreement with Microsoft. Under the contract, Contact Energy will supply all the renewable energy attributes generated by the company's 51.4 MW Te Huka Unit 3 geothermal power station, New Zealand. Contact Energy announced the Te Huka Unit 3 geothermal power station in August 2022 and will be built at a cost of USD 189 million. The plant is expected to commence operations by the end of 2023.

- In February 2024, the United States Department of Energy's Geothermal Technologies Office announced a funding opportunity of up to USD 31 million for projects that support geothermal systems wellbore tools as well as the use of low-temperature geothermal heat for industrial systems. Also, funding of up to USD 23.1 million will enhance projects to address downhole cement and casing evaluation tools.

- Furthermore, new projects are also planned in the region, which is expected to support the region's market growth. For example, in March 2023, Also, the government in Mexico announced a exploratory project under Federal Electricity Commission (CFE) through a tender called 'Acquisition of Geothermal Well Drilling Services.

- Therefore, based on the above factors, North America is expected to dominate the geothermal energy market during the forecast period.

Geothermal Energy Industry Overview

The geothermal energy market is semi-fragmented. Some of the major players in the market (in no particular order) include Mitsubishi Power Ltd, Ormat Technologies Inc., Engie SA, Tetra Tech Inc., and First Gen Corporation, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Geothermal Energy Installed Capacity and Forecast, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Electricity Security Concerns Due to Clean and Eco-Friendly Resources

- 4.5.1.2 Increasing Demand for Heating and Cooling Systems, Including Ground Source Heat Pumps

- 4.5.2 Restraints

- 4.5.2.1 Lucrative Market Opportunities for Alternative Clean Energy Sources Like Solar and Wind

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Plant Type

- 5.1.1 Dry Steam Plants

- 5.1.2 Flash Steam Plants

- 5.1.3 Binary Cycle Power Plants

- 5.2 Geography (Regional Market Analysis {Market Size and Demand Forecast till 2029 (for regions only)})

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 France

- 5.2.2.3 United Kingdom

- 5.2.2.4 Spain

- 5.2.2.5 NORDIC

- 5.2.2.6 Turkey

- 5.2.2.7 Russia

- 5.2.2.8 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 India

- 5.2.3.3 Japan

- 5.2.3.4 South Korea

- 5.2.3.5 Malaysia

- 5.2.3.6 Thailand

- 5.2.3.7 Indonesia

- 5.2.3.8 Vietnam

- 5.2.3.9 Rest of Asia-Pacific

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Colombia

- 5.2.4.4 Rest of South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 United Arab Emirates

- 5.2.5.3 South Africa

- 5.2.5.4 Nigeria

- 5.2.5.5 Qatar

- 5.2.5.6 Egypt

- 5.2.5.7 Rest of Middle-East and Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Geothermal Power Plant Equipment Manufacturers

- 6.3.1.1 Toshiba Corporation

- 6.3.1.2 Ansaldo Energia SpA

- 6.3.1.3 Fuji Electric Co. Ltd.

- 6.3.1.4 Baker Hughes Company

- 6.3.1.5 Doosan Skoda Power

- 6.3.2 Geothermal Power Plant EPC Companies and Operators

- 6.3.2.1 Mitsubishi Power Ltd

- 6.3.2.2 Ormat Technologies Inc.

- 6.3.2.3 Kenya Electricity Generating Company (KenGen)

- 6.3.2.4 Sosian Energy Limited

- 6.3.2.5 Tetra Tech Inc.

- 6.3.2.6 Engie SA

- 6.3.2.7 First Gen Corporation

- 6.3.2.8 PT Pertamina Geothermal Energy

- 6.3.2.9 Enel SpA

- 6.3.2.10 Aboitiz Power Corporation

- 6.3.1 Geothermal Power Plant Equipment Manufacturers

- 6.4 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Government-Undertaken Initiatives such as Financial Benefits and Tax Refunds

02-2729-4219

+886-2-2729-4219