|

市場調查報告書

商品編碼

1687235

詐騙偵測與預防 (FDP) - 市場佔有率分析、產業趨勢與統計、成長預測 (2025-2030)Fraud Detection and Prevention (FDP) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

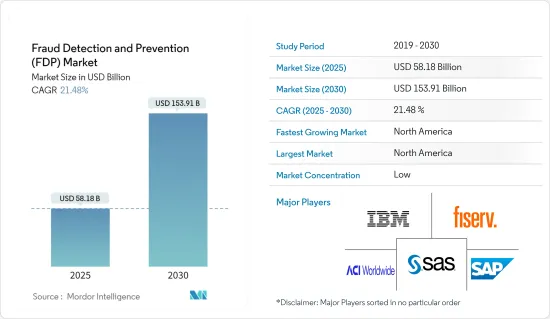

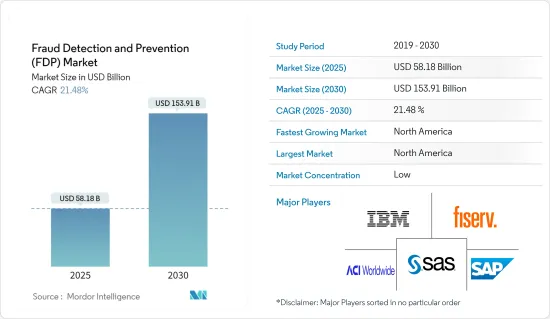

預計 2025 年詐騙偵測與預防市場規模為 581.8 億美元,到 2030 年將達到 1,539.1 億美元,預測期內(2025-2030 年)的複合年成長率為 21.48%。

詐欺偵測通常是公司損失預防策略的核心要素,在某些情況下,也是組織更廣泛的反洗錢 (AML) 合規工作的一部分。當詐欺檢測和相關功能嵌入更廣泛的反洗錢背景中時,兩者的結合有時被稱為「詐欺和反洗錢」或「FRAML」。

詐欺偵測可在詐欺活動發生之前或發生時發現它,從而幫助企業保護客戶交易和帳戶。根據美國聯邦調查局統計,2022年美國老年詐騙受害者平均每人損失超過35,101美元,整體損失超過30億美元。 2021年,全球詐騙損失將超過550億美元,科技使非法資金得以跨國流動。

此外,合成身分詐騙導致美國金融機構在 2023 年損失約 200 億美元。隨著世界數位化,詐騙也不斷改進其手段,要求企業改善其詐騙預防措施,以保護其資產和客戶免受詐騙。

隨著詐騙類型變得越來越多樣化和複雜,加強監管和執法將影響全面的合規要求。雖然如今公司可能沒有被直接要求這樣做,但詐欺是洗錢的先決條件,並可能導致更廣泛的犯罪網路。將詐欺納入您的整體風險管理策略可以提高消費者保護、合規性、損失控制和金融犯罪預防。

詐騙機制的效率根據客戶期望支持每個行業。各行業的詐欺行為包括卡片付款詐騙、醫療保健報銷詐騙、資料異常、可疑活動、洗錢和各種交易風險。

由於存在各種系統和防詐騙工具,因此很難涵蓋所有防線並整體情況您的風險敞口。此外,這可能會導致糟糕的客戶體驗。當消費者透過多個供應商在不同管道進行不同類型的詐欺偵測時,很難實施一致、全面的方法和適當的風險平衡。預計這將抑制市場成長。

然而,我們正在進行投資以改善詐欺基礎設施和預防控制框架。該公司正在將行為分析與機器學習和自動警報生成相結合,以更好地防止不良行為者訪問其網路。具體來說,機器學習和行為分析可用於識別詐欺模式,使組織能夠制定適應最新詐欺趨勢的敏捷預防措施。加強詐欺培訓和意識將加強公司的預防策略並有助於打擊詐欺。因此,由於未來對詐欺檢測解決方案的投資增加,預計預測期內市場將會成長。

詐騙偵測與預防(FDP)市場趨勢

BFSI產業將成為最大的終端使用者產業

- BFSI 行業的詐欺活動已經發展了幾十年。由於網路空間的發展和網路犯罪領域的擴大,詐騙詐騙呈現出更虛擬的形式。

- 隨著科技越來越普及,網路銀行和行動銀行等數位管道作為客戶使用銀行服務的選擇變得越來越突出,對銀行來說,預防詐騙解決方案的需求變得至關重要。

- 詐欺預防和偵測可能是金融機構最關注的問題,也是 IT 支出的主要驅動力。此外,線上交易、保險索賠和信用卡相關詐欺正在推動保險、銀行和金融服務領域擴大採用此類解決方案。

- 詐欺的潛在風險是付款和數位付款面臨的最大風險之一,隨著越來越多的企業提供線上付款並建立數位客戶關係,這種風險預計會增加。

亞太地區預計將佔據主要市場佔有率

- 北美的數位交易和網路銀行業務大幅成長,增加了詐騙的可能性。詐騙偵測和預防解決方案有助於防止敏感資料和交易的線上外洩。預計預測期內詐騙案件的增加將推動市場成長。

- 網路犯罪分子擴大將企業和醫療保健組織作為目標,以獲取受害者的個人資料。個人資料經常被用於工程攻擊,這種攻擊比傳統的網路攻擊更容易欺騙受害者。 2023年,美國資料外洩事件達3,205起。同時,同年有超過 3.53 億個人受到資料外洩的影響,包括資料外洩、洩密和暴露。

- 詐騙偵測和預防解決方案供應商已在該地區建立了強大的影響力,促進了市場的成長。 IBM 公司、SAS Institute Inc.、DXC Technology、RSA Security LLC 和 Oracle 公司。

- 各個地區的公司都在不斷致力於產品創新,以滿足先進的網路威脅要求。例如,2023 年 11 月,為金融機構提供合規、信用風險和貸款解決方案的 Abrigo 與行動存款和詐騙防制公司 Mitek 建立了策略夥伴關係。此次合作為當地金融機構提供了打擊支票詐騙等金融犯罪的工具。

詐騙偵測與預防(FDP)市場概覽

詐騙偵測和預防市場分散且競爭激烈。市場的主要企業包括 SAP SE、IBM Corporation、SAS Institute Inc.、ACI Worldwide Inc. 等。然而,只有少數新參與企業能夠透過其產品線的重大創新吸引大規模投資進入市場。

2024年3月,ACI Worldwide(ACI)宣布與Comforte AG建立策略夥伴關係,以協助客戶遵守PCI DSS(支付卡產業資料安全)標準。 ACI 和 Comforte 將共同努力以滿足新的 PCI DSS 標準 (v4.0)。作為合作的一部分,Comforte 將其資料為中心的解決方案列入 ACI,這些解決方案經過 ACI 的全面測試,以確保與 ACI 解決方案的互通性。

2023 年 10 月,Fiserv 宣布已從 Fiserv 手中收購巴西領先的 Software Express SiTef® 經銷商 Skytef。 Skytef 將 Fiserv 在巴西的經銷網路擴展到 1,000 多個合作夥伴,其中包括 600 多家獨立軟體供應商 (ISV) 和 27,000 多家商家。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 非現金付款/交易量增加

- BFSI 領域詐欺行為增多

- 市場限制

- 缺乏與任何產業的整合能力

第6章市場區隔

- 按解決方案

- 詐欺分析

- 認證

- 彙報

- 視覺化

- 管治、風險與合規 (GRC) 解決方案

- 按最終用戶規模

- 小規模

- 中等規模

- 大規模

- 按詐欺類型

- 內部的

- 外部的

- 按最終用戶產業

- BFSI

- 零售

- 資訊科技/通訊

- 醫療保健

- 能源動力

- 製造業

- 其他

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

第7章競爭格局

- 公司簡介

- SAP SE

- IBM Corporation

- SAS Institute Inc.

- ACI Worldwide Inc.

- Fiserv Inc.

- Experian PLC

- DXC Technology Company

- BAE Systems PLC

- RSA Security LLC(Dell Technologies Inc.)

- Oracle Corporation

- NICE Ltd

- Equifax Inc.

- LexisNexis Group

- Fair Isaac Corporation

- Cybersource Corporation

- Global Payments Inc.

- Feedzai Inc.

第8章投資分析

第9章 市場機會與未來趨勢

The Fraud Detection and Prevention Market size is estimated at USD 58.18 billion in 2025, and is expected to reach USD 153.91 billion by 2030, at a CAGR of 21.48% during the forecast period (2025-2030).

Fraud detection is typically a central component of a firm's loss prevention strategy, and in some cases, it is part of an organization's broader AML (anti-money laundering) compliance efforts. When fraud detection and related functions are incorporated into a broader AML context, the combination of the two is sometimes called "Fraud and Anti-Money Laundering" or "FRAML."

Fraud detection helps companies protect their customers' transactions and accounts by spotting fraudulent activity before or as it occurs. According to the FBI, elder fraud victims lost an average of over USD 35,101 per victim in the United States in 2022, resulting in an overall loss of over USD 3 billion. Global fraud losses in 2021 exceeded USD 55 billion with technology enabling illegal funds to cross borders.

Moreover, synthetic identity fraud cost US financial institutions an estimated USD 20 billion in losses in 2023. As the world becomes more digital, fraudsters are continuously evolving their tactics, and businesses need to improve their fraud prevention measures to protect assets and clients from fraud.

As the world comes to terms with fraud's increasing diversity and sophistication of typologies, more regulation and enforcement will impact compliance requirements across the board. While a firm may not be directly subject to direct requirements today, fraud is a prerequisite for money laundering and can be linked to a broader criminal network. Firms incorporating fraud into their overall risk management strategy can improve consumer protection, compliance, loss management, and financial crime prevention.

The efficiency of fraud mechanisms backs each vertical based on customer expectations. Fraud across various industries may include card payment fraud, healthcare reimbursement fraud, data anomalies, suspicious activities, money laundering, and various transaction risks.

Various systems or fraud prevention tools make it difficult to cover all lines of defense and maintain a holistic view of risk exposure. Furthermore, they can result in a poor customer experience. If a consumer is using multiple vendors for different types of fraud detection across various channels, it is challenging to implement a consistent, integrated approach and the right risk balance. This is expected to restrain the market's growth.

However, investments are being made to improve the fraud infrastructure and the preventative control framework. Firms are integrating machine learning and automated alert generation with behavioral analytics to better prevent bad actors from accessing their networks. In particular, machine learning and behavioral analytics will help identify fraudulent patterns that enable agile preventative controls to be developed and adapted to the latest fraud trends. Increasing fraud training and awareness will strengthen a company's prevention strategy and help fight fraud. Thus, with the growth in future investment in fraud detection solutions, the market is expected to grow in the forecasted period.

Fraud Detection and Prevention (FDP) Market Trends

BFSI Sector to be the Largest End-user Industry

- Fraudulent activities in the BFSI industry have evolved over the decades. While it was previously limited to cheque frauds and wire frauds, with the growth of the cybersphere and the accompanying expansion of the cybercriminal realm, it has taken on more virtualized forms.

- The increasing technological penetration, coupled with digital channels such as Internet banking and mobile banking, are becoming prominent choices of customers for banking services, making it a crucial need for banks to leverage fraud prevention solutions.

- Fraud prevention and detection represent one of the biggest areas of concern for financial institutions and are likely to become prominent drivers of IT spending. Moreover, online transactions, insurance claims, and card-related frauds have been increasing the usage of these solutions in the insurance, banking, and financial services sectors.

- The potential risk of fraud has been one of the biggest in online and digital payments, and it is anticipated to grow with the availability of digital customer relationships as more companies offer online payments.

Asia-Pacific is Expected to Hold Significant Market Share

- Digital transactions in North America and online banking are increasing remarkably, thus increasing the chances of fraud. Fraud detection and prevention solutions can help prevent any online breach of sensitive data and transactions. Rising fraud cases are expected to propel the market's growth over the predicted period.

- Cybercriminals are increasingly targeting businesses and medical institutions to gain the personal data of the victims. Personal data is often used for engineering attacks, which is more likely to trick the victim than traditional cyberattacks. In 2023, the number of data compromises in the United States stood at 3,205 cases. Meanwhile, over 353 million individuals were affected in the same year by data compromises, including data breaches, leakage, and exposure.

- The region has a strong foothold of fraud detection and prevention solution vendors contributing to the market's growth. Some include IBM Corporation, SAS Institute Inc., DXC Technology, RSA Security LLC, and Oracle Corporation.

- Various regional companies are continuously involved in product innovations to meet advanced cyber threat requirements. For instance, in November 2023, Abrigo, a provider of compliance, credit risk, and lending solutions for financial institutions, entered a strategic partnership with Mitek, a mobile deposit and fraud prevention player. This partnership provides community financial institutions the tools to combat financial crimes like check fraud.

Fraud Detection and Prevention (FDP) Market Overview

The fraud detection and prevention market is fragmented and very competitive. The major players in the market are SAP SE, IBM Corporation, SAS Institute Inc., ACI Worldwide Inc., and many more. However, owing to significant innovations in product lines, only some new entrants are attracting major investments into the market.

In March 2024, ACI Worldwide (ACI) announced a strategic partnership with comforte AG (comforte AG) to support customers' compliance with PCI DSS (Payment Card Industry Data Security) standards. ACI and Comforte will work together to meet the new PCI DSS standards (v4.0). As part of the partnership, Comforte will provide ACI with data-centric solutions that ACI has thoroughly tested to ensure they are interoperable with ACI solutions.

In October 2023, Fiserv announced that it had acquired Skytef, a leading distributor of Software Express' SiTef(R) in Brazil, from Fiserv. Skytef brings Fiserv's distribution network in Brazil to over 1,000 partners, including more than 600 Independent Software Vendors (ISVs) and 27,000 merchants.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Volume of Non-cash Payment/transaction

- 5.1.2 Increasing Frauds in BFSI Sector

- 5.2 Market Restraints

- 5.2.1 Lack of Integration Capability with All Verticals

6 MARKET SEGMENTATION

- 6.1 By Solution

- 6.1.1 Fraud Analytics

- 6.1.2 Authentication

- 6.1.3 Reporting

- 6.1.4 Visualization

- 6.1.5 Governance, Risk, and Compliance (GRC) Solutions

- 6.2 By Scale of End User

- 6.2.1 Small-scale

- 6.2.2 Medium-scale

- 6.2.3 Large-scale

- 6.3 By Type of Fraud

- 6.3.1 Internal

- 6.3.2 External

- 6.4 By End-user Industry

- 6.4.1 BFSI

- 6.4.2 Retail

- 6.4.3 IT and Telecom

- 6.4.4 Healthcare

- 6.4.5 Energy and Power

- 6.4.6 Manufacturing

- 6.4.7 Other End-user Industries

- 6.5 By Geography

- 6.5.1 North America

- 6.5.2 Europe

- 6.5.3 Asia

- 6.5.4 Australia and New Zealand

- 6.5.5 Latin America

- 6.5.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 SAP SE

- 7.1.2 IBM Corporation

- 7.1.3 SAS Institute Inc.

- 7.1.4 ACI Worldwide Inc.

- 7.1.5 Fiserv Inc.

- 7.1.6 Experian PLC

- 7.1.7 DXC Technology Company

- 7.1.8 BAE Systems PLC

- 7.1.9 RSA Security LLC (Dell Technologies Inc.)

- 7.1.10 Oracle Corporation

- 7.1.11 NICE Ltd

- 7.1.12 Equifax Inc.

- 7.1.13 LexisNexis Group

- 7.1.14 Fair Isaac Corporation

- 7.1.15 Cybersource Corporation

- 7.1.16 Global Payments Inc.

- 7.1.17 Feedzai Inc.