|

市場調查報告書

商品編碼

1687157

電池管理系統-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Battery Management System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

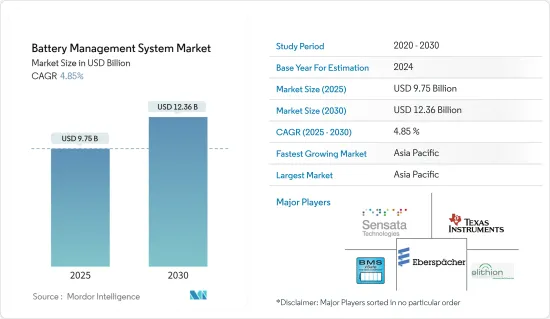

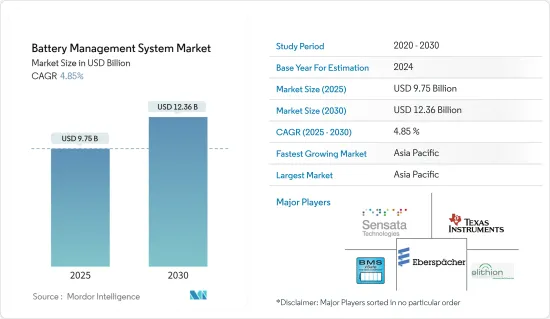

電池管理系統市場規模預計在 2025 年為 97.5 億美元,預計到 2030 年將達到 123.6 億美元,預測期內(2025-2030 年)的複合年成長率為 4.85%。

市場受到了 COVID-19 的負面影響。目前市場已恢復至疫情前的水準。

關鍵亮點

- 從中期來看,對電池管理系統的需求不斷成長預計將刺激電池管理系統市場的成長。此外,電動車的普及、對強大充電基礎設施的需求以及對提高電池能源效率的關注也有望推動市場的成長。

- 然而,現成或標準電池管理系統的技術限制是市場的主要限制因素之一。

- 電池管理系統的技術進步,具有降低複雜性、提高效率和增強可靠性等優勢,預計將在預測期內提供成長機會。

- 亞太地區佔據市場主導地位,並可能在預測期內實現最高的複合年成長率。這一成長是由中國和日本等國家電動車銷量的激增所推動的。這種成長是由於政府大力減少溫室氣體排放所致。

電池管理系統市場趨勢

預計運輸領域將主導市場

- 以前,只使用內燃機車輛(ICE)。然而,人們對環境問題的日益擔憂正導致技術轉向電動車(EV)。因此,電池管理系統在 ICE 領域沒有市場。

- 去年,全球電動車銷量約660萬輛(含電池電動車和插電式混合動力電動車)。隨著世界各地採取各種電動車舉措,預計銷量將進一步成長。

- 鋰離子電池主要用於電動車,因為它們具有能量密度高、自放電低、重量輕和維護成本低等特性。鉛基電池廣泛用於內燃機汽車,預計在可預見的未來仍將是唯一可生產的電池系統。鋰離子電池需要進一步降低成本,才能在 SLI 應用中大規模取代鉛電池。

- 鋰離子電池系統為插混合動力汽車汽車和電動車提供動力。鋰離子電池具有高能量密度、快速充電能力和高放電功率,是唯一可以滿足OEM對車輛行駛里程和充電時間要求的技術。鉛基牽引電池由於比能量低、重量大,在全混合動力車或電動車中使用不具競爭力。

- 全球電動車電池生產主要集中在亞太地區,中國、日本和韓國公司佔據主導地位,並在歐洲建立工廠以捍衛其主導地位。中國在鋰離子電池中下游價值鏈中佔有較大的市場佔有率,是全球最大的鋰離子電池生產國。此外,隨著國家努力降低空氣污染水平,電動車銷售預計將實現高成長,從而導致對電動車電池的強勁需求。

- 此外,中國是全球電動車電池製造熱點區域。中國目前擁有 93 座超級工廠,預計到 2030 年將建成約 130 座。因此,預計中國對電池管理系統的需求將會增加。

- 此外,印度各邦政府正在採取多項舉措在該國推廣電動車。例如,德里政府推出了一項電動車計劃,為每千瓦時電池和每輛電動車提供獎勵。例如,該州為每千瓦時電池容量提供約 120 美元的獎勵,或為每輛電動車提供約 1,850 美元的獎勵。該計劃的主要目標是促進電動和混合動力汽車汽車在印度汽車市場的滲透。

- 近年來,亞太地區一直佔據電池製造市場的主導地位,預計在預測期內將繼續保持這一地位。由於各私人公司增加對電動車計劃的投資等因素,預計歐洲在預測期內將顯著成長。

- 例如,大眾汽車於2022年7月在德國成立了一家名為Power Co的新公司,並計劃投資約200億美元用於電動車電池開發。該工廠預計將於 2025 年投入生產,以滿足未來幾年近 50 萬輛電動車的需求。

- 因此,由於上述因素,預測期內運輸領域很可能主導電池管理系統市場。

亞太地區可望主導市場

- 在預測期內,亞太地區很可能成為電池管理系統的主要市場。在亞太地區,中國預計將因電動車市場的快速擴張而實現強勁成長。

- 由於出於安全目的,家用電子電器中 BMS 的整合度不斷提高,家用電子電器需求的不斷成長可能會刺激對 BMS 的需求。

- 中國是最大的電動車市場,去年電動車銷量超過 333 萬輛。 2021年中國將佔全球電動車銷量的近40%。

- 此前,外國汽車製造商必須面臨25%的進口關稅,或在中國設廠,但股權比例不得超過50%。目前,乘用車50%的投資限制已放寬。它還將取消限制外國公司在該國設立兩家以上生產同類汽車的合資企業的規定。

- 由於中國電動車產業的成功,中國政府將在 2022 年將電動車補貼削減 30%,並在年底前取消補貼。計劃削減補貼的目的是使製造商減少對政府資金的依賴,以開發新技術和新車型。

- 此外,根據印度品牌資產基金會(IBEF)的數據,印度家用電子電器和耐久財市場預計將以 9% 的複合年成長率成長,本會計年度達到 3.15 兆印度盧比。此外,印度政府預計未來印度電子製造業規模將達3,000億美元。因此,在預測期內,家用電子電器需求的不斷成長可能會增加印度對電池管理系統的需求。

- 汽車產業是印度電池管理系統的主要終端用戶之一。在汽車產業,BMS 用於鋰離子電池溫度、電壓、電流監控、電池充電狀態 (SoC) 和電池平衡等關鍵應用。此外,印度電動車的日益普及也推動了汽車電池管理系統市場的成長,該系統提供安全性、性能最佳化、電池健康監測和診斷以及與其他電控系統(ECU) 的通訊。

- 2022 年 6 月,電動車新興企業Mecwin India 宣布可能投資約 638 萬美元在印度卡納塔克邦建立電動車馬達、控制器和 BMS 系統製造工廠。該工廠的初始生產能力為 2,000 輛日產汽車,以滿足電動車目的地設備製造商 (OEM) 的需求。因此,此類即將開展的計劃可能會在預測期內增加印度對 BMS 系統的需求。

- 因此,上述因素可被視為該地區電池管理系統的關鍵促進因素,並預計預測期內市場將出現成長。

電池管理系統產業概況

電池管理系統市場區隔程度適中。市場的主要企業(不分先後順序)包括 Eberspaecher Vecture Inc.、Elithion Inc.、BMS Powersafe、Texas Instruments Incorporated 和 Sensata Technologies Inc.

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究範圍

- 市場定義

- 調查前提

第2章執行摘要

第3章調查方法

第4章 市場概述

- 介紹

- 2027 年市場規模與需求預測

- 近期趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 限制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章市場區隔

- 按應用

- 固定式

- 可攜式的

- 用於運輸

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 法國

- 義大利

- 英國

- 俄羅斯聯邦

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 其他中東和非洲地區

- 北美洲

第6章競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- Eberspaecher Vecture Inc.

- Elithion Inc.

- Leclanche SA

- Renesas Electronics Corporation

- LION Smart GmbH

- Sensata Technologies Inc.

- RCRS Innovations Pvt. Ltd

- Nuvation Energy

- Texas Instruments Incorporated

- BMS Powersafe

第7章 市場機會與未來趨勢

The Battery Management System Market size is estimated at USD 9.75 billion in 2025, and is expected to reach USD 12.36 billion by 2030, at a CAGR of 4.85% during the forecast period (2025-2030).

The market was negatively impacted by COVID-19. Presently the market has now reached pre-pandemic levels.

Key Highlights

- Over the medium term, the growing demand for battery management systems is expected to stimulate the market growth of battery management systems. Furthermore, the increasing adoption of electric vehicles, the need for robust charging infrastructure, and the focus on increasing the energy efficiency of batteries are also expected to drive the growth of the market studied.

- On the other hand, technological limitation on off-the-shelf battery management systems or standard battery management systems is one of the major restraints for the market.

- Nevertheless, technological advancements in battery management systems with advantages, such as reduced complexity, better efficiency, and improved reliability, among others, are expected to provide growth opportunities in the forecast period.

- The Asian-Pacific region dominates the market and is also likely to witness the highest CAGR during the forecast period. This growth is attributed to the rapid rise in sales of electric vehicles in countries like China and Japan. This rise has been due to the extensive efforts of the governments to reduce greenhouse gas emissions.

Battery Management System Market Trends

Transportation Segment Expected to Dominate the Market

- Vehicles with internal combustion engines (ICE) were the only types used earlier. However, technology has been shifting toward electric vehicles (EVs) due to growing environmental concerns. Therefore, due to these reasons, battery management systems do not have any market in the ICE sector.

- Last year's global EV sales stood at around 6.6 million (including battery electric vehicles and plug-in hybrid electric vehicles). The sales are likely to increase further with various EV policy adoption by different countries globally.

- Lithium-ion batteries are mostly used in EVs as they provide high energy density, low self-discharge, less weight, and low maintenance. For ICE vehicles, the lead-based battery is widely used and is expected to continue to be the only viable mass-market battery system for the foreseeable future. Lithium-ion batteries still require higher cost reductions for use in SLI applications to be considered a viable mass-market alternative to lead-based batteries.

- Lithium-ion battery systems propel plug-in hybrid and electric vehicles. Due to their high energy density, fast recharge capability, and high discharge power, lithium-ion batteries are the only available technology that meets OEM requirements for the vehicle driving range and charging time. The lead-based traction batteries are not competitive for use in full hybrid electric vehicles or electric vehicles because of their lower specific energy and higher weight.

- The global production of batteries for electric vehicles is mainly concentrated in the Asian-Pacific region, with Chinese, Japanese, and South Korean companies dominating the sector and building European factories to conserve their supremacy. China's significant market share in the midstream and downstream value chain of li-ion batteries makes it the largest producer of li-ion batteries globally. The country is also making efforts to reduce air pollution levels, which is expected to register a high growth rate in the sales of electric vehicles and lead to high demand for EV batteries.

- Additionally, China is the global hotspot for electric vehicle battery manufacturing. There are 93 Giga factories in China, and the country is projected to have around 130 by 2030; the country is expected to dominate the market during the forecast period. This, in turn, is expected to create tremendous demand scope for battery management systems in the country.

- Furthermore, the Indian state government has taken several initiatives to promote electric vehicles in the country. For instance, the Delhi government has an EV policy that provides incentives per Kwh of battery and per EV. For instance, the state provides about USD 120 as incentives per KWh battery capacity and about USD 1,850 incentives per EV. The main objective of such a scheme is to promote faster adoption of electric and hybrid vehicles in the Indian automotive market.

- In recent years, the Asian-Pacific region dominated the electric battery manufacturing market, and it is expected to continue to do so during the forecast period. Europe is expected to witness significant growth during the forecast period owing to factors like increasing investment in electric vehicle projects by various private players.

- For instance, in July 2022, Volkswagen planned to invest nearly USD 20 billion in developing EV batteries in a new company named Power Co in Germany. The plant production is expected to begin by 2025 and will likely cater to the demand for nearly 500,000 EVs in the upcoming years.

- Hence, based on the factors mentioned above, the transportation segment is likely to dominate the battery management systems market during the forecast period.

Asia-Pacific is Expected to Dominate the Market

- Asia-Pacific is likely to be a major market for battery management systems during the forecast period. In Asia-Pacific, China is expected to witness strong growth due to the rapid growth in the EV market.

- The rising demand for consumer electronics is likely to add to the demand for BMS, owing to the increasing integration of BMS in consumer electronics for safety purposes.

- China is the largest market for electric vehicles (EVs), with over 3.33 million EVs sold last year, and it is expected to remain the largest global electric car market. China accounted for almost 40% of global electric car sales in 2021.

- Earlier, foreign automakers faced a 25% import tariff or were required to build a factory in China with a cap of 50% ownership. Currently, the 50% ownership rule is relaxed for passenger cars. The rules restricting a foreign company from establishing more than two joint ventures producing similar vehicles in the country are also removed.

- The Government of China is likely to cut subsidies on electric vehicles by 30% in 2022 and eliminate it by the end of the year, as the electric vehicle industry in the country is now successful. The planned subsidy cut is aimed at reducing manufacturers' reliance on government funds for developing new technologies and vehicles.

- Furthermore, according to the Indian Brand Equity Foundation (IBEF), the Indian appliance and consumer durables market is expected to increase to a CAGR of 9%, accounting for INR 3.15 trillion in the current year. Furthermore, the Indian government anticipates that the Indian electronics manufacturing sector is likely to reach USD 300 billion in the future. Thus, the increasing demand for consumer electronics is likely to increase the demand for battery management systems in India during the forecast period.

- The automotive industry is one of India's major end users of battery management systems. In the automobile industry, BMS is used for critical applications such as temperature, voltage, current monitoring, battery state of charge (SoC), and cell balancing for lithium-ion batteries. In addition, the rising adoption of electric vehicles in India is driving the market for the automotive battery management system to provide safety, performance optimization, health monitoring and diagnostic of battery, and communication with other electronic control units (ECU).

- In June 2022, EV startup Mecwin India announced that it is likely to invest approximately USD 6.38 million to set up an EV motor, controller, and BMS systems manufacturing plant in Karnataka, India. The factory will likely have an initial manufacturing capacity of 2,000 units per day and will likely cater to the demand for EV Original Equipment Manufacturers (OEMs). Thus, such upcoming projects are likely to increase the demand for BMS systems in India during the forecast period.

- Therefore, the above-stated factors can be considered the major driving factors for battery management systems in the region, where the market is expected to grow during the forecast period.

Battery Management System Industry Overview

The battery management system market is moderately fragmented. Some of the major players in the market (in no particular order) include Eberspaecher Vecture Inc., Elithion Inc., BMS Powersafe, Texas Instruments Incorporated, and Sensata Technologies Inc., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Application

- 5.1.1 Stationary

- 5.1.2 Portable

- 5.1.3 Transportation

- 5.2 By Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 Francy

- 5.2.2.3 Italy

- 5.2.2.4 United Kingdom

- 5.2.2.5 Russian Federation

- 5.2.2.6 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 India

- 5.2.3.3 Japan

- 5.2.3.4 South Korea

- 5.2.3.5 Rest of Asia-Pacific

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 United Arab Emirates

- 5.2.5.3 South Africa

- 5.2.5.4 Rest of Middle-East and Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Eberspaecher Vecture Inc.

- 6.3.2 Elithion Inc.

- 6.3.3 Leclanche SA

- 6.3.4 Renesas Electronics Corporation

- 6.3.5 LION Smart GmbH

- 6.3.6 Sensata Technologies Inc.

- 6.3.7 RCRS Innovations Pvt. Ltd

- 6.3.8 Nuvation Energy

- 6.3.9 Texas Instruments Incorporated

- 6.3.10 BMS Powersafe