|

市場調查報告書

商品編碼

1689683

電池能源儲存系統系統-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Battery Energy Storage System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

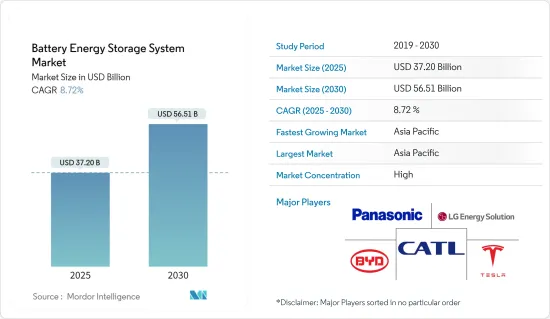

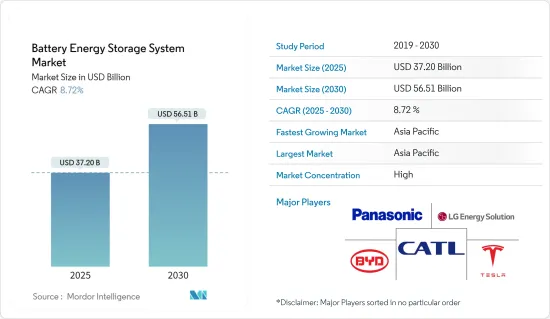

電池能源儲存系統市場規模預計在 2025 年為 372 億美元,預計到 2030 年將達到 565.1 億美元,預測期內(2025-2030 年)的複合年成長率為 8.72%。

關鍵亮點

- 從中期來看,預計鋰離子電池價格下降和可再生能源滲透率提高等因素將在預測期內推動電池能源儲存系統系統市場的發展。

- 另一方面,鈷、鋰和銅等原料的供需不匹配可能會在研究期間阻礙電池能源儲存系統(BESS) 市場的成長。

- 在預測期內,用於儲存能源的新電池技術的進步可能會為 BESS 市場創造豐厚的成長機會。

- 由於能源需求不斷增加,亞太地區是預測期內成長最快的市場。這一成長歸因於印度、中國和澳大利亞等地區國家的投資增加以及政府的支持措施。

電池能源儲存系統系統市場趨勢

住宅用途預計將快速成長

- 住宅能源儲存系統系統是小型可充電電池與分散式發電源相結合,通常是屋頂太陽能光伏 (PV) 系統。大多數住宅儲能系統 (BESS) 的容量在 2.5 至 25.2 kWh 之間,標稱電壓約為 50V。大多數鋰離子 BESS 都是採用鋰鎳錳鈷氧化物 (NMC) 或磷酸鐵鋰 (LiFePO4) 電池化學成分。

- 近年來,隨著全國對可再生能源基礎設施的投資不斷增加,能源儲存系統(ESS)經歷了顯著成長,尤其是在住宅領域。由於年度可支配所得的增加、在家工作趨勢的上升以及全球電力消耗的增加,預計預測期內住宅部門的電力消耗將會增加。能源儲存系統用於在尖峰時段停電期間為家庭提供持續電力。

- 據SolarPower Europe稱,2021年歐洲將安裝約2.3GWh的住宅電池儲能,與前一年同期比較翻倍。安裝量的增加是由於歐盟委員會要求在新建和重建的建築物中安裝太陽能系統,以及作為國家能源和氣候計畫(NECP)制定的國家清潔靈活性計畫的一部分的電池儲存目標。未來這種情況可能還會進一步升級。

- 許多歐洲國家已經制定了引入能源儲存的目標。例如,據西班牙能源儲存協會稱,作為新策略的一部分,該國的目標是到 2030 年實現 20GW 的能源儲存容量,到 2050 年實現 30GW 的能源儲存容量。

- 由於政府的激勵措施和稅收減免,電池儲能系統的成本已經下降。例如,2022 年 3 月,英國政府推出了新立法,推翻了歐盟法院帶來的法律變化,該變化規定對住宅節能技術(包括住宅BESS 裝置)徵收零增值稅。此減稅措施有效期限為五年,之後增值稅稅率可能回落至5%。

- 在可再生能源中,大部分住宅需求來自太陽能,這就產生了對住宅電池儲存系統的需求。例如,根據法國Territoire Solaire的數據,2023年第四季法國住宅太陽能容量將達到2,645兆瓦,比2022年第四季成長36.4%。

- 2022年6月,豐田推出住宅蓄電池“大內九電系統”,進軍儲能市場。豐田發布了額定輸出功率為5.5kWh、額定容量為8.7kWh的儲能系統。它採用了該公司的電動車電池技術。將太陽能發電系統連接到屋頂可以為您的家庭提供日夜供電。該公司最初的目標是在日本銷售其儲能系統。

- 因此,預計在預測期內,住宅應用將在電池儲存市場產生良好的需求。

亞太地區可望進一步成長

- 預計未來幾年亞太地區將繼續引領電池能源儲存市場。該地區由兩種主要類型的電網組成,每種類型的電網都有不同的特點和能源儲存系統機會。一方面,日本、韓國、紐西蘭和澳洲等高度發展的國家,擁有特大城市和採用最新技術的先進電網。

- 2023年上半年,中國能源儲存新增項目持續高速發展,新增計劃850個(含規劃、在建、委託計劃),較2022年同期成長一倍以上;新增委託容量8.0GW/16.7GWh,超過去年2022年全年新增容量水準(7.3GW/15.9GWh)。新增計劃主要在6月運作,容量達3.95GW/8.31GWh,佔2023年上半年運作計劃新增容量的50%,並且預計未來幾年仍將維持顯著成長。

- 同樣,在印度,政府表示能源儲存需求將激增至 7,393 萬千瓦(2,669 萬千瓦 PSP 和 4,724 萬千瓦 BESS),預計到 2031-32 年儲存容量將達到 4,114 萬吉瓦時。據估計,2022 年至 2032 年間,PSP 將需要 5,420.3 億印度盧比,BESS 將需要 67 億美元來開發儲存容量。

- 此外,從長遠來看,CEA預測,隨著該國在2070年實現淨零排放的目標以及可再生能源的快速成長,到2047年,該國的能源儲存需求將達到約320GW(90GW PSP和230GW BESS),總能源儲存容量將達到2,380GWh。

- 根據世界能源資料統計評論,亞太地區2022年的發電量將比2021年增加4%,其中大部分來自可再生。此外,日本政府也設定了2050年實現碳中和的目標,政府的目標是到2030年將可再生能源發電佔總發電量的36-38%,其中太陽能和風能佔19-21%。該國先前的目標是在2019-20年將再生能源佔比從18%提高到22-24%。

- 中國正大力投資電池能源儲存系統(BESS),目標是到2030年實現100GW的能源儲存容量。 「十四五」規劃推出了支持各類BESS的政策,包括新型鋰離子電池、鈉離子電池、鉛碳電池和氧化還原液流電池。電池具有容量大、成本低、壽命長、反應快等優點。目標是鼓勵在未來幾年建造獨立擁有的電池能源儲存設施,以支持和平衡風力發電機和太陽能電池板快速成長但不穩定的發電能力。

- 此外,2023 年 9 月,印度聯邦內閣核准了可行性缺口融資計畫 (VGF),用於為過剩的風能和太陽能建造強大的儲能系統。根據該計劃,預計到 2031 會計年度將開發總合4,000 兆瓦時 (MWh) 的電池儲能系統 (BESS)計劃。該計劃已提供初始支出 11.2818 億美元,其中包括 4.5127 億美元的預算支持。

- 因此,預計亞太地區將在預測期內佔據市場主導地位。

電池能源儲存系統系統產業概況

電池能源儲存系統市場較分散。市場主要企業(不分先後順序)包括比亞迪股份有限公司、松下公司、LG能源解決方案有限公司、特斯拉公司和寧德時代新能源科技股份有限公司。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究範圍

- 市場定義

- 調查前提

第2章調查方法

第3章執行摘要

第4章 市場概述

- 介紹

- 至2029年的市場規模及需求預測(單位:美元)

- 近期趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 可再生能源需求不斷成長

- 鋰離子電池價格下跌

- 限制因素

- 原料供應減少

- 驅動程式

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章市場區隔

- 類型

- 鋰離子電池

- 鉛酸電池

- 鎳氫電池

- 其他類型(鈉硫電池、液流電池)

- 應用

- 公共產業

- 商業/工業

- 住宅

- 地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 法國

- 英國

- 義大利

- 西班牙

- 北歐的

- 土耳其

- 俄羅斯

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 馬來西亞

- 泰國

- 印尼

- 越南

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 智利

- 哥倫比亞

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 卡達

- 奈及利亞

- 埃及

- 其他中東和非洲地區

- 北美洲

第6章競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- BYD Company Limited

- Panasonic Corporation

- LG Energy Solution Ltd.

- Contemporary Amperex Technology Co. Limited

- Sony Corp.

- Varta AG

- Tesla Inc.

- Samsung SDI Co. Ltd.

- Cellcube Energy Storage System Inc.

- 市場排名分析

第7章 市場機會與未來趨勢

- 新電池技術的技術進步

簡介目錄

Product Code: 67278

The Battery Energy Storage System Market size is estimated at USD 37.20 billion in 2025, and is expected to reach USD 56.51 billion by 2030, at a CAGR of 8.72% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as declining prices of lithium-ion batteries and increased penetration of renewable energy are likely to drive the battery energy storage systems market in the forecast period.

- On the other hand, the demand-supply mismatch of raw materials like cobalt, lithium, copper, etc., will likely hinder the growth of the battery energy storage systems (BESS) market in the studied period.

- Nevertheless, technological advancements in new battery technologies to store energy will likely create lucrative growth opportunities for the BESS market during the forecast period.

- Asia-Pacific is the fastest-growing market during the forecast period due to the rising energy demand. This growth is attributed to increasing investments, coupled with supportive government policies in the countries of this region, including India, China, and Australia.

Battery Energy Storage System Market Trends

Residential Expected to be the Fastest-growing Segment

- Residential energy storage systems are small-scale rechargeable batteries paired with distributed generation sources, mainly rooftop solar photovoltaic (PV) systems. Most residential battery energy storage systems (BESS) have a capacity of 2.5-25.2 kWh and a nominal voltage of nearly 50 V. However, systems with higher nominal voltage outputs are available in the market. Most of these Li-ion BESS are of Lithium Nickel Manganese Cobalt Oxide (NMC) or Lithium Iron Phosphate (LiFePO4) battery chemistry.

- In recent years, the energy storage system (ESS) has experienced significant growth, especially in the residential sector, along with rising investments in renewable energy infrastructure across the country. Electricity consumption in the residential sector is estimated to increase during the forecast period due to increasing annual disposable incomes, rising work-from-home trends, and rising power consumption across the globe. Energy storage systems are used for continuous power supply at homes during power outages at peak hours.

- According to SolarPower Europe, the European region installed residential battery energy storage of about 2.3 GWh in 2021, a two-fold increase from the previous year. The rise in installations was attributed to the mandatory installation of solar energy systems on new and renovated buildings as directed by the European Commission and battery storage targets as part of the National Clean Flexibility Plan as per ' National Energy and Climate Plans (NECPs). This is likely to escalate the same in the future as well.

- Many European countries have charted energy storage installation targets. For instance, according to the Spanish Energy Storage Association, the nation aims to achieve 20 GW of energy storage installations by 2030 and 30 GW by 2050 as part of its new strategy.

- The cost of battery energy storage systems declined due to favorable government incentives and tax cuts. For instance, in March 2022, the UK government introduced new legislation, reversing the legislative changes brought in by the Court of Justice of the European Union, through which the government mandated a zero VAT rate for energy-saving technologies for residential accommodations, including residential BESS units. This tax cut would be valid for five years, after which the VAT rate will likely be revised to 5%.

- In renewable power sources, the majority of residential demand comes from the solar energy segment, which, in turn, creates demand for residential battery energy storage systems. For instance, according to France Territoire Solaire, in Q4 2023, France's total residential photovoltaic solar energy capacity accounted for 2,645 MW, an increase of 36.4 % compared to Q4 2022.

- In June 2022, Toyota entered the energy storage market by launching the O-Uchi Kyuden System, a residential battery product. Toyota launched a rated output of 5.5 kWh and a rated capacity of 8.7 kWh battery storage system. It uses the company's electric vehicle battery technology. When connected to a photovoltaic rooftop system, the system can power a home day and night. Initially, the company aimed to sell the storage system in Japan.

- Therefore, owing to these factors, the residential application is expected to create lucrative demand in the battery energy storage systems market during the forecast period.

Asia-Pacific Expected to Witness Faster Growth

- Asia-Pacific is expected to keep leading the market for battery energy storage over the next few years. The region consists of two main types of power grids, each with different characteristics and opportunities for energy storage systems. On one side are highly developed countries like Japan, South Korea, New Zealand, and Australia, as well as other large cities with advanced grids that work well and use the latest technologies.

- In the first half of 2023, China's new energy storage continued to develop at a high speed, with 850 projects (including planning, under construction, and commissioned projects), over twice that of the same period in 2022. The newly commissioned scale is 8.0GW/16.7 GWh, higher than the new scale level last year (7.3GW/15.9GWh) in 2022. The newly added projects were mainly put into operation in June, and the capacity reached 3.95GW/8.31GWh, accounting for 50% of the total increased capacity of operating projects in the first half of 2023. Further, it is expected that it will likely continue to maintain significant growth in the coming years.

- Similarly, in India, According to the government, the energy storage requirement is expected to soar to 73.93 GW (26.69 GW PSP and 47.24 GW BESS) with a significant storage capacity of 411.4 GWh by 2031-32. To develop the energy storage capacity from 2022 to 2032, an estimated fund requirement of over INR 54,203 crore for PSP and USD 6.7 billion for BESS is anticipated.

- Further, CEA has also set its sights on the long-term, projecting that by 2047, the country's energy storage demand will likely reach about 320 GW (90 GW PSP and 230 GW BESS) with a total energy storage capacity of 2,380 GWh, aligning with the country's aim to achieve the net zero emissions by 2070 and the rapid renewable energy growth.

- According to the Statistical Review of World Energy Data, in the Asia Pacific region, electricity generation will increase by 4% in 2022 as compared to 2021, the majority due to renewable sources of energy. Furthermore, the Japanese government has set a goal of reaching carbon neutrality by 2050. It intends to boost production from renewables in the overall energy generation to 36-38% by 2030, with solar and wind accounting for 19-21%. The country's prior objective was for renewables to increase from 18% to 22-24% in 2019-2020.

- China is investing heavily in battery energy storage systems (BESS), targeting 100 GW energy storage capacity by 2030. The 14th FYP set the tone to support all types of BESS, including novel lithium-ion, sodium-ion, lead-carbon, and redox flow. The battery energy storages have the advantages of high capacity, low cost, long life cycles, and fast response times. The goal is to boost the build-out of independently owned battery energy storage facilities to support and balance the rapidly growing but intermittent generation capacity from wind turbines and solar panels in the coming years.

- Furthermore, in September 2023, the Union Cabinet of India approved the viability gap funding scheme (VGF) to create a robust storage system for excess wind and solar power production. A total of 4,000 megawatt hours (MWh) of Battery Energy Storage System (BESS) projects will be developed by FY31 under the scheme. An initial outlay of USD 1,128.18 million, including budgetary support of USD 451.27 million, has been provided under the scheme.

- Therefore, owing to such factors, Asia-Pacific is expected to dominate the market during the forecast period.

Battery Energy Storage System Industry Overview

The battery energy storage system market is fragmented. Some of the major players in the market (in no particular order) are BYD Company Limited, Panasonic Corporation, LG Energy Solution Ltd., Tesla Inc., and Contemporary Amperex Technology Co. Limited.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, until 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increased Demand of Renewable Energy

- 4.5.1.2 Reducing Prices of Lithium-ion Batteries

- 4.5.2 Restraints

- 4.5.2.1 Reduction in Supply of Raw Materials

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Lithium-ion Batteries

- 5.1.2 Lead-acid Batteries

- 5.1.3 Nickel Metal Hydride

- 5.1.4 Other Types (Sodium-sulfur Batteries and Flow Batteries)

- 5.2 Application

- 5.2.1 Utility

- 5.2.2 Commercial and Industrial

- 5.2.3 Residential

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 France

- 5.3.2.3 United Kingdom

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Nordic

- 5.3.2.7 Turkey

- 5.3.2.8 Russia

- 5.3.2.9 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 Australia

- 5.3.3.5 Malaysia

- 5.3.3.6 Thailand

- 5.3.3.7 Indonesia

- 5.3.3.8 Vietnam

- 5.3.3.9 Rest of Asia-pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Chile

- 5.3.4.4 Colombia

- 5.3.4.5 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 South Africa

- 5.3.5.4 Qatar

- 5.3.5.5 Nigeria

- 5.3.5.6 Egypt

- 5.3.5.7 Rest of Middle East & Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 BYD Company Limited

- 6.3.2 Panasonic Corporation

- 6.3.3 LG Energy Solution Ltd.

- 6.3.4 Contemporary Amperex Technology Co. Limited

- 6.3.5 Sony Corp.

- 6.3.6 Varta AG

- 6.3.7 Tesla Inc.

- 6.3.8 Samsung SDI Co. Ltd.

- 6.3.9 Cellcube Energy Storage System Inc.

- 6.4 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Advancements in New Battery Technologies

02-2729-4219

+886-2-2729-4219