|

市場調查報告書

商品編碼

1687426

不乾膠標籤:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Self-adhesive Labels - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

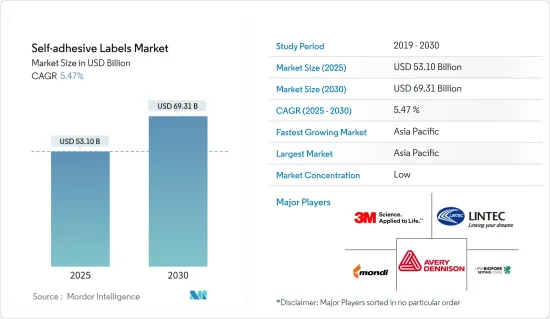

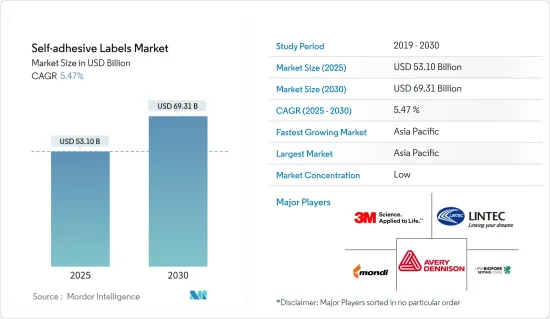

不乾膠標籤市場規模預計在 2025 年為 531 億美元,預計到 2030 年將達到 693.1 億美元,預測期內(2025-2030 年)的複合年成長率為 5.47%。

COVID-19 疫情爆發以及隨後的全國封鎖、製造業活動和供應鏈中斷以及生產停頓對 2020 年的市場產生了負面影響。然而,情況在 2021 年開始復甦,在預測期內恢復了市場成長軌跡。

主要亮點

- 預計快速成長的電子商務行業和不斷成長的食品飲料消費將推動市場需求。

- 相反,政府監管的日益嚴格以及無底紙標籤等替代品的出現可能會阻礙市場的成長。

- 由於向永續實踐的轉變,對生物基自黏劑的需求不斷增加,這將為所研究的市場帶來機會。

- 亞太地區佔據了市場的大部分佔有率,預計在預測期內將繼續保持主導地位。

不乾膠標籤市場趨勢

食品和飲料行業的需求增加

- 眾所周知,不乾膠標籤可以增強食品和飲料包裝品牌的美感。包裝和標籤在銷售產品中起著至關重要的作用,因為它們有助於吸引消費者的注意力。負責人主要使用標籤來鼓勵潛在消費者購買產品。標籤告知如何使用、運輸、回收和處理包裝或產品。

- 標籤提供食品和飲料領域的成分資訊、產品標識和警告。不乾膠標籤製造商必須遵守法律要求,確保其黏合劑不會影響食品成分。

- 此外,預計到年終全球食品包裝市場價值將達到約 3,620 億美元,到 2027 年將達到 4,636.5 億美元。因此,食品包裝市場的成長可能會在未來幾年增加對不乾膠標籤的需求。

- 根據美國商務部的數據,2023 年 1 月零售和餐飲服務機構的總銷售額為 782.7 億美元。而2022年1月,這一數字為749.8億美元。已經有約4.39%的大幅成長,預計還會進一步增加。

- 此外,各食品加工公司都在投資新工廠並擴大包裝食品業務的產能。根據生產連結獎勵(PLI) 計劃,印度政府已收到 60 家包裝食品公司的投資提案,包括印度斯坦聯合利華、Amul、雀巢、Dabur、ITC、Parle 和 Britannia。

- 因此,上述因素將在預測期內增加對不乾膠標籤的需求。

亞太地區佔市場主導地位

- 亞太地區佔據市場主導地位,預計在預測期內將大幅成長。中國、印度、日本和韓國等國家的包裝、電子和個人護理行業的成長正在推動不乾膠標籤的消費。

- 2022年,中國個人護理及化妝品出口總額為56.3億美元,2021年為48.5億美元,與前一年同期比較成長16.08%,預計未來將進一步成長。

- 中國是最大的電子產品生產中心。智慧型手機、電視和其他個人設備等電子產品在電子產品中成長最快。該國不僅滿足了國內對電子產品的需求,還將其電子產品出口到其他國家。隨著中產階級可支配收入的增加,對電子產品的需求預計會增加。

- 根據ZEVI預測,2021年亞洲電子產品市場規模將達到3.11兆歐元(3.674兆美元),成長10%。預計2022年市場將成長13%,2023年將成長7%。中國市場是世界上最大的市場,比工業國家市場的總合還要大。此外,預計中國電子產業2022年將成長14%,2023年將成長8%。

- 不乾膠標籤廣泛應用於各國進出口的藥品及醫療設備的包裝。據印度政府稱,到2030年,印度醫藥市場規模預計將達到1,300億美元。印度向200多個國家供應藥品,未來有潛力繼續這樣做。

- 受經濟成長、人口紅利和電子商務不斷發展的推動,印度第五大包裝產業正在經歷強勁成長。例如,2022 年 1 月,Flipkart 宣布將擴大其雜貨服務至印度 1,800 個城市。 2022 年 6 月,亞馬遜印度公司與曼尼普爾邦政府企業曼尼普爾邦手工織布及手工藝品發展有限公司(MHHDCL)簽署了一份合作備忘錄,以支持全邦工匠和織工的發展。

- 這些因素可能會在預測期內推動所研究市場的需求。

不乾膠標籤行業概況

該研究涉及的市場較為分散。市場的主要企業包括(不分先後順序)3M、艾利丹尼森公司、UPM、Mondi 和 LINTEC 公司。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 蓬勃發展的電子商務產業

- 食品和飲料業對加工食品的需求不斷增加

- 其他促進因素

- 限制因素

- 政府監管不斷加強

- 其他限制因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場區隔

- 膠合劑類型

- 熱熔膠

- 乳液丙烯酸

- 溶劑

- 表面材質

- 紙

- 塑膠

- 聚丙烯

- 聚酯纖維

- 乙烯基塑膠

- 其他塑膠

- 應用

- 飲食

- 藥品

- 物流與運輸

- 個人護理

- 耐久財

- 其他用途

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作、協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- 3M

- Asteria Group

- Avery Dennison Corporation

- CPC Haferkamp GmbH & Co. KG

- Fuji Seal International, Inc.

- HB Fuller Company

- HERMA

- LECTA

- LINTEC Corporation

- Mondi

- Optimum Group

- Symbio, Inc.

- Thai KK Group

- UPM

第7章 市場機會與未來趨勢

- 將重點轉向生物基不乾膠標籤

- 其他機會

The Self-adhesive Labels Market size is estimated at USD 53.10 billion in 2025, and is expected to reach USD 69.31 billion by 2030, at a CAGR of 5.47% during the forecast period (2025-2030).

The COVID-19 outbreak and the subsequent nationwide lockdowns, disruption in manufacturing activities and supply chains, and production halts negatively impacted the market in 2020. However, the conditions started recovering in 2021, restoring the market's growth trajectory for the forecast period.

Key Highlights

- The rapidly growing e-commerce industry and increased consumption of food and beverage products will likely drive the market demand.

- Conversely, increasing government regulations and the availability of substitutes like linerless labels will likely hinder market growth.

- The increasing demand for bio-based self-adhesives with a shift to sustainable practices will act as an opportunity for the market studied.

- Asia-Pacific dominated the market with a significant share and is expected to continue its dominance during the forecast period.

Self Adhesive Labels Market Trends

Increasing Demand from the Food and Beverage Industry

- Self-adhesive labels are known to improve the aesthetic characteristics of food and beverage packaging brands. Packaging and labeling play an essential role in the sale of products, as they help grab consumers' attention. Marketers mainly use them to encourage potential consumers to purchase the product. Labels communicate how to use, transport, recycle, and/or dispose of the package or product.

- Labeling provides ingredient information, product identification, and cautionary notifications in the food and beverage sector. Self-adhesive label manufacturers must comply with the legal requirements to ensure the adhesive does not affect the food ingredients.

- Furthermore, the global food packaging market is estimated to reach around USD 362 billion by the end of this year and USD 463.65 billion in 2027. Thus, the growing food packaging market will increase the demand for self-adhesive labels in the coming years.

- According to the US Department of Commerce, in January 2023, the total sales of retail and food services stores stood at USD 78.27 billion. In contrast, in January 2022, the figure stood at USD 74.98 billion. There is a substantial increase of approximately 4.39%, which is expected to increase further.

- Moreover, various food processing companies invest in new plants and capacity expansions of the packaged food business. Under the Production Linked Incentive (PLI) scheme, the Indian government received investment proposals from 60 processed food companies, including Hindustan Unilever, Amul, Nestle, Dabur, ITC, Parle, and Britannia.

- Thus, the abovementioned factors will likely increase the demand for self-adhesive labels in the forecast period.

Asia-Pacific to Dominate the Market

- Asia-Pacific dominated the market and is expected to grow significantly over the forecast period. With the growing packaging, electronics, and personal care industries in countries like China, India, Japan, and South Korea, the consumption of self-adhesive labels is increasing.

- In 2022, the total export of personal care and cosmetics from China stood at USD 5.63 billion; in 2021, the figure was USD 4.85 billion. There is an increase of 16.08% compared to the previous year, which is expected to increase further.

- China is the largest base for electronics production. Electronic products, such as smartphones, TVs, and other personal devices, recorded the highest growth in electronics. The country serves the domestic demand for electronics and exports electronic output to other countries. With an increase in disposable incomes of the middle-class population, the demand for electronic products is projected to increase.

- According to ZEVI, the Asian electro market reached EUR 3.11 trillion (USD 3.674 trillion) in 2021, a 10% rise. The market increased by 13% in 2022 and estimated a 7% growth rate for 2023. China's market is the largest in the world, even larger than the combined markets of all industrialized countries. Additionally, the Chinese electronic industry expanded by 14% in 2022, and the sector is expected to grow by 8% in 2023

- Self-adhesive labels are widely used in packaging medicines and medical equipment imported or exported to different countries. According to the government of India, the Indian pharma industry market size is expected to reach USD 130 billion by 2030. India provides pharmaceutical products to more than 200 countries and may continue to do so.

- India's fifth-largest packaging industry is growing significantly, led by economic growth, demographic dividend, and growing e-commerce. For instance, in January 2022, Flipkart announced expanding its grocery services and will offer services to 1,800 Indian cities. In June 2022, Amazon India signed an MoU with Manipur Handloom & Handicrafts Development Corporation Limited (MHHDCL), a Government of Manipur Enterprise, to support the growth of artisans and weavers across the state.

- Such factors will likely drive the market demand studied during the forecast period.

Self Adhesive Labels Industry Overview

The market studied is fragmented. Some key players in the market include (not in any particular order) 3M, Avery Dennison Corporation, UPM, Mondi, and LINTEC Corporation, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rapidly Growing E-commerce Industry

- 4.1.2 Increasing Demand for Packed Foods from Food and Beverage Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Increasing Government Regulations

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Adhesive Type

- 5.1.1 Hot-melt

- 5.1.2 Emulsion Acrylic

- 5.1.3 Solvent

- 5.2 Face Material

- 5.2.1 Paper

- 5.2.2 Plastic

- 5.2.2.1 Polypropylene

- 5.2.2.2 Polyester

- 5.2.2.3 Vinyl

- 5.2.2.4 Other Plastics

- 5.3 Application

- 5.3.1 Food and Beverage

- 5.3.2 Pharmaceutical

- 5.3.3 Logistics and Transport

- 5.3.4 Personal Care

- 5.3.5 Consumer Durables

- 5.3.6 Other Applications

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Asteria Group

- 6.4.3 Avery Dennison Corporation

- 6.4.4 CPC Haferkamp GmbH & Co. KG

- 6.4.5 Fuji Seal International, Inc.

- 6.4.6 H.B. Fuller Company

- 6.4.7 HERMA

- 6.4.8 LECTA

- 6.4.9 LINTEC Corporation

- 6.4.10 Mondi

- 6.4.11 Optimum Group

- 6.4.12 Symbio, Inc.

- 6.4.13 Thai KK Group

- 6.4.14 UPM

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Shifting Focus Toward Bio-based Self-adhesive Labels

- 7.2 Other Opportunities