|

市場調查報告書

商品編碼

1687975

伺服馬達和驅動器:市場佔有率分析、行業趨勢和統計數據、成長預測(2025-2030 年)Servo Motors and Drives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

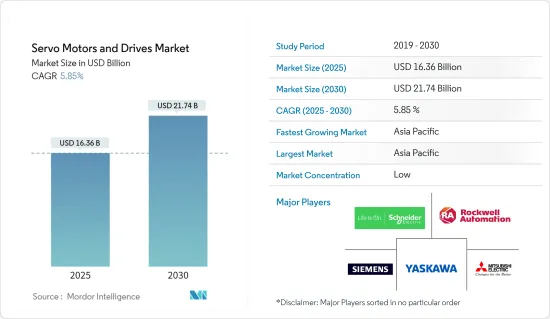

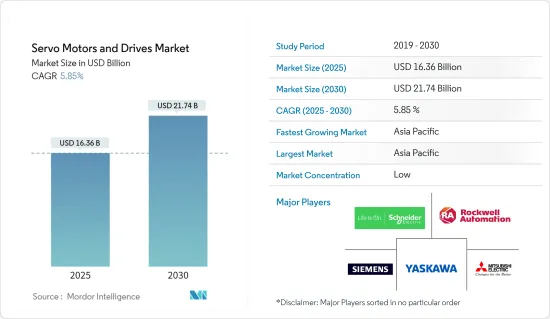

伺服馬達和驅動器市場規模預計在 2025 年達到 163.6 億美元,預計到 2030 年將達到 217.4 億美元,預測期內(2025-2030 年)的複合年成長率為 5.85%。

伺服馬達是具有內建位置回饋的交流、直流或線性馬達。這些馬達用於封閉回路型運動控制系統,可以精確控制角位置、速度和扭矩。使用永久磁鐵可以改變繞組之間的電壓和電流。伺服驅動器是一種與伺服馬達配合使用的自動裝置,用於向馬達提供所需的電壓,以糾正與指令狀態的任何偏差,並幫助馬達準確定位。

關鍵亮點

- 工具機的靈活性是其最大的優勢之一。此外,伺服取代了傳統的齒輪、皮帶和滑輪,消除了舊技術常見的磨損和故障問題。伺服可提高生產率、可靠性和機器吞吐量。

- 工業領域是伺服馬達驅動器的主要消費者之一。伺服馬達驅動器由於其提供精確運動控制的能力而非常適合用於許多不同類型的行業。因此,由於工業化率的提高,特別是在新興地區,這些地區可能會更高地採用機器人和自動化設備等先進解決方案。

- 近年來,全球對節能解決方案的需求大幅成長。日益成長的環境問題和消費者意識的提高是影響節能解決方案需求的關鍵因素。預計這些因素在預測期內將變得更加普遍,對伺服馬達驅動器市場的動態產生重大影響。

- 伺服馬達的主要替代品之一是步進馬達。步進馬達是一種將電能轉換為機械能的電子機械設備。它也是一種無刷同步馬達,這意味著一圈旋轉可以分成多個步驟。如果馬達尺寸適合應用,則可以在沒有任何回饋機制的情況下精確控制馬達的位置。步進馬達類似於開關式磁阻電動機。

- 新冠疫情是一場工業噩夢:製造業衰退。中國伺服馬達和驅動器銷售大幅放緩,擾亂了包括設備、包裝材料、原料和其他工廠供應在內的各個應用領域的供應鏈。鋼材是伺服馬達的主要原料之一。由於鋼鐵業遭受干擾,特別是在新冠疫情初期,伺服馬達的生產受到阻礙。例如,中國是鋼鐵生產大國。由於中華民國政府在疫情期間實施的限制措施,疫情爆發導致貿易限制、大面積停工和工廠關閉,阻礙了該國的鋼鐵生產。

- 新冠疫情增加了家用電子電器和汽車產業對半導體的需求,這主要是由於疫情後電動車的普及率不斷提高。根據半導體產業協會預測,2022年全球半導體銷售額將達5,740億美元,其中美國半導體公司總合銷售額將達2,750億美元,佔全球市場的48%。此外,2023年第三季全球半導體銷售額將達1,347億美元,較2023年第二季成長6.3%。

伺服馬達和驅動器的市場趨勢

汽車領域預計將佔據主要市場佔有率

- 伺服馬達在各種汽車應用中發揮著至關重要的作用,有助於各種車輛系統的功能和性能。以下是伺服馬達在汽車行業的一些常見應用:包括動力方向盤、油門控制、煞車系統、變速箱和換檔、空調系統和前燈控制。

- 伺服馬達驅動器在汽車產業的使用日益增多,推動了自動化和機器人技術的普及。事實上,伺服馬達驅動器在各種汽車系統中發揮著至關重要的作用,包括防鎖死煞車、燃油噴射和巡航控制。這使得這些系統能夠精確控制和高效運行,從而提高車輛的整體性能和安全性。

- 機器人已經成為汽車組裝的重要組成部分,執行物料輸送、底盤組裝和噴漆等任務。這項自動化技術提高了生產力,減少了錯誤並降低了汽車製造商的營運成本。福特、梅賽德斯-奔馳、通用和寶馬等主要汽車製造商正在使用協作機器人(「cobots」),進一步推動了對伺服馬達驅動器的需求。

- 汽車產業擴大採用自動化、數位化和人工智慧 (AI),從而推動了對工業機器人的需求。自動化改善了製造流程,提高了效率並增強了生產線的靈活性。正如你提到的報告所說,專家預測到2025年將有高達75%的汽車由機器人生產,這意味著機器人將在汽車產業中發揮重要作用。

- 隨著自動化和機器人技術的發展,汽車產業的伺服馬達驅動器市場預計將擴大。根據IFR統計,2020年全球工業機器人出貨量約384萬台。預計2024年全球工業機器人出貨量約51.8萬台。各組織正在意識到設備自動化可以提高生產力和效率的好處。這一趨勢,加上數位化和人工智慧的融合,正在推動汽車領域對伺服馬達驅動器的需求不斷增加。

- 總體而言,汽車產業對自動化和機器人技術的推動正在推動對伺服馬達驅動器的需求。這些組件可實現精確控制,提高生產力並支援汽車行業採用先進的製造流程。

亞太地區:預計大幅成長

- 由於亞太地區行業數量的不斷增加及其與自動化的融合以提高投資回報率,該地區伺服馬達驅動器市場正在大幅擴張。由於中國機器人解決方案的生產、銷售和交易不斷增加,預計亞太伺服馬達和驅動器市場將由中國主導。

- 隨著中國不斷重視工業自動化,中國伺服馬達及驅動器市場在歐洲、中東和非洲以及美洲迅速成長。例如,2021年12月21日,北京工業和資訊化部發布了機器人產業發展「十四五」規劃,重點推動技術創新,在未來五年內將機器人技術納入八大重點產業,使中國在機器人技術和產業發展方面達到全球領先水平。在日前開幕的2023世界機器人大會上,中國機器人產業取得了令人矚目的發展,預計2022年機器人銷售收入將突破1700億元人民幣(約233億美元),2022年中國工業機器人銷售佔全球整體將超過50%,連續10年位居全球第一。

- 日本正快速邁向「社會5.0」的概念,引入人類發展四大階段中的第5章。在這個新的超智慧社會中,一切都將透過物聯網技術連接起來,所有技術都將融合,生活品質將大幅提高。為了實現這一新時代,日本政府採取了各種適當措施,鼓勵各類參與企業,包括Start-Ups企業和中小企業的“隱藏人才”,為市場帶來新的創新理念,以解決人口造成的勞動力短缺等問題。在日本這樣一個以將大型工業機器人引入工廠而聞名的國家,這樣的製造問題意味著這些相對較小的機器被視為小眾且利潤低的。伺服控制器將機器人自動化提升到一個新的水平,使機器能夠做出平穩、可重複和精確的運動。這些綜合特性使電子設計工程師能夠創造出令人興奮的創新。

- 製造業和服務業行動計畫包括先進空中運輸、自動駕駛或開發以下一代人工智慧和機器人為核心的整合技術計劃。此外,在2020年至2025年的五年「登月研究與發展計畫」下,已為機器人相關計劃撥款4.4億美元預算。

- 印度的汽車工業歷來是經濟實力的重要指標,因為它在宏觀經濟擴張和技術進步中發揮關鍵作用。根據國際汽車製造商組織的數據,2022年印度的乘用車和商用車銷售量為470萬輛,創歷史新高。此外,預計到 2025 年,印度的電動車 (EV) 市場規模將達到 70.9 億美元。 CEEW 能源金融中心的一項研究表明,到 2030 年,印度的電動車商業機會可能達到 2,060 億美元。預計這需要在汽車製造和充電基礎設施方面投資 1800 億美元。

伺服馬達和驅動器市場概況

伺服馬達和驅動器市場較為分散,主要參與者包括安川電機公司、三菱電機公司、西門子股份公司、施耐德電氣和羅克韋爾自動化。市場參與企業正在採取聯盟和收購等策略來加強其產品供應並獲得永續的競爭優勢。

- 2023年10月,安川電機株式會社宣布擴大其下一代交流變頻器產品線-GA700系列。 400V級容量陣容從0.4~355kW擴大至0.4~630kW。高容量頻寬的加入使得GA700能夠適用於更大型的通用工業機械設備,支援廣泛的應用領域。

- 2023年9月,三菱電機自動化公司宣布將擴展其MELESRVO-J5產品系列,為OEM和最終用戶提供更多選擇。新一代MR-J5伺服產品線包括兩種新型伺服類型:HK-RT/ST,以及額定轉速3000rpm的HK-KT/ST高速伺服馬達。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 產業價值鏈分析

- COVID-19 的副作用和其他宏觀經濟因素將如何影響市場

第5章市場動態

- 市場促進因素

- 新興經濟體快速工業化

- 加強能源效率法規

- 市場問題

- 存在替代產品

第6章市場區隔

- 按類型

- 馬達

- 交流伺服馬達

- 直流無刷伺服馬達

- 有刷直流伺服馬達

- 直線伺服馬達

- 駕駛

- 交流伺服驅動器

- 直流伺服驅動器

- 可調伺服驅動器

- 其他驅動器

- 馬達

- 電壓範圍

- 低電壓

- 中壓

- 高壓

- 按最終用戶產業

- 車

- 石油和天然氣

- 醫療保健

- 包裝

- 半導體電子

- 化工和石化

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 其他亞太地區

- 拉丁美洲

- 中東和非洲

- 北美洲

第7章競爭格局

- 公司簡介

- Yaskawa Electric Corp.

- Mitsubishi Electric Corp.

- Siemens AG

- Schneider Electric

- Rockwell Automation Inc.

- ABB Ltd

- Delta Electronics Inc.

- FANUC Corporation

- Kollmorgen(regal Rexnord Corporation)

- Bosch Rexroth AG(Robert Bosch GmbH)

第8章投資分析

第9章:未來展望

The Servo Motors and Drives Market size is estimated at USD 16.36 billion in 2025, and is expected to reach USD 21.74 billion by 2030, at a CAGR of 5.85% during the forecast period (2025-2030).

Servo motors are AC, DC, or linear motors with in-built positional feedback. These motors are used in closed-loop motion control systems where angular position, speed, and torque can be accurately controlled. Using permanent magnets enables the variation of the voltage and current between windings. A servo drive is an automatic device used with servo motors that provide the required voltage to the motor to correct any deviation from the commanded status, helping the motor achieve precise positioning.

Key Highlights

- Flexibility in machine tool operations is one of the most significant benefits. In addition, servos replace traditional gears, belts, and pulleys to eliminate wear and failure problems typical with older technologies. Servos increase productivity, reliability, and machine throughput.

- The industrial sector is among the major consumers of servo motors and drives as they are highly suitable for use in different types of industries owing to their ability to provide precise motion control. As a result, due to a growing rate of industrialization, especially across emerging regions, the adoption rate of advanced solutions such as robotics and automated equipment is likely to be higher across these regions.

- There has been significant growth in the demand for energy-efficient solutions on a global scale in recent years. The growing environmental concern and rising consumer awareness are among the major factors influencing the demand for energy-efficient solutions. With these factors becoming more prevalent during the forecast period, it is expected to have a notable impact on the dynamics of the servo motors and drives market.

- One of the major substitutes for servo motors is the stepper motor. A stepper motor is an electromechanical device that converts electrical energy into mechanical energy. It is also a brushless synchronous motor that can divide one rotation into many steps. Motor position can be precisely controlled without a feedback mechanism if the motor is carefully sized for the application. A stepper motor is like a switched reluctance motor.

- The outbreak of COVID-19 had been a nightmare for industrialists, i.e., a manufacturing recession. A significant slowdown in the sales of servo motors and drives from China disrupted the supply chain across applications, such as equipment, packaging materials, ingredients, and other plant supplies. Steel is among the major raw materials used in servo motors. As a result of disruptions that occurred in the steel industry, especially during the initial phase of COVID-19, the production of servo motors was hampered. For instance, China is a major steel producer. Owing to the outbreak of the pandemic, steel production in the country was hampered by trade restrictions, widespread lockdowns, and factory closures owing to restrictions imposed by the Republic of China's government during the pandemic.

- The COVID-19 pandemic increased the demand for semiconductors across the consumer electronics and automotive sectors, mainly due to the growing adoption of EVs post-pandemic. According to the Semiconductor Industry Association, in FY 2022, global semiconductor sales reached USD 574 billion, with total sales of US semiconductor companies at USD 275 billion, accounting for 48% of the global market. Moreover, worldwide sales of semiconductors totaled USD 134.7 billion during the third quarter of 2023, an increase of 6.3% compared to the second quarter of 2023.

Servo Motors and Drives Market Trends

Automotive Sector Is Expected to Hold Significant Market Share

- Servo motors play a crucial role in various automotive applications, contributing to the functionality and performance of different vehicle systems. Here are some common uses of servo motors in the automotive industry: Power Steering, Throttle Control, Brake Systems, Transmission and Gear Shift, HVAC Systems, and Headlight Control.

- There is an increasing use of servo motors and drives in the automotive industry and an increasing adoption of automation and robotics. Indeed, servo motors and drives play a crucial role in various automotive systems, including anti-lock brakes, fuel injection, cruise control, and more. They enable precise control and efficient operation of these systems, enhancing overall vehicle performance and safety.

- Robots have become integral in automotive assembly lines, performing tasks such as material handling, chassis assembly, painting, and more. This automation technology improves productivity, reduces errors, and lowers operating expenses for automakers. Collaborative robots, or "co-bots," are being utilized by major automotive manufacturers like Ford, Mercedes-Benz, GM, and BMW, further driving the demand for servo motors and drives.

- The automotive industry's increasing adoption of automation, digitalization, and artificial intelligence (AI) is propelling the demand for industrial robots. Automation improves manufacturing processes, enhances efficiency, and enables flexibility in production lines. As per the report you mentioned, experts predict that up to 75% of vehicles will be produced by robots by 2025, indicating the significant role of robotics in the automotive industry.

- With the growth in automation and robotics, the automotive industry's market for servo motors and drives is expected to expand. According to IFR, global industrial robot shipments amounted to approximately 3,84,000 in 2020. It is forecasted that 2024, the global industrial robot shipments will be about 518,000. Organizations recognize the benefits of automating their facilities to improve productivity and efficiency. This trend, coupled with the integration of digitalization and AI, contributes to the increasing demand for servo motors and drives in the automotive sector.

- Overall, the automotive industry's push toward automation and robotics is driving the demand for servo motors and drives. These components enable precise control, enhance productivity, and support adopting advanced manufacturing processes in the automotive sector.

Asia Pacific Expected to Witness Significant Growth

- The market for servo motors and drives in Asia-Pacific is expanding significantly due to the rising number of industries in the region and their integration with automation to increase ROI. The Asia-Pacific servo motors and drives market is predicted to be dominated by China with the growing production, sales, and trade of robotic solutions in China.

- The Chinese market for servo motors and drives is growing rapidly in the EMEA and Americas regions as the country continues to focus on industrial automation. For instance, the Ministry of Industry and Information Technology (MIIT) in Beijing released the "14th Five-Year Plan" for Robot Industry Development on 21st December 2021, focusing on promoting innovation to make China a global leader in robot technology and industrial advancement by including it in 8 critical industries for the next five years. As per the recent 2023 World Robot Conference, China's robotics industry has achieved significant progress, with revenue exceeding CNY 170 billion (USD 23.3 billion) in 2022, with China's sales of industrial robots accounting for more than 50% of the world's total in 2022, ranking first globally for ten consecutive years.

- Japan is rapidly moving toward the concept of "Society 5.0," introducing the fifth chapter to the four major stages of human development. In this new ultra-smart society, all things are connected through IoT technology, and all technologies are integrated, dramatically improving the quality of life. To realize this new era, the Government of Japan is taking various suitable steps to encourage various players, including start-ups and "hidden gems" among small- and medium-sized enterprises, to come up with brand-new and innovative ideas for facilitating the world with solutions to problems such as labor shortages owing to population. In a country such as Japan, known for bringing large-scale industrial robots to the factory floor, these problems in the manufacturing sector have led such relatively dainty machines to be dismissed as niche and low-margin. These factors are likely to drive the growth of the servo motors and drive market in the country as servo controllers are taking robotic automation to the next level by making it possible for machines to make smooth, repeatable, and exact movements. Together, those characteristics allow electronic design engineers to create fascinating innovations.

- The action plan for manufacturing and service included projects such as advanced air mobility, autonomous driving, or the development of integrated technologies as the core of next-generation artificial intelligence and robots. Additionally, a budget of 440 million USD was allotted to robotics-related projects in the "Moonshot Research and Development Program" for five years from 2020 to 2025.

- The Indian automobile industry has historically been a significant indicator of how well the economy is doing, as the automobile sector plays a crucial role in both macroeconomic expansion and technological advancement. According to the Organisation Internationale des Constructeurs d'Automobiles, a record 4.7 million passenger cars and commercial vehicles were sold in India in 2022. In addition, the electric vehicle (EV) market is estimated to reach USD 7.09 billion in India by 2025. A study by the CEEW Centre for Energy Finance recognized a USD 206 billion opportunity for electric vehicles in India by 2030. This is expected to necessitate a USD 180 billion investment in vehicle manufacturing and charging infrastructure.

Servo Motors and Drives Market Overview

The servo motors and drives market is fragmented with the presence of major players like Yaskawa Electric Corp., Mitsubishi Electric Corp., Siemens AG, Schneider Electric, and Rockwell Automation, Inc. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- October 2023: Yaskawa Electric Corporation announced the expansion of the GA700 series of next-generation AC drives. The 400V-class capacity lineup has been expanded from 0.4 to 355 kW to 0.4 to 630 kW. With the addition of the high-capacity band, the GA700 can now be applied to larger general industrial machinery and equipment for a broader range of applications.

- September 2023: Mitsubishi Electric Automation Inc. announced the expansion of its MELESRVO-J5 product family to include more options for OEMs and end-users. The new generation of MR-J5 servo products includes two new servo types, HK-RT/ST, and the addition of high-speed HK-KT/ST servo motors with 3,000 rpm-rated speed.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rapid Industrialization Across the Emerging Economies

- 5.1.2 Growing Regulations Regarding Energy Efficiency

- 5.2 Market Challenges

- 5.2.1 Presence of Substitute Products

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Motor

- 6.1.1.1 AC Servo Motor

- 6.1.1.2 DC Brushless Servo Motor

- 6.1.1.3 Brushed DC Servo Motor

- 6.1.1.4 Linear Servo Motor

- 6.1.2 Drive

- 6.1.2.1 AC Servo Drive

- 6.1.2.2 DC Servo Drive

- 6.1.2.3 Adjustable Servo Drive

- 6.1.2.4 Other Types of Drives

- 6.1.1 Motor

- 6.2 By Voltage Range

- 6.2.1 Low Voltage

- 6.2.2 Medium Voltage

- 6.2.3 High Voltage

- 6.3 By End-user Industry

- 6.3.1 Automotive

- 6.3.2 Oil and Gas

- 6.3.3 Healthcare

- 6.3.4 Packaging

- 6.3.5 Semiconductor and Electronics

- 6.3.6 Chemicals and Petrochemicals

- 6.3.7 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Rest of Europe

- 6.4.3 Asia-Pacific

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.3.4 South Korea

- 6.4.3.5 Rest of Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Yaskawa Electric Corp.

- 7.1.2 Mitsubishi Electric Corp.

- 7.1.3 Siemens AG

- 7.1.4 Schneider Electric

- 7.1.5 Rockwell Automation Inc.

- 7.1.6 ABB Ltd

- 7.1.7 Delta Electronics Inc.

- 7.1.8 FANUC Corporation

- 7.1.9 Kollmorgen (regal Rexnord Corporation)

- 7.1.10 Bosch Rexroth AG (Robert Bosch GmbH)