|

市場調查報告書

商品編碼

1687926

印尼紙包裝:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)Indonesia Folding Carton Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

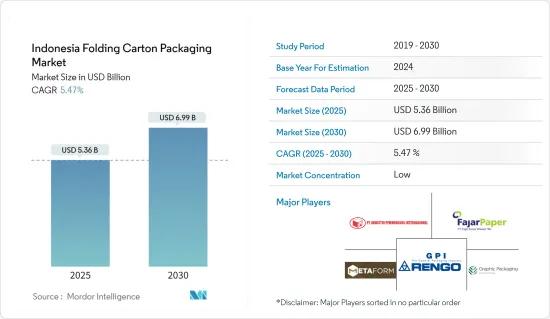

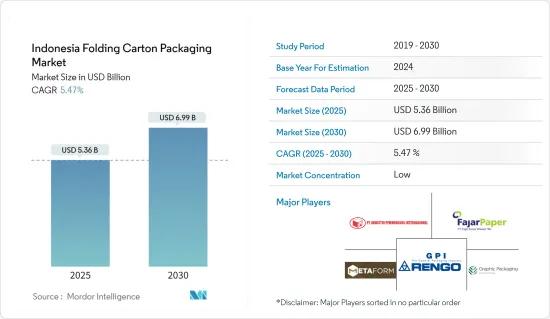

印尼折疊紙盒包裝市場規模預計在2025年為53.6億美元,預計在2030年達到69.9億美元,預測期內(2025-2030年)的複合年成長率為5.47%。

關鍵亮點

- 印尼折疊紙盒市場是一個充滿活力的市場,受到經濟、社會和工業領域各種因素的影響。根據Paper Desk 2023年11月報道,印尼紙漿和造紙工業(IPPI)由112個產業組成,總生產能力為紙漿1,145萬噸、紙張2,065萬噸。該行業在該國經濟中發揮著至關重要的作用。關鍵在於,市場成長與印尼經濟擴張息息相關。隨著國家都市化和工業化的不斷發展,對包裝商品的需求不斷增加,推動了各個領域對折疊紙盒的需求。

- 消費者偏好的改變對於折疊紙盒市場重回正軌起著至關重要的作用。隨著印尼消費者變得越來越挑剔和注重健康,他們擴大選擇方便、安全和永續性的包裝商品。這些偏好推動了對不僅用途廣泛而且環保的折疊式紙盒的需求。

- 印尼零售業蓬勃發展,折疊式紙盒的需求量不斷增加。根據惠譽評等2023年9月發布的消息,印尼零售商協會(Aprindo)宣布,2023年上半年零售額成長了3.2%。隨著超級市場、大賣場和便利商店在都市區地區激增,對美觀且實用的包裝解決方案的需求正在激增。折疊式紙盒具有多種設計、耐用性和成本優勢,已成為企業在競爭日益激烈的市場中吸引消費者的首選包裝解決方案。

- 在印尼,製藥和化妝品行業是折疊紙盒需求的主要貢獻者。隨著印尼人口的成長以及醫療和美容產品普及率的提高,對安全、外觀吸引人的包裝的需求也日益成長,以確保產品安全和品牌認知度。

- 折疊紙盒包裝所用原料的價格波動較大。因此,製造商被迫調整最終價格或降低營運成本以實現利潤最大化。大多數化學品和其他產品的原料都來自原油(主要用於製造過程)。

印尼紙包裝市場趨勢

食品和飲料業佔比最大

- 千禧世代顧客對環保包裝和便攜食品的偏好推動了印尼對食品和飲料包裝解決方案的需求。諸如攜帶式食品之類的產品被設計成便攜、耐用且輕便的,因此折疊式紙盒是包裝它們的最佳選擇。例如,根據印尼統計局的報告,2023年3月,印尼農村地區約56.4%的支出用於食品。

- 紙箱的需求涵蓋各個領域,每個領域都受到獨特的消費者偏好和行業動態的驅動。印尼進口乳製品原料可為該國提供基本投入、滿足消費者需求、促進技術轉移並刺激經濟活動,從而增強該國乳製品產業的發展。在乳製品領域,紙盒是牛奶、優格和調味飲料等產品的重要包裝解決方案。消費者對健康和營養的意識不斷增強,推動了對採用便利、環保容器包裝的乳製品的需求

- 印尼的食品服務業(包括快餐店)大量使用紙箱來包裝外帶和外送訂單。日益成長的行動消費習慣和食品宅配服務的日益普及正在推動對功能性、視覺吸引力和環境永續包裝解決方案的需求。

- 過去幾年,印尼在烘焙食品和穀物棒方面的支出大幅增加,推動了該國折疊紙盒市場的成長。隨著手工和高階產品在烘焙市場不斷湧現,包裝的美觀在吸引消費者方面變得越來越重要。折疊式紙盒具有引人注目的設計和堅固的結構,不僅能展示烘焙點心的手工性質,還能確保安全的運輸和儲存,從而提高整體客戶滿意度和品牌認知度。

醫療產業將經歷顯著成長

- 印尼醫藥市場的成長,加上快速成長的人口和年輕的人口結構,為全球和本地公司創造了有吸引力的投資機會。作為東南亞最大的市場,印尼的製藥業預計將因醫療支出增加、慢性病盛行率上升以及政府努力改善醫療服務而持續擴張。預計該領域的投資將推動對紙盒的需求,紙盒是藥品的重要包裝解決方案。

- 製藥業的投資將使印尼的製藥製造和包裝設施激增。隨著非處方藥、處方藥和維生素補充劑等藥品種類的不斷增加,對安全、合規的包裝解決方案的需求將不斷增加,以確保產品的完整性和安全性。折疊紙盒具有可自訂的設計選項和滿足嚴格監管要求的能力,將成為尋求維持品質標準和提高品牌知名度的製藥公司的首選包裝解決方案。

- 隨著製藥公司努力滿足其產品日益成長的需求,對先進包裝技術和材料(如防篡改折疊式紙盒)的投資對於確保產品安全和符合監管標準變得越來越重要。例如,2023年4月,Natco Pharma Ltd宣布將投資高達300萬美元在印尼設立子公司,在該國銷售醫藥產品。

- 折疊式紙盒擁有充足的空間用於放置說明書、劑量資訊和品牌標識,為製藥公司提供了一個多功能平台,以便與患者溝通並在市場上實現產品差異化。在印尼各地政府措施和系統的支持下,醫療保健支出的增加預計將直接影響醫療保健產業的成長,並導致藥品和醫療產品散裝運輸中紙包裝的使用量增加。

印尼紙包裝產業概況

印尼折疊紙盒包裝市場根據國際和本地供應商的存在進行細分。為了獲得市場佔有率並在市場中競爭,公司採用併購等各種策略。例如,供應商 AR Packaging 透過收購國內公司 PT Maju Jaya Sarana Grafika 進入市場。主要市場參與企業是 Industri Pembungkus Internasional Pt、PT.Fajar Surya Wisesa Tbk 和 Pt.Metaform (Kompas Gramedia)。

2023年8月,領先的永續紡織品和產品製造商亞太資源國際有限公司加強支持印尼綠色經濟成長。該公司宣布將投資 33.4 兆印度盧比(205.7 億美元)建造永續紙板生產設施,以擴大其下游產品系列。

2024年1月,印尼政府修改了有關食品供應鏈中危險化學物質存在的食品包裝法規。該法規的範圍包括新材料和再生材料,例如塑膠、油墨和染料、紙和紙板、樹脂和聚合物塗層、金屬、陶瓷和玻璃。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章市場動態

- 市場促進因素

- 對環保包裝的需求不斷增加

- 各行各業擴大採用紙質容器

- 市場問題

- 原物料價格波動

- 產業價值鏈分析

- 貿易情境分析-對應HS編碼的進出口分析

- 印尼紙板和廢紙分析

第6章市場區隔

- 按最終用戶產業

- 飲食

- 醫療保健

- 家庭和個人護理

- 工業

- 其他

第7章競爭格局

- 公司簡介

- Industri Pembungkus Internasional Pt

- PT. Fajar Surya Wisesa Tbk

- Pt. Metaform(Kompas Gramedia)

- AR Packaging(CVC Capital Partners SICAV-FIS SA)

- Rengo Co. Ltd

- APP(Asia Pulp & Paper)

- PT Pabrik Kertas Indonesia(PT Pakerin)

- PT Kanepackage Indonesia

- PT Asia Carton Lestari

- Teguh Group

- PT Pura Barutama

第8章:市場的未來

The Indonesia Folding Carton Packaging Market size is estimated at USD 5.36 billion in 2025, and is expected to reach USD 6.99 billion by 2030, at a CAGR of 5.47% during the forecast period (2025-2030).

Key Highlights

- The Indonesian folding carton market is a dynamic landscape shaped by a confluence of factors spanning economic, social, and industrial domains. As per a news published in Paper Desk in November 2023, Indonesia's pulp and paper industry (IPPI) comprises 112 industries with a total capacity of 11.45 million tons of pulp and 20.65 million tons of paper. The industry plays a significant role in the country's economy. At its core, the market's growth is tied to Indonesia's expanding economy. As the nation continues to develop, fueled by urbanization and industrialization, the demand for packaged goods escalates, propelling the need for folding cartons across various sectors.

- Shifting consumer preferences play a pivotal role in steering the trajectory of the folding carton market. As Indonesian consumers become increasingly discerning and health-conscious, there is a growing inclination toward packaged goods that offer convenience, safety, and sustainability. This preference amplifies the demand for folding cartons, which are not only versatile but also environmentally friendly.

- The burgeoning retail landscape in Indonesia catalyzes the rising demand for folding cartons. As per a news published by FitchRatings in September 2023, Indonesia's Retail Business Association, or Aprindo, said retail sales rose by 3.2% in 1H23. With the proliferation of supermarkets, hypermarkets, and convenience stores across urban and rural areas, there is a surge in the requirement for aesthetically appealing and functional packaging solutions. Folding cartons, with their versatility in design, durability, and cost-effcetiveness, emerge as the packaging solution of choice for businesses striving to captivate consumers in an increasingly competitive market.

- The pharmaceutical and cosmetics industries contribute significantly to the demand for folding cartons in Indonesia. The growing population of Indonesia and increasing access to healthcare and beauty products are leading to an escalating need for secure and visually appealing packaging to ensure product safety and brand recognition.

- Prices of raw materials used for folding cartons packaging are volatile. Thus, manufacturers have to adjust the end price or reduce operational costs to maximize the profit. Most raw materials, such as chemicals, are derived from crude oil (primarily utilized during the manufacturing process).

Indonesia Folding Carton Packaging Market Trends

The Food and Beverages Segment Occupies the Largest Share

- Millenial customers drive the demand for folding carton food and beverage packaging solutions in Indonesia, as they prefer environment-friendly packaging and on-the-go food. As products such as on-the-go food are designed to be portable, durable, and lightweight, folding cartons are a great option to pack them. The increase in online food deliveries has been and Consumer expenditure on food are driving the growth of the folding carton market in the country, For Instance, Statistics Indonesia reported that in March 2023, around 56.4 percent of spending in rural areas in Indonesia was designated for food.

- The demand for folding cartons spans various sectors, each driven by unique consumer preferences and industry dynamics. Importing dairy ingredients to Indonesia strengthens the country's dairy industry by providing access to essential raw materials, meeting consumer demand, facilitating technology transfer, and stimulating economic activity. In the dairy sector, folding cartons serve as indispensable packaging solutions for products such as milk, yogurt, and flavored beverages. As consumer awareness regarding health and nutrition grows, the demand for dairy products packaged in convenient and environmentally friendly containers is increasing.

- The foodservice sector in Indonesia, comprising quick service restaurants, relies heavily on folding cartons for packaging takeaway and delivery orders. With the rise in on-the-go consumption habits and the growing popularity of food delivery services, the demand for packaging solutions that are functional, visually appealing, and environemntally sustainable is increasing.

- The spending on bakery and cereal bars has increased considerably in Indonesia during the past few years, driving the growth of the folding carton market in the country. With the bakery market witnessing a surge in artisanal and premium products, packaging aestheics are becoming increasingly vital in attracting consumers. Folding cartons with eye-catcing designs and sturdy construction not only showcase the artisanal nature of baked goods but also ensure their safe transportation and storage, contributing to overall customer satisfaction and brand perception.

The Healthcare Sector will Witness Significant Growth

- The growth of Indonesia's pharmaceutical market, coupled with its burgeoning population and youthful demographic, presents a compelling investment opportunity for both global and local companies. As the largest market in Southeast Asia, Indonesia's pharmaceutical sector is poised for sustained expansion, driven by the increasing healthcare expenditure, rising prevalence of chronic diseases, and the government's initiaves to improve access to healthcare services. Investments in this sector are expected to catalyze the demand for folding cartons, which serve as essential packaging solutions for pharmaceutical products.

- Investments in the pharmaceutical sector will lead to a proliferation of drug manufacturing and packaging facilities in Indonesia. With the production of a diverse range of pharmaceutical products, including over-the-counter medications, prescription drugs, and vitamins, there will be a heightened need for secure and compliant packaging solutions to ensure product integrity and safety. Folding cartons, with their customizable design options and ability to meet stringent regulatory requirements, will emerge as the packaging solution of choice for pharmaceutical companies looking to uphold quality standards and enhance brand perception.

- As pharmaceutical companies strive to meet the growing demand for their products, investments in advanced packaging technologies and materials, such as folding cartons with tamper-evident features, tend to become imperative to ensure product safety and compliace with regulatory standards. For instance, in April 2023, Natco Pharma Ltd announced setting up of a subsidiary in Indonesia with an investment of up to USD 3 million for selling pharmaceutical products in the country.

- Folding cartons, with their ample space for instructional leaflets, dosage information, and branding, offer a versatile platform for pharmaceutical companies to communicate with patients and differentiate their products in the market. The increased spending on the healthcare, supported by government initiatives and schemes across Indonesia, directly impacts the growth of the healthcare industry, which is expected to lead to higher usage of folding carton packaging for bulk shipping of pharmaceuticals and healthcare products.

The Indonesian Folding Carton Packaging Industry Overview

The Indonesian folding carton packaging market is fragmented with the presence of international and local vendors. To garner market share and compete in the market ladscape, companies are adopting diverse strategies, such as mergers and acquisitions. For example, the vendor, AR Packaging, entered the market by acquiring the domestic company, PT Maju Jaya Sarana Grafika. Key market players are Industri Pembungkus Internasional Pt, PT. Fajar Surya Wisesa Tbk, and Pt. Metaform (Kompas Gramedia).

August 2023: Leading sustainable fiber and product producer, Asia Pacific Resources International Limited, strengthened its commitment to supporting Indonesia's green economy's growth. The company announced the expansion of its product portfolio in the downstream sector by investing IDR 33.4 trillion (USD 20.57 billion) in a sustainable paperboard production facility.

January 2024: The Indonesian government revised its food packaging regulations over the presence of dangerous chemicals entering the food supply chain. The scope of the regulation covers both new and recycled materials, including plastics, inks and dyes, paper and paperboard, resins and polymer coatings, metals, ceramics, and glass.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Force Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Eco Friendly Packaging

- 5.1.2 Increase in Adoption of Folding Carton by Different Industries

- 5.2 Market Challenges

- 5.2.1 Fluctuations in the Price of Raw Materials

- 5.3 Industry Value Chain Analysis

- 5.4 Trade Scenario Analysis - Import & Export Analysis of Corresponding HS Codes

- 5.5 Analysis of Cartonboard & Recovered Paper In Indonesia

6 MARKET SEGMENTATION

- 6.1 By End-User Industry

- 6.1.1 Food and Beverages

- 6.1.2 Healthcare

- 6.1.3 Household and Personal Care

- 6.1.4 Industrial

- 6.1.5 Other End-user Industries

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Industri Pembungkus Internasional Pt

- 7.1.2 PT. Fajar Surya Wisesa Tbk

- 7.1.3 Pt. Metaform (Kompas Gramedia)

- 7.1.4 AR Packaging (CVC Capital Partners SICAV-FIS S.A)

- 7.1.5 Rengo Co. Ltd

- 7.1.6 APP (Asia Pulp & Paper)

- 7.1.7 PT Pabrik Kertas Indonesia (PT Pakerin

- 7.1.8 PT Kanepackage Indonesia

- 7.1.9 PT Asia Carton Lestari

- 7.1.10 Teguh Group

- 7.1.11 PT Pura Barutama