|

市場調查報告書

商品編碼

1687743

全球空膠囊市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Global Empty Capsules - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

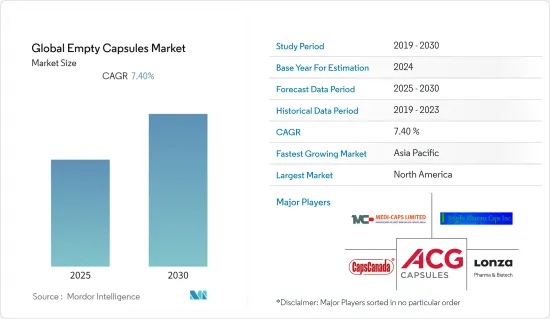

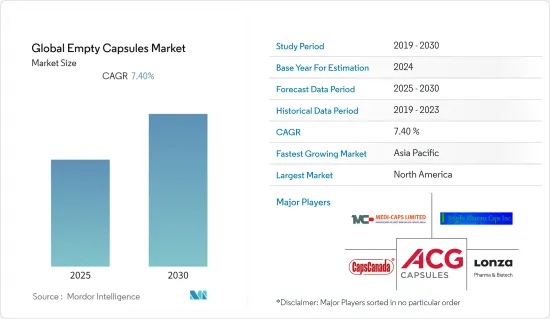

預計預測期內全球空膠囊市場將以 7.4% 的複合年成長率成長。

預計 COVID-19 疫情將對市場成長產生正面影響。增強免疫力對於抵抗病毒感染至關重要,因此對天然草藥和膳食補充劑形式的免疫力增強劑的需求正在上升。除了基本的衛生習慣外,良好的飲食和生活習慣對於預防和治療 COVID-19 等呼吸道病毒性疾病也至關重要。根據2020年發表的一篇研究論文,所有COVID-19患者入院時都應接受營養不良篩檢,並評估其血清維生素D濃度。此外,2020 年 3 月,Stabilitech BioPharma Ltd 開發了一種用於接種 COVID-19 疫苗的新型口服膠囊。因此,COVID-19 疫情正在推動對膳食補充劑的需求,預計這將推動市場成長。

推動市場成長的關鍵因素包括膠囊相對於其他藥物輸送形式越來越受歡迎,以及空膠囊供應商和明膠製造商之間戰略聯盟的日益加強。此外,全球老齡人口數量的不斷成長也推動了對一系列治療和營養補充劑的需求,以實現更好的健康結果。根據聯合國《世界老化:2020 年修訂版》預測,到 2050 年,年齡在 65 歲或以上的人口將達到 15 億左右,高於 2020 年的 7.27 億。此外,膠囊輸送技術的快速進步預計將促進市場成長。然而,道德問題、明膠材料的價格波動以及製藥業的嚴格監管預計將阻礙市場成長。

空膠囊的市場趨勢

心血管治療領域預計將在預測期內實現健康的複合年成長率

心血管疾病(CVD)在全球十分普遍。根據世界衛生組織(WHO)2019年的數據,全球每年約有1,790萬人死於心血管疾病,預計2030年將增加至2,360萬以上。此外,根據美國心臟協會2020年的研究報告,被列為根本死因的心血管疾病在美國每天約造成2,353人死亡,平均每37秒就有一人死亡。此外,根據英國心臟基金會中心 2021 年的數據,英國約有 760 萬人患有心臟和循環系統疾病。英國每年有超過 40,000 名 75 歲以下的人死於心臟和循環系統疾病。全球心血管疾病的高發生率刺激了對有效治療心血管疾病療法的需求,從而推動了市場的成長。

此外,在COVID-19疫情期間,美國心臟病學會和加拿大心血管學會發布了重新引入心臟服務的指南,包括家庭心臟康復,提供運動訓練和飲食諮詢、藥物管理、戒菸諮詢和心理社會評估干預。因此,預計心臟復健課程的增加將促進 COVID-19 大流行期間的學習發展。

此外,2019年9月,魯賓公司獲得加拿大衛生監管機構核准,可生產用於治療高血壓和減少心絞痛發作頻率的Propranolol普萘洛爾緩釋膠囊。預測期內,產品核可的增加預計也將推動此領域的發展。

空膠囊可以有效遮罩心臟病藥物的味道,防止患者感到噁心。因此,隨著心血管疾病盛行率的增加,對心臟照護的需求也隨之增加。這項因素可能會對空膠囊市場產生正面影響。

北美佔據了大部分市場佔有率,預計在預測期內將繼續保持這一地位。

由於人們對膠囊型營養保健品配方的偏好日益成長,預計該地區將佔據相當大的佔有率。這些膳食補充劑的消費量正在上升,因為它們有助於預防肥胖、癌症和關節炎等重大健康問題。此外,由於膠囊是最受歡迎的固態口服劑型,該地區的膳食補充劑行業對空膠囊的需求很高。

此外,美國慢性病負擔加重以及老年人口增加也被認為是北美市場成長的主要因素。根據《美國人口老化公報》,預計到 2060 年,65 歲及以上美國的數量將幾乎加倍,從 2018 年的 5,200 萬人增加到 9,500 萬人。同樣,根據 CRN 2019 年膳食補充劑消費者調查報告,77% 的美國人表示他們服用膳食補充劑。調查也發現,維生素和礦物質是2019年美國最常消費的補充劑,佔膳食補充劑總消費量的76%,其次是特種補充劑(40%)、草藥和植物藥(39%)、運動營養補充劑(28%)和體重管理補充劑(17%)。

然而,在新冠疫情期間,大多數肉類加工廠都關閉了,限制了明膠的供應。此外,由於世界各地邊境的運輸限制,北美的明膠膠囊供應鏈預計將受到嚴重影響,這將阻礙該地區的市場成長。

此外,美國和加拿大已經開發並建立了鼓勵研發的醫療保健體系。此外,美國和加拿大正在鼓勵全球公司進入該市場。因此,這些國家擁有許多全球市場參與企業。由於該地區跨國公司滿足了高需求,預計市場在預測期內將進一步成長。

空膠囊產業概況

主要企業生產大部分空膠囊。擁有更多研究資金和更好分銷系統的市場領導正在市場上站穩腳跟。空膠囊市場高度整合,由幾家主要參與企業組成,包括 ACG Worldwide、Medi-Caps Ltd、LonzaGroup (Capsugel)、Capscanada Corporation 和 Bright Pharma Caps Inc. 此外,亞太地區對空膠囊的認知不斷提高,導致了一些中小型企業的出現。此外,主要企業參與策略聯盟和產品發布,以確保其在競爭激烈的市場中的地位。例如,2020年10月,龍沙向其膠囊和健康成分(CHI)部門投資8,500萬瑞士法郎,以將其膠囊生產能力擴大至每年300億粒膠囊。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概覽

- 市場促進因素

- 增加藥物用途

- 空膠囊的技術進步

- 老年人口不斷增加

- 市場限制

- 明膠價格上漲,原料取得困難

- 文化習俗和飲食限制

- 波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章市場區隔

- 按產品

- 明膠膠囊

- 非明膠膠囊

- 功能

- 即時釋膠囊

- 緩釋性膠囊

- 緩釋性膠囊

- 按治療用途

- 抗生素和抗菌藥物

- 維生素和營養補充劑

- 制酸劑和腸道調節劑

- 心血管治療

- 其他

- 按最終用戶

- 製藥業

- 營養保健品產業

- 化妝品產業

- 研究所

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 其他亞太地區

- 中東和非洲

- 海灣合作理事會國家

- 南非

- 其他中東和非洲地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 北美洲

第6章競爭格局

- 公司簡介

- ACG Worldwide

- Bright Pharma Caps Inc.

- Capscanada Corporation

- Lonza Group(Capsugel)

- Medi-Caps Ltd

- Qualicaps

- Suheung Capsule Co. Ltd

- Qingdao Yiqing Medicinal Capsules Co. Ltd

- Shanxi Guangsheng Medicinal Capsules Co. Ltd

- Healthcaps India Ltd

- Nectar Lifesciences Ltd

- Shanxi JC Biological Technology Co. Ltd

第7章 市場機會與未來趨勢

The Global Empty Capsules Market is expected to register a CAGR of 7.4% during the forecast period.

The COVID-19 pandemic is expected to positively impact the market's growth. As the development of strong immunity plays a vital role in fighting against viral infection, there has been an increasing demand for immunity boosters in the form of natural herbs and nutraceuticals. Apart from the basic hygienic practices, proper dietary and lifestyle behaviors are essential for preventing and treating respiratory viral diseases, such as COVID-19. As per the research article published in 2020, every COVID-19 patient should be screened for malnutrition on admission and assessed for serum vitamin D levels. Additionally, in March 2020, Stabilitech BioPharma Ltd developed a new oral capsule to deliver the COVID-19 vaccine. Thus, the COVID-19 pandemic is boosting the demand for nutraceuticals, which is expected to help the market to grow.

The key factors that boost the market's growth include a rise in the popularity of capsules over other drug delivery forms and an increase in strategic collaborations between empty capsule suppliers and gelatin manufacturers. Also, the growing geriatric population worldwide increases the demand for various therapy drugs and dietary supplements for better health outcomes. According to the United Nations, World Ageing Population: the 2020 Revision, by 2050, approximately 1.5 billion people are likely to be over 65 years, up from 727 million in 2020. In addition, rapid advancements in capsule delivery technologies are set to supplement the market's growth. However, ethical concerns, price fluctuations regarding gelatin materials, and stringent regulations in the pharmaceutical industry are expected to hamper the market growth.

Empty Capsules Market Trends

The Cardiovascular Therapy Drugs Segment is Expected to Witness a Healthy CAGR Over the Forecast Period

Cardiovascular diseases (CVD) are highly prevalent globally. According to the World Health Organization 2019, an estimated 17.9 million people die due to cardiovascular diseases worldwide each year, and the number is expected to grow to more than 23.6 million by 2030. Additionally, as per the American Heart Association Research Report 2020, cardiovascular disease, listed as the underlying cause of death, accounts for nearly 2,353 deaths daily in the United States, which is an average of 1 death every 37 seconds. Also, according to the British Heart Foundation Centre, 2021, around 7.6 million people were living with heart and circulatory diseases in the United Kingdom. More than 40,000 people under the age of 75 years in the United Kingdom die from heart and circulatory diseases each year. The high incidence of cardiovascular diseases worldwide surges the demand for cardiovascular therapy drugs for effective treatment, thus driving the market's growth.

Additionally, during the COVID-19 pandemic, the American College of Cardiology and the Canadian Cardiovascular Society issued guidelines for the reintroduction of cardiac services, including home-based cardiac rehabilitation that provide exercise training and dietary counseling, medication management, tobacco cessation counseling, and psychosocial assessment interventions. Hence, the increasing cardiac rehabilitation sessions are expected to boost the studied segment during the COVID-19 pandemic.

Also, in September 2019, Lupin received approval from the Canadian health regulator for its Propranolol Hydrochloride extended-release capsules used to treat hypertension and decreased frequency of angina. The increasing product approvals are also expected to boost the segment over the forecast period.

Empty capsules are useful in masking the taste of cardiac therapy drugs, which prevents the patient from feeling nauseated. Hence, as the prevalence of CVDs increases, the demand for cardiac therapy drugs will also increase. This factor may positively impact the empty capsules market.

North America Holds a Significant Share in the Market and is Expected to Continue the Trend over the Forecast Period

The region holds a major share due to the rising preference for capsule-based nutraceutical formulations. Since these nutraceuticals help prevent major health problems, such as obesity, cancer, and arthritis, their consumption has increased. Additionally, capsules are the most preferred solid oral dosage forms, and thus, the demand for empty capsules in the nutraceutical industry is high in the region.

Also, the growing burden of chronic diseases, along with the rising geriatric population in the United States, is considered a major factor for the growth of the market in North America. According to the Population Reference Bureau's Population Bulletin-Aging in the United States, the number of Americans aged 65 years and older is projected to nearly double from 52 million in 2018 to 95 million by 2060. Similarly, as per the CRN Consumer Survey on Dietary Supplements, 2019 report, 77% of Americans reported consuming dietary supplements. Also, the survey revealed that vitamins and minerals were the most common supplements consumed by the American population in 2019, accounting for 76% of total dietary supplement consumption, followed by specialty supplements (40%), herbals and botanicals (39%), sports nutrition supplements (28%), and weight management supplements (17 %) in 2019.

However, during the COVID-19 pandemic, most meat processing facilities were shut down, which limited the availability of gelatin. Additionally, due to the transport restrictions in the borders of various countries worldwide, North America is expected to be severely impacted on the supply chain of the gelatin capsule, which is expected to hamper the market's growth in the region.

Moreover, the United States and Canada have a developed and well-structured healthcare system, which encourages research and development. They also encourage global players to enter the United States and Canada. As a result, these countries enjoy the presence of many global market players. As the high demand is met by the presence of global players in the region, the market is further expected to grow over the forecast period.

Empty Capsules Industry Overview

Global key players are manufacturing the majority of empty capsules. Market leaders with more funds for research and a better distribution system have established their positions in the market. The empty capsules market is highly consolidated and consists of a few major players, including ACG Worldwide, Medi-Caps Ltd, LonzaGroup (Capsugel), Capscanada Corporation, and Bright Pharma Caps Inc. Moreover, Asia-Pacific is witnessing the emergence of a few small- and medium-sized players due to the rising awareness of empty capsules. Additionally, key players are involved in strategic alliances and product launches to secure their positions in the competitive market. For instance, in October 2020, Lonza invested CHF 85 million in its Capsules and Health Ingredients (CHI) division to expand its capsule manufacturing capacity by 30 billion capsules annually.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Pharmaceutical Applications

- 4.2.2 Technological Advancements in Empty Capsules

- 4.2.3 Growing Geriatric Population

- 4.3 Market Restraints

- 4.3.1 Rising Gelatin Prices and Lower Availability of Raw Materials

- 4.3.2 Cultural Practices and Dietary Restrictions

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Product

- 5.1.1 Gelatin Capsules

- 5.1.2 Non-gelatin Capsules

- 5.2 By Functionality

- 5.2.1 Immediate-release Capsules

- 5.2.2 Delayed-release Capsules

- 5.2.3 Sustained-release Capsules

- 5.3 By Therapeutic Application

- 5.3.1 Antibiotic and Antibacterial Drugs

- 5.3.2 Vitamins and Dietary Supplements

- 5.3.3 Antacid and Antiflatulent Preparations

- 5.3.4 Cardiovascular Therapy Drugs

- 5.3.5 Other Therapeutic Applications

- 5.4 By End User

- 5.4.1 Pharmaceutical Industry

- 5.4.2 Nutraceutical Industry

- 5.4.3 Cosmetics Industry

- 5.4.4 Research Laboratories

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle-East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle-East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 ACG Worldwide

- 6.1.2 Bright Pharma Caps Inc.

- 6.1.3 Capscanada Corporation

- 6.1.4 Lonza Group (Capsugel)

- 6.1.5 Medi-Caps Ltd

- 6.1.6 Qualicaps

- 6.1.7 Suheung Capsule Co. Ltd

- 6.1.8 Qingdao Yiqing Medicinal Capsules Co. Ltd

- 6.1.9 Shanxi Guangsheng Medicinal Capsules Co. Ltd

- 6.1.10 Healthcaps India Ltd

- 6.1.11 Nectar Lifesciences Ltd

- 6.1.12 Shanxi JC Biological Technology Co. Ltd