|

市場調查報告書

商品編碼

1687974

數位印刷:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Digital Printing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

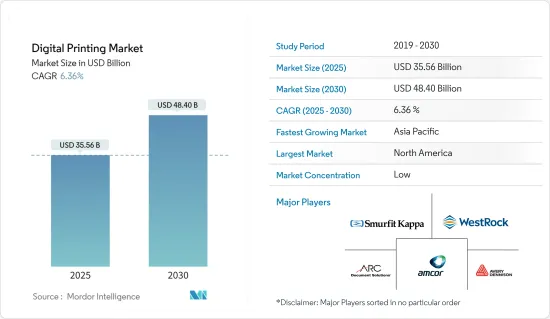

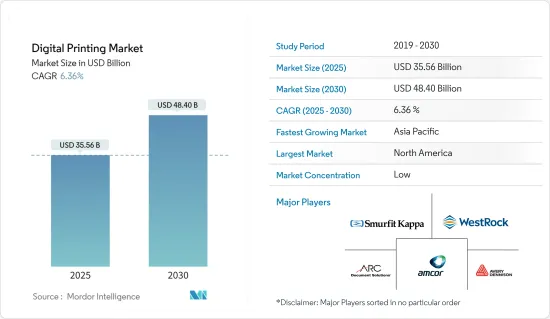

預計 2025 年數位印刷市場規模為 355.6 億美元,到 2030 年將達到 484 億美元,預測期內(2025-2030 年)的複合年成長率為 6.36%。

數位印刷是利用科技將印刷品印刷到各種介質基材上的過程。數位印刷比傳統印刷過程更準確、更經濟。對高品質、具成本效益的圖形和環境永續性的需求預計將提高人們對數位印刷的認知。

主要亮點

- 印刷製造業的顯著進步,包括從準時生產中獲得的效率以及對供應鏈管理的更多關注,正在減少印刷市場的浪費。支援數位印刷的技術發展確保在保持相同印刷品質的同時最大限度地廢棄物。

- 先進的數位印刷技術不含溶劑或有害化學物質,比固體油墨印刷和膠印等傳統印刷技術更溫和。因此,印刷電子市場對數位印刷解決方案的需求日益增加,並且越來越注重綠色印刷和高效的生產。

- 商業印刷作為一種關鍵應用,正在經歷轉型和結構性變化,因為從傳統印刷方法到數位化的即時過渡很困難。商業印刷仍然是一種小眾業務,需要短版印刷和定製印刷,因此印刷成本預計會成為一個負擔。

- 此外,超級市場、大賣場、電子商務等零售業的興起正在推動個人化、客製化印刷產品的需求。數位印刷技術使公司能夠以經濟高效的方式生產小批量或單一產品,以滿足利基市場和客製化客戶的選擇。

- 人工智慧、機器學習、物聯網和資料分析等最新進步在很大程度上實現了產品個人化。數位印刷融合為大量訂單的印刷個人化帶來了優勢。然而,成本因素仍然是一個主要障礙。此外,油墨、設備、維護、安裝成本和其他消耗品的高額投資可能會限制市場的成長。

主要市場趨勢

包裝產業可望大幅成長

- 包裝產業看到了採用數位印刷的巨大潛力。為了滿足不同的產品類型,不同的包裝方法和技術引入了不同的印刷技術。包裝產業包括紙箱、標籤、金屬包裝、硬質塑膠包裝、瓦楞包裝、軟包裝等。

- 瓦楞紙箱和展示架處於加工行業的數位化前沿。數位印刷可以在印前或印後製作中取代平版印刷或柔版印刷,但每種印刷都需要不同的配置。在過去的十年中,高速單一途徑,配備了強大的送紙器,其產量遠高於每小時可處理數千張紙的平板印刷機。

- 根據 Huhtamaki Ois 的研究,無論是採用個人化包裝的節日促銷,還是推出基於多種產品設計的高檔乾果包裝,創新的數位印刷都在資料列印、短版印刷、短交貨時間和重振軟質包裝的貨架吸引力等方面為包裝帶來了新的機會。數位印刷在未來的產品安全和透過軟包裝進行促銷的過程中發揮著不可或缺的作用。

- 紙箱具有許多優點,包括出色的印刷性和靈活性。作為二次包裝,它被廣泛應用於藥品、消費品、化妝品、家用產品等各領域的產品包裝。數位印刷系統和裝飾印刷機可以將特殊塗層應用於折疊紙盒,為商業印刷商開闢新的收益來源。

- 根據Suzano SA預測,2021年紙板消費量將達5,300萬噸,預計2024年將達5,600萬噸。此外,預計未來十年紙板需求量將進一步成長,2032年將達到6,600萬噸。數位印刷包裝產品可以重現原始設計文件的漸變和細節,創造出令人驚嘆的視覺效果。數位印刷可產生全系列的 CMYK 顏色並適用於各種紙質材料。

亞太地區可望成為成長最快的市場

- 數位印刷產業專注於基於資料庫的經營模式、數位平台解決方案和端到端的數位化價值創造鏈。過去十年,由於網路媒體的興起,印度的印刷相關產業競爭愈加激烈。

- 印度等新興國家的數位印刷產業呈現顯著的成長勢頭,全球市場規模不斷擴大。技術進步、消費行為的變化以及包裝產業的發展正在推動市場的發展。

- 隨著中小型企業 (SME) 的發展以及客製化行銷材料需求的激增,迫切需要一種能夠高效且經濟地提供少量高品質印刷輸出的解決方案。小型企業的崛起和客製化行銷材料的日益成長的趨勢成為解決在確保速度和成本效益的同時小批量生產一流印刷材料的挑戰的解決方案。

- 從事該行業的公司正專注於在市場上創新新的印刷解決方案。例如,2024年1月,為印刷OEM開發智慧軟體元件的Global Graphics Software與一家日本數位噴墨印表機製造商擴大了策略業務合作夥伴關係。雙方合作始於 2016 年,當時該公司將 Global Graphics Software 的 Harlequin Core SDK 整合到推動其印表機的 RIP 軟體中。

- 此外,根據《印度印刷和出版商》報道,商業印刷擴大採用數位印刷。指示牌產業也關注數位 3D 增材列印等新技術。因此,作為成長最快的經濟體之一的印度等新興經濟體可能會推動該國各個終端用戶產業的數位印刷市場的發展。

數位印刷業概況

數位印刷市場由幾家主要企業組成。目前,Smurfit Kappa Group PLC、Westrock Company、Avery Dennison Corporation、Multi-Color Corporation、Amcor PLC 和 ARC Document Solutions LLC 等少數主要公司在市場市場佔有率方面佔據主導地位。每家公司都在透過提供專門的產品和利用策略合作計劃來增加市場佔有率和盈利。在市場上營運的公司傾向於透過併購來增強其產品能力並改善數位印刷設備提供的市場組合。

- 2024 年 3 月:惠普公司 (HP Inc.) 將利用最新的惠普數位印刷機和智慧解決方案推動數位印刷的發展,旨在解決商業印刷實驗室、ELS 和包裝行業的生產挑戰。 HP 是數位轉型的領導者,其數位印刷技術為商業印刷、標籤和包裝生產樹立了黃金標準。

- 2023 年 10 月 - 全球數位印刷技術領域的領導者之一 ZEICON 宣布將參加在喬治亞喬治亞世界會議中心舉行的印刷業頂級盛會 PRINTING United 2023。作為印刷技術領域的主要參與者,Zeikon 展示了尖端的數位化生產解決方案。該公司推出了一系列產品,包括 Xeikon SX30000,它重新定義了數位印刷的可能性。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 技術簡介

第5章 市場動態

- 市場促進因素

- 包裝和紡織業的成長以及對數位廣告的需求不斷成長

- 使用數位印表機降低列印成本

- 市場限制

- 研發活動投資與額外資本支出

第6章 市場細分

- 按印刷過程

- 電子照相術

- 噴墨

- 按應用

- 圖書

- 商業印刷

- 包裝

- 標籤

- 紙板

- 紙盒

- 軟包裝

- 硬質塑膠包裝

- 金屬包裝

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 波蘭

- 亞洲

- 中國

- 印度

- 日本

- 澳洲和紐西蘭

- 拉丁美洲

- 巴西

- 墨西哥

- 中東和非洲

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

- 埃及

- 北美洲

第7章 競爭格局

- 公司簡介

- Smurfit Kappa Group PLC

- Westrock Company

- Southland Printing Company Inc.

- IronMark Inc.

- Xeikon NV

- ARC Document Solutions LLC

- Avery Dennison Corporation

- Multi Color Corporation

- Amcor PLC

- Sato America

- DS Smith PLC

- Mondi PLC

- CPI Corporate

- Core Publishing Solutions

- Command Companies

- Quad/Graphics Inc.

- Walsworth Publishing Company

第8章投資分析

第9章 市場機會與未來趨勢

The Digital Printing Market size is estimated at USD 35.56 billion in 2025, and is expected to reach USD 48.40 billion by 2030, at a CAGR of 6.36% during the forecast period (2025-2030).

Digital printing is a process of printing using technologies onto various media substrates. Digital printing is more accurate and cost-effective than conventional printing processes. The need for high-quality, cost-effective graphics and environmental sustainability is anticipated to drive awareness toward digital printing.

Key Highlights

- Significant improvements in print manufacturing include efficiency, with just-in-time production and a growing focus on supply chain management, which have reduced wastage in the print market. Technological developments aiding digital printing have guaranteed waste minimization, keeping the print quality at par.

- Advanced digital printing technology includes mild solvents and less harmful chemicals than conventional printing technologies, such as solid ink printing and offset printing. Hence, the demand for digital printing solutions is increasing in the printed electronics market, increasing the focus on green printing and cost-effective production.

- Commercial printing is witnessing transitional and structural changes as a significant application, as the immediate transition from conventional methods of print to digital is challenging. The printing cost is expected to take a toll since it is still a niche method requiring print of shorter/customized batches.

- Moreover, with the rise of retail businesses such as supermarkets, hypermarkets, and e-commerce, there is an increasing demand for personalized and customized printed products. Digital printing technology allows firms to produce small batches or even individualized items cost-effectively, catering to niche markets and customized customer choices.

- The latest advancements, such as AI, machine learning, IoT, and data analytics, have personalized offerings to a significant extent. The convergence in digital printing enables superiority in print personalization for large-volume orders. However, the cost factor remains a big hurdle. Additionally, high-priced investments for inks or equipment, maintenance, installation fees, and other consumables might limit the market's growth.

Key Market Trends

The Packaging Segment is Expected to Witness Significant Growth

- The packaging industry sees vast scope for implementing digital printing. Different packaging methods and technologies to cater to varying product demands for specific types of branding deploy different printing technologies. Some packaging industries include cartons, labels, metal packaging, rigid plastic packaging, corrugated packaging, and flexible packaging.

- Corrugated boxes and display making have been at the forefront of digital in the converting sectors. Digital printing can replace litho or flexo for either pre-print or post-print production, although each requires different configurations. The past decade witnessed the advancement in high-speed single-pass inkjet presses with robust sheet feeders for much higher throughputs than flatbeds could ever manage, which could handle thousands of sheets per hour.

- According to a study by Huhtamaki Oyj, from festive promotion with personalized packaging or premium dry fruit packing launched in multiple product-based designs, innovative digital printing allows a realm of new packaging opportunities in terms of data printing, short-runs, quick turn-around time, and energizing shelf-appeal of flexible packaging. Digital printing is shaping up an essential role in the future of product safety and promotions through flexible packaging.

- Cartons offer many benefits, such as superior printability and flexibility. As secondary packaging, it is widely needed for packaging products in different sectors, such as medicine, consumer goods, cosmetics, and household products. Digital printing systems and embellishment presses can apply specialty coatings to folding cartons, delivering new sources of profitability for commercial printers.

- According to Suzano SA, the consumption of cartonboard in 2021 was 53 million tons and is expected to reach 56 million tons in 2024. Moreover, the demand for cartonboards is predicted to increase further over the next decade, reaching 66 million tons by 2032. Digitally printed packaging products can be created with stunning visual effects, reproducing the gradient and details in original design files. Digital printing will generate the full CMYK spectrum of colors and works on a range of paper materials.

Asia-Pacific is Expected to be the Fastest Growing Market

- The digital printing industry is focused on data-based business models, digital platform solutions, and end-to-end digitized value-creation chains. Over the last decade, enterprises operating in printing-related industries in India have witnessed fierce competition owing to the rise of online media.

- The digital printing industry in emerging countries such as India is on a trajectory of significant growth, with an expanding global market size. Technological advancements, transforming consumer behavior, and developing the packaging industries are pushing the market.

- As small and medium enterprises (SMEs) have grown and customized marketing collateral has surged, a pressing demand arose for a solution that could efficiently and affordably deliver high-quality prints in small quantities. The rise of SMEs and the growing trend of tailored marketing materials have arisen as a solution to address the challenge of producing top-notch prints in small amounts while also ensuring speed and cost-effectiveness.

- Companies operating in the industry are focused on innovating new printing solutions in the market. For instance, in January 2024, Global Graphics Software, a developer of smart software components for print OEMs, extended its strategic business partnership with a Japanese manufacturer of digital inkjet printers. The partnership was initially started in 2016 when the company integrated Global Graphics Software's Harlequin Core SDK into its RIP software that pushes its printers.

- Further, according to Indian Printer and Publisher, commercial printing increasingly embraces digital printing. Also, the signage industry is considering new technologies such as digital 3D additive printing. Therefore, developing countries, such as India, are among the fastest-growing economies, which would leverage the market for digital printing in various end-user industries across the country.

Digital Printing Industry Overview

The digital printing market consists of several major players, and the market is fragmented. Some significant players, such as Smurfit Kappa Group PLC, Westrock Company, Avery Dennison Corporation, Multi-Color Corporation, Amcor PLC, and ARC Document Solutions LLC, currently dominate the market in terms of market share. The companies offer specialized products, increasing their market share and profitability by leveraging strategic collaborative initiatives. Companies operating in the market prefer mergers and acquisitions to strengthen their product capabilities and improve the market portfolio served by digital printing devices.

- March 2024: HP Inc. is driving digital printing with the latest HP digital printing presses and intelligent solutions designed to address production challenges in the commercial printing lab, ELS, and packaging industries. HP has been a digital transformation leader, and its digital printing technology has established the gold standard in commercial print, label, and packaging production.

- October 2023 - Xeikon, one of the global leaders in digital printing technology, announced its participation in PRINTING United 2023, the premier event for the printing industry, which took place at the Georgia World Congress Center in Atlanta, Georgia. As a critical player in the printing technology sector, Xeikon showcased its cutting-edge digital production solutions. The company launched various products, such as Xeikon SX30000, which redefines the possibilities of digital printing.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Technology Snapshot

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growth of Packaging and Textile Industries and Rising Demand for Digital Advertisements

- 5.1.2 Reduction in Per Unit Cost of Printing with Digital Printers

- 5.2 Market Restraints

- 5.2.1 Investment in R&D Activities and Additional Capital Expenditure

6 MARKET SEGMENTATION

- 6.1 By Printing Process

- 6.1.1 Electrophotography

- 6.1.2 Inkjet

- 6.2 By Application

- 6.2.1 Books

- 6.2.2 Commercial Printing

- 6.2.3 Packaging

- 6.2.3.1 Labels

- 6.2.3.2 Corrugated Packaging

- 6.2.3.3 Cartons

- 6.2.3.4 Flexible Packaging

- 6.2.3.5 Rigid Plastic Packaging

- 6.2.3.6 Metal Packaging

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Italy

- 6.3.2.5 Spain

- 6.3.2.6 Netherlands

- 6.3.2.7 Poland

- 6.3.3 Asia

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.3.4 Australia and New Zealand

- 6.3.4 Latin America

- 6.3.4.1 Brazil

- 6.3.4.2 Mexico

- 6.3.5 Middle East and Africa

- 6.3.5.1 United Arab Emirates

- 6.3.5.2 South Africa

- 6.3.5.3 Saudi Arabia

- 6.3.5.4 Egypt

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Smurfit Kappa Group PLC

- 7.1.2 Westrock Company

- 7.1.3 Southland Printing Company Inc.

- 7.1.4 IronMark Inc.

- 7.1.5 Xeikon NV

- 7.1.6 ARC Document Solutions LLC

- 7.1.7 Avery Dennison Corporation

- 7.1.8 Multi Color Corporation

- 7.1.9 Amcor PLC

- 7.1.10 Sato America

- 7.1.11 DS Smith PLC

- 7.1.12 Mondi PLC

- 7.1.13 CPI Corporate

- 7.1.14 Core Publishing Solutions

- 7.1.15 Command Companies

- 7.1.16 Quad/Graphics Inc.

- 7.1.17 Walsworth Publishing Company