|

市場調查報告書

商品編碼

1687462

越野車:市場佔有率分析、行業趨勢和統計數據、成長預測(2025-2030 年)Off-road Vehicle - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

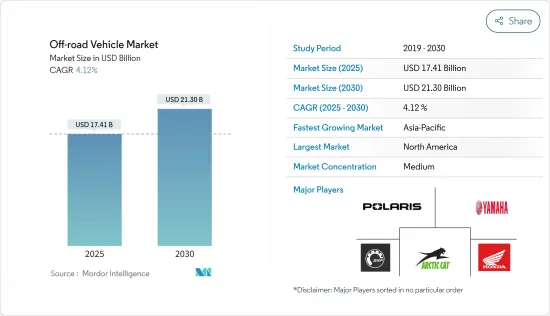

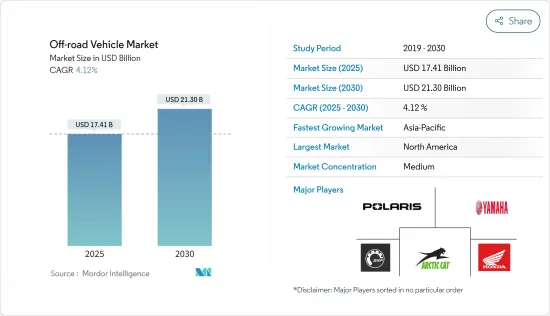

越野車市場規模預計在 2025 年為 174.1 億美元,預計到 2030 年將達到 213 億美元,預測期內(2025-2030 年)的複合年成長率為 4.12%。

由於關閉門戶和旅行限制導致需求放緩,COVID-19 疫情對市場造成了沉重打擊。然而,疫情過後,隨著限制措施的放寬,我們看到休閒和體育活動呈現正面趨勢。因此,預計預測期內越野車的需求將會增加。

越野運動的日益普及以及對堅固而緊湊的設備的需求推動了對越野車的需求。此外,由於越野車廣泛應用於農業、採礦業和建築業等多個領域,預計將實現樂觀的成長。此外,最低的維護成本、降低的燃料消耗和低保險成本也促進了建設產業對這些車輛的需求。

由於全地形車和多功能車不允許在高速公路和其他主要道路上行駛,政府官員正在撥出更多資金來建造新的越野路。預計這將推動市場發展。此外,該公司還專注於推出具有改進功能的新產品,以吸引更多客戶並在市場上獲得競爭優勢。

電動傳動系統等新技術發展可能為越野車市場帶來新的成長機會。由於人們對排放問題的日益擔憂,電動越野車越來越受歡迎,推動了越野車產業的發展。

預計北美仍將是越野車的最大市場,其次是歐洲。亞太地區預計將成為越野車市場成長最快的地區。這是由於高滲透率和蓬勃發展的汽車產業推動了越野車的生產,尤其是在中國和印度。

越野車市場趨勢

全地形車(ATV)領域預計將顯著成長

隨著汽車製造商開發出多種最終用途的全地形車,全地形車市場正在蓬勃發展。人們對體育和休閒的興趣日益濃厚,是這一領域發展的主要驅動力。此外,製造商對各種環保車型不斷改進開發的興趣可能會促進市場的發展。

2022年8月,北極星在印度推出了全新旗艦車型RZR(R) Pro R Sport ATV。這款新型 ATV 配備了強大的 1997cc 4 衝程 DOHC 直列 4 缸引擎,最大輸出為 225bhp。 2022 年,Arctic Cat 推出了四種不同裝飾等級的新款 Alterra 600 ATV。 2021 年 4 月,Arctic Cat 宣布新款 ATV 將作為其 2022 年車型系列的一部分,預計將於 7 月上市。新款 Alterra 600 EPS 採用全新的引擎、傳動系統和底盤,可提供更強大的動力、更好的操控性和更輕鬆的維修服務。這款 ATV 的推出恰逢 Arctic Cat 為強力運動帶來創新新產品的 60 週年。 2020 年 9 月, Yamaha發布了其最新 ATV 車型:2021 年 Grizzly 以及 Kodiak 700 和 450。該公司還宣布了其 2021 年青少年 ATV 陣容,包括裝甲灰色的 Grizzly 90(建議零售價 3,099 美元)、Yamaha團隊藍白配色的 Raptor 90(建議零售價 3,099 美元)和Yamaha團隊藍白配色的 YFZ50(建議零售價 2,199 美元)。 2020 年 9 月,Polaris 宣布與 Zero Motorcycles 成立合資企業,開發電動全地形車和雪上摩托車。

預計全地形車的市場佔有率將穩步成長。這是由於管理和製定全地形車使用標準的規則和法規發生了變化。總部位於加州的非營利組織和監管機構(例如全地形車安全研究所 (ASI))制定了全地形車的正確使用規定,並推廣已通過核准的產品和配件,例如安全帶、腳踏板、頭盔和緊急開關。

預計北美將佔據市場主導地位

預計預測期內北美將佔據越野車市場的大部分佔有率。儘管受到疫情影響,2020年北美市場在銷售方面仍然是非常成功的一年,年輕人對運動休閒活動的偏好日益增加,全地形車銷量也顯著成長。

休閒支出的增加和越野駕駛活動數量的增加是推動該地區 ATV 市場發展的因素。此外,預計在預測期內,各種價位的產品供應也將推動成長。

2022 年 3 月,Polaris Inc. 公佈了首款搭載 Zero Motorcycles動力傳動系統的全尺寸越野電動 RANGER UTV 的試運行。 2022年2月,美國Landmaster將進軍電動UTV市場,推出2門、4門版本,牽引力1200LBS,4X2駕駛模式的電動UTV。 2022 年 2 月,Segway 強力運動將 Fugelman Side-by-Sides 的銷售範圍擴大到美國 40 多家經銷店。 2020 年 6 月,川崎發布了 2020 年 MULE 和 ATV 系列。它包括暴力破解 ATV 系列、MULE PRO 和 SX 系列。為了幫助減輕這些事故的影響,美國休閒非公路用車協會 (ROHVA)、美國消費品安全委員會 (CPSC) 和美國環保署 (EPA) 等監管機構頒布了許多有關全地形車使用和乘員安全的法規。因此,預計在預測期內,政府舉措和年輕人對休閒日益成長的興趣將成為推動該地區越野車市場成長的因素。

越野車產業概況

越野車市場由多家公司主導。業界領先的市場參與者正專注於推出新產品和新技術來吸引來自世界各地的客戶。北極貓 (Arctic Cat)、北極星工業 (Polaris Industries) 和龐巴迪休閒產品 (BRP) 等大型公司已經佔據了相當大的市場佔有率。預計電動 ATV 和 UTV 將在未來幾年為該行業的公司提供豐厚的機會。

- 2022 年 3 月,Polaris Inc. 擴建了其位於俄亥俄州威爾明頓的配送中心。透過此次擴張,該公司增強了分銷能力,擴大了產品種類,改善了交付和客戶服務,並最佳化了其在北美的業務。

- 2022 年 2 月,Polaris Inc. 與全球大型公司的電動車 (EV) 充電和能源管理解決方案提供商 Wallbox NV 合作。透過此次合作,Wallbox將為美國和加拿大的Polaris電動車提供充電解決方案。

- 2021 年 3 月,Arctic Cat 宣布了 2022 年雪上摩托車陣容。新款 Thundercat 是第一款配備電子動力方向盤(EPS) 的高性能渦輪增壓雪橇。 BLAST 產品線進一步擴展,增加了 BLAST XR 4000 和 BLAST XR Touring 4000,為該系列添加了第一款中型旅行雪橇。

- 2021 年 3 月,BRP 承諾在未來五年內投資 3 億美元,到 2026 年底實現其現有產品線的電氣化。 BRP 開發了自己的 Rotax 模組化電力組技術,可用於所有產品線。

- 2020 年 11 月,美國 Landmaster 推出了全新 2021 年並排卡車系列,名為 Landmaster。 2021 年 Landmaster UTV 配備了 30 多項受客戶和經銷商啟發的新功能、一流的懸吊系統、汽車級組件和防風雨電氣系統。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場促進因素

- 市場限制

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章市場區隔

- 按車輛類型

- 全地形車(ATV)

- 多用途車輛(UTV)

- 按應用

- 運動的

- 農業

- 其他用途

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

第6章 競爭格局

- 供應商市場佔有率

- 公司簡介

- Polaris Inc.

- Bombardier Recreational Products Inc.

- Yamaha Motor Corporation

- Arctic Cat Inc.

- Kawasaki Motors Corp.

- Suzuki Motor Corporation

- American LandMaster

- Kwang Yang Motor Co. Ltd

- Honda Company Motor Ltd

第7章 市場機會與未來趨勢

The Off-road Vehicle Market size is estimated at USD 17.41 billion in 2025, and is expected to reach USD 21.30 billion by 2030, at a CAGR of 4.12% during the forecast period (2025-2030).

The COVID-19 pandemic hurt the market as lockdowns and travel restrictions resulted in a slowdown in demand. However, post-pandemic, as restrictions eased, recreational and sports activities started seeing positive trends. Due to this, the demand for off-road vehicles is expected to increase during the forecast period.

The growing popularity of off-road sports and the need for robust, compact equipment are elevating the demand for off-road vehicles. Moreover, as off-road vehicles have a wide range of users across the agriculture, mining, construction, and other sectors, they are expected to witness optimistic growth. Additionally, minimal maintenance costs, reduced fuel consumption, and low insurance costs will aid the demand for these vehicles in the construction industry.

ATVs and UTVs are not allowed to operate on highways and other main roads, so government authorities have allocated more funds to build new off-road trails, which may be useful for recreational enthusiasts and boost adventure sports activities worldwide. This is expected to drive the market. In addition, companies are also focusing on introducing new products with improved features to attract more customers and gain a competitive position in the market.

New technological developments, such as electric drive trains, will create new growth opportunities for the off-road vehicles market. The growing popularity of electric off-road vehicles owing to rising emission concerns will spur the off-road vehicles industry.

North America is expected to remain the largest market for off-road vehicles, followed by Europe, owing to growing consumer demand in the region. Asia-Pacific is expected to witness the fastest growth in the off-road vehicle market, owing to the high adoption rate and the booming automotive sector, leading to increased production of off-road vehicles, especially in China and India.

Off-Road Vehicle Market Trends

The All-Terrain Vehicle Segment is Likely to Witness Significant Growth

The ATV market is growing rapidly as vehicle manufacturers are developing ATVs for many end-use applications. The increasing interest of people in sports and recreational activities has emerged as a significant driving factor for the segment. Moreover, manufacturers' interest in frequent advancements in the development of various eco-friendly vehicle versions is likely to boost the market.

In August 2022, Polaris launched a new flagship RZR (R) Pro R Sport ATV model in India. The new ATV has a powerful 1997 cc 4-stroke DOHC inline four-cylinder engine responsible for delivering 225 bhp of maximum power. In 2022, Arctic Cat introduced the new Alterra 600 ATV in four different trim levels. In April 2021, Arctic Cat announced a new ATV as part of its model year 2022 line-up for dealerships in July. The new Alterra 600 EPS features an all-new engine, drivetrain, and chassis offering, with increased power, better handling, and easier servicing. The launch of the ATV coincides with Arctic Cat's 60th anniversary of bringing new and innovative products to power sports. In September 2020, Yamaha unveiled its latest ATV models, the Grizzly 2021 and Kodiak 700 and 450 models. The company unveiled its 2021 Youth ATV lineup, including the Grizzly 90 in Armor Gray (USD 3,099 MSRP), Raptor 90 in Team Yamaha Blue and White (USD 3,099 MSRP), and YFZ50 in Team Yamaha Blue and White (USD 2,199 MSRP). In September 2020, Polaris announced entering a joint venture with Zero Motorcycles to develop electric ATVs and snowmobiles.

ATVs' market share is projected to witness steady growth. This is owing to the change in the rules and regulations that govern and define the standards in the way ATVs are used. Regulatory authorities, such as the California-based non-profit organization and the All-terrain Vehicle Safety Institute (ASI), determine proper ATV usage regulations and promote approved products and accessories, such as seatbelts, footrests, helmets, and kill switches.

North America is Expected to Hold a Prominent Share in the Market

The North American region is anticipated to hold a significant share of the off-road vehicle market during the forecast period. Despite the pandemic, in 2020, the North American market had a very successful year in sales, with significant growth seen in all-terrain vehicles as the preference for sports and recreational activities rose among youth.

The increasing recreational expenditure and the increasing number of off-roading events are the factors driving the ATV market in the region. Furthermore, the availability of a wide range of products at varied prices is anticipated to enhance growth during the forecast period.

In March 2022, Polaris Inc. showed the testing of the first full-size off-road electric RANGER UTV with a Zero Motorcycles powertrain, which will be launched by the end of 2022. In February 2022, American Landmaster joined the electric UTV fray to provide electric-powered UTVs with a towing capacity of 1,200 LBS in 2-door and 4-door versions in 4X2 driving mode. In February 2022, Segway Powersports expanded the availability of Fugleman side-by-side to over 40 dealerships across the United States. In June 2020, Kawasaki unveiled the 2020 line-up for its MULE and ATV range of vehicles. It consists of the Brute Force ATV line-up, MULE PRO, and SX series. In order to reduce the impact of the hindrances, regulatory authorities, such as the Recreational Off-Highway Vehicle Association (ROHVA), the United States Consumer Product Safety Commission (CPSC), and the US Environmental Protection Agency (EPA), established numerous regulations regarding the use of ATVs and occupant safety. Thus, government initiatives and the growing interest of the youth in recreational events are the factors expected to drive the growth of the off-road vehicles market in the region during the forecast period.

Off-Road Vehicle Industry Overview

The off-road vehicle market is dominated by numerous players. The key market players in the industry emphasize introducing new products and technologies to attract customers worldwide. Some of the major players, like Arctic Cat, Polaris Industries, and Bombardier Recreational Products (BRP), captured significant shares of the market. Electric ATVs and UTVs are expected to offer lucrative opportunities for players in the industry over the coming years.

- In March 2022, Polaris Inc. expanded its distribution facility in Wilmington, Ohio. Through this expansion, the company enhanced distribution capacity, expanded product assortment, improved delivery, customer service, and optimized operations across North America.

- In February 2022, Polaris Inc. collaborated with Wallbox N.V., a leading provider of electric vehicle (EV) charging and energy management solutions worldwide. Through this collaboration, Wallbox provides charging solutions for Polaris electric vehicles in the United States and Canada.

- In March 2021, Arctic Cat announced the launch of the 2022 snowmobile line-up. The new Thundercat offers electronic power steering (EPS) for the first time on a high-performance, turbocharged sled. The BLAST line-up welcomes two new sleds to the family with the addition of the BLAST XR 4000 and BLAST XR Touring 4000, the first mid-sized touring sled.

- In March 2021, BRP invested USD 300 million over the next five years to electrify its existing product lines by the end of 2026. BRP developed its Rotax modular electric powerpack technology in-house, which may be leveraged across all product lines.

- In November 2020, American Landmaster revealed its all-new line-up of 2021 side-by-sides called the Landmaster. The 2021 Landmaster UTVs are equipped with over 30 new customer and dealer-inspired features, a best-in-class suspension system, automotive-grade components, and a weather-sealed electrical system.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD Billion)

- 5.1 By Vehicle Type

- 5.1.1 All-terrain Vehicle (ATV)

- 5.1.2 Utility Task Vehicle (UTV)

- 5.2 By Application

- 5.2.1 Sports

- 5.2.2 Agricultural

- 5.2.3 Other Applications

- 5.3 By Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Polaris Inc.

- 6.2.2 Bombardier Recreational Products Inc.

- 6.2.3 Yamaha Motor Corporation

- 6.2.4 Arctic Cat Inc.

- 6.2.5 Kawasaki Motors Corp.

- 6.2.6 Suzuki Motor Corporation

- 6.2.7 American LandMaster

- 6.2.8 Kwang Yang Motor Co. Ltd

- 6.2.8.1 Honda Company Motor Ltd