|

市場調查報告書

商品編碼

1687267

OLED微型顯示器:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)OLED Microdisplay - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

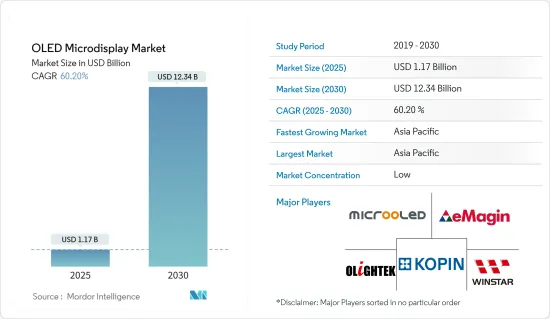

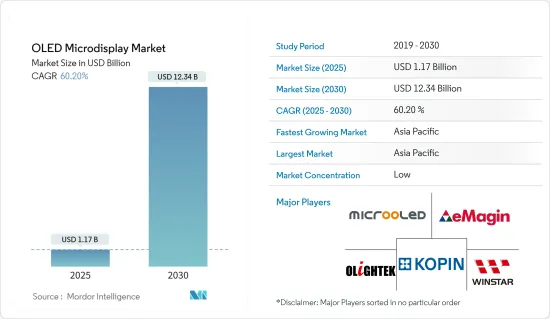

OLED微顯示器市場規模預計在2025年達到11.7億美元,在2030年達到123.4億美元,預測期間(2025-2030年)的複合年成長率為60.2%。

關鍵亮點

- OLED微顯示器市場近年來經歷了顯著成長。這主要得益於AR/VR等技術的進步以及各地區終端用戶產業的擴張。例如,向 5G 的過渡正在加速對先進近眼設備的需求。此外,TCL 在 2023 年 CES 上發布了三款最新的 AR/VR 產品,包括 RayNeo X2、TCL NXTWEAR V 和 TCL NXTWARE S 等產品。

- 由於對比度、功耗、尺寸和色彩空間方面的優勢,NTE 應用有望為 OLED 微型顯示器提供豐厚的機會。這與電子觀景器和個人取景器(PV)有關。 OLED微型顯示器正在虛擬實境(VR)、擴增實境(AR)、抬頭顯示器(HUD)和穿戴式裝置等領域廣泛應用。

- OLED 微型顯示器最顯著的特點之一是其高解析度。高像素密度使這些顯示器能夠提供高水準的細節,使其適用於VR頭戴裝置、擴增實境(AR) 眼鏡和頭戴式顯示器等應用。 OLED 微型顯示器的高解析度可確保使用者獲得Sharp Corporation的影像,實現真正身臨其境的視覺效果。

- 保護 OLED 層免受水蒸氣和氧氣的影響是 OLED 微型顯示器開發中的關鍵挑戰,並在抑制市場成長方面發揮了一定作用。

OLED微顯示器市場趨勢

消費性電子領域佔據大部分市場佔有率

- 家用電子電器領域日益成長的需求和技術快速發展的步伐迫使OEM不斷向市場推出獨特的產品。消費性電子產品供應商主要依賴電子產品製造商來提供諸如降低成本、提高品質、縮短時間、縮短時間和靈活交付產品等優勢。

- 智慧型手機需求的不斷成長也是受調查市場需求的主要驅動力。根據愛立信預測,全球智慧型手機行動網路用戶數量預計在2022年達到約64億,到2028年將超過77億人。中國、印度和美國的智慧型手機行動網路用戶數量最多。

- 此外,預計到2023年5G智慧型手機的比例將會增加。

- 隨著顯示技術的發展,OLED折疊式行動電話的滲透率將會擴大。由於規格的提高和價格的實惠,各大品牌定期推出新的旗艦折疊式設備,預計智慧型手機的普及率將會增加。這是機會,因為通貨膨脹已經抑制了消費者信心,並推動了折疊式行動電話的普及。

- 美國消費者科技協會預計,2022 年至 2024 年間,美國消費科技零售收益將略有成長,到 2024 年底將達到 5,000 億美元以上。大部分收益將來自硬體,預計到 2024 年將達到約 3,450 億美元。市場也正在經歷多項 OLED 微顯示器創新和製造能力擴張,以滿足消費者複雜且不斷變化的需求。

預計亞太地區市場將顯著成長

- 該地區在市場研究方面投入了大量資金。各國對 VR/AR 和穿戴式應用的日益普及以及對消費性電子產品的投資不斷增加,進一步推動了對 OLED 微型顯示器的需求。

- 此外,韓國、中國和日本等國家已成為消費性電子產品製造和創新的中心。這些國家擁有推動顯示器技術進步的關鍵技術公司,包括 OLED 微型顯示器。例如,起亞於2023年8月開設了VR展示室,向客戶展示新車型。

- OLED 微型顯示器擴大被應用於相機、AR 和 VR 眼鏡/護目鏡、娛樂、工業應用和體育等各種領域。大多數國家對這些產品的需求都在增加,這推動了市場的成長。

- 除了日本、韓國和中國等國家外,印度和台灣等國家的電子產業的成長也推動著市場的成長。此外,這些國家中產階級可支配所得的增加也為所研究的市場創造了新的機會。

- 都市化的加快和顯示器技術的進步為亞太地區的 OLED 微型顯示器創造了巨大的潛力。根據世界銀行預測,到2022年,印度約有三分之一的人口將居住在城市。這一趨勢表明,過去十年間都市化成長了4%以上。人口的成長可能會進一步刺激對其他先進設備(如智慧穿戴裝置和 AR/ VR頭戴裝置等)的需求,從而進一步推動所研究市場的成長。此外,全部區域領先公司的存在、先進技術的採用、資本投資和快速的經濟成長都促進了所研究市場的成長。

- 例如,索尼半導體解決方案公司 (SSS) 計劃於 2023 年 8 月在幾個月內發布 ECX344A,這是一款大型高清 1.3 吋 OLED 微型顯示器,具有 4K 解析度,有助於實現更逼真的空間再現。新型有機發光二極體微型顯示器主要用於虛擬實境 (VR) 和擴增實境(AR) 頭戴式顯示器。透過採用 SSS 在相機電子觀景器(EVF) 及其像素驅動電路開發中累積的小型化工藝,它在 1.3 吋大顯示器上實現了 4K 解析度。

- 而且OLED技術的不斷創新,帶來了功率效率和反應速度的提升,使得OLED微顯示器在各個地區得到認可。 2023 年 11 月,中國面板供應商京東方科技集團表示,將建造一座價值 630 億元人民幣(88.4 億美元)的生產工廠,並採用先進技術生產 OLED 螢幕。該工廠位於成都,將採用8.6代技術生產有機發光二極體基板。

OLED微顯示器市場概況

OLED 微型顯示器市場主要分為以下幾大主要參與者:Winstar Display、Microoled SA(Photonis Technologies SAS)、雲南歐萊特光電科技、Emagin Corporation 和 Kopin Corporation。該市場的參與企業正在採取收購和夥伴關係等策略來加強其產品供應並獲得永續的競爭優勢。

- 2024 年 2 月 - Kopin 公司宣布已獲得海軍空戰中心頒發的一份新的小型企業創新研究 (SBIR) 合約。透過該協議,Kopin 將利用美國30 多年的微顯示器開發專業知識來描述用於無透鏡計算成像的先進微顯示器。

- 2023 年 8 月 - 索尼半導體解決方案 (SSS) 宣布推出 ECX344A 4K 解析度 OLED 微型顯示器。新型微型顯示器專為虛擬實境 (VR)、擴增實境(AR) 和其他頭戴式顯示器 (HMD) 應用而設計。 ECX344A 是一款大型 OLED 微型顯示器,具有 1.3*(1.3 吋)的高清(HDR)解析度。它採用了SSS在相機電子場顯示(CEF)設備開發過程中累積的小型化工藝,以及其獨特的像素驅動電路。這種新型微型顯示器由於其高速驅動電路,有可能實現4K解析度,提供流暢的影像品質和高度的真實感。此外,SSS獨特的像素結構實現了寬色域(WCG)和高亮度(HV)性能。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概覽

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- COVID-19 和其他宏觀經濟因素對市場的影響

第5章市場動態

- 市場促進因素

- 近眼(NTE)應用的興起

- 高解析度、高畫質、低功耗

- 市場問題

- 保護 OLED 層免受氧氣和水蒸氣的侵害

- 識別高溫條件下的亮度和壽命

第6章市場區隔

- 按類型

- 對於近視

- 投影

- 按最終用戶產業

- 車

- 醫療保健

- 產業

- 家用電子電器

- 航太與國防

- 執法

- 其他

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

第7章競爭格局

- Vendor Positioning Analysis

- 公司簡介

- Microoled SA(Photonis Technologies SAS)

- Yunnan Olightek Opto-electronic Technology Co. Ltd

- Winstar Display Co. Ltd

- eMagin Corporation

- Kopin Corporation

- Wisechip Semiconductor Inc.

- Seiko Epson Corporation

- Fraunhofer FEP

- Sony Semiconductor Solutions Corp.(Sony Corporation)

- Sunlike Display Technology Corporation

第8章投資分析

第9章:未來趨勢

The OLED Microdisplay Market size is estimated at USD 1.17 billion in 2025, and is expected to reach USD 12.34 billion by 2030, at a CAGR of 60.2% during the forecast period (2025-2030).

Key Highlights

- The OLED microdisplay market has been witnessing significant growth over the years. This is primarily due to the advancement of technologies such as AR/VR and the expansion of end-user industries across various regions. For instance, the transition toward 5G accelerates the demand for advanced near-to-eye devices. Further, TCL announced three of the latest AR/VR products at CES 2023. It includes products such as RayNeo X2, TCL NXTWEAR V, and TCL NXTWARE S.

- Due to contrast, power, size, and color-space advantages, NTE applications are anticipated to offer lucrative opportunities for OLED microdisplay. This relates to electronic viewfinders and personal viewers (PV). OLED microdisplay are finding widespread adoption in fields such as virtual reality (VR), augmented reality (AR), heads-up displays (HUDs), and wearable devices.

- One of the most striking features of OLED microdisplay is its high resolution. With a high pixel density, these displays offer a high level of detail, making them suitable for applications like VR headsets, augmented reality (AR) glasses, and head-mounted displays. The high resolution of OLED microdisplay ensures that users are presented with sharp, clear images, allowing for a truly immersive visual.

- The protection of OLED layers against water vapors and oxygen has been a significant challenge in developing OLED microdisplays, and it has played a role in restraining the market growth.

OLED Microdisplay Market Trends

Consumer Electronics Segment to Hold Major Market Share

- The studied sector is predominantly driven by the increasing demand from the consumer electronics sector and fast-paced technological developments, which pressure OEMs to present unique products continuously in the market. Consumer electronics providers primarily rely on electronic manufacturers that deliver benefits such as cost savings, quality, decreased time-to-market, reduced time-to-volume, and flexibility to provide their products.

- The increasing demand for smartphones is also significantly driving the demand for the market studied. According to Ericsson, smartphone mobile network subscriptions reached nearly 6.4 billion globally in 2022 and are forecasted to exceed 7.7 billion by 2028. China, India, and the United States have the highest smartphone mobile network subscriptions.

- Additionally, the percentage of 5G smartphones is expected to increase by 2023.

- The penetration rate of OLED folding mobile phones will grow as display technology develops. The smartphone penetration rate will increase as brands launch new flagship folding devices regularly, driven by improved specifications and more affordable pricing. A chance exists to breathe new life into a market where inflation has resulted in a downturn in consumer confidence and pushed the adoption of folding mobile phones.

- According to the Consumer Technology Association, in the United States, consumer technology retail revenue is forecast to increase slightly between 2022 and 2024, reaching over USD 500 billion at the end of the period. Hardware is likely to account for most of the revenue, bringing in around USD 345 billion in 2024. The market is also witnessing several OLED microdisplay innovations and manufacturing capacity expansions to cater to consumers' complex and evolving requirements.

Asia Pacific Expected to Witness Significant Growth in the Market

- The region is considerably investing in the market studied. Increasing adoption of applications in VR/AR and wearables and growing investments in consumer electronics across various countries further propelling demand for OLED microdisplay.

- Additionally, countries such as South Korea, China, and Japan are hubs for consumer electronics manufacturing and innovation. These countries are home to significant technology companies that drive advancements in display technologies, including OLED microdisplay. For instance, in August 2023, KIA launched the VR showroom to showcase new vehicle models to customers.

- OLED microdisplay are being increasingly adopted in various applications ranging from cameras, AR and VR glasses/goggles field, entertainment, industrial applications, and sports. The increasing demand for these products across most countries spurs the market's growth.

- Apart from countries like Japan, South Korea, and China, the growth of the electronics sector across countries such as India and Taiwan is favoring the market's growth. The rising disposable income among the middle-class population across these countries also creates new opportunities for the market studied.

- The increasing urbanization and technological advancements in display screens create massive potential for OLED microdisplay in Asia-Pacific. According to the World Bank, in 2022, around a third of the total population in India lived in cities. The trend indicates an increase in urbanization by more than 4% in the last decade. Such an increase in population may further create demand for smart wearables and other advanced instruments like AR/VR headsets, and many others may further propel the growth of the market studied. Further, due to the presence of major players across the region, the growing adoption of advanced technology, capital investments, and rapidly growing economies contribute to the growth of the market studied.

- For instance, in August 2023, Sony Semiconductor Solutions Corp. (SSS) intended to release the ECX344A, a large-size, high-definition 1.3-type OLED Microdisplay with 4K resolution in the coming months, which would contribute to more realistic recreations of spaces. The new OLED Microdisplay mainly targets virtual reality (VR) and augmented reality (AR) head-mounted display applications. It delivers 4K resolution with a 1.3-type large-size display by employing miniaturization processes that SSS has achieved while developing camera electronic viewfinders (EVFs) and their pixel drive circuits.

- The constant innovation in OLED technology, leading to improved power efficiency and response times, has also contributed to the growing acceptance of OLED microdisplay in various regional sectors. In November 2023, Chinese panel supplier BOE Technology Group announced to build a CNY 63 billion (USD 8.84 billion) production facility to make OLED screens using advanced technology. The factory, planned for Chengdu, will turn out organic light-emitting diode substrates using 8.6-generation technology.

OLED Microdisplay Market Overview

The OLED microdisplay market is fragmented with the presence of major players like Winstar Display Co. Ltd, Microoled SA (Photonis Technologies SAS), Yunnan Olightek Opto-electronic Technology Co. Ltd, Emagin Corporation, and Kopin Corporation. Players in the market are adopting strategies such as acquisitions and partnerships to enhance their product offerings and gain sustainable competitive advantage.

- February 2024 - Kopin Corporation announced the award of a new Small Business Innovation Research (SBIR) contract from the Naval Air Warfare Center. Under the terms of the contract, Kopin would leverage over 30 years of expertise in US-based microdisplay development to deliver advanced microdisplay for lensless computational imaging.

- August 2023 - Sony Semiconductor Solutions (SSS) announced the upcoming ECX344A 4K resolution OLED Microdisplay launch. This new microdisplay is designed for use in virtual reality (VR), augmented reality (AR), and other head-mounted display (HMD) applications. The ECX344A is a large-size OLED Microdisplay with a high-definition (HDR) resolution of 1.3* (1.3-type). It uses miniaturization processes developed by SSS to develop camera electronic field display (CEF) devices and its proprietary pixel drive circuits. This new microdisplay may deliver 4K resolution with high-speed driver circuits, allowing smooth image quality and a greater sense of reality. SSS's original pixel structure also allows wide color gamut (WCG) and high luminance (HV) performance.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Degree of Competition

- 4.4 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Number of Near-to-eye (NTE) Applications

- 5.1.2 High Resolution, Excellent Picture Quality, and Low Power Consumption

- 5.2 Market Challenges

- 5.2.1 Protection of OLED Layers Against Oxygen and Water Vapor

- 5.2.2 Luminance and Lifetime Specifically Under High-temperature Conditions

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Near-to-eye

- 6.1.2 Projections

- 6.2 By End-user Industry

- 6.2.1 Automotive

- 6.2.2 Healthcare

- 6.2.3 Industrial

- 6.2.4 Consumer Electronics

- 6.2.5 Aerospace and Defense

- 6.2.6 Law Enforcement

- 6.2.7 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Vendor Positioning Analysis

- 7.2 Company Profiles

- 7.2.1 Microoled SA (Photonis Technologies SAS)

- 7.2.2 Yunnan Olightek Opto-electronic Technology Co. Ltd

- 7.2.3 Winstar Display Co. Ltd

- 7.2.4 eMagin Corporation

- 7.2.5 Kopin Corporation

- 7.2.6 Wisechip Semiconductor Inc.

- 7.2.7 Seiko Epson Corporation

- 7.2.8 Fraunhofer FEP

- 7.2.9 Sony Semiconductor Solutions Corp. (Sony Corporation)

- 7.2.10 Sunlike Display Technology Corporation