|

市場調查報告書

商品編碼

1687786

高壓壓鑄:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)High-Pressure Die Casting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

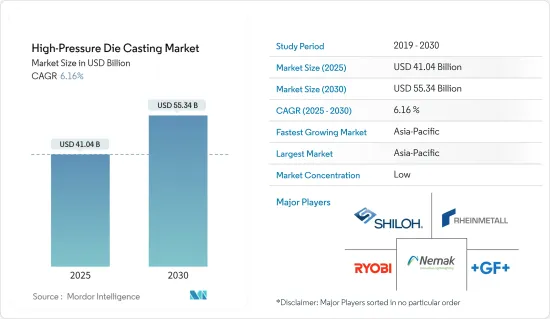

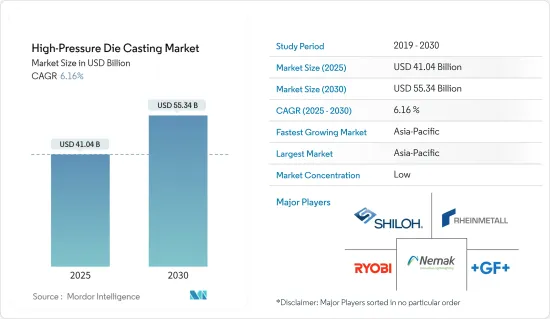

高壓壓鑄市場規模預計在 2025 年為 410.4 億美元,預計到 2030 年將達到 553.4 億美元,預測期內(2025-2030 年)的複合年成長率為 6.16%。

全球向電動車的轉變和嚴格的燃油效率標準正在增加對輕質耐用汽車零件的需求,從而推動高壓壓鑄 (HPDC) 市場的發展。隨著汽車製造商尋求延長車輛行駛里程並減少排放氣體,HPDC 因其能夠生產具有高尺寸精度和出色表面光潔度的複雜形狀而受到青睞,使其成為生產輕質、結構合理的零件的理想選擇。

汽車產業正在向電氣化轉型,這進一步加劇了這些需求,需要開發能夠滿足電動動力傳動系統獨特需求的零件,例如電池框架和馬達外殼。因此,HPDC 市場正在經歷顯著成長,製造商正在投資新技術並擴大生產能力以滿足不斷變化的需求。

高壓壓鑄產業正經歷技術投資和產能擴張的顯著趨勢,這得益於對輕量化和結構高效零件的需求不斷成長,尤其是電動車。隨著汽車產業向電氣化轉變,HPDC 市場的公司正專注於提高零件性能和重量效率的創新。此舉體現了整個產業對永續性和燃油效率的更廣泛追求。例如

主要亮點

- 2024年4月,現代汽車宣布投資超級鑄造技術。超級鑄造技術可以一次生產整個車身,大大提高了製造效率並減少了材料浪費。

- 2024 年 4 月,本田宣布利用高壓壓鑄機開發智慧動力單元 (IPU) 外殼,作為其俄亥俄電動車輪轂的一部分。這項發展展示了 HPDC 技術在生產更輕、結構更堅固的關鍵車輛零件方面的整合。

高壓壓鑄市場趨勢

預計在預測期內,汽車產業將繼續成為關注的焦點

汽車產業是高壓壓鑄 (HPDC) 市場的主要細分市場,主要受鋁使用量激增和電動車產量激增的推動。向輕量化材料的轉變是汽車產業的關鍵驅動力,主要是為了滿足日益嚴格的燃油經濟性和排放法規。

- 目前每輛汽車的平均鋁含量約為 450 磅,預計到 2030 年將增加至 550 磅。這反映了近 22% 的成長,並標誌著該行業繼續轉向更輕、更省油的汽車。

這一趨勢在電動車生產中尤其明顯,電動車使用的鋁比傳統內燃機汽車更多。鋁在汽車中的使用量不斷增加,這與汽車行業對 HPDC 的需求相一致,HPDC 能夠高效、永續生產複雜、精加工的零件。此外,電動車產量的激增進一步凸顯了HPDC在汽車產業的重要性。

- 根據國際能源總署 (IEA) 的數據,電動車銷量預計將從 2023 年的 1,400 萬輛大幅成長至 2030 年的近 4,500 萬輛,到 2035 年將達到 6,500 萬輛。這一成長將反映在銷售佔有率上,預計將從 2023 年的 15% 成長至 2030 年的約 40%,並於 2035 年超過 50%(既定政策情境)。

電動車產量的增加將需要更多的 HPDC 組件。特別是,需要輕質結構部件來適應電池增加的重量,同時又不影響車輛性能。

預計亞太地區將在預測期內實現最高成長

預計亞太地區將主導全球高壓壓鑄市場並在預測期內呈現最快的成長率。在亞太地區,中國、印度和日本等國家可能會在市場上發揮關鍵作用。

- 例如,中國是壓鑄件的主要生產國之一,佔據了區域壓鑄市場佔有率的大部分佔有率。中國金屬鑄造業有3萬多家企業,其中生產有色金屬鑄件的約8,000多家。中國鑄件產量超過5500萬噸。

省油車的日益普及和壓鑄技術的最新進步預計將進一步促進市場的發展。這些優勢使得該地區的汽車製造商簽訂了長期契約,以持續供應原料和擴大工廠。

為了生產符合消費者偏好和國際標準的產品,鑄造廠越來越注重提高技術創新,為市場參與者提供新的機會。鑄造公司注重技術品質和品牌導向,這是亞太地區壓鑄市場的關鍵市場驅動力。這些發展和案例可能有助於亞太國家市場的整體發展。

高壓壓鑄產業概況

高壓壓鑄市場高度分散,全球有許多地區和國際參與者。近年來,許多來自新興國家的中小型企業進入市場並擴大業務,加劇了市場競爭。市場上一些公認的參與者包括 Nemak、Georg Fischer Automotive、Ryobi Die Casting、Rheinmetall AG、Form Technologies Inc. (Dynacast) 和 Shiloh Industries。其他主要企業包括科赫企業、利納馬集團和 Bocar 集團。

HPDC 市場的主要企業正在積極致力於技術進步、提高業務效率和策略擴張,以增強其產品供應並在不斷發展的汽車市場(尤其是向電動車的轉變)中佔據一席之地。這些策略舉措旨在滿足傳統汽車和電動車對高品質精密零件日益成長的需求,從而佔據更大的市場佔有率。

- 例如, Ryobi Die Casting 於 2024 年 5 月宣布將斥資 5,000 萬美元擴建其位於墨西哥的工廠,以提高產能,以滿足未來對電動車的需求。此次擴張包括增加新的更大型的 HPDC 機器,並凸顯了Ryobi根據市場趨勢擴大業務的策略性舉措。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場促進因素

- 由於壓鑄設備中鋁的使用增加,市場需求增加

- 家電成長

- 電動車銷量上升導致汽車產業需求增加

- 市場限制

- 初期成本高

- 原物料價格波動

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 原料類型

- 鋁

- 鋅

- 鎂

- 應用

- 車

- 電氣和電子

- 工業應用

- 其他用途

- 生產流程

- 真空高壓鑄

- 擠壓高壓鑄

- 地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 亞太地區

- 印度

- 中國

- 日本

- 韓國

- 其他亞太地區

- 世界其他地區

- 南美洲

- 中東和非洲

- 北美洲

第6章 競爭格局

- 供應商市場佔有率

- 公司簡介

- Georg Fischer AG

- Shiloh Industries Ltd

- Ryobi Die Casting Inc.

- Nemak SAB De CV

- Rheinmetall AG(Rheinmetall Automotive, formerly KSPG AG)

- Sundaram-Clayton Ltd

- Koch Enterprises Inc.(Gibbs Die Casting Group)

- Engtek Group

- Officine Meccaniche Rezzatesi SpA

- Endurance Group

- Rockman Industries

- Dynacast(Form Technologies Inc.)

第7章 市場機會與未來趨勢

The High-Pressure Die Casting Market size is estimated at USD 41.04 billion in 2025, and is expected to reach USD 55.34 billion by 2030, at a CAGR of 6.16% during the forecast period (2025-2030).

Increasing demand for lightweight yet durable automotive components, driven by a global shift toward electric vehicles and more stringent fuel efficiency standards, is driving the high-pressure die casting (HPDC) market. As automotive manufacturers aim to extend the range and reduce the emissions of their vehicles, HPDC is favored for its ability to produce complex shapes with high dimensional accuracy and excellent surface finish, making it ideal for creating components that are both lightweight and structurally robust.

This need is further amplified by the automotive industry's ongoing transition to electrification, which necessitates the development of components that can withstand the unique demands of electric powertrains, such as battery frames and motor housings. As a result, the HPDC market is experiencing substantial growth, with manufacturers investing in new technologies and expanding capacity to meet these evolving requirements.

The high-pressure die-casting industry is experiencing a key trend with increased investments in technology and capacity expansion, driven by the growing demand for lightweight and structurally efficient components, especially in electric vehicles. As the automotive industry shifts toward electrification, companies within the HPDC market are focusing on innovations that enhance the performance and weight efficiency of their components. This trend is reflective of a broader industry movement toward sustainability and increased fuel efficiency. For instance,

Key Highlights

- In April 2024, Hyundai Motor announced an investment in hypercasting technology, which allows for the production of entire car bodies in a single process, significantly enhancing manufacturing efficiency and reducing material wastage.

- In April 2024, Honda announced developments in the Intelligent Power Unit (IPU) case, utilizing high-pressure die-casting machines as part of its EV hub in Ohio. This development showcased the integration of HPDC technology in manufacturing critical vehicle components that are lighter and structurally sound.

High-Pressure Die Casting Market Trends

Automotive Segment Expected to Gain Prominence During the Forecast Period

The automotive industry is the predominant segment within the high-pressure die casting (HPDC) market, primarily driven by the surge in aluminum usage and the escalating production of EVs. The shift toward lightweight materials is a critical driver in the automotive industry, primarily due to the need to meet stricter fuel economy and emissions standards.

- The aluminum content in vehicles, which currently averages about 450 pounds per vehicle, is projected to increase to 550 pounds per vehicle by 2030. This reflects a nearly 22% rise, underscoring the industry's ongoing shift toward lighter and more fuel-efficient vehicles.

This trend is particularly pronounced in the production of electric vehicles, which are more aluminum-intensive than traditional combustion engine vehicles. The increased aluminum usage in vehicles aligns with the automotive industry's needs for HPDC as it allows for the efficient and sustainable production of complex, high-integrity parts. Furthermore, the surge in EV production further underscores the importance of HPDC in the automotive industry.

- According to the International Energy Agency (IEA), EV sales are projected to rise significantly from 14 million units in 2023 to nearly 45 million by 2030 and continue to rise to reach 65 million by 2035. This growth is mirrored in the sales share, which is expected to jump from 15% in 2023 to about 40% by 2030 and over 50% by 2035 in the Stated Policies Scenario.

This increase in EV production necessitates more HPDC parts, particularly because of the need for lightweight structural components that accommodate the additional weight of batteries without compromising vehicle performance.

Asia-Pacific Expected to Witness the Highest Growth During the Forecast Period

The Asia-Pacific region is expected to dominate the global high-pressure die-casting market, and it is also expected to witness the fastest growth rate during the forecast period. In the Asia-Pacific region, countries like China, India, and Japan are likely to play a key role in the market.

- For instance, China is one of the major producers of die-casting parts and accounts for the majority of the regional die-casting market's share. The metal casting industry in China has more than 30,000 facilities, of which around 8,000 facilities produce non-ferrous castings. China produces over 55.0 million metric tons of castings.

The increasing popularity of fuel-efficient vehicles and the latest advancements in die-casting techniques are expected to further contribute to the market's development. Thus, due to such benefits, automakers in the region are entering long-term deals for uninterrupted supply of raw materials, expansion of plants, etc.

The growing focus of foundries on improving innovation to produce products that meet consumer preferences and international standards offers new opportunities for players in the market. Foundries are focusing on technical quality and brand orientation, which are considered major growth drivers for the Asia-Pacific high-pressure die-casting market. Such developments and instances are likely to contribute to the overall development of the market across Asia-Pacific countries.

High-Pressure Die Casting Industry Overview

The high-pressure die-casting market is highly fragmented, with the presence of many regional and international players worldwide. Competition in the market has increased, as many small- and medium-scale players from developing countries have entered and expanded their business in the market over recent years. Some of the recognized players in the market are Nemak, Georg Fischer Automotive, Ryobi Die Casting, Rheinmetall AG, Form Technologies Inc. (Dynacast), and Shiloh Industries. Some other notable players include Koch Enterprise, Linamar Corporation, and Bocar Group.

Major players in the HPDC market are actively engaging in technological advancements, operational efficiency improvements, and strategic expansions to enhance their product offerings and better position themselves in the evolving automotive market, especially with the shift toward electric vehicles. These strategic moves are aimed at capturing a larger share of the market by meeting the increasing demands for high-quality, precision components in both conventional and electric vehicles.

- For instance, in May 2024, Ryobi Die Casting announced a USD 50 million expansion of its plant in Mexico to increase production capacity in anticipation of future EV demands. This expansion included the addition of new large HPDC machines, underscoring Ryobi's strategic initiative to scale operations in line with market trends.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Growing Use of Aluminum in Die Casting Equipment to Increase Market Demand

- 4.1.2 Growth in Consumer Electronics

- 4.1.3 Automotive Industry Demand Rising Because of Increasing EV Sales

- 4.2 Market Restraints

- 4.2.1 High Initial Costs

- 4.2.2 Fluctuations in Raw Material Prices

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value - USD Million)

- 5.1 Raw Material Type

- 5.1.1 Aluminum

- 5.1.2 Zinc

- 5.1.3 Magnesium

- 5.2 Application

- 5.2.1 Automotive

- 5.2.2 Electrical and Electronics

- 5.2.3 Industrial Applications

- 5.2.4 Other Applications

- 5.3 Production Process

- 5.3.1 Vacuum High-pressure Die Casting

- 5.3.2 Squeeze High-pressure Die Casting

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 South America

- 5.4.4.2 Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Georg Fischer AG

- 6.2.2 Shiloh Industries Ltd

- 6.2.3 Ryobi Die Casting Inc.

- 6.2.4 Nemak SAB De CV

- 6.2.5 Rheinmetall AG (Rheinmetall Automotive, formerly KSPG AG)

- 6.2.6 Sundaram - Clayton Ltd

- 6.2.7 Koch Enterprises Inc. (Gibbs Die Casting Group)

- 6.2.8 Engtek Group

- 6.2.9 Officine Meccaniche Rezzatesi SpA

- 6.2.10 Endurance Group

- 6.2.11 Rockman Industries

- 6.2.12 Dynacast (Form Technologies Inc.)